QUESTION: Hello Marty,

I am fascinated by Socrates as it has opened my mind to patterns in my own nature and the flow in life.

In fact, your economic models have open my awareness of the cycles in my life. As I have experienced support, resistance, reversals, phase transition and slingshots out of expanded consciousness. It really is amazing to see this in myself, others, societies and cultures.

Which leads to my question, have you ever been asked to apply and integrate your research with the research of Clare W Grave, specifically his Spiral Dynamics models of human and societal consciousness?

Your economic models are far superiority anything I have ever seen. Same goes for Spiral Dynamics for understanding why and how humans behavior manifests and emerges.

Like you I’m interested in advancing the world to a more sustainable future less driven by self interest and more driven by system’s thinking grounded in unbiased research that lets the data tell the story, rather than setting out to to confirm own perspectives and bias.

I believe your work will be recognized on a much more grand scale by future generations. You definitely are someone who exhibits the characteristics of Stage Yellow & Stage Turquoise thinker. You are rare and are ahead of your time.

Thank you for your work.

MLK

ANSWER: Clare W. Grave’s work in psychology concluded that the mature human being transitions from a current level of cultural existence based on current life conditions to a more complex level in response to (or to cope with) changes in existential reality. Graves’s model demonstrates the dual nature of human social emergence with state changes between communal/collective value systems (sacrifice self) and individualistic (express self) value systems.

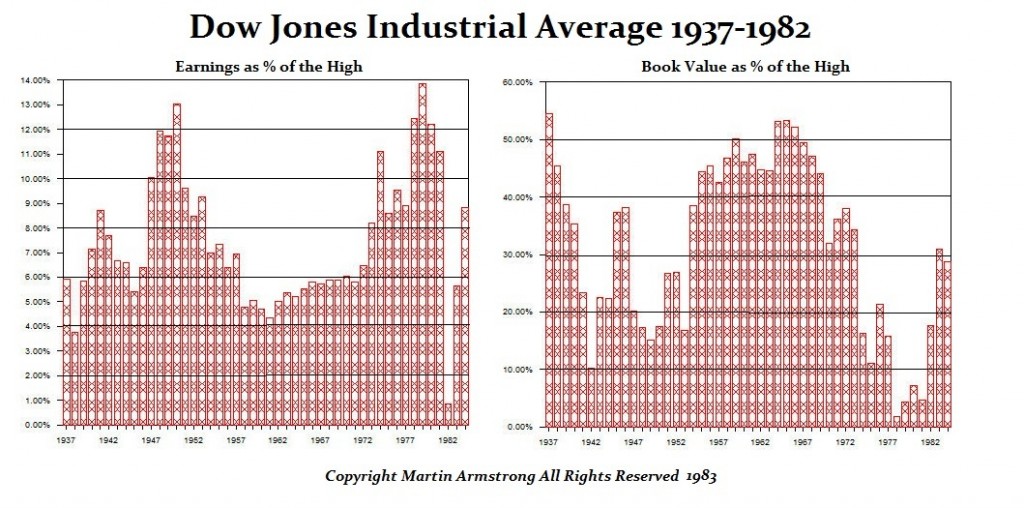

I have not sought to integrate my work into his. You must understand that there are a few of us who have learned how humans behave through trading markets. I never considered that what I was writing or doing had any validity or significance in psychology or economics for that matter. It was during the early 1980s when many people began to take notice of what I was doing because I emerged as the leading analyst in foreign exchange in a new world of floating exchange rates.

