Posted originally on the CTH on August 9, 2023 | Sundance

The Global Disinformation Index (GDI) is the group who define the content on platforms according to their ideological worldview and then blacklist sites who do not align their content to support the GDI perspective. According to the Washington Examiner, Elon Musk has just partnered with them in order to enhance the advertising portfolio of Twitter and find ways to make it lose less money.

CTH has previously said to watch the economics of the Musk situation, because that will determine the outcome of the decisions. The hiring of NBC-Universal executive Linda Yaccarino was explicitly to lure the advertising side of the issue back onto the platform.

Once you are reliant on the advertising, you must then comply with the content terms of the companies who control the advertising. Joining with a group to define “disinformation” is an outcome.

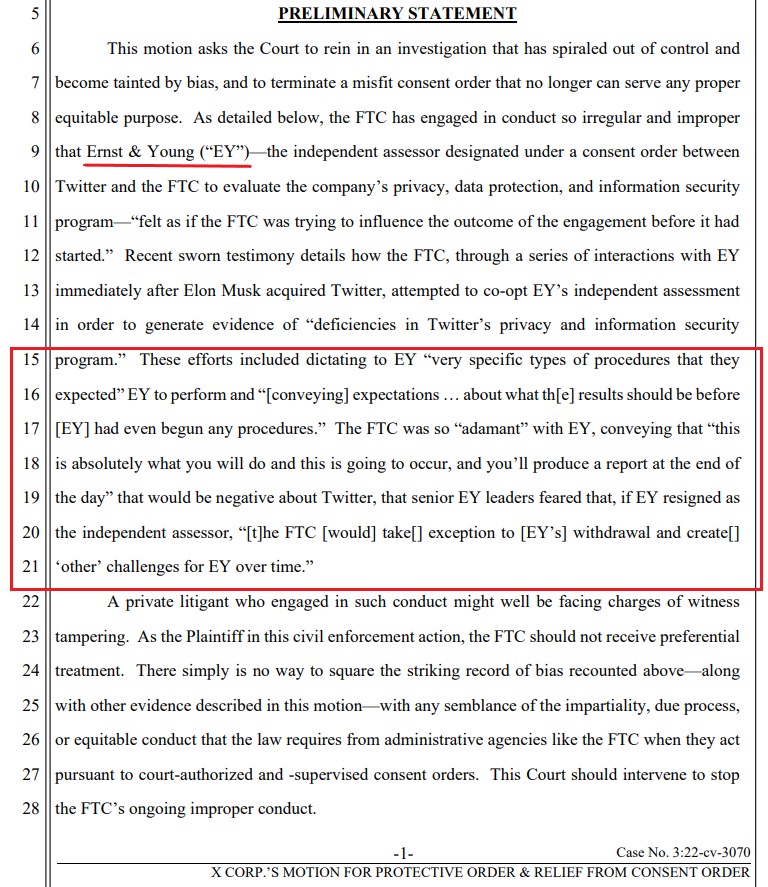

WASHINGTON – Elon Musk’s X, the social media company formerly known as Twitter, signed an exclusive partnership with a “misinformation” tracker linked to a government-funded group blacklisting conservative media outlets, records show.

On the heels of Musk in July describing how the social media company had negative cash flows due to a 50% drop in advertising revenue, X is teaming up with Integral Ad Science, an ad-verification company, for a “brand safety” initiative. That same ad group, which uses an artificial intelligence algorithm to rate alleged “misinformation,” is affiliated with the Global Disinformation Index, a British group with two affiliated U.S. nonprofit groups that the Washington Examiner revealed is covertly feeding blacklists of conservative websites to advertisers to defund disfavored speech.

“I am completely against GDI in any form,” Rep. Ken Buck (R-CO), who sits on the House Judiciary and Foreign Affairs committees and has launched investigations into the British group over its alleged censorship efforts, told the Washington Examiner. “This new partnership with a group connected with GDI would only amplify the coercive and destructive powers targeting free speech.”

The partnership between X and IAS appears to undercut Musk’s touted commitment to free speech. The X owner has notably released “Twitter Files” documents to journalists, including Matt Taibbi, from Jack Dorsey’s time running the platform that show the company’s apparent coordination with the government to thwart right-leaning voices online. (read more)

I don’t want to say I told you so, but….

