Armstrong Economics Blog/China

Re-Posted Jun 10, 2019 by Martin Armstrong

QUESTION: Martin, You said that China will become the financial capital of the world by 2032. Why do you think that what Trump is doing to China with tariffs and the trade war will not be able to stop China becoming the financial capital of the world?

RM

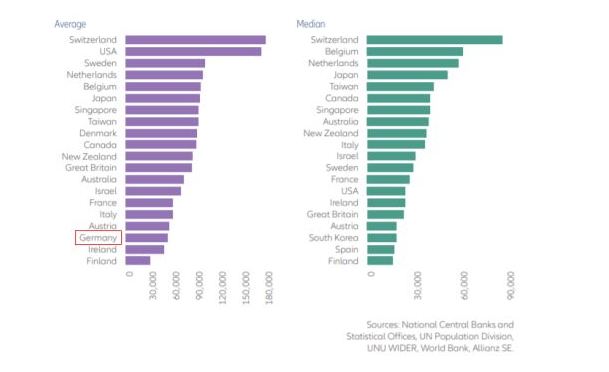

ANSWER: Trump’s tariffs are not intended to prevent China from rising. Rather, they are intended to open up China. The rise of China will come by turning inward to develop their own consumer market. The mercantilist model employed by Germany may have made Germany the biggest economy, but its people have not shared in that rise. This is the difference between an export model and a domestic model. The U.S. is the biggest economy and everyone wants to sell to America because it has the largest consumer market.

The Eighteen Year Real Estate Cycle

Trading Against the Reversals

Armstrong Economics Blog/Training Tools

Re-Posted May 20, 2019 by Martin Armstrong

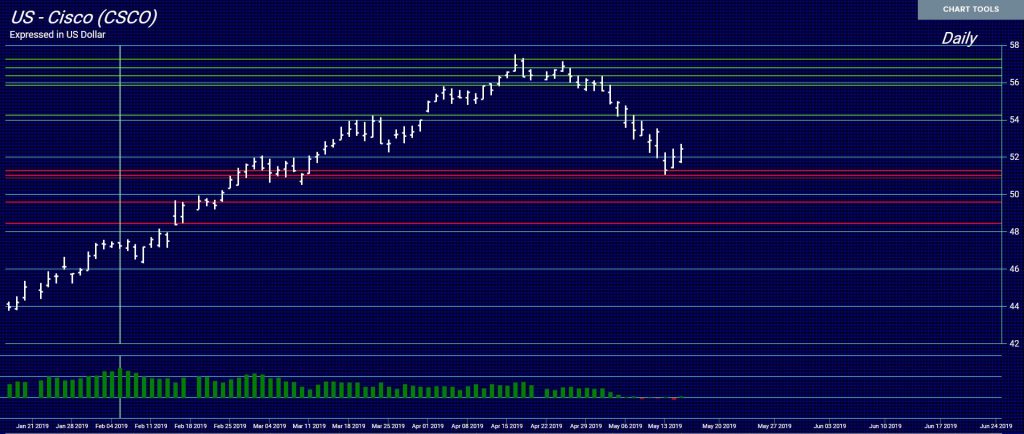

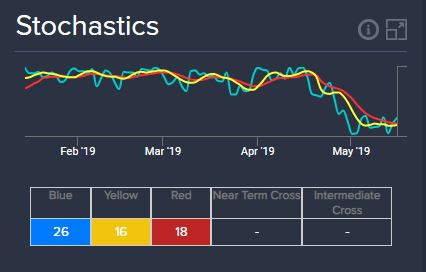

COMMENT: So guess what. I’ve always played the gaps when one elects and it’s a decent size and it lines up with the arrays and technicals I’ll get in and sell at the touch of the next reversal after the gap. Easy. But last month for the first time I tried trading against the reversal and it worked out amazingly. There was a quadruple bullish reversal in Cisco and a direction change the week and month after and I shorted it a few cents away from that reversal and basically got the high in a very strong uptrend. AM even thought I was crazy shorting it. The very next day it started falling and fell straight to the last major weekly yesterday.

