The European Central Bank (ECB) is expected to begin reducing its bond purchases gradually tampering its stimulation program of Quantitative Easing (QE). Nevertheless, reliable sources tell of the ECB being extremely cautious fearing what will happen if buyers do not appear and rates begin to rise sharply. The difference between the ECB and the Fed is stark. The ECB owns 40% of Eurozone government debt. The Fed does not even come close.

Obviously, the European financial markets have become addicted to the unprecedented inflow of cheap money even though there has been no appreciable rise in economic growth or inflation as was expected. This raises the question only asked behind the curtain: Will the economy spiral downward if QE ends? The Fed never reached the levels of ECB’s QE program so there