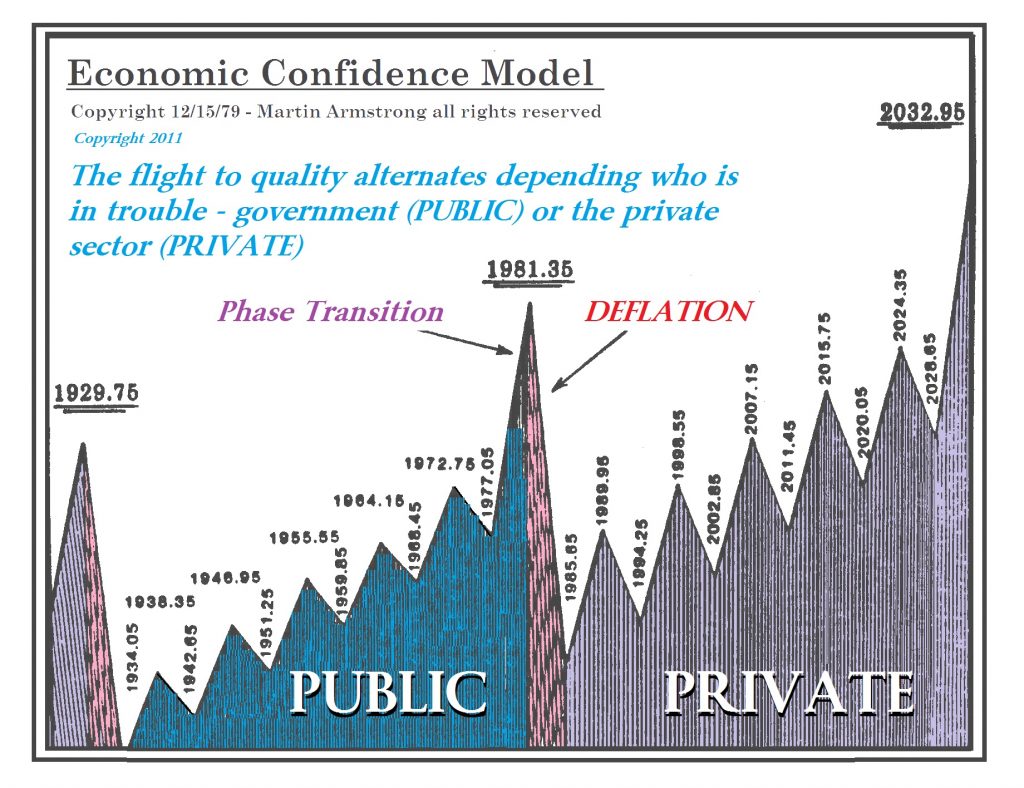

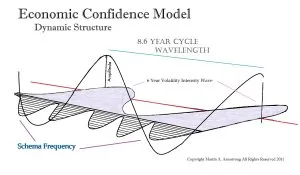

I was contacted by the Military University known as the Citadel. I was asked for permission to teach the Economic Confidence Model as the key to understanding the economy and war. They told me I was the modern Hegel, which was perhaps the first time I was being compared to any philosopher. Hegelianism is the main philosophy of G. W. F. Hegel (1770–1831) who was also a major influence of Karl Marx and revolutionary movements during the 19th century. Hegel’s philosophy has been summed up by the dictum that “the rational alone is real,” which means that all reality is capable of being expressed in rational categories. His goal was to reduce reality to a more synthetic unity within the system of absolute idealism.

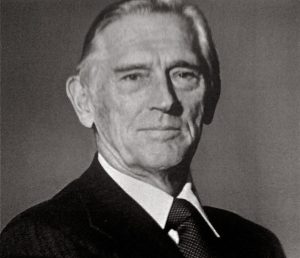

I was then rather shocked when a rather famous central banker called and wanted to meet with me back in the early 1980s. John Exter (1910–2006) was an American economist, member of the Board of Governors of the United States Federal Reserve System, and founder of the Central Bank of Sri Lanka. I still have the tape from our meeting which we recorded. He was the first central banker who actually came to my office (Part I of three).

I was then rather shocked when a rather famous central banker called and wanted to meet with me back in the early 1980s. John Exter (1910–2006) was an American economist, member of the Board of Governors of the United States Federal Reserve System, and founder of the Central Bank of Sri Lanka. I still have the tape from our meeting which we recorded. He was the first central banker who actually came to my office (Part I of three).

