QUESTION: You originally said back at the 2015 WEC the first window for the monetary crisis and the collapse of the Euro could arrive by 2018 and then the cycle was extended into 2021 when the Euro finally elected a weekly bullish. So it appears correct that 2018 is the start as the Euro never reached your target but came close and the EU seems to be coming apart at the seams. Gold could never get through your 1362 number either so that too seems to have confirmed a false move extending your cycle into 2021. I understand that cryptocurrencies are really an asset class and not really a currency. Nevertheless, do you think that cryptocurrencies can survive a monetary crisis?

WN

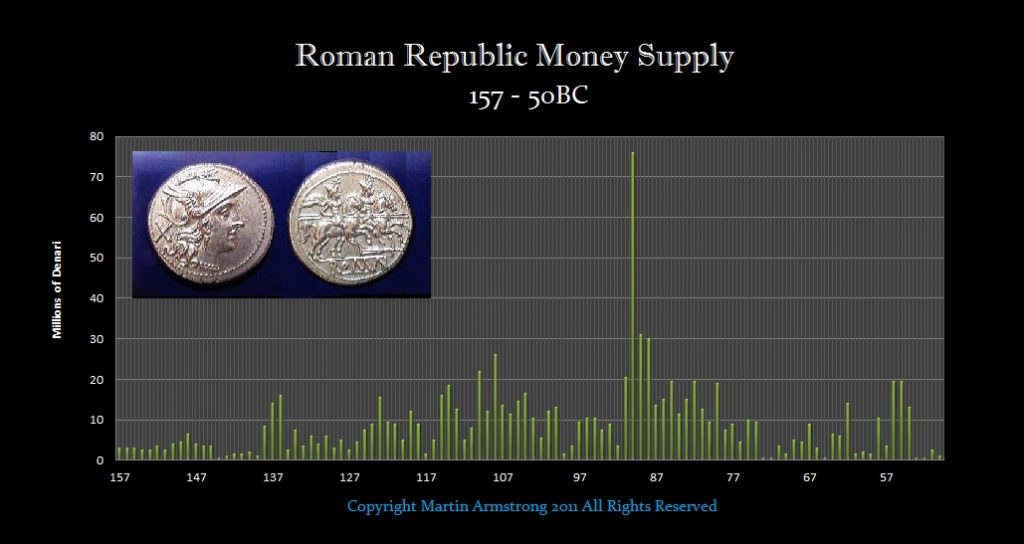

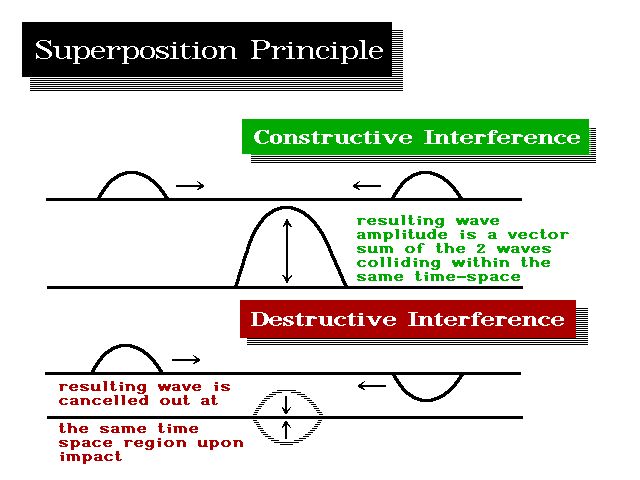

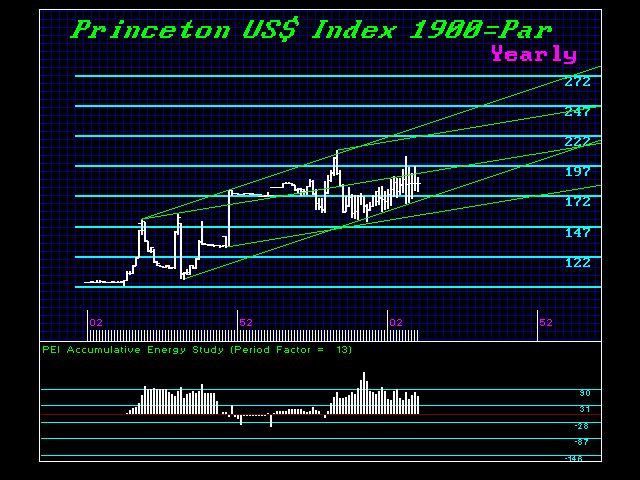

ANSWER: The year 2018 was the start of the Monetary Crisis. We had a shot that this could all come undone in 2018. However, you are correct. All we achieved was a false rally with the Euro stopping just shy of our number and gold struggled admirably but could not get through 1362. There were many other markets also confirming that we are dealing with only the beginning of the crisis here in 2018 rather than the conclusion including the consolidation in the stock market without election any monthly bearish reversals. The monetary reset can arrive during the next window in time come 2021 if we get the dollar at new highs. Then the monetary system will crack. However, this could drag out to the third window which is of course 2032. That appears to be more the shift of the Financial Capital of the World to China at that time.

