Pi & Major Changes in the Monetary System

QUESTION: Mr. Armstrong, you have said that the Pi cycle shows up everywhere in finance. I have looked at the charts you posted in the Roman Empire. Has this had a major impact in modern times aside from your Economic Confidence Model?

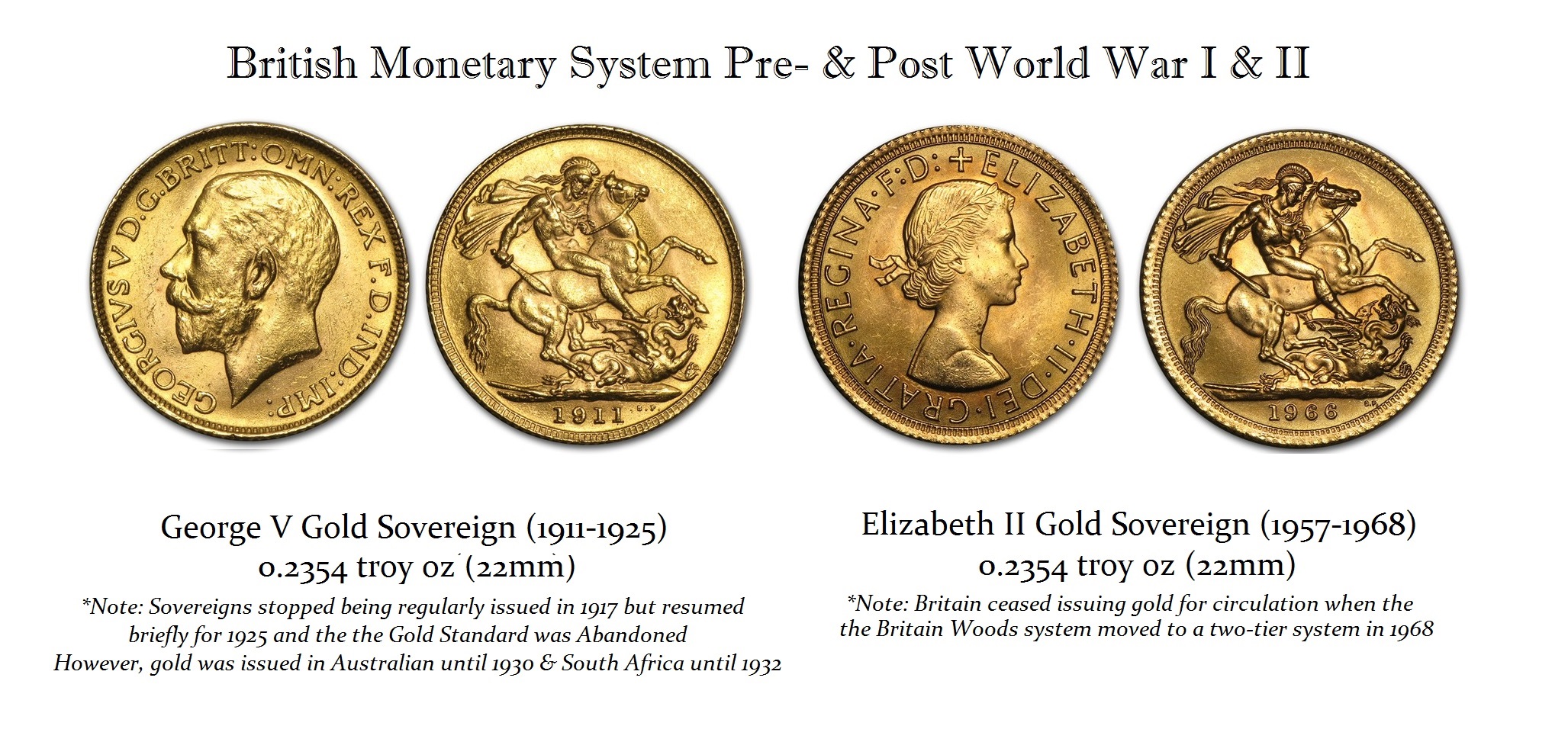

ANSWER: Of course. Just look at Roosevelt’s 1934 confiscation of gold. Add 31.4 years and you get 1964, the last year silver appeared in the coinage. Add another 31.4 years and you come to 1995. That was the historic low in the dollar against the Japanese yen for example. Britain abandoned the gold standard in 1925. That was the last year they minted gold sovereigns. They resumed 31.4 years later – 1957.

ANSWER: Of course. Just look at Roosevelt’s 1934 confiscation of gold. Add 31.4 years and you get 1964, the last year silver appeared in the coinage. Add another 31.4 years and you come to 1995. That was the historic low in the dollar against the Japanese yen for example. Britain abandoned the gold standard in 1925. That was the last year they minted gold sovereigns. They resumed 31.4 years later – 1957.

This is but one derivative of time. There are over 40 tests the computer runs just on Pi alone with this forming just one model. This is why the Forecasting Arrays cannot be reversed engineered because there are 72 models all independent and this is the sum of all time models with numerous sub-models within each. The top row is the composite and is the most important reflecting turning points with the highest and lowest bars. The color changes to indicate direction blue rising pink declining. Panic Cycles are outside reversals or big moves in one direction (breakout/collapses) where as volatility is measure in three primary manners, internal (diff between high/ow of trading session), overnight (previous close to open), and general volatility (close to close).