QUESTION: Mr. Armstrong; There are these people so desperate to argue that cryptocurrency will change the world, I have heard the same pitch behind gold and I suspect most are just goldbugs who gave up and moved to cryptocurrencies. The same arguments of fiat and central banks are at the base of this as well. Do you think that cryptocurrency can somehow emerge as a solution after the Crash and Burn? How can there be thousands of these cryptos? If the dream they pitch is even plausible, then does there not have to be just one cryptocurrency?

Thank you

Hank

ANSWER: We have to ask what is at the core of this trend. In essence, it is the very same trend that put Trump in office. The entire 2007-2009 global financial crisis and bank bailout created an entirely new “skepticism” of government in most countries. This is where the digital assets have come into play. Are they capable of altering or influencing traditional global monetary policy? The answer: absolutely no possible way. To accomplish that we MUST end socialism. I doubt these people really understand the full scope of structural changes that would need to be made to move to any cryptocurrency. Adam Smith’s Invisible Hand rules the question. Until it is in the self-interest of those in power to hand back the scepter of power itself, there is just no way to accomplish such a monumental change without the house burning down FIRST. The other possibility is that governments just usurp the crypto world like they confiscated gold and then control it for taxes. They do want to eliminate all paper currency to collect 100% taxes they believe are avoided. They also pitch it would end crime as we know it. The black market would then no doubt emerge as barter once again. To think that cryptocurrency can defeat central banks and governments is really far-fetched.

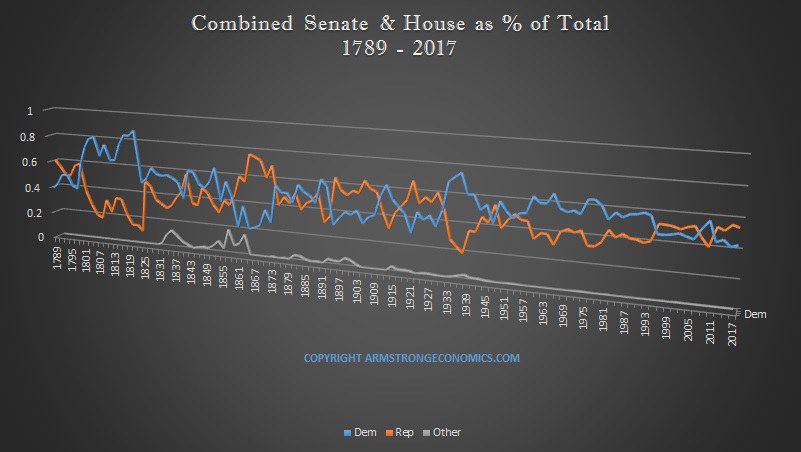

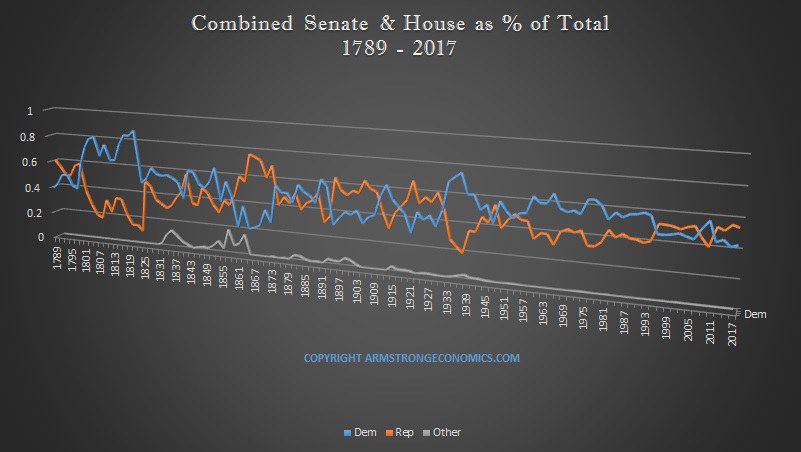

The political changes are monumental. Politicians can no longer run for office promising benefits by robbing the rich and handing it to the poor. In order for crypto assets to replace money, it would require a profound change in politics. It is not simply central bank money. The entire pitch of cryptocurrency is that it will take the creation of money away from central banks and thus government. Think that through. Career politicians would be completely at a loss. They have no qualifications with respect to management of an economy. The Democrats have been selling the same promise since FDR’s first election. Just look at the chart above and you will see that the Democrats have been in a bear market ever since FDR. They pretend that someone cannot get rich without oppressing the poor. Wealth to them is very Marxist and a zero-sum game. They are stuck in the idea that someone makes a product and the capitalist profits on their labor. They fail to comprehend that someone can invent something like Google, Amazon, Microsoft, or our Socrates Platform that by no means oppressed some poor individual to create it. They are frozen in time and cannot comprehend the Invisible Hand of Adam Smith. This is why I say that socialism is dead and indeed the entire cryptocurrency movement is part of that collapse in the public’s confidence in government.