Audio Player

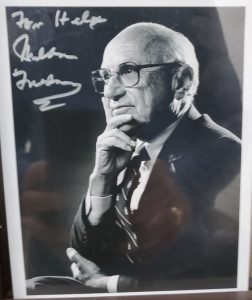

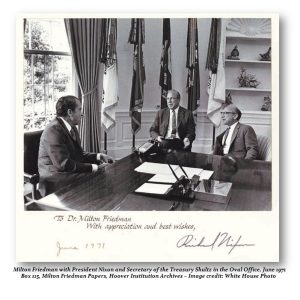

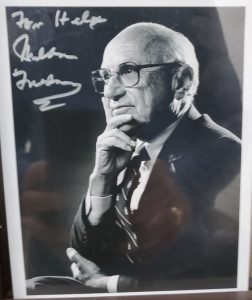

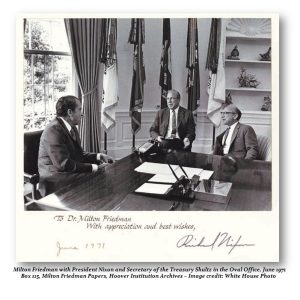

Then I was giving a lecture in Chicago at COMPUTRAC or Market Technicians. Milton Friedman came there to listen to me. When I was finished, he came up and introduced himself and said I was doing what he had only dreamed about when he first wrote about creating a floating exchange rate system in 1953. We became friends after that meeting.

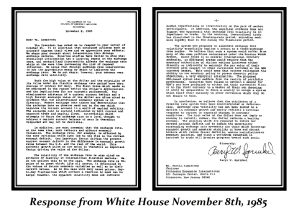

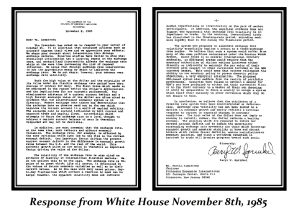

When it came time to create the G5 in 1985, I was asked for my opinion. I was opposed to the manipulation of the dollar by announcing it would be lowered by 40% under the pretense that would reduce the trade deficit and create jobs. I expressed my objection to President Reagan and the White House was compelled to respond.