…”There is no such thing as “disinformation” or “misinformation”. There is only information you accept and information you do not accept. You were not born with a requirement to believe everything you are told; rather, you were born with a brain that allows you to process the information you receive and make independent decisions.”…

Keep in mind, long before people realized the Dept of Homeland Security (FBI, DHS, CISA etc.) had a portal into Twitter, I was explaining how transparently obvious it was. {Go Deep – Jack’s Magic Coffee Shop} In part, the transparency of the problem is driven by CTH understanding of the costs associated with Twitter as a very unique platform in the sphere of social media. {Go Deep – Understand the Costs}

With the latest revelations we shared about the financial position of Twitter {Go Deep on FINANCIALS}, all of the moves now underway make sense. Musk was on track to hit a date in/around October of this year where Twitter would be insolvent. If you had read those previous “Go Deep” links, you will easily see the problem.

In 2021, Twitter generated $5.1 billion in revenue, according to the Wall Street Journal. According to the New York Times, in 2023 that revenue has dropped to around $1 billion per year.

Musk stated during public conversation that Twitter was essentially break even at $4 billion, which was the position in 2022 just prior to his taking over. [2022 costs around $4.5 billion and revenue around $4 billion +/-, per public financial statements and reporting]. Musk cut approximately $500 million in expenses from realignment and staffing reductions.

Musk has a $1.5 billion debt service on the loan he took out, per his own admission: that’s more than $100 million per month. The debt service alone is higher than his revenue. As I noted last month, Twitter is losing somewhere around $300 million per month. With $1 billion liquid in the bank, as of June (per Musk), that only gets him to September; by October, he needs another influx of cash, or else.

There is no business model, even with paying subscribers, for Twitter to exist without a major increase in revenue (Yaccarino) or a major decrease in costs. As the business grows (more users), the costs increase (more simultaneous users), and the costs to subscribers would grow. Twitter Blue subscriptions are around 180,000 users, paying $11/mo. That’s around $2 million a month- a pittance in comparison to what he needs.

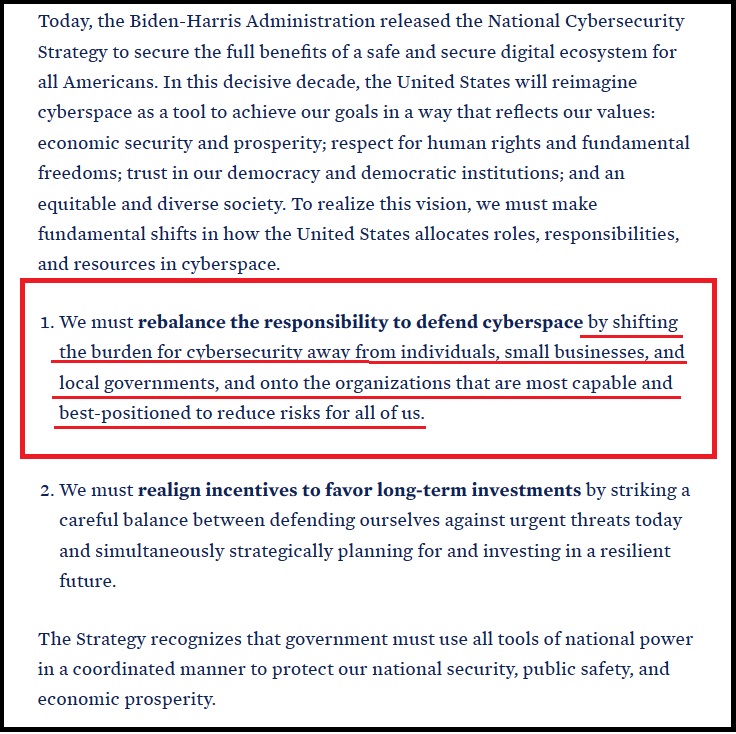

On March 2, 2023, the people in control of the Joe Biden administration officially announced that government control of internet content was now officially a part of the national security apparatus. [White House Link] If you have followed the history of how the Fourth Branch of Government has been created, you will immediately recognize the intent of this new framework.

The “National Cybersecurity Strategy” aligns with, supports, and works in concert with a total U.S. surveillance system, where definitions of information are then applied to “cybersecurity” and communication vectors. This policy is both a surveillance system and an information filtration prism where the government will decide what is information, disinformation, misinformation and malinformation, then act upon it.

In part, this appears to be a response to the revelations around government influence of social media, the Twitter Files. Now we see the formalization of the intent. The government will be the arbiter of truth and cyber security, not the communication platforms or private companies. This announcement puts the government in control.

All of the control systems previously assembled under the guise of the Dept of Homeland Security now become part of the online, digital national security apparatus. I simply cannot emphasis enough how dangerous this is, and the unspoken motive behind it; however, to the latter, you are part of a small select group who are capable of understanding what was in this announcement without me spelling it out.