Armstrong Economics Blog/ECM

Re-Posted Feb 2, 2020 by Martin Armstrong

COMMENT: Marty, I have to laugh. Only those who have followed you more 20 years understand you have discovered the hidden order behind the facade. Fantastic call on this turn in the ECM. Once again to the very day in the Dow. And people do not think your model is real? They must be idiots who also worship Greta.

All the best

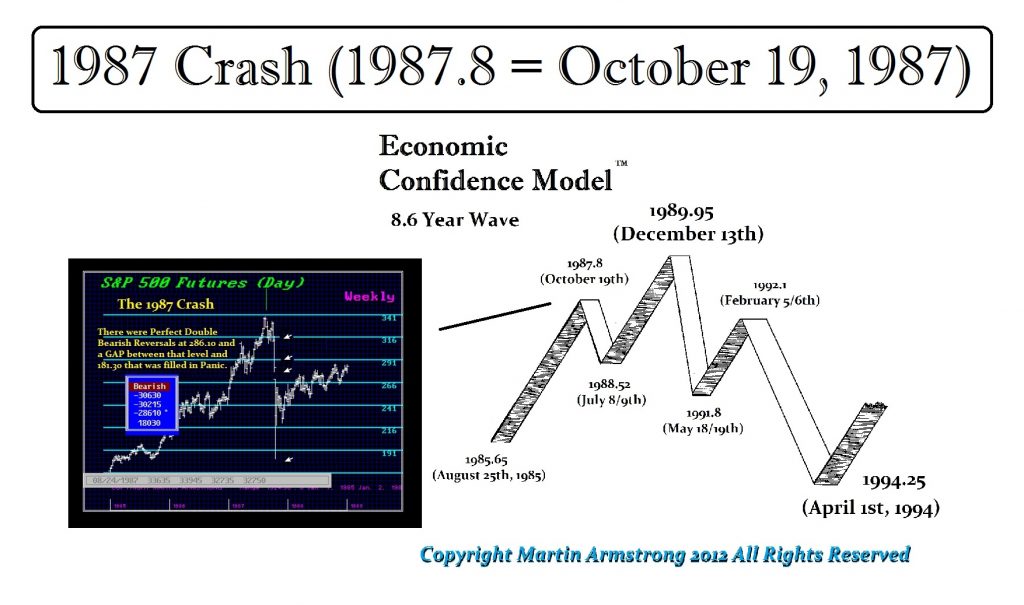

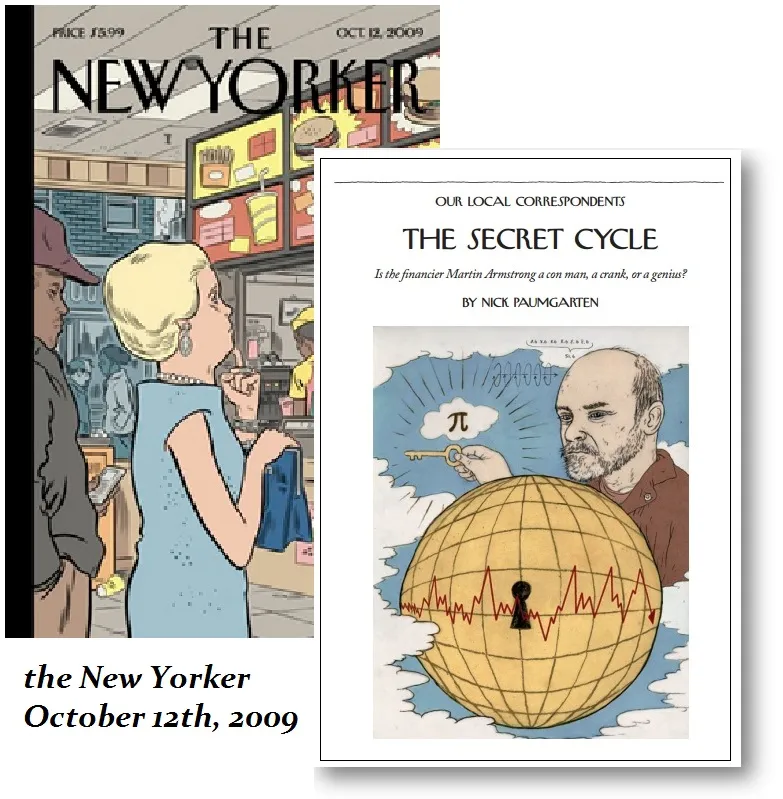

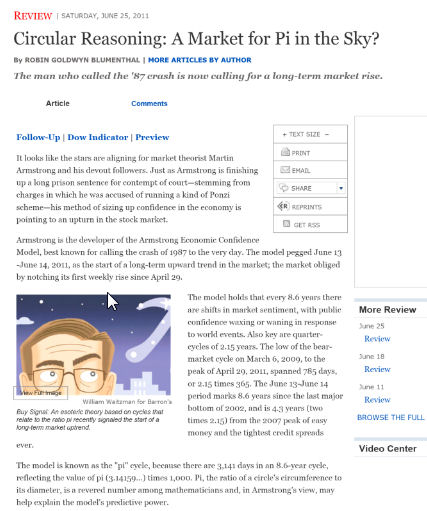

