QUESTION: Mr. Armstrong; I believe you said at the WEC in 2017 that central banks will diversify and increase their gold reserves going into the currency crisis coming in 2021. China has continued to increase its gold reserves. You would please update on that development.

Thank you

PK

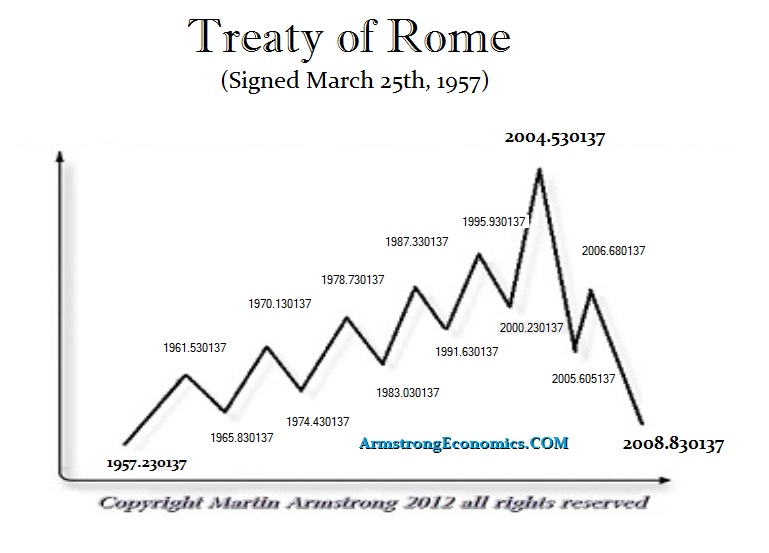

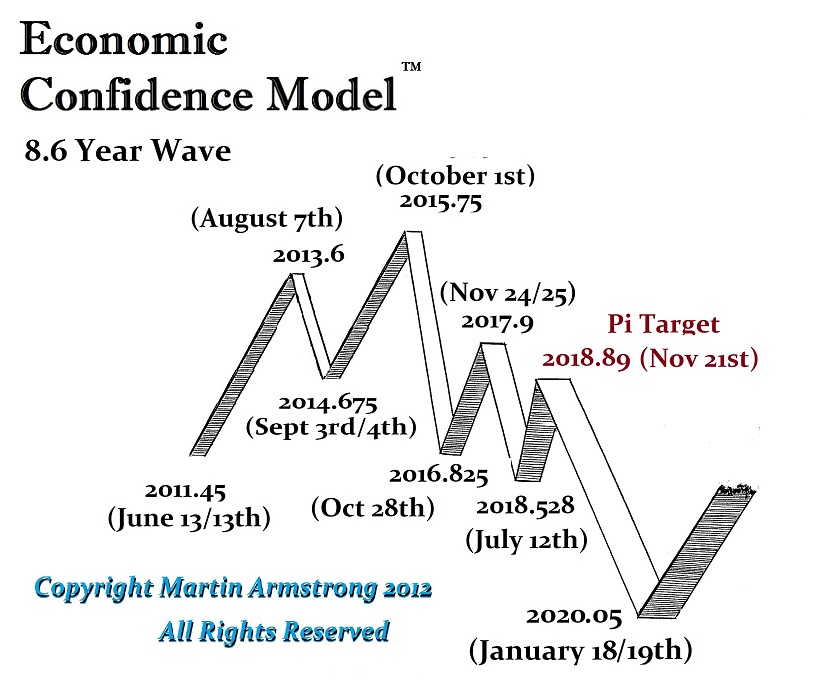

ANSWER: Central banks are in a very difficult position. The ECB has really put the entire world at risk. Draghi is now realizing that negative interest rates have seriously harmed the European economy and led to a major growing liquidity crisis in European banking. The euro is regarded as a time bomb for it is neither a national currency nor a stable unit of account. The failure to have consolidated the debts from the outset has simply left the euro vulnerable to separatist movements and sheer chaos.

This is what has been behind the strength in the dollar. Central banks outside Europe have been caught in this dollar vortex. They have been selling dollars and buying gold in an effort to stem the advance of the dollar. China also has a debt problem with many provinces and companies who borrowed in dollars. Here in 2019, there is $1.2 trillion in Chinese dollar borrowings that must be rolled over. There is a rising concern that this year there could be a major threat of a dollar funding crunch. The total debt issued in US dollars outside the USA approached $12 trillion at the end of 2018. That is about 50% of the US national debt. The forex risk is huge, no less the interest rate risk on top of that. The more crises we see in Europe, the greater the pressure on the dollar to rise regardless of the Fed trying to stop capital inflows by delaying raising rates.

