Posted originally on the CTH on August 17, 2023 | Sundance

Some economic data released by the land of the rising sun points to a larger global weakness in manufacturing demand. Within the data year-over-year exports from Japan fell in July by 0.3%, which is the first time since 2021 the contraction was noted.

Digging a little deeper, the weakness in Japanese exports is driven primarily by a decline in exports to China of 14.3% in July, which follows a 10.9% decline in June. Japan is a component supplier to China, which would indicate the demand for Chinese products globally is substantially less than Beijing has previously admitted.

That said, Japan’s direct export of finished goods to the U.S. actually increased 13.5%, mostly driven by the export of electric vehicles.

However, 13.5% is identical to the overall decrease in Japanese imports.

Essentially, component parts to China are down, but completed finished goods to the U.S. are up. Overall, the results from Japan point to a soft overall global economic status, the result of continued contraction of Western economic activity.

TOKYO, Aug 17 (Reuters) – Japan’s exports fell in July for the first time in nearly 2-1/2 years, dragged down by faltering demand for light oil and chip-making equipment, underlining concerns about a global recession as demand in key markets such as China weaken.

Japanese exports fell 0.3% in July year-on-year, Ministry of Finance (MOF) data showed on Thursday, compared with a 0.8% decrease expected by economists in a Reuters poll. It followed a 1.5% rise in the previous month.

[…] Japanese policymakers are counting on exports to shore up the world’s No. 3 economy and pick up the slack in private consumption that has suffered due to rising prices.

However, the spectre of a sharper global slowdown and faltering growth in Japan’s major market China have raised concerns about the outlook.

The World Bank has warned that higher interest rates and tighter credit will take a bigger toll on global growth in 2024. (read more)

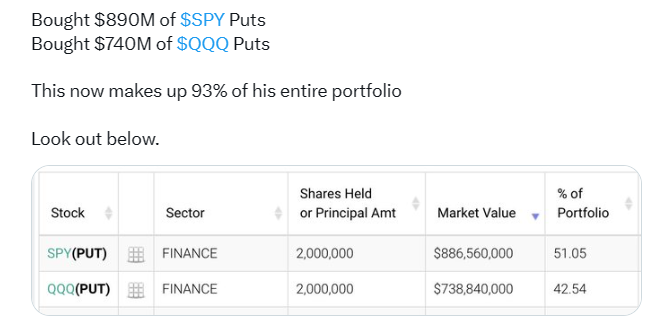

Meanwhile, I would not bet against Michael Burry.

Burry is betting against the S&P 500 and Nasdaq 100 this week, according to his fund’s latest releases. Securities and Exchange Commission filings. The filing shows that he is now holding options against the S&P 500, hedging $886.6 million against the index.

The filing also revealed that Burry sold his shares in Capitol One, First Republic, PacWest Bancorp, Wells Fargo and Western Alliance after betting on them earlier this year in Trying to make money from the regional banking crisis. Burry also sold his stakes in Chinese e-commerce giants Alibaba and JD.com.

In addition, he bought $738.8 million in put options against the Invesco QQQ Trust ETF – a fund made up of popular high-tech Nasdaq companies, such as big tech companies Apple and Microsoft as well as Nvidia, Tesla and PepsiCo.

Burry has pulled money out of China investments and U.S. banks and is hedging against tech and the S&P. He took these positions before the data from Japanese exports to China was released.