Armstrong Economics Blog/World Economic Conference

Re-Posted Aug 25, 2019 by Martin Armstrong

QUESTION: Since we are nearing the turn in the ECM in January, will the focus be on how to position oneself for the next wave covering bonds, commodities, share markets, and currencies? You can smell this Monetary Crisis Cycle coming and the Sovereign Debt Crisis in the air. Has such a convergence ever taken place before?

BD

See you in Orlando

ANSWER: I am publishing for attendees for the first time the Dark Age Cycle. In addition the Manipulating the World Economy which is a detailed account of central banks and how the entire system has been managed which is now slipping through their fingers, we have indeed the first time in modern history when such things have converged. Historical accounts exist, but well before the 17th century so it is hard to provide daily charts to reflect upon.

ANSWER: I am publishing for attendees for the first time the Dark Age Cycle. In addition the Manipulating the World Economy which is a detailed account of central banks and how the entire system has been managed which is now slipping through their fingers, we have indeed the first time in modern history when such things have converged. Historical accounts exist, but well before the 17th century so it is hard to provide daily charts to reflect upon.

I have also completed probably the most documented report on the precious metals ever written tracing the ratio and how these metals have responded in times of financial stress.

I have also completed probably the most documented report on the precious metals ever written tracing the ratio and how these metals have responded in times of financial stress.

This report traces the ratio from 8:1 to 120:1 and why it has moved. Yet most of all, what has been completely overlooked is the fact that people do not understand that the ratio was manipulated as part of Quantitative Easing even under the gold standard. Sorry central bankers, it failed to work then and nearly bankrupted the economy.

I have also put together a report on the Hoarding of Dollars and the implications for the world Foreign exchange markets. Here you will have a guide to the currencies and how they will impact the future as we head into the Monetary Crisis Cycle in the years ahead.

I have also put together a report on the Hoarding of Dollars and the implications for the world Foreign exchange markets. Here you will have a guide to the currencies and how they will impact the future as we head into the Monetary Crisis Cycle in the years ahead.

Virtually 70% of the physical paper US currency is now circulating outside the United States. On top of that, there are now outstanding more $100 billions than $1.

As the world has turned toward trying to outlaw cash transactions to eliminating cash altogether outside the United States, the trend has shifted toward hoarding dollars that is just not considered in the analysis these days of the future prospects in currency. This report provides the forecasts fo all the strategy currencies going forward.

Also included will be the report we handed out at the Rome WEC early this year. We have not made this report available for sale. Here you will learn a shocking reality behind the curtain of the Euro.

Also included will be the report we handed out at the Rome WEC early this year. We have not made this report available for sale. Here you will learn a shocking reality behind the curtain of the Euro.

The Fate of Europe is a very important report for you need to understand the backdrop to what we face going forward. Like the Great Depression, the crisis will begin in Europe and spread like a contagion.

Nigel Farage delivered the keynote speech at the Rome WEC. He called the World Economic Conferences we have been holding since 1985 – the “Alternative to Davos.”

In addition, attendees will be provided with the special report for Year-End on the World Share Markets – the Good, the Bad, & the Ugly. With the majority of economists now talking up a bear market and a recession in an effort to desperately overthrow Trump in the 2020 election, it is no wonder that the share market outlook is anything but clear.

In addition, attendees will be provided with the special report for Year-End on the World Share Markets – the Good, the Bad, & the Ugly. With the majority of economists now talking up a bear market and a recession in an effort to desperately overthrow Trump in the 2020 election, it is no wonder that the share market outlook is anything but clear.

The world share markets are by no means all in the same position. Their fates will also depend upon their underlying currency. Will Shanghai recover or continue to decline? Has the German DAX lost its gilt edge among European share markets? What about London in the face of BREXIT? Will the Southeast Asia markets be impacted by China trends?

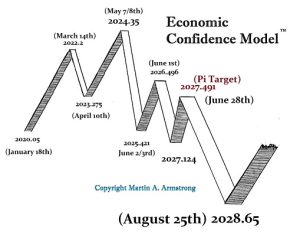

Then attendees will also receiver the Monetary Crisis Report. Here we have provided the details on this cycle and how it has performed in the past with its implications for 2021/2022.

Then attendees will also receiver the Monetary Crisis Report. Here we have provided the details on this cycle and how it has performed in the past with its implications for 2021/2022.

Granted, the price of the ticket virtually covers the cost of all these reports if purchased separately. In addition, we will be providing video updates as we head into this crisis so you are kept up to date as things unfold.

So welcome to this year’s 2019 World Economic Conference. We have reduced the number of seats this year because we had a large conference in Rome with over 300 attendees. These events have gotten too big so we are trying to reduce the size of Orlando and hopefully provide a more intimate setting as takes place with the overseas WEC events.