These are the turning points. The Reversals are the key which confirms or denies the trend. My opinion as to the future is still an opinion. I will say this. As long as cryptocurrencies are an asset class, then they will survive a monetary crisis along with all other assets. Assets are the ONLY thing that survives the collapse of a currency. So be careful of what you wish for.

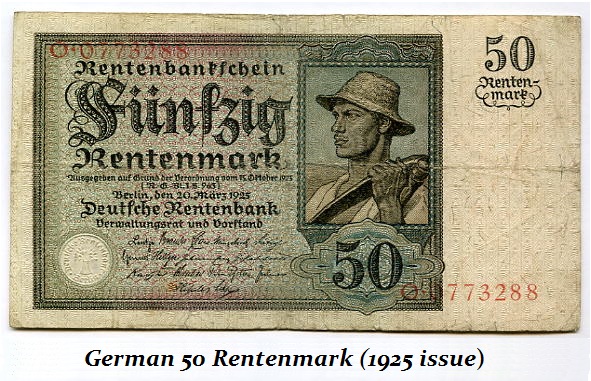

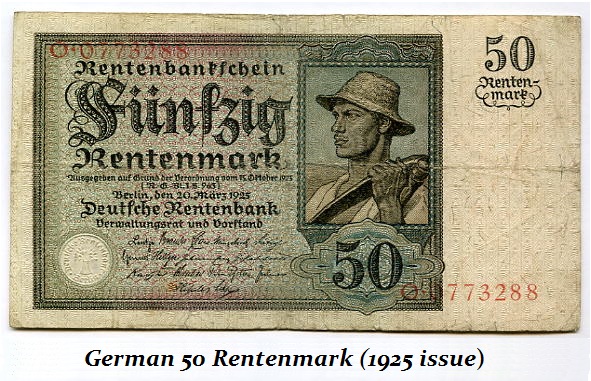

The new currency issued after the German Hyperinflation, Rentenmark, was backed by real estate. Tangible assets are on the opposite side of whatever the currency is in use. When the stock market rises, the purchasing power of the currency declines. When the stock market crashes, then the purchasing power of the currency rises. They are on OPPOSITE sides. Do you really want a cryptocurrency to be a currency or asset? Most people pitching them are really explaining an alternative asset – not a currency.

Cryptocurrencies are a new asset class. Just look at them from that perspective. You are asking a lot if we are talking about replacing the monetary system with private money. That is just not likely in the cards. Nonetheless, we will probably end up with a new RESERVE currency used among nations. That is still unlikely going to be a world currency used by the people in every country. What we use for currency can be cryptocurrencies of some sort ONLY if we see the political powers crumble and fall.

None of the big IT companies are doing anything with Blockchain. That may change in the future and it may even be replaced by something even better. I draw the line between an asset class and a replacement currency for the dollar with a very thick marker. You would have to completely destroy the system as is for that to even come into play. Is that what people are praying for? All pensions gone, banks destroyed and you think this cryptocurrency will be the only thing to survive? You go that far the ONLY money becomes FOOD! We are still in mid-game and we are not yet close to the end-zone.

For now, cryptocurrencies are not a currency at all, they are a new asset class. Just because they are called “currency” does not make them an actual currency. If they are not widely accepted in payment as legal tender, then they are not yet ready for prime time. When you go online to buy anything, they display the standard payment methods – not BitCoin.

You buy insurance for healthcare, fire, accident, but when it comes to death insurance, they flipped the name to life insurance. They could not sell “Death Insurance” for people would respond that they were not ready to die and it was seen as bad luck to buy death insurance because you may invite such an event. To sell “Death Insurance” they called it “Life Insurance” and then everyone would buy it and brag how much they had. Calling BitCoin a “currency” does not make it one. It is still an asset class and for it to be a currency, it would have to respond OPPOSITE of assets, not trade with them.

Cryptocurrencies are an ASSET CLASS for trading. Do not marry the trade. Treat them as any stock and you will be fine.