Maybe not “Marty” type amazing trade, but I saw it unfolding the way Socrates said and I thought Damn haha

First time against a reversal!!! And a quadruple at that. Wanted to share that with you.

REPLY: Excellent. That was a good trade. Notice the energy. It peaked well before, so as the market is making new highs and failing to get through the reversals, look at the energy. If you see divergence and the stochastic, the odds are in your favor.

REPLY: Excellent. That was a good trade. Notice the energy. It peaked well before, so as the market is making new highs and failing to get through the reversals, look at the energy. If you see divergence and the stochastic, the odds are in your favor.

The divergences in those two indicators with the Array and the Reversal System allows for low-risk trades. Always know where you are wrong on a trade. In that case, the other side of the Reversals you are selling against. The declining energy with a rising market warns that the rally is not sustainable.

Decline in Craftsmanship Between the 1st and 3rd Centuries

Armstrong Economics Blog/Understanding Cycles

Re-Posted May 17, 2019 by Martin Armstrong

COMMENT: I took the tour of the Vatican museum and the sculpture collection is unsurpassed. It was great that a pope told the people to bring statues to the Vatican rather than destroy them as some pagan god. The guide also pointed out how the best art was the first century and the quality diminished into the third and fourth century. I remember the mug from the WEC. It was interesting how the quality of art declined following your chart on the collapse of the monetary system.

I can get an extra mug?

KW

ANSWER: Yes, several people took that same tour. The quality of art declined with the collapse of the monetary system as well as the artistic quality of coins. Each die was hand engraved back then, so you can also see the decline in craftsmanship. Sculptures are the same. The details in the face, hair, and clothing during the 1st century is easily distinguishable from the 3rd century as we see in the coinage.

The quality of craftsmanship declines with the economy. Buildings constructed today are far cheaper in construction materials than you see even decades before. Most historians claim that Emperor Augustus’ right-hand man, Agrippa, built the first Pantheon in 27 BC. It burned in the great fire of 80 AD, was rebuilt by Emperor Domitian, and then was struck by lightning and burned again in 110 AD. The Pantheon as we know it today was built in 120 AD by Emperor Hadrian who was passionate about architecture and design. The inscription states that it was attributed to Marcus Agrippa. Nevertheless, this is a building that has stood almost 2,000 years.

As for the mugs, sorry, they are all gone. People have been making collections of them. Even I have only have one myself. I didn’t even have any leftover to give to Nigel.

A Strong US Dollar is the Only Way to Create Change

Armstrong Economics Blog/USD $

Re-Posted May 10, 2019 by Martin Armstrong

COMMENT: It is interesting how these people take your interviews and inject headlines like you say the dollar will collapse in April 2019 when you have said exactly the opposite. Just unbelievable how these people use your name to promote their BS.

JD

REPLY: I know. They keep preaching the dollar will collapse when it is exactly the opposite. They are trying to sell their biased view which is always based upon the idea of the quantity theory of money – the same exact philosophy used by the central banks in Quantitative Easing.

The ONLY way the monetary system will break is with a STRONG dollar – not a weak dollar.The monetary system has broke ONLY when the dollar rises as in 1934 and 1985. The US always wants a weak dollar to increase corporate profits and and create a trade surplus. It is really quite amazing how these people keep preaching the same nonsense for decades and have never been right for more than 30 years.

Cycles & Turning Points

Armstrong Economics Blog/Uncategorized

Re-Posted May 9, 2019 by Martin Armstrong

QUESTION:

Hello Mr. Armstrong;

Rome was fantastic!. I find it very interesting that you hold the conference on the dates when the markets hit their peak and I come back and Monday we start the decline that you cautioned us that we could see at the conference. Was this planned:)?

Cycles are amazing and now i have to live and invest only based on the cycles.

Thank you again for Rome and bringing Nigel!!