REPLY: I know. They cannot get their head around the fact that the Economic Confidence Model has pinpointed so many events in markets to geopolitical events to the very day. This proves BEYOND a shadow of a doubt that there is a hidden order behind the chaos.

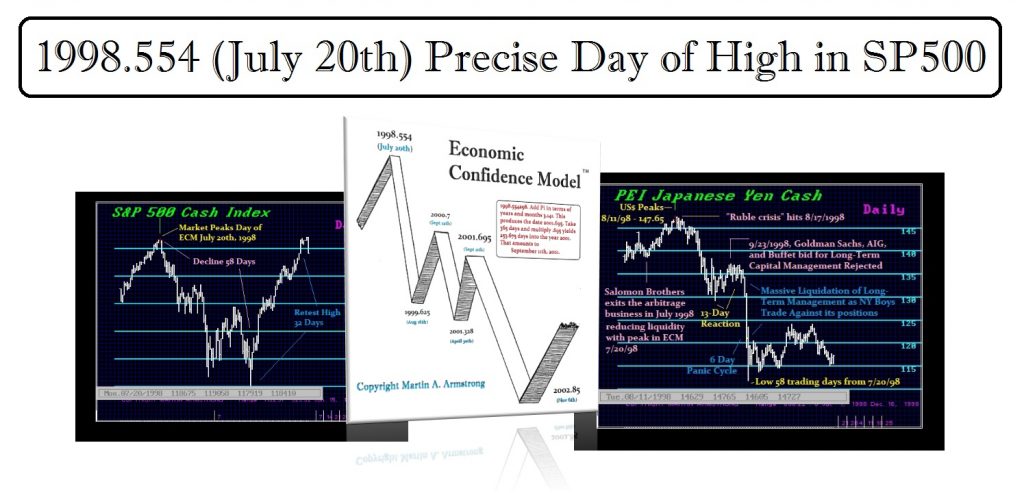

The 1998 forecast also landed me being named hedge fund manager of the year. I had sold the stock market the very day of the high on July 20th, 1998 and caught the ride down for the Long-Term Capital Management debacle.