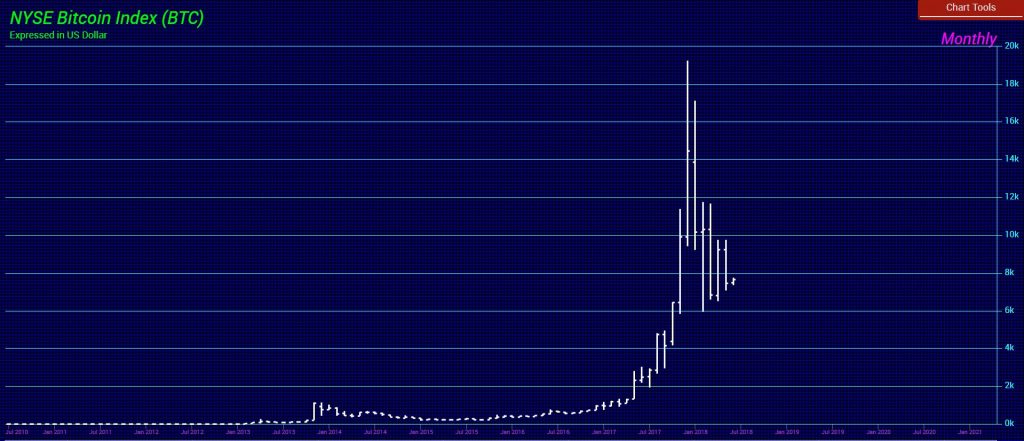

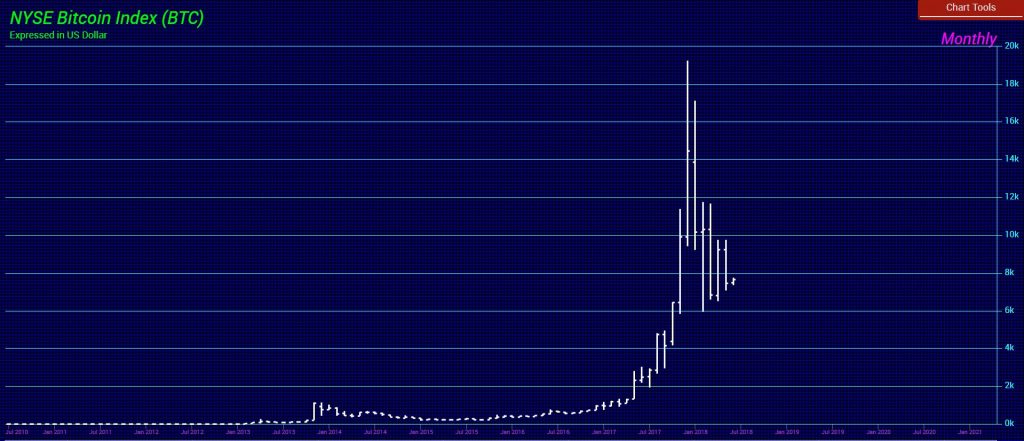

Additionally, cryptocurrencies are promising to end fiat currencies, and in reality, it is a return to a sort of commodity-based money not so dissimilar from a gold standard. The problem with all of this is the idea that if we somehow returned to a gold standard, then money would be worth “something” as if it would never change in value. That just cannot exist and NEVER has. Whatever you define as money, it will rise and fall against assets. That is fundamental to the economy. It is why communism failed. Here is a chart of Bitcoin. It has risen and crashed. It did not hold on to value permanently at some fixed level. This is why I say it is an “asset class” fluctuating against the currency – the dollar.

