Armstrong Economics Blog/Dow Jones

Re-Posted Feb 7, 2018 by Martin Armstrong

QUESTION: Marty; I have been following you since the 1980s. I was there at your WEC in 1987 when you had to hold one every weekend for three weeks in a row the world was going so crazy. I have never known your model to miss a high or picking the low in a panic. Will you update How to Trade a Panic you published back in the 1980s? It is time to get that out.

At the last WEC, I had a conversation with a first timer. He commented you never advertise yet have the biggest audiences ever. I told him I do not recall you ever advertising since the 90s. You don’t need to. All roads lead to you like Rome. My hat’s off to you for calling this panic again to the day. I find it curious why the TV shows, newspapers, none of them will quote you or tell the world what you have accomplished so consistently. This I have come to realize is confirmation of their own dishonesty for if they really report news, they should report you have done it again.

Will this be like 1987, 2000, and 2007? New highs yet again?

Your loyal follower for decades

PD

ANSWER: That is a good idea, I will update How to Trade a Panic. It’s about time I suppose.

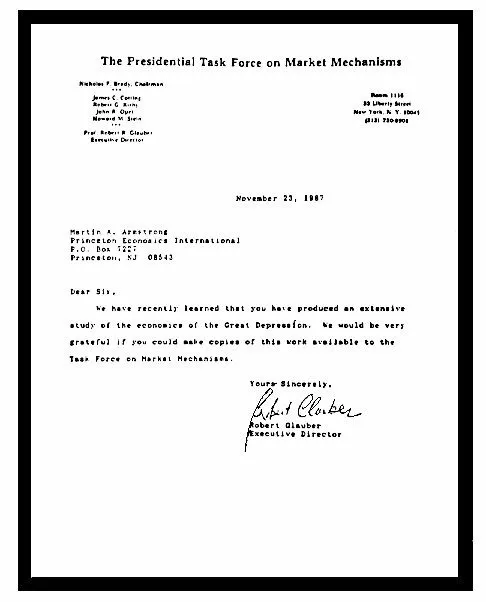

Of yes, I remember 1987. I was so exhausted after doing three WEC three weekends in a row selling out each time. That’s when even the Presidential Commission wanted the research. It was a crazy yet fun time. I was thinner and had more energy back then.

Yes, we have not advertised since the early 1980s. Perhaps only after launch and everything is stable after setting up servers around the world. Will we see new highs again? Yes, of course!

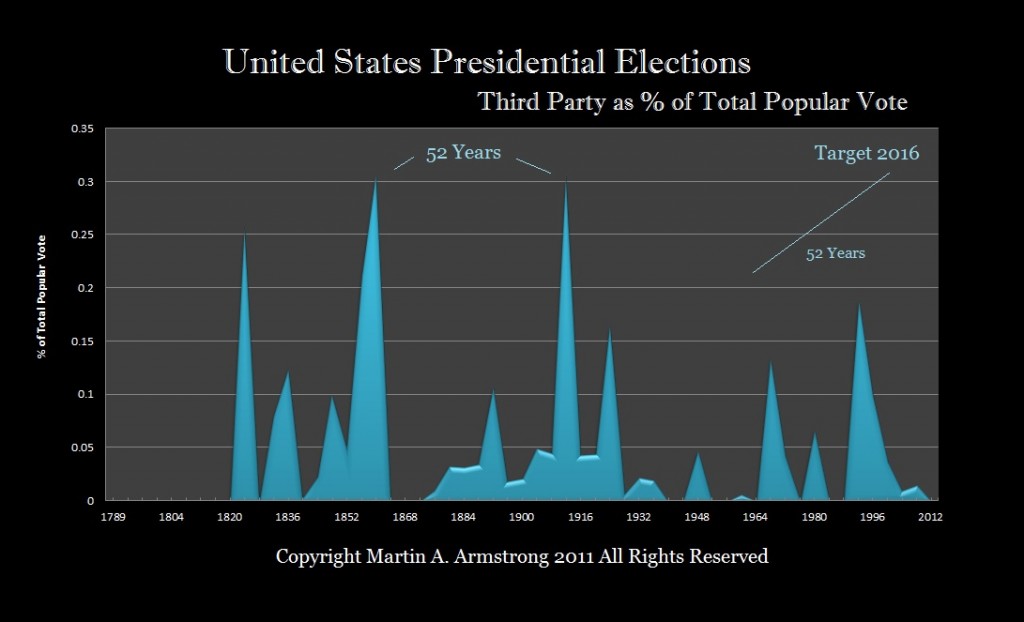

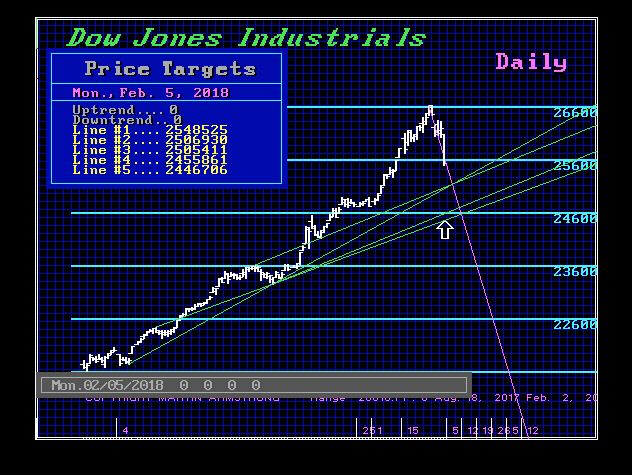

This was a Panic Cycle Year I announced at the WEC. It was also 8.6 years up from the 2009 low. The market crashed right on target and it was also the Gold Benchmark target. Then it made the initial low on the Directional Change and bounced. Pretty standard. Hang on. The fat lady has not sung yet.

This was a Panic Cycle Year I announced at the WEC. It was also 8.6 years up from the 2009 low. The market crashed right on target and it was also the Gold Benchmark target. Then it made the initial low on the Directional Change and bounced. Pretty standard. Hang on. The fat lady has not sung yet.

We still have the weekly numbers coming into play on Friday