Posted originally on Rumble By Charlie Kirk show on: Apr 6, 2024 at 6:00 pm EST

Peter proceeded to speak and said:

“You know what has happened all over Judea,

beginning in Galilee after the baptism

that John preached,

how God anointed Jesus of Nazareth

with the Holy Spirit and power.

He went about doing good

and healing all those oppressed by the devil,

for God was with him.

We are witnesses of all that he did

both in the country of the Jews and in Jerusalem.

They put him to death by hanging him on a tree.

This man God raised on the third day and granted that he be visible,

not to all the people, but to us,

the witnesses chosen by God in advance,

who ate and drank with him after he rose from the dead.

He commissioned us to preach to the people

and testify that he is the one appointed by God

as judge of the living and the dead.

To him all the prophets bear witness,

that everyone who believes in him

will receive forgiveness of sins through his name.”

R (24) This is the day the Lord has made; let us rejoice and be glad.

or:

R Alleluia.

Give thanks to the LORD, for he is good,

for his mercy endures forever.

Let the house of Israel say,

“His mercy endures forever.”

R This is the day the Lord has made; let us rejoice and be glad.

or:

R Alleluia.

“The right hand of the LORD has struck with power;

the right hand of the LORD is exalted.

I shall not die, but live,

and declare the works of the LORD.”

R This is the day the Lord has made; let us rejoice and be glad.

or:

R Alleluia.

The stone which the builders rejected

has become the cornerstone.

By the LORD has this been done;

it is wonderful in our eyes.

R This is the day the Lord has made; let us rejoice and be glad.

or:

R Alleluia.

Brothers and sisters:

If then you were raised with Christ, seek what is above,

where Christ is seated at the right hand of God.

Think of what is above, not of what is on earth.

For you have died, and your life is hidden with Christ in God.

When Christ your life appears,

then you too will appear with him in glory.

OR:

Brothers and sisters:

Do you not know that a little yeast leavens all the dough?

Clear out the old yeast,

so that you may become a fresh batch of dough,

inasmuch as you are unleavened.

For our paschal lamb, Christ, has been sacrificed.

Therefore, let us celebrate the feast,

not with the old yeast, the yeast of malice and wickedness,

but with the unleavened bread of sincerity and truth.

Victimae paschali laudes

Christians, to the Paschal Victim

Offer your thankful praises!

A Lamb the sheep redeems;

Christ, who only is sinless,

Reconciles sinners to the Father.

Death and life have contended in that combat stupendous:

The Prince of life, who died, reigns immortal.

Speak, Mary, declaring

What you saw, wayfaring.

“The tomb of Christ, who is living,

The glory of Jesus’ resurrection;

bright angels attesting,

The shroud and napkin resting.

Yes, Christ my hope is arisen;

to Galilee he goes before you.”

Christ indeed from death is risen, our new life obtaining.

Have mercy, victor King, ever reigning!

Amen. Alleluia.

R. Alleluia, alleluia.

Christ, our paschal lamb, has been sacrificed;

let us then feast with joy in the Lord.

R. Alleluia, alleluia.

On the first day of the week,

Mary of Magdala came to the tomb early in the morning,

while it was still dark,

and saw the stone removed from the tomb.

So she ran and went to Simon Peter

and to the other disciple whom Jesus loved, and told them,

“They have taken the Lord from the tomb,

and we don’t know where they put him.”

So Peter and the other disciple went out and came to the tomb.

They both ran, but the other disciple ran faster than Peter

and arrived at the tomb first;

he bent down and saw the burial cloths there, but did not go in.

When Simon Peter arrived after him,

he went into the tomb and saw the burial cloths there,

and the cloth that had covered his head,

not with the burial cloths but rolled up in a separate place.

Then the other disciple also went in,

the one who had arrived at the tomb first,

and he saw and believed.

For they did not yet understand the Scripture

that he had to rise from the dead.

Happy Easter to our Christian readers.

