Posted originally on the CTH on July 1, 2023 | Sundance

The Twitter platform decisions are making headlines and opening conversation, because Elon Musk is trying to retain his platform against all odds and not really working to solve his problem. Several platform changes are taking place that are being less than honestly explained. As interested CTH readers look on quizzically, perhaps it’s time for me to revisit the truth of Musk’s challenge as it has always existed so people can understand. [NBC ARTICLE HERE, that doesn’t understand]

Keep in mind, long before people realized the Dept of Homeland Security (FBI, DHS, CISA etc.) had a portal into Twitter, I was explaining how transparently obvious it was. {Go Deep – Jack’s Magic Coffee Shop} In part, the transparency of the problem is driven by CTH understanding of the costs associated with Twitter as a very unique platform in the sphere of social media. {Go Deep – Understand the Costs}

With the latest revelations we shared about the financial position of Twitter {Go Deep on FINANCIALS}, all of the moves now underway make sense. Musk was on track to hit a date in/around October of this year where Twitter would be insolvent. If you had read those previous “Go Deep” links, you will easily see the problem. However, if you have not read those backgrounds, this could be difficult to understand.

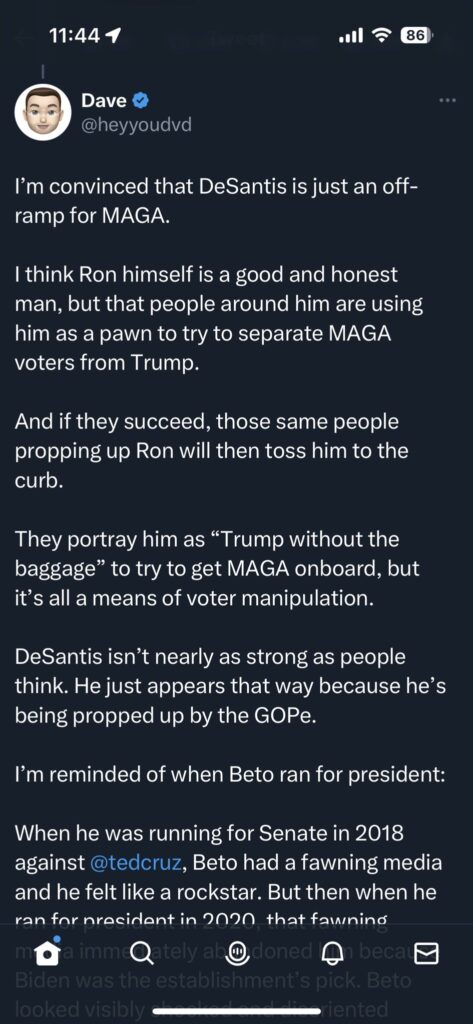

Musk is being disingenuous in his explanation here. I’m being generous in not calling him a fibber. His problem is multifaceted, and he is looking at it with two approaches.

First, by Musk’s prior admissions, he’s losing approximately $300 million/month and needs to grow revenue fast. That’s why he hired Linda Yaccarino. Second, he’s trying desperately to reduce operational costs for data processing. Twitter has a systemic platform cost issue that will not change easily – due to his very unique issue of “simultaneous users,” in combination with no proprietary content. That’s where he is being less than honest about these changes.

Twitter is a global discussion platform, essentially a global commenting system. Elon Musk is trying to address the cost and utility of his platform at the same time that a similarly constructed META alternative is about to launch. Yes, Mark Zuckerberg is JUST ABOUT to launch a Twitter version of META that will link Facebook, Instagram, and Google YouTube content into one big instant conversation and commenting system.

Zuckerberg has one key thing Musk doesn’t, proprietary content and actively engaged and solid advertising systems built into the operation.

META CEO Mark Zuckerberg has the revenue options that will cover the extreme costs of the simultaneous user interface and data processing, while simultaneously allowing content creators to cross post their content.

Zuckerberg has multifaceted advertising engagement systems that allow advertisers to target and engage with users in very creative ways on his platform(s). You can even shop directly from Instagram and Facebook with the advertiser. Setting aside the other issues with advertisers, corporate wokeism etc, Elon Musk has nothing like that – not even close.

However, Musk’s biggest issue is the cost of his platform. This is what he is trying to tackle right now, while simultaneously fending off the META infringement.

In the big picture of tech platforms, Twitter, as an operating model, is a massive high-user commenting system.

Twitter is not a platform built around a website; Twitter is a platform for comments and discussion that operates in the sphere of social media. As a consequence, the technology and data processing required to operate the platform does not have an economy of scale.

There is no business model where Twitter is financially viable to operate…. UNLESS the tech architecture under the platform was subsidized.

[NOTE: In my opinion, there is only one technological system and entity that could possibly have underwritten the cost of Twitter to operate. That entity is the United States Government. That’s where the quid pro quo in allowing DHS to have a backdoor comes in.]

Unlike websites and other social media, Twitter is unique in that it only represents a platform for user engagement and discussion. There is no content other than commentary, discussion and the sharing of information – such as linking to other information, pictures, graphics, videos url links etc.

In essence, Twitter is like the commenting system on the CTH website. It is the global commenting system for users to share information and debate. It is, in some ways, like the public square of global discussion. However, the key point is that user engagement on the platform creates a massive amount of data demand.

Within the systems of technology for public (user engagement) commenting, there is no economy of scale. Each added user represents an increased cost to the operation of the platform, because each user engagement demands database performance to respond to the simultaneous users on the platform. The term “simultaneous users” is critical to understand because that drives the cost.

According to the Wall Street Journal, Twitter has approximately 217 million registered daily users, and their goal is to expand to 315 million users by the end of 2023. Let me explain why things are not what they seem.