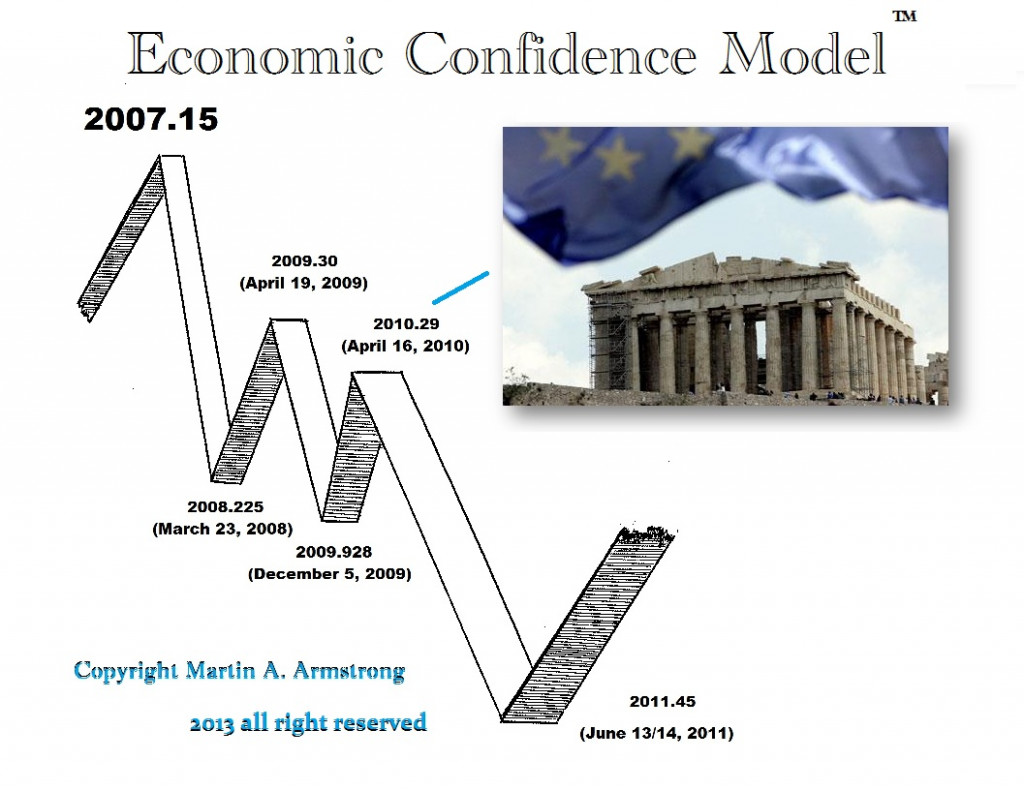

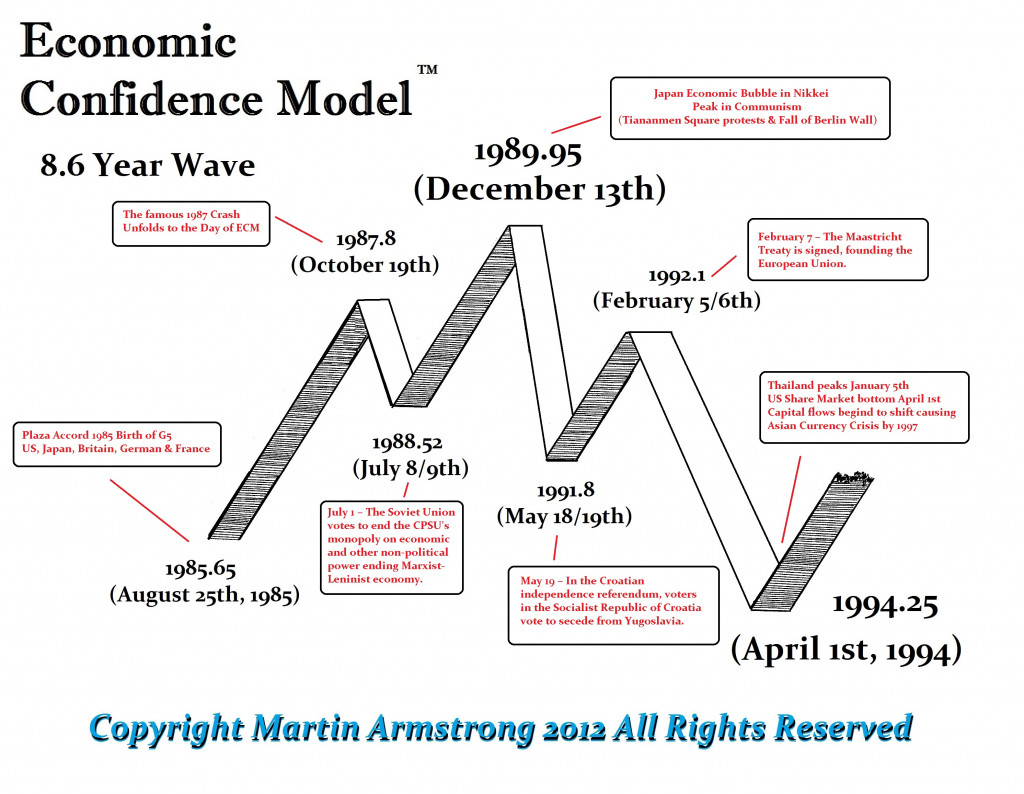

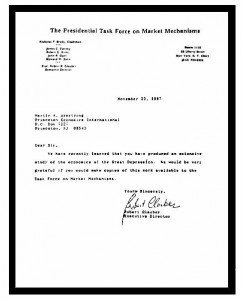

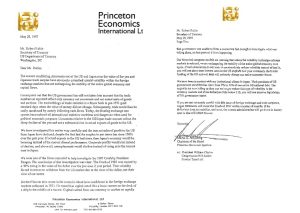

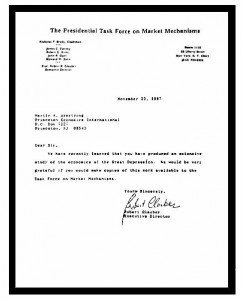

By the 1987 Crash, then the Presidential Task Force, known as the Brady Commission, was compelled to call me in because we ended up with a few clients on the Commission who insisted I be brought in because we had not only forecast the event due to foreign exchange, but that the day of the low we also said that was the low and new highs would be seen by 1989. When the 1989 Japanese Crash took place, I had two central banks on the phone simultaneously asking if they needed to intervene into the foreign exchange markets to stem it from spreading into a global contagion. I advised it was contained to Japan and they did not need to intervene.