Embracing the idea of rebirth and renewal can help us face the future with optimism and courage. With each new phase, there are opportunities for growth and innovation. As long as we approach these changes with an open mind, a collaborative spirit, and a commitment to positive transformation, we can navigate whatever the future holds with resilience and optimism.

This is why I urge those not to fear what is to come in 2032. We cannot alter cycles or the forces that drive them. The world will look drastically different, the world economy will shift, and our governments will be unrecognizable, but change is necessary to advance civilization.

“So do not fear, for I am with you; do not be dismayed, for I am your God. I will strengthen you and help you; I will uphold you with my righteous right hand.” — Isaiah 41:10

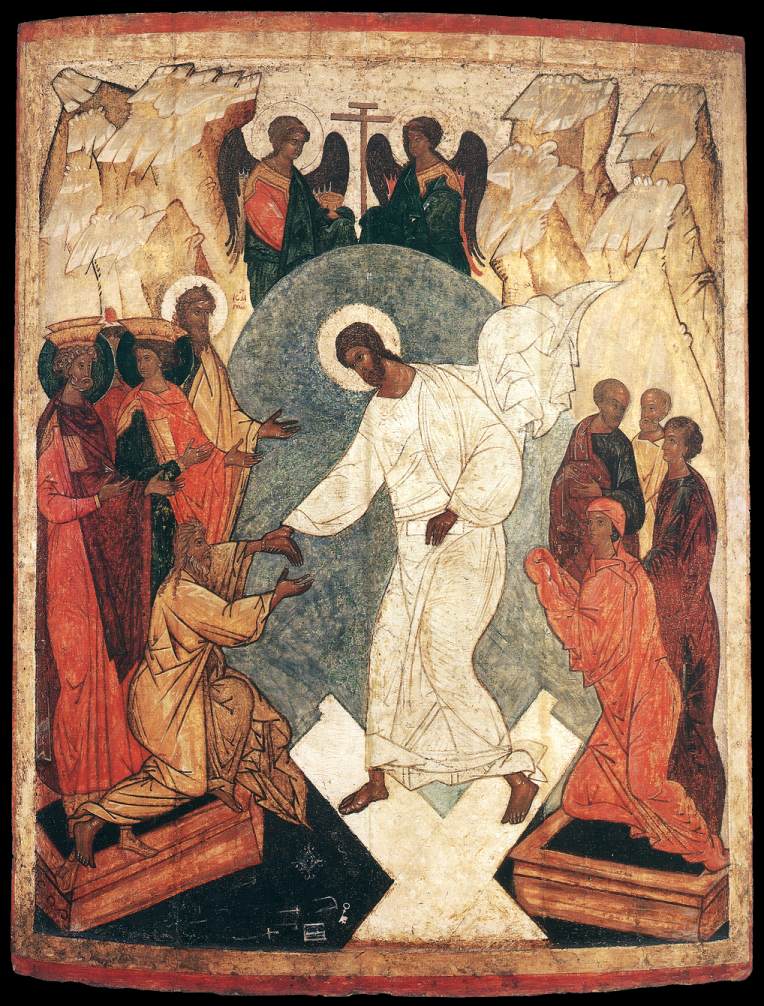

From an ancient homily for Holy Saturday.

What is happening? Today there is a great silence over the earth, a great silence, and stillness, a great silence because the King sleeps; the earth was in terror and was still, because God slept in the flesh and raised up those who were sleeping from the ages. God has died in the flesh, and the underworld has trembled.

Truly he goes to seek out our first parent like a lost sheep; he wishes to visit those who sit in darkness and in the shadow of death. He goes to free the prisoner Adam and his fellow-prisoner Eve from their pains, he who is God, and Adam’s son.

The Lord goes in to them holding his victorious weapon, his cross. When Adam, the first created man, sees him, he strikes his breast in terror and calls out to all: ‘My Lord be with you all.’ And Christ in reply says to Adam: ‘And with your spirit.’ And grasping his hand he raises him up, saying: ‘Awake, O sleeper, and arise from the dead, and Christ shall give you light.