When people, users, operate on a tech platform using the engagement features, writing comments, hitting likes, posting images, links etc, the user is sending a data request to the platform’s servers. The servers must then respond allowing all simultaneous users to see the change triggered by the single user.

Example: when you hit the “like” button feature on an engagement system, the response (like increasing by one) must not only be visible to you, but must also be visible to those simultaneously looking at the action you took. If 100,000 simultaneous users are looking at the same thing, the database must deliver the response to 100,000 people. As a result, the number of simultaneous users on a user engagement platform drives massive performance costs. In the example above, a single action by one person requires the server to respond to 100,000 simultaneous users with the updated data.

As a consequence, when a commenting platform increases in users, the cost not only increases because of that one user, the cost increases because the servers need to respond to all the simultaneous users. Using CTH as an example, 10,000 to 15,000 simultaneous commenting system users, engaging with the servers, costs around $4,500/mo.

This is why most websites, even big media websites, do not have proprietary user engagement, i.e. commenting systems. Instead, most websites use third party providers like Disqus who run the commenting systems on their own servers. Their commenting systems are plugged in to the website; that defers the cost from the website operator, and the third party can function as a business by selling ads and controlling the user experience. [It also sucks because user privacy is non existent]

The key to understanding the Twitter dynamic is to see the difference between, (a) running a website, where it doesn’t really matter how many people come to look at the content (low server costs), and (b) running a user engagement system, where the costs to accommodate the data processing -which increase exponentially with a higher number of simultaneous users- are extremely expensive. Twitter’s entire platform is based on the latter.

There is no economy of scale in any simultaneous user engagement system. Every added user costs exponentially more in data-processing demand, because every user needs a response, and every simultaneous user (follower) requires the same simultaneous response. A Twitter user with 100 followers (simultaneously logged in) that takes an action – costs less than a Twitter user with 100,000 followers (simultaneously logged in), that takes an action.

If you understand the cost increases in the data demand for simultaneous users, you can see the business model for Twitter is non-existent.

Bottom line, more users means it costs Twitter more money to operate. The business model is backwards from traditional business. More customers = higher costs, because each customer brings more simultaneous users….. which means exponentially more data performance is needed.

User engagement features on Twitter are significant, because that’s all Twitter does. Not only can users write comments, graphics, memes, videos, but they can also like comments, retweet comments, subtweet comments, bookmark comments, and participate in DM systems. That is a massive amount of server/data performance demand, and when you consider simultaneous users, it’s almost unimaginable in scale. That cost and capacity is also the reason why Twitter does not have an edit function.

With 217 million users, you could expect 50 million simultaneous users on Twitter during peak operating times. My back of the envelope calculations, which are really just estimations based on known industry costs for data performance and functions per second (pfp), would put the data cost to operate Twitter around $200 to $300 million per month.

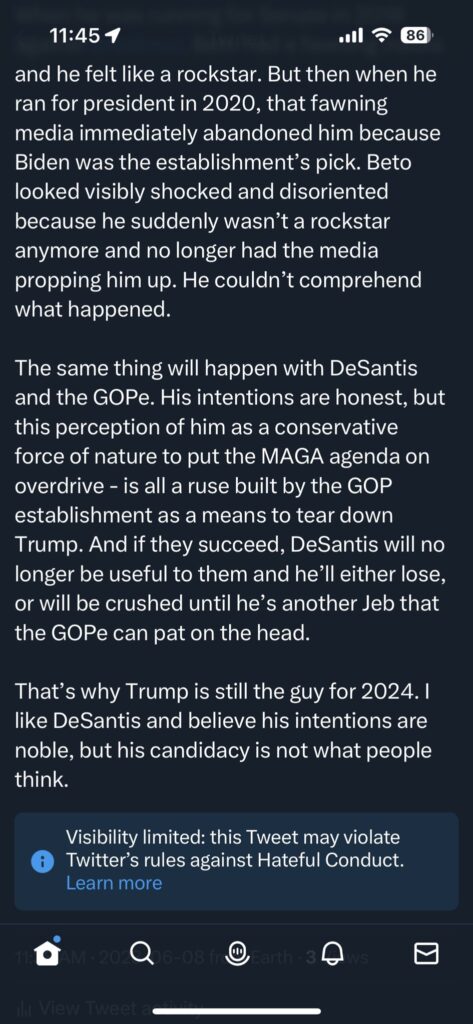

In 2021, Twitter generated $5.1 billion in revenue, according to the Wall Street Journal. According to the New York Times, in 2023 that revenue has dropped to around $1 billion per year.

Musk stated during public conversation that Twitter was essentially break even at $4 billion, which was the position in 2022 just prior to his taking over. [2022 costs around $4.5 billion and revenue around $4 billion +/-, per public financial statements and reporting]. Musk cut approximately $500 million in expenses from realignment and staffing reductions.

Musk has a $1.5 billion debt service on the loan he took out, per his own admission: that’s more than $100 million per month. The debt service alone is higher than his revenue. As I noted last month, Twitter is losing somewhere around $300 million per month. With $1 billion liquid in the bank, as of June (per Musk), that only gets him to September; by October, he needs another influx of cash, or else.

There is no business model, even with paying subscribers, for Twitter to exist without a major increase in revenue (Yaccarino) or a major decrease in costs. As the business grows (more users), the costs increase (more simultaneous users), and the costs to subscribers would grow. Twitter Blue subscriptions are around 180,000 users, paying $11/mo. That’s around $2 million a month- a pittance in comparison to what he needs.

Right now, meaning literally right now, Musk is trying to reduce operational costs by limiting user engagement.

It is not an accident these solutions target the “simultaneous user” issue?

Can you see it now?

.