China has added to its gold reserves in a desperate attempt to try to keep the dollar down, which also has an inverse trade problem as the yuan declines. At the end of January, China’s gold holdings stood at 59.94m ounces, which was up from 59.56m a month earlier, according to figures released by the People’s Bank of China. Of course, the gold bugs think this is because China hates the dollar and sees the world returning to a gold standard. In reality, none of that is true. China is smart enough that they are trying to keep the yuan from crashing against the dollar, but by selling the dollar they also do not want to buy euros or Japanese yen. With the chaos of BREXIT, the neutral political place is gold. Over the past year, central banks emerged as big buyers of gold with purchases up almost 75% as the private institutional market ignores gold and retail trade has shrunk. The main buyers have been Russia, Turkey, and Kazakhstan who all shifted their reserves away from the US dollar for political reasons in 2018, amounting to $27bn worth of bullion.

I used to help the Arabs buy gold and lease it out to circumvent their religious laws against earning interest. Leasing gold was effectively the interest rate but it was trading commodities and thus did not violate their religion. With the Japanese, to reduce the trade crisis, I instructed them to buy gold in New York and export it to London to be resold. It did not matter what they bought in the USA; as long as it was exported it reduced the trade surplus. The same tactic is in play here with China, but they have been accumulating gold to reduce the trade surplus. It is a neutral trade within their reserves that avoids problem currencies.

I used to help the Arabs buy gold and lease it out to circumvent their religious laws against earning interest. Leasing gold was effectively the interest rate but it was trading commodities and thus did not violate their religion. With the Japanese, to reduce the trade crisis, I instructed them to buy gold in New York and export it to London to be resold. It did not matter what they bought in the USA; as long as it was exported it reduced the trade surplus. The same tactic is in play here with China, but they have been accumulating gold to reduce the trade surplus. It is a neutral trade within their reserves that avoids problem currencies.

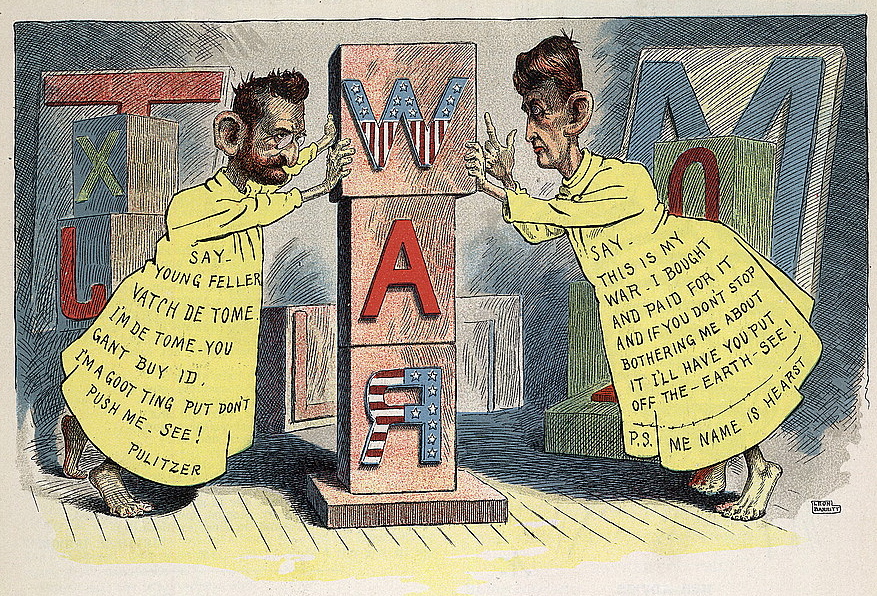

China is now the world’s biggest consumer and producer of gold. China only begun to buy gold again, which is also supporting its mining industry as the US did during the 19th century with silver. Prior to December 2018, the last time China bought gold was back in 2016. Nevertheless, as geopolitical tensions rise pointing toward world war, we should expect the former Soviet Union region to continue accumulating gold and avoiding the dollar. The Democrats seem to be increasing the tensions all to remove Trump from office.

Tensions between the US and China are nowhere near as bad as they are with Russia. China is strategically moving to develop their own consumer economy. They realize that what made the US dollar the reserve currency was not a force of arms, but the domestic consumer market. Japan and Germany rose from the ashes after World War II using the mercantilist model designed to build things to sell to Americans. China realized that is a dead-end and they have turned inward to develop their own consumer market to replace the United States.

In Italy, Deputy Prime Minister Matteo Salvini has raised the possibility of taking control of Italy’s sizeable gold reserves away from the country’s central bank. The Bank of Italy has the third-largest central bank holding of gold reserves in the world after the US and Germany, owning 2,452 tonnes at the end of 2018. This is also reflective of the tensions with the entire dictatorial approach of Brussels. Brussels tried to create a central government, but one that refuses to accept responsibility for member state’s debts. That conflict is why the euro will never be ready to compete on the world stage of currencies in a serious manner.