Posted originally on CTH on July 30, 2025 | Sundance

Too funny. The economic pretending is so strong almost every outlet leads the Gross Domestic Product news release by saying “better than expected.” Duh! The Bureau of Economic Analysis (BEA) releases the GDP date for the second quarter (Q2) and shows a 3.0% jump in economic growth.

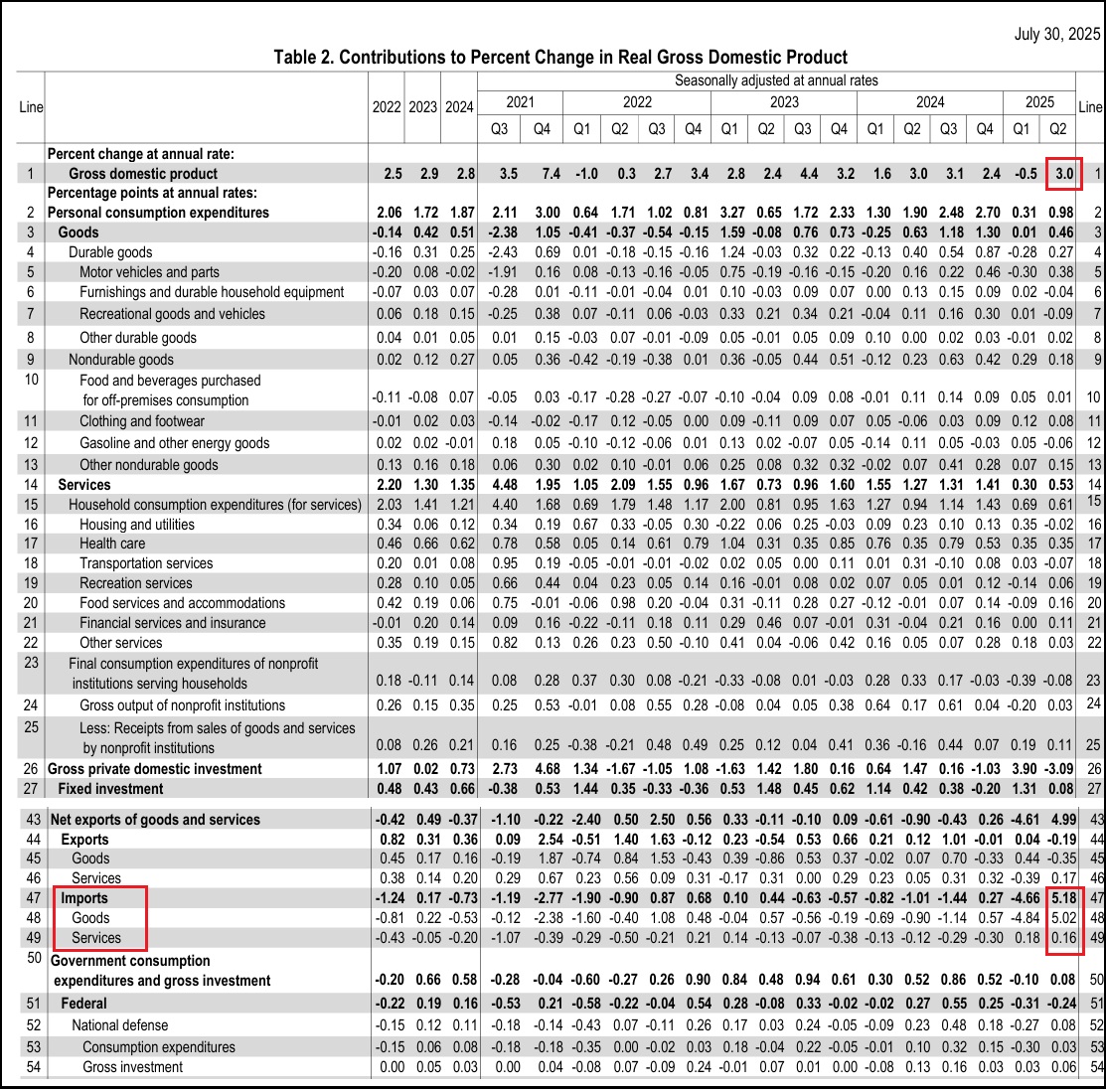

We say “duh”, because it was an entirely predictable result. Why, because imports are a deduction to the GDP equation and imports dropped 30.3% in the second quarter (Table 1, line 19). We said this was going to happen because there was a surge of imported goods in the first quarter as companies tried to be proactive with orders in advance of tariffs.

That massive influx of imports made the Q1 GDP weak (-0.5%). Conversely, with all those goods delivered in the first quarter, the products were not imported in Q2 and the GDP rebounded. The lack of imports, ultimately the lack of deduction, resulted in a 5.18% positive change to the second quarter GDP (Table 2, line 47).

But wait, the winning doesn’t stop there. Remember, the Big Beautiful Bill just passed in July. That means fixed asset investment is likely to expand in Q3 because 100% expensing on capital investment was part of the BBB.

But wait, there’s more. Annual wages spiked 4.4% — double the rate of inflation (2.1%). That means people are growing their wage incomes twice as fast as prices are rising. Real wage growth is back again! Yes, REAL WAGE GROWTH.

WASHINGTON – Recession? What recession? The US economy bucked nonstop doom-and-gloom by economists — including some at Wall Street’s biggest banks — and reported stronger-than-expected growth in the second quarter, marked by a surge in hiring and wages.

Gross domestic product – the value of all goods and services produced across the US economy – jumped by a seasonally and inflation adjusted 3% in the second quarter, the Commerce Department said Wednesday.

That rebounded from a 0.5% decline in the first quarter and beat estimates of just 2.3% growth. A recession is usually defined by the GDP slipping in two consecutive quarters.

Meanwhile, private employers added 104,000 jobs last month, according to the ADP National Employment Report released Wednesday. That reversed a 23,000 drop in June and exceeded the forecast for an increase of 64,000.

Annual wages spiked 4.4% — well above the rate of inflation, which has remained below 3% despite harping that President Trump’s tariffs would jack up prices.

“Our hiring and pay data are broadly indicative of a healthy economy,” Nela Richardson, ADP’s chief economist, said.

“Employers have grown more optimistic that consumers, the backbone of the economy, will remain resilient.” (more)