‘I am your God, who for your sake became your son, who for you and your descendants now speak and command with authority those in prison: Come forth, and those in darkness: Have light, and those who sleep: Rise.

‘I command you: Awake, sleeper, I have not made you to be held a prisoner in the underworld. Arise from the dead; I am the life of the dead. Arise, O man, work of my hands, arise, you who were fashioned in my image. Rise, let us go hence; for you in me and I in you, together we are one undivided person.

‘For you, I your God became your son; for you, I the Master took on your form; that of slave; for you, I who am above the heavens came on earth and under the earth; for you, man, I became as a man without help, free among the dead; for you, who left a garden, I was handed over to Jews from a garden and crucified in a garden.

‘Look at the spittle on my face, which I received because of you, in order to restore you to that first divine inbreathing at creation. See the blows on my cheeks, which I accepted in order to refashion your distorted form to my own image.

‘See the scourging of my back, which I accepted in order to disperse the load of your sins which was laid upon your back. See my hands nailed to the tree for a good purpose, for you, who stretched out your hand to the tree for an evil one.

`I slept on the cross and a sword pierced my side, for you, who slept in paradise and brought forth Eve from your side. My side healed the pain of your side; my sleep will release you from your sleep in Hades; my sword has checked the sword which was turned against you.

‘But arise, let us go hence. The enemy brought you out of the land of paradise; I will reinstate you, no longer in paradise, but on the throne of heaven. I denied you the tree of life, which was a figure, but now I myself am united to you, I who am life. I posted the cherubim to guard you as they would slaves; now I make the cherubim worship you as they would God.

“The cherubim throne has been prepared, the bearers are ready and waiting, the bridal chamber is in order, the food is provided, the everlasting houses and rooms are in readiness; the treasures of good things have been opened; the kingdom of heaven has been prepared before the ages.”

The Angels Hovering Over the Body of Christ in the Sepulcher” (1805)

Medium: pen, ink, and watercolor on paper, 42.0 x 32.4 cm

Artist: William Blake (1757-1827)

Location: The Victoria and Albert Museum, London

h/t Lucille at Stella’s Place

Religion has always influenced economics and geopolitical events. For nearly two hundred years, the emperors of the Eastern Roman Empire, known as Byzantium, had followed the traditions of just placing the emperor’s image on the obverse of their coinage as it had been done since the days of Augustus since 27BC.

It was during the reign of Justinian II, who was ambitious and passionate about restoring the Roman Empire to its glory days. During his first reign, 685-695AD, about 300 years after these documents, this is the first time we see any coin issued with a facing bust of Christ on the obverse, and on the reverse, Justinian standing facing, holding a cross.

This gold Solidus (4.38 grams) struck at the Constantinople mint set in motion political and economic upheaval. This coin broke with tradition and placed the image of Christ on the coinage, and the growing Islamic empire was perfectly fine using the coinage of Byzantium. Even in Europe, they traded in “Byzants” rather than produce their own coinage. We have the birth of Islamic coinage because the picture of Christ on the coins transformed the money into a religious issue.

This coin also set in motion the rift within Christianity. Iconoclastic Controversy originated from the Byzantine Iconoclasm, the struggles between proponents and opponents of religious icons in the Byzantine Empire from 726 to 842 AD. This became, at times, a violent conflict over the use of religious images (icons) in the Byzantine Empire. The Iconoclasts (those who rejected images) objected to icon veneration, insisting that the Old Testament prohibited images in the Ten Commandments (Exodus 20:4) and the possibility of idolatry. The defenders of the use of icons insisted on the symbolic nature of images and the dignity of created matter. Some priests were killed for merely protecting images of Christ.

I am hoping to offer a good message for all Christians, and I had one of our finest and most respected Treepers make this comment in reply last year:

“Menagerie, I am not Roman Catholic nor associated with any church denomination. I study the Bible under Pre-Tribulation Dispensational teachings. I find nothing in Bishop Barron’s homily that disagrees with what I understand about our Father and His will, His Grace, and His agapé love for us, and His Son Jesus Christ.”This is an exceptionally good message that universally applies to all Christians. Thank you for posting it this Palm Sunday morning.