Because I became a forecaster of foreign exchange and helped companies do takeovers and reorganized them as to what countries to set up in, former Prime Minister Margaret Thatcher wanted to meet the guy who was restructuring companies and placing so much foreign business into Britain. We too became friends and she even spoke at our World Economic Conference.

When the British pound was being attacked by Soros, the administration of John Major called and asked how long was the attack of the pound going to last? I advised that they had to devalue the pound. I was told they could not because Prime Minister John Major said he would not devalue the pound and the goal was to join the euro. This became the ERM Crisis. My advice was to exit the ERM and allow the pound to seek its own level.

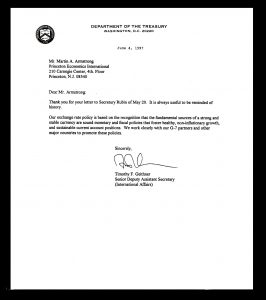

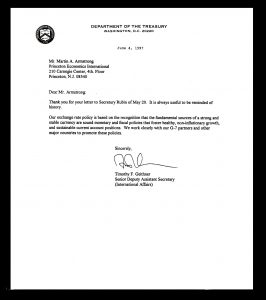

In 1997, I warned Treasurer Robert Rubin against trying to talk down the dollar for trade as they attempted back in 1987. Again, while I managed to to get them to stop that nonsense, the capital flows had nonetheless shifted from Asia back to Europe to get on board for the coming euro. This resulted in me being called in by the central bank of China as a result of the 1997 Asian Currency Crisis.

