Armstrong Economics Blog/Canada

Re-Posted Oct 20, 2017 by Martin Armstrong

The hunt for taxes has turned to employees of companies. Any benefit you give an employee is considered “soft-income” and is to be taxed. In the USA, the maximum value of a gift I can hand an employee is $25. I can’t even give them a decent bottle of champagne for New Years.

In Canada, this same idea of taxing any employee benefit has gone all the way to hunting the minimum wage earners. The politicians have classified any discount an employee gets as tax-avoidance and they want their nickel and dime. A minimum wage store employee who gets a 20% discount on anything the store sells or if a waitress gets a free meal while working is to be taxed. The Income Tax Act of the Canada Revenue Agency is now targeting not the “rich” but minimum wage earners since the rich are leaving. When an employee receives any sort of a discount on merchandise or a free meal because of their employment, the value of the discount is to be included in the employee’s income and taxed.

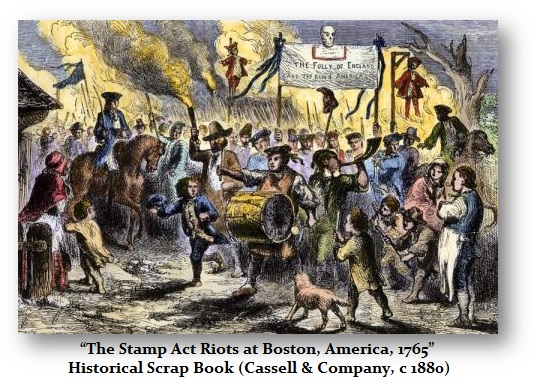

The hunt for taxes is just going to get worse until the people rise up, as they have always done, and probably start yelling the same words: No Taxation Without Representation!” Politicians are doing the same thing that sparked the French Revolution with their arrogance when taxes reduced the standard of living and people could no longer survive. The response of the government was “let them eat cake” and that did not sit very well even if those words were not really spoken – it was the rumor attached to Marie Antoinette

The hunt for taxes is just going to get worse until the people rise up, as they have always done, and probably start yelling the same words: No Taxation Without Representation!” Politicians are doing the same thing that sparked the French Revolution with their arrogance when taxes reduced the standard of living and people could no longer survive. The response of the government was “let them eat cake” and that did not sit very well even if those words were not really spoken – it was the rumor attached to Marie Antoinette

Reblogged this on Brittius.

LikeLike