Posted originally on the conservative tree house April 13, 2021 | Sundance | 333 Comments

The Bureau of Labor Statistics highlights some alarming inflation numbers today [Link Here] that are unfortunately, not unexpected…. unless you are a liberally trained economist (most of them) and so the results are surprisingly “unexpected”. But the actual JoeBama-nomic policy is even worse because wages increased less than inflation increased, so real wages (actual purchasing power) decreased. That spells trouble, Trouble.

Middle-class wage earners already know this problem; you are seeing it at the gas pumps and at the grocery store. Fuel prices are rapidly increasing and the amount of inflation in the ‘at home’ food industry (grocery store) is even more concerning.

Let me first walk through the data and then provide some forward analysis with tips to help you offset what is about to hit.

First, it is important to know that BLS price survey data lags actual prices as felt today. The prices you are seeing today/tommorrow at the store and gas pump will not show up in the rolled-up data for over a month…. So the data released today is unfortunately far behind what you are witnessing in real time.

Gas prices rose last month by 9.1%. The year-over-year inflation number is an alarming 2.6 percent last month. Keep in mind that retail grocery prices are not in the inflation number, and they generally follow the same price index as fuel; so it is safe to say monthly grocery store price increases are in the 8 to 10 percent range.

Part of the reason gas and food track together is fuel and energy prices are the #2 cost within the food sector. With packaging prices increasing; with fuel prices and distribution costs increasing; with energy prices increasing; all costs associated with food production, processing, delivery, warehousing and distribution, all end up in the final price at the grocery store.

This problem with inflation is only going to get worse as the FED gets more involved (that’s coming), because interest rates are already disconnected from the economic costs associated with business investment. [Note: the Fed said last year that it would hold its benchmark interest rate near zero, for some time, even if inflation were to rise above its preferred rate.] JoeBama is returning us to a “service driven economy”, and that is a problem for inflation.

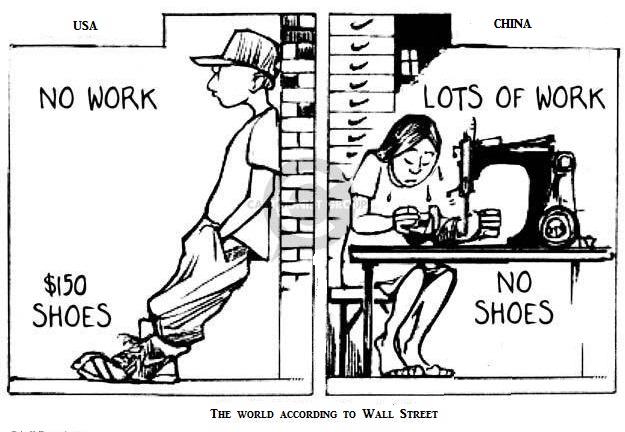

President Trump’s MAGAnomic (USA First) increased wages and lowered prices (deflation) {Go Deep} but hurt Wall Street. JoeBama’s globalist policies lower U.S. wages and increase prices (inflation) but increase Wall Street (via multinationals).

Gas prices are going to keep rising because JoeBama is shutting down U.S. energy sources, blocking pipelines and using regulation to stall energy development (including refineries). We will be back to energy dependence soon. This process will continue driving up food prices which is really bad for the middle-class.

In the longer term, the impact of wages purchasing less means middle-class housing prices will drop as people struggle to afford mortgages. However, the Wall Street gains will keep the upper tier real estate market less impacted. You can see how the wealth gap is directly attributed to policy.

Trump decreased the wealth gap with policies that disproportionately (in a good way) helped the middle-class and blue-collar worker by increasing wages. JoeBama expands the wealth gap with policies that disproportionately (in a bad way) hurt the middle-class and blue-collar worker by decreasing real wages and increasing prices. Under JoeBama-nomics the rich get richer and the poor get more poor.

If you know that fuel and food prices are going to increase, you can take action now to plan out your home budget in an effort to offset or cope with the inflation. Example: buy bulk items that can last longer as ingredients. You can also save money by making your own laundry detergent, shop sales, cut coupons and be proactive in preparation for a period of large price increases at the supermarket. Use your freezer and eat out less.

Employment is going to be an issue again. While the current employment picture is good, it will not last into 2022. Make a safety net now (somehow) and start thinking about your longer term expenses and how you can take action now in preparation.

I am not a doomsayer… but I can see when supply chains start to fill up because overall demand begins to stall. We are exactly at that point.