BB

ANSWER: Yes, I do time the conferences around the cycles. That gives us something to talk about. They are simply points where the human emotions shift. This pull back is necessary for we are treading water (i.e. time) until the consolidation is complete in order to produce the next phase.

Just for the record for those who did not attend the Rome WEC, Nigel came because, as he put it, we are the “alternative to Davos.” He was not paid a fee. He had agreed to come and wanted to attend the conference and be at our famous networking cocktail party.

As things turned out, Nigel started his new BREXIT Party after he agreed to come to the WEC. I was concerned he would be too busy to attend with the change in plans. Nevertheless, he flew in for a few hours to make his appearance and then sadly had to leave because of a rally back in the UK the next morning.

The May Turning Point

Armstrong Economics Blog/Training Tools

Re-Posted May 9, 2019 by Martin Armstrong

COMMENT: It is interesting how your model picks the timing for a turn in the market as of May yet it leaves us guessing as to what the fundamental will be. Very interesting to say the least.

Fantastic event in Rome. The cocktail party was the best view of Rome ever!

Cheers

HKD

REPLY: The fundamentals really do not matter. What I have come to understand is TIME is everything. The market will turn on these targets regardless of the fundamental. It is simply a turning point in human emotion for maintaining a given trend. They will exit a trend regardless of the news. How many times have we seen bearish news ignored in a bull run or bullish news ignored during a bearish decline? It is only a matter of the length of a rally or decline.

Robo Trading v Human Trading

Armstrong Economics Blog/Training Tools

Re-Posted May 8, 2019 by Martin Armstrong

QUESTION: So is there any difference between a Robot and a person trading if they just follow the same system on a single market?

ANSWER: Any system that is created which claims to be some robo-trading system is vulnerable to a contagion that impacts a given market from external sources. We are entering a highly correlated global capital flow era which events external to a domestic market can overwhelm a domestic economy and any market.

The only difference between a robo-trading system and a human is that the human can get all emotion and panic. The computer would not do that, but it would be vulnerable to external forces and would not be able to make a judgment call.

The only possible way to overcome this is a complete global model which is monitoring everything and will pick up the external contagions. You can visually see this using the Global Market Watch. You can glance at the trends in all world stock markets for example on one page.

The End of Diversification?

Armstrong Economics Blog/Understanding Cycles

Re-Posted May 8, 2019 by Martin Armstrong

Recent years there has been a shift in how various assets classes are trading. There is emerging a high degree of positive correlation among various financial asset classes that have many concerned since it is not conforming with the perceived historic norms. Many are reading into this as a warning of what is to come. When different asset classes move in the same direction simultaneously, this obviously eliminates the theory of diversification is asset allocation.

Asset allocation over the years has been the way portfolios are arranged because they lack the ability to forecast the major trends. The belief has been that the possible benefits of diversification across classes reduces risk and offers a management tool knowing that you will lose on one side but win on another class.

When there is a high correlation between classes, these asset allocation models fail. The concerns become that this injects a negative development because they fear if one asset class falls, it will take all of the others with it.

What is being overlooked here is the fact that there is a major shift underway which is not understood and this creates the risk of a LIQUIDITY CONTAGION whereby a loss in one asset class causes liquidation in all others to raise cash to cover the losses in one particular asset class. Welcome to the new age of international contagion which is far more serious and cannot be reduced by simply diversification.

We will be looking at establishing a Webinar for Institutional Clients on this subject matte

WEC 2019 Rome The Great Unknown

Armstrong Economics Blog/Uncategorized

Re-Posted May 6, 2019 by Martin Armstrong

This year’s World Economic Conference was most interesting. We really had to put our thinking caps on because we have entered the Great Unknown where Keynesian Economics has crumbled to dust. We have to reassess the future and how this will unfold as the central banks are beside themselves in many countries and the contagion of Quantitative Easing combined with Negative Interest rates has completely altered the economy and have driven a huge wave of disparity between Public v Private sectors of the economy. This is clearly the times that will test the best skills of what traders are made of.