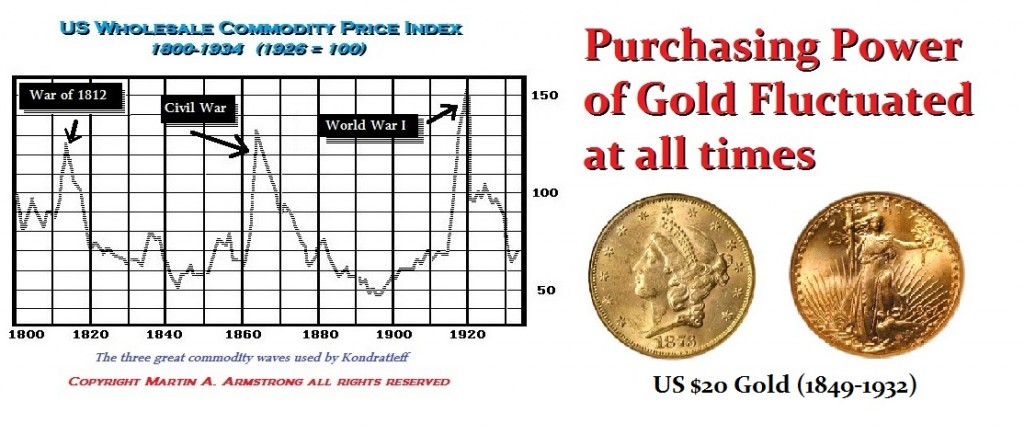

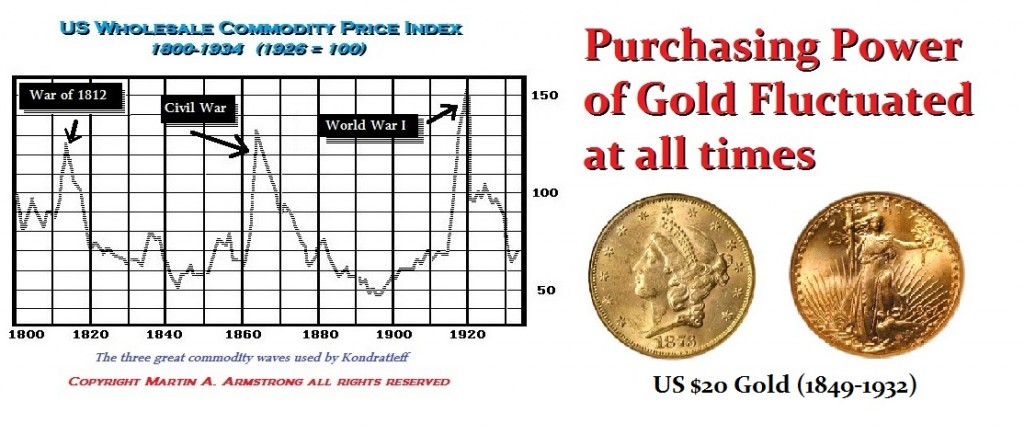

Here is a chart of the rise and fall of the inflation index when gold was money. These very swings in the economy are what Kondratieff studied and created his long wave. Gold did NOT prevent the boom and bust cycle. That is part of nature that CANNOT be eliminated. When gold was money and the stock market rose in value, that meant money declined in purchasing power which was gold. It acted economically NO DIFFERENT it money were paper, seashells, or cattle.

So, will cryptocurrencies replace paper currency? The actual amount of transactions today in physical money is less than 5%. So we are already using electronic money every day, such as when you buy something online. So will that emerge eventually as a cryptocurrency? Perhaps. There is nothing to prevent that once we get the crash and burn, and the “burn” is the replacement of the political system.

Will there be only ONE cryptocurrency for the entire world? Unlikely. I would probably bet on each government adopting a cryptocurrency per nation and prohibit the use of “foreign” cryptocurrency domestically. We also must respect that government WANTS to create some sort of cryptocurrency to ensure that everyone pays taxes. Australia already uses the phrase – “Cash is for Criminals.”

What I disagree with is the notion that somehow cryptocurrency will force political change and government will simply yield and hand back the scepter of power when politely asked. That has NEVER taken place, not even one time throughout history. Governments do NOT voluntarily surrender power. They will use whatever power they have to the bitter end. So, sorry. History is on my side on this one. Dream all you want. Human nature never changes throughout the centuries. Those in power will act in their own self-interest and defend against the loss of that power.

What I disagree with is the notion that somehow cryptocurrency will force political change and government will simply yield and hand back the scepter of power when politely asked. That has NEVER taken place, not even one time throughout history. Governments do NOT voluntarily surrender power. They will use whatever power they have to the bitter end. So, sorry. History is on my side on this one. Dream all you want. Human nature never changes throughout the centuries. Those in power will act in their own self-interest and defend against the loss of that power.

We are headed into a major economic crisis. Cryptocurrency will not save the day. We have to crash and burn. That is the ONLY way such economic imbalances have been resolved throughout history. That is NOT my personal OPINION. It is simply reality