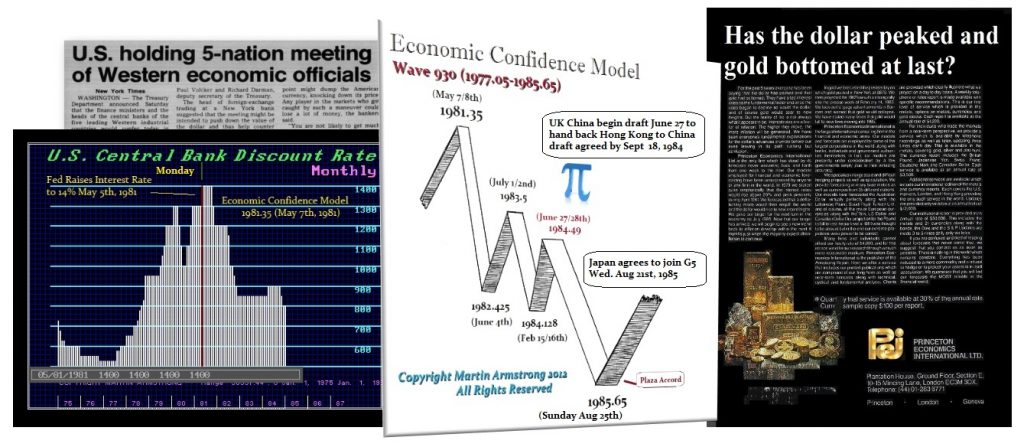

The forecasts it made back in 1981 were also amazing. It was off 2 days for the peak in interest rates when the Federal Reserve raised the discount rate to 14% on May 5th when the model targeted May 7th. It picked on the Pi turning point the negotiations to hand Hong Kong back to China, then on August 21st, Japan agreed to join the G5 which became known as the Plaza Accord on August 21, 1985, when the target was Sunday, August 25th. We even took the back cover of the Economist Magazine for three weeks in July 1985 to announce that the bottom of the cycle of deflation was reached and that a new wave of inflation was about to begin.

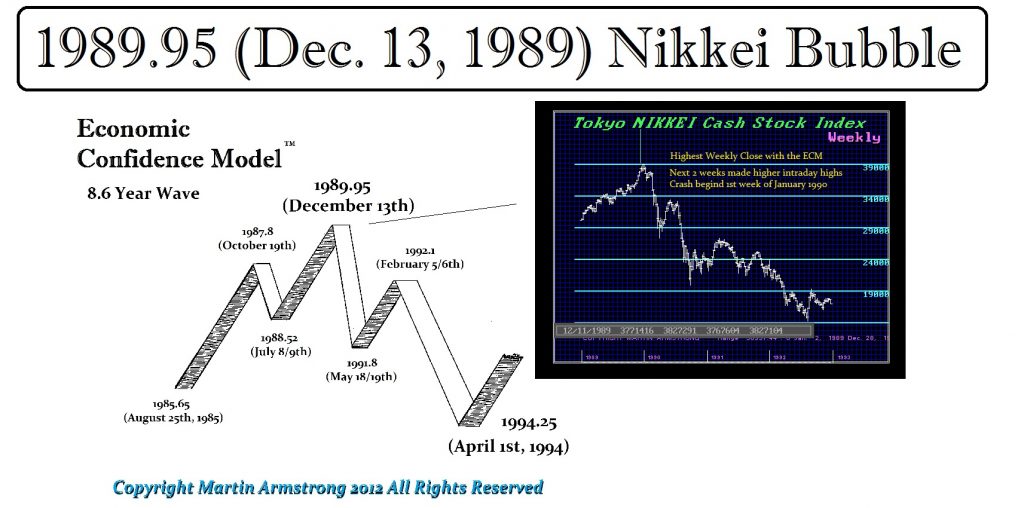

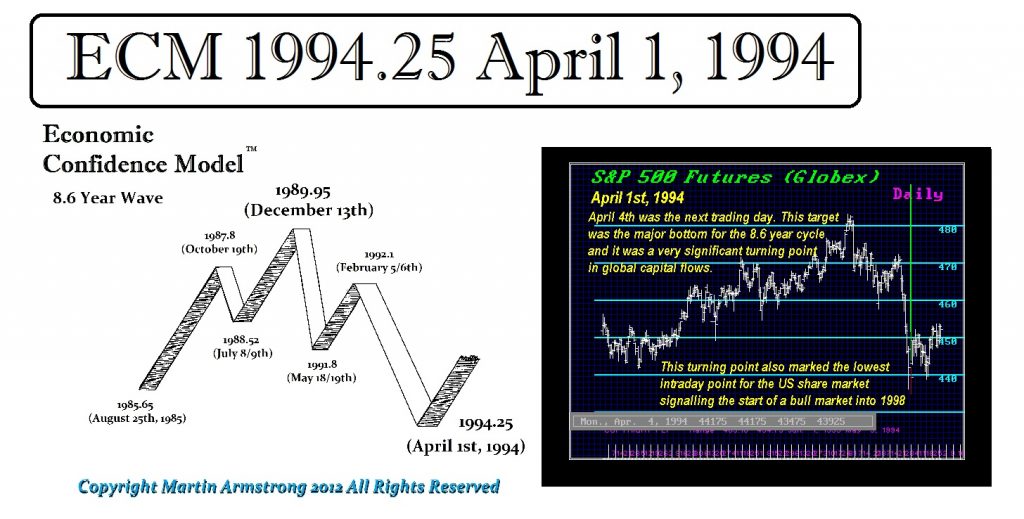

While 1989.95 picked the peak in the Bubble Top in Japan, the precise day of the low in the stock market in the USA came on the bottom of that wave on April 1, 1994.