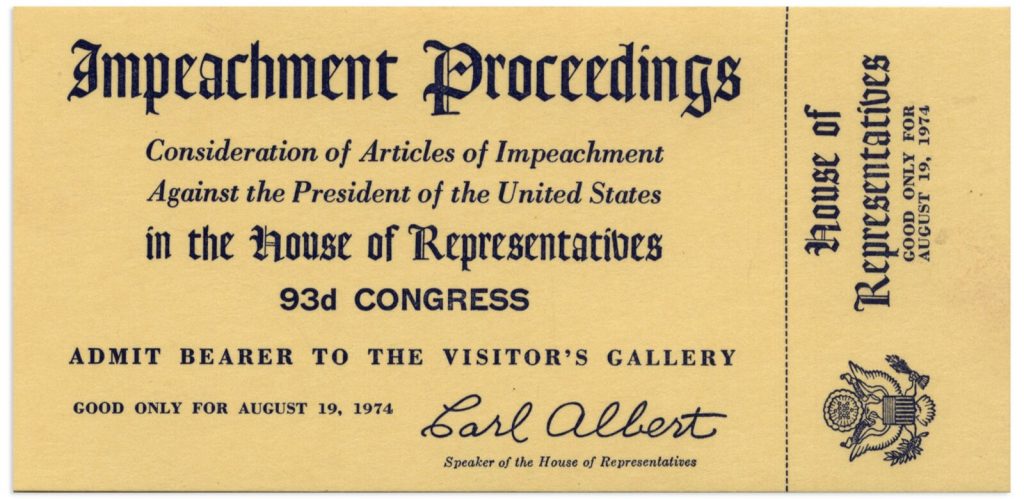

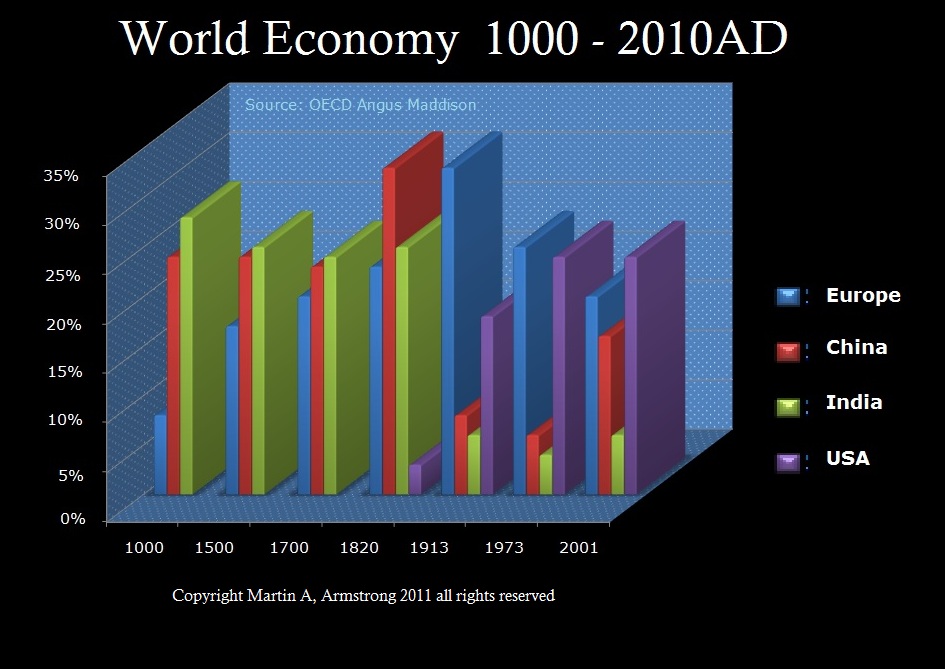

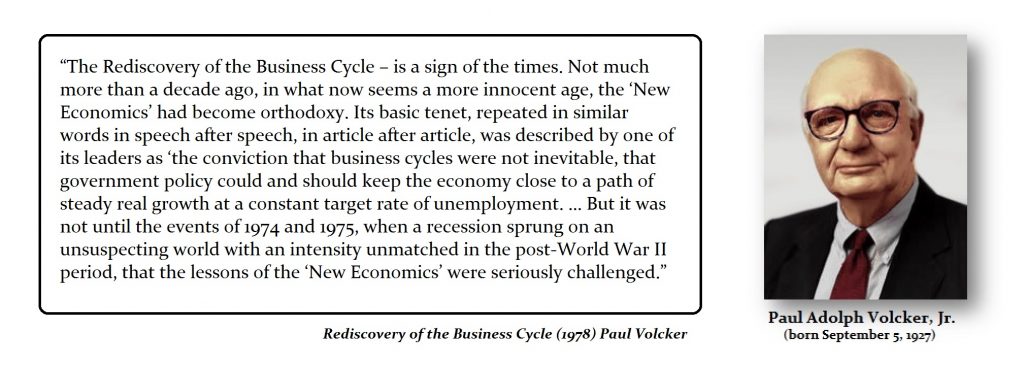

I have never sought to correlate my work with any others. I have been a trader, not an academic. I have been called the modern Hegel and compared to many others in philosophy as well as psychology. Because the floating exchange rate system was born out of necessity in 1971 as the Bretton Woods system was collapsing, I was often the only voice to be heard who actually had hands-on experience worldwide. When I was asked to testify before Congress in 1996, I was the largest adviser in the world with just over $3 trillion under contract which at that time was about 50% of the entire US national debt. No one had ever had such a role in world foreign exchange markets. I was fortunate to have a front row seat during the entire evolution of the floating exchange rate system. That was never a subject that could be taught in university since the last such floating exchange rate period predated the first course in economics which began at Cambridge University in 1902.

I have been trained, not by some university which could never teach anything to do with the Floating Exchange Rate System, but by the markets and my clients. The person who came up with the very concept of supply and demand was also a trader who had been in the trading room of Amsterdam — the first trading center post Dark Age. His name was John Law (1671-1729), who was also plagiarized by just about everyone else.

Some things can only be discovered by actually observing them from the trading floor. They do not appear out of thin air from a dream. What I learned about the world economy involving foreign exchange and observing capital flows between nations and currencies could only be accomplished by life experience. Likewise, John Law observed the basic human reactions and formed his idea of supply and demand with its impact upon price.

Some things can only be discovered by actually observing them from the trading floor. They do not appear out of thin air from a dream. What I learned about the world economy involving foreign exchange and observing capital flows between nations and currencies could only be accomplished by life experience. Likewise, John Law observed the basic human reactions and formed his idea of supply and demand with its impact upon price.

A trader does not have the luxury of clinging to old theories. If you are wrong, you must respond quickly. Knowledge is gained ONLY from making mistakes and surviving our own decisions.