This is what I was shooting for.

When Jesus and his disciples drew near to Jerusalem,

to Bethphage and Bethany at the Mount of Olives,

he sent two of his disciples and said to them,

“Go into the village opposite you,

and immediately on entering it,

you will find a colt tethered on which no one has ever sat.

Untie it and bring it here.

If anyone should say to you,

‘Why are you doing this?’ reply,

‘The Master has need of it

and will send it back here at once.’”

So they went off

and found a colt tethered at a gate outside on the street,

and they untied it.

Some of the bystanders said to them,

“What are you doing, untying the colt?”

They answered them just as Jesus had told them to,

and they permitted them to do it.

So they brought the colt to Jesus

and put their cloaks over it.

And he sat on it.

Many people spread their cloaks on the road,

and others spread leafy branches

that they had cut from the fields.

Those preceding him as well as those following kept crying out:

“Hosanna!

Blessed is he who comes in the name of the Lord!

Blessed is the kingdom of our father David that is to come!

Hosanna in the highest!”

Some Greeks who had come to worship at the Passover Feast

came to Philip, who was from Bethsaida in Galilee,

and asked him, “Sir, we would like to see Jesus.”

Philip went and told Andrew;

then Andrew and Philip went and told Jesus.

Jesus answered them,

“The hour has come for the Son of Man to be glorified.

Amen, amen, I say to you,

unless a grain of wheat falls to the ground and dies,

it remains just a grain of wheat;

but if it dies, it produces much fruit.

Whoever loves his life loses it,

and whoever hates his life in this world

will preserve it for eternal life.

Whoever serves me must follow me,

and where I am, there also will my servant be.

The Father will honor whoever serves me.

“I am troubled now. Yet what should I say?

‘Father, save me from this hour’?

But it was for this purpose that I came to this hour.

Father, glorify your name.”

Then a voice came from heaven,

“I have glorified it and will glorify it again.”

The crowd there heard it and said it was thunder;

but others said, “An angel has spoken to him.”

Jesus answered and said,

“This voice did not come for my sake but for yours.

Now is the time of judgment on this world;

now the ruler of this world will be driven out.

And when I am lifted up from the earth,

I will draw everyone to myself.”

He said this indicating the kind of death he would die.

Jesus said to Nicodemus:

“Just as Moses lifted up the serpent in the desert,

so must the Son of Man be lifted up,

so that everyone who believes in him may have eternal life.”

For God so loved the world that he gave his only Son,

so that everyone who believes in him might not perish

but might have eternal life.

For God did not send his Son into the world to condemn the world,

but that the world might be saved through him.

Whoever believes in him will not be condemned,

but whoever does not believe has already been condemned,

because he has not believed in the name of the only Son of God.

And this is the verdict,

that the light came into the world,

but people preferred darkness to light,

because their works were evil.

For everyone who does wicked things hates the light

and does not come toward the light,

so that his works might not be exposed.

But whoever lives the truth comes to the light,

so that his works may be clearly seen as done in God.

De Oppresso Liber

A group of Americans united by our commitment to Freedom, Constitutional Governance, and Civic Duty.

Share the truth at whatever cost.

De Oppresso Liber

Uncensored updates on world events, economics, the environment and medicine

De Oppresso Liber

This is a library of News Events not reported by the Main Stream Media documenting & connecting the dots on How the Obama Marxist Liberal agenda is destroying America

Australia's Front Line

See what War is like and how it affects our Warriors

Nwo News, End Time, Deep State, World News, No Fake News

De Oppresso Liber

Politics | Talk | Opinion - Contact Info: stellasplace@wowway.com

Exposition and Encouragement

The Physician Wellness Movement and Illegitimate Authority: The Need for Revolt and Reconstruction

Real Estate Lending

"Feel free to associate..."