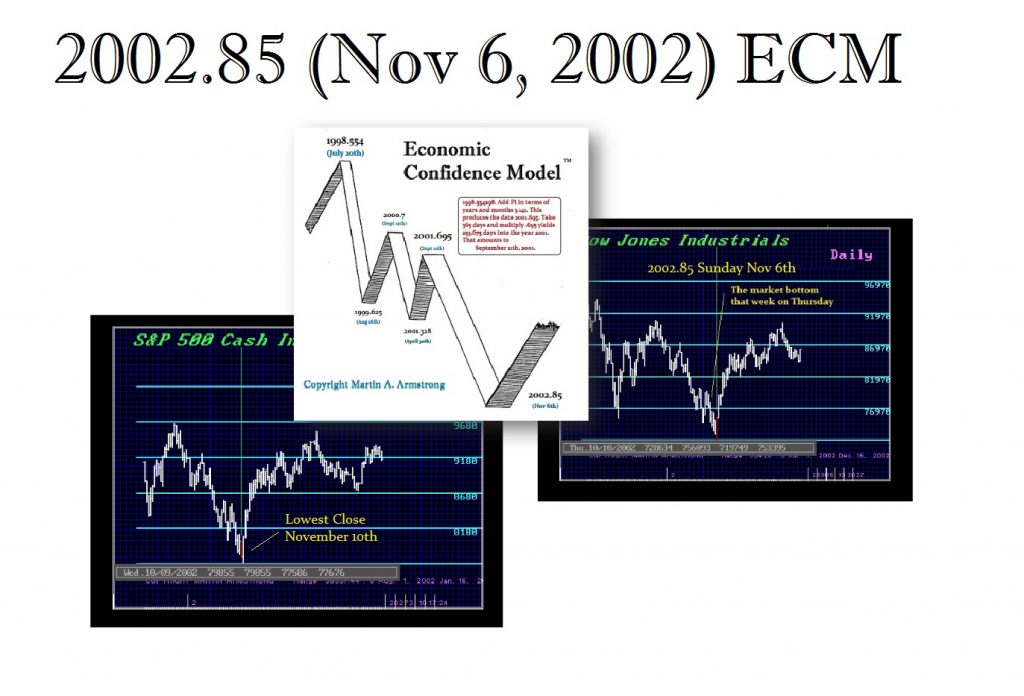

After that wave market the precise day of the high in the S&P500 on July 20th, 1998, the Pi turning point picked precisely the day of the 911 attack. Then the bottom of the wave was to be Sunday November 6th, 2002, and the market bottomed the next week.

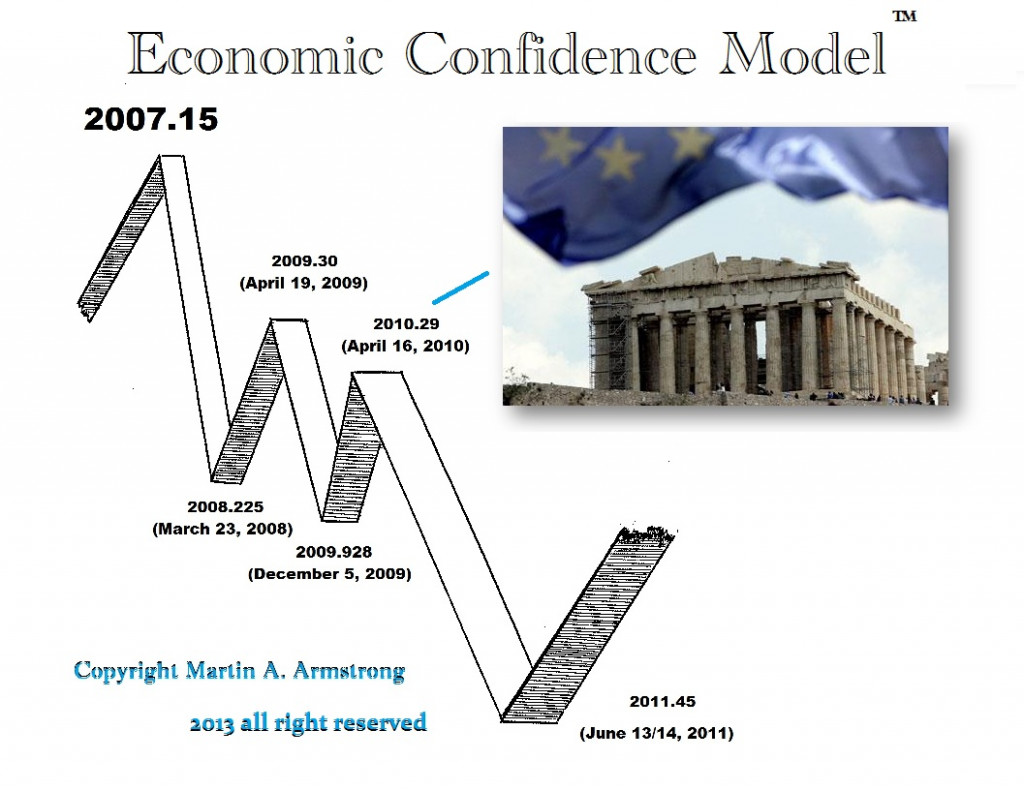

The wave which peaked in 2007.15 picked the precise day of the high in the Schiller Real Estate Index. The Pi target marked the precise day Greece applied for the IMF loan beginning the whole European debt crisis.

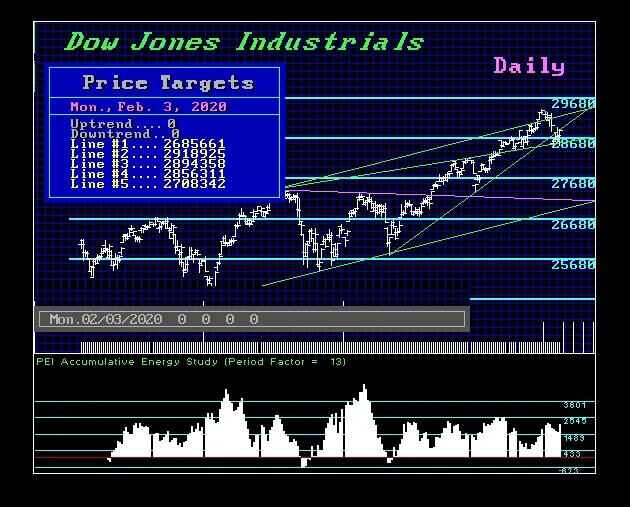

The top of this wave 2015.75 marked the start of Merkel opening the gates to the European refugees which have been the downfall of Europe. It marked the very day that Russian troops entered Syria. We now have the temporary high in the US stock market at the bottom of this wave.

Sure, no matter what evidence I put forward, there will be people who refuse to believe anything. We need those type of people for that are what make the cycle work. We all also have our personal life-cycle where we grow in experience and knowledge. We begin life ignorant and those who are smart, actually learn from their mistakes. As we proceed through life, we change and adapt so in the early stages of life we buy the high and sell the low. Those of us who are actually intelligent and are capable of learning from our mistakes, mature and then we become the people who sell the high to the novice and buy when they panic and sell everything at the low.

The morons, incapable of ever learning the lessons of life, cry to government that they WOULD HAVE BEEN correct except for some devil who manipulated the market against them. What they are really doing is refusing to admit that they were wrong. That inability to learn the lessons of life keep them perpetually on the wrong side of the cycle. We need those fools. I choose not to be a fool and assume I can teach anyone. If you have the spark of curiosity, then you have the ability to learn and advance in life which is what this journey is all about – the quest for knowledge.

A professor from Princeton University once told me I reminded him of Einstein. I was shocked. I said I was not some genuine is physics. He explained to me that was not what he saw. He said it was my curiosity to try to figure out what made things function. It does not matter what the subject might be or the task. It is the curiosity that made one try to sail across the Atlantic when others feared the end of the world. It has been my curiosity which has driven me to try to understand how a business cycle can act so precisely throughout even ancient history. This has been the curiosity of my life I have tried to share with those who share my curiosity.

No, the mainstream press will not report this. It is not something the majority is yet willing to hea