Armstrong Economics Blog/Basic Concepts

Re-Posted Jan 1, 2017 by Martin Armstrong

Trying to understand forecasting will be critical as we move forward. The HUGE turning point appears to be 2018 and that is most likely when things will start to come unglued. How do I even make such a statement? This is not a claim that I make based upon some gut feeling. I arrive at this statement not by looking at some domestic fundamental or speculation on what Trump might do or not. It is not based upon my contacts behind the curtain. This is simply looking at Socrates and nothing else.

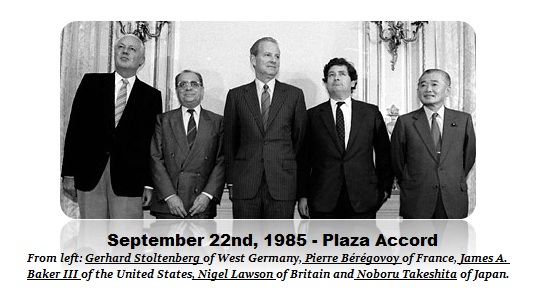

So how do I arrive at that statement? It is the process of understanding that everything is connected. I have argued against the conspiracy theorists who claim gold is not up because it have been manipulated by the bankers. I have fought against the “real” manipulations and warned clients when they are in action. But the bankers are not capable of manipulating a market counter trend – nobody is. We have had 8 years of quantitative easing by Mario Draghi without any success. Not even a central bank can manipulate the economy no less a single market. The entire Plaza Accord was the gathering of 5 countries to try to manipulate the dollar lower for trade. The US Treasury and Federal Reserve Bank could not pull that off. Why listen to such nonsense about gold is manipulated to prevent a rally? These types of nonsense PREVENT you from understanding how the world really works.

When I warned the White House back in 1985 and trying to manipulate the dollar lower creating the G5 would increase the volatility and lead to a crash in 2 years (1987), the White House responded and said they disagreed that volatility would increase.

When I warned the White House back in 1985 and trying to manipulate the dollar lower creating the G5 would increase the volatility and lead to a crash in 2 years (1987), the White House responded and said they disagreed that volatility would increase.

Of course, when the 1987 Crash hit, the Brady Commission was forced to request my work. My greatest accomplishment was to prevent them from taking crazy sanctions against the market plays when the real cause was the G5.

I was advising the equivalent of about 50% of the value of the US National Debt at that time. The Japanese to ease trade restrictions, had been buying US debt and owned bout 33% of the US national debt at that time. I warned the Treasury that to lower the value of the dollar by 40% as the Plaza Accord said that was their goal, the would set off a crash and higher volatility because foreign investors will be forced to sell and exit the dollar. Yes, the value of exports would look good to foreign consumers, but US assets would also look like a sell. Capital will move to the most advantageous location globally because we are all connected.

I was advising the equivalent of about 50% of the value of the US National Debt at that time. The Japanese to ease trade restrictions, had been buying US debt and owned bout 33% of the US national debt at that time. I warned the Treasury that to lower the value of the dollar by 40% as the Plaza Accord said that was their goal, the would set off a crash and higher volatility because foreign investors will be forced to sell and exit the dollar. Yes, the value of exports would look good to foreign consumers, but US assets would also look like a sell. Capital will move to the most advantageous location globally because we are all connected.

On May 28th, 1997, again I wrote to then Robert Rubin who was Secretary of the Treasury. Rubin was doing the same thing and trying to talk the dollar down criticizing the Japanese. Our models were warning of another crash and indeed it hit within just a few weeks of my letter and became known as the Asian Currency Crisis. The Asian financial crisis was a period of financial crisis that gripped much of East Asia beginning in July 1997 and raised fears of a worldwide economic meltdown due to financial contagion. Indonesia, South Korea and Thailand were the countries most affected by the crisis.

On May 28th, 1997, again I wrote to then Robert Rubin who was Secretary of the Treasury. Rubin was doing the same thing and trying to talk the dollar down criticizing the Japanese. Our models were warning of another crash and indeed it hit within just a few weeks of my letter and became known as the Asian Currency Crisis. The Asian financial crisis was a period of financial crisis that gripped much of East Asia beginning in July 1997 and raised fears of a worldwide economic meltdown due to financial contagion. Indonesia, South Korea and Thailand were the countries most affected by the crisis.

It was Tim Geithner who responded in just 4 days.Our model has been well known behind the curtain for decades. When the Asian Currency Crisis hit, I was invited to China to meet with the central bank.

By monitoring the world, what emerges is the overall trend. Trump won not by some isolated fluke. We put that forecast out years in advance and it did not matter the flip-flopping polls or how much money Hillary spent. Our computer saw the trend forming decades in advance. The Catalonia vote in July 2016 to separate from Spain followed by BREXIT was showing you the global trend. Once you understand that NOTHING takes place in isolation, you can see the trend coming before it arrives.

Our forecast that gold would peak in 2011, the US share market would rally to new highs made back in 2011 that Barron’s thought was nuts, and that the euro would collapse, were all connected. If one unfolded, the other HAD to follow. Once you see that the world capital flows dictate the outcome of everything, then investing and trading becomes a lot easier.

So why do I try to teach people? Because I can say buy or sell. Most people will not do so unless they agree and/or have confidence in that conclusion. The way to invest securely demands you have confidence in you action.