Armstrong Economics Blog/Silver

Re-Posted Jan 17, 2019 by Martin Armstrong

QUESTION: RE: ….& Coming Barter System.

So, are you suggesting that we may see a shift to Silver by private individuals as the only way to sidestep Government stupidity, or will it be even worse, like trading whiskey for toilet paper??

TWE

ANSWER: Assuming government attempts to follow the IMF’s advice and create cryptocurrencies to replace paper money, then the only alternative will be the barter system. To make this clear, the likelihood of the USA following this route is a last resort. It will NOT be the first, but the last. We will see this in Europe before we will ever see it in the USA.

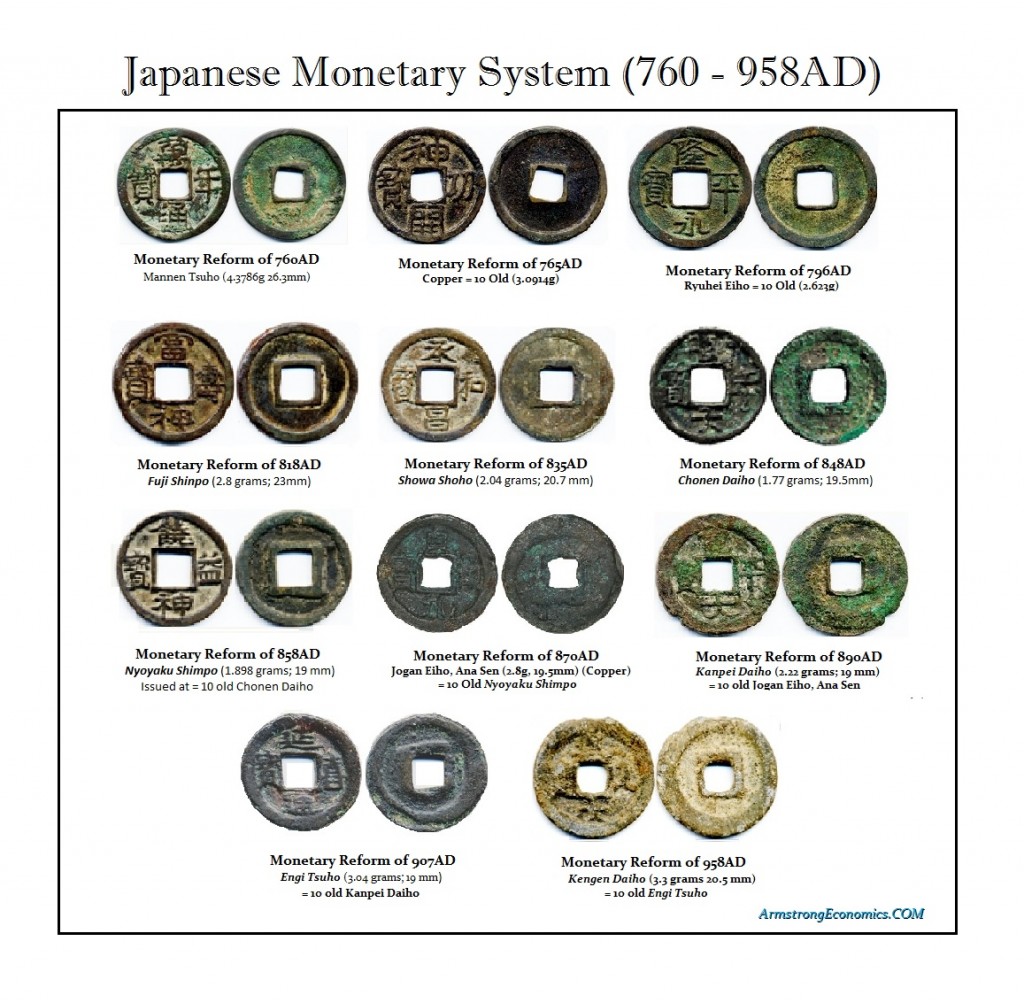

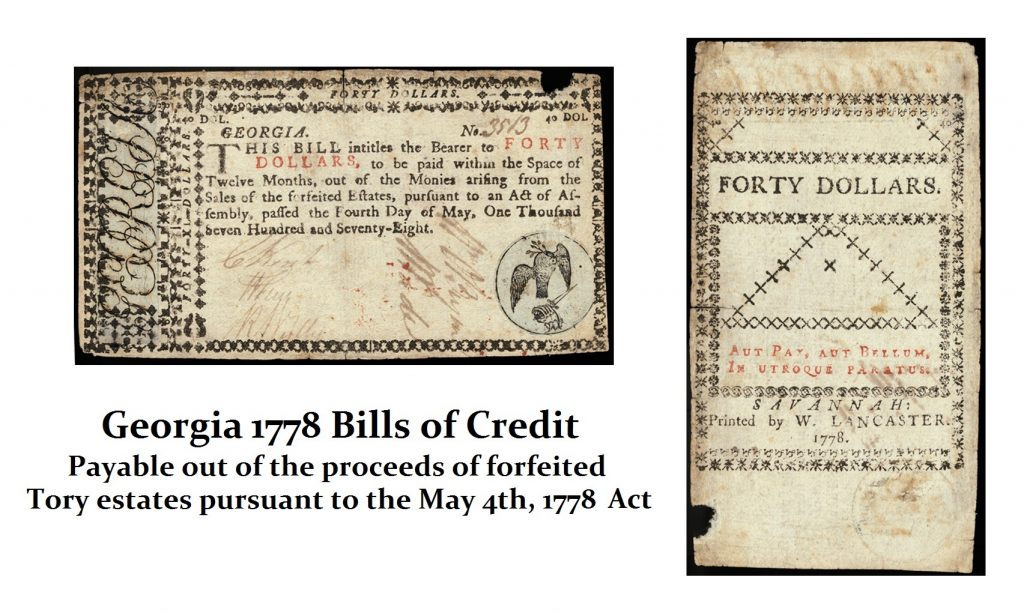

This cannot be a question that is answered based upon OPINION, for we all have one. The only rational way to approach that question is to look at history and see how people responded to similar but not identical positions. What comes to mind in Japan. Each new emperor devalued the money issued his own coins worth 10x that of the coins of the previous emperor. People resorted to bags of rice and they used the coins of China. Everyone refused to use Japanese coins. The result was that Japan LOST the right to issue coins at all for 600 years.

Moving to a cryptocurrency to stop the underground economy from using paper money will simply switch it to foreign currency (dollars in Europe) or something commodity based. In federal prisons, when they banned smoking back in 2004, packs of mackerel industry became the prison currency. Everyone operated an internal economy. They used cigarettes as their currency of choice to purchase anything from food and home-brewed prison hooch. They also used books of stamps. Prisoners could ship books of stamps out and they could resell them at a discount. Mackerel became the small change at about $1 a pack. There are fully developed economies within prisons. Someone skilled at drawing would make cards for holidays, while others were good at a trades tailoring to fix your clothing. Others would take a scarf and turn it into a warm knitted hat.

Once you eliminate the freedom that paper money provides, the government may believe it will get 100% of every tax it ever dreamed of but the underground economy will flip to barter. As far as silver is concerned, I would prefer silver coins that are recognizable to the average person. Offering bars of silver would be at a discount, for it will require knowledge and testing.

Then we have the legislative branches who spend whatever they need and look to the central banks to manage the inflation they themselves create. They take no responsibility for their own actions. This places the central bank between a rock and a hard place. Trump was bashing the Fed over its rate hike while he fails to understand the crisis we are in thanks to Larry Summers. The Fed has to choose between Fiscal Policy and its own monetary policy or Fed Policy. It raises rates to deal with the crisis of excessively low interest rates and then the budget deficit increases as the cost to keep rolling the debt grows exponentially.

Then we have the legislative branches who spend whatever they need and look to the central banks to manage the inflation they themselves create. They take no responsibility for their own actions. This places the central bank between a rock and a hard place. Trump was bashing the Fed over its rate hike while he fails to understand the crisis we are in thanks to Larry Summers. The Fed has to choose between Fiscal Policy and its own monetary policy or Fed Policy. It raises rates to deal with the crisis of excessively low interest rates and then the budget deficit increases as the cost to keep rolling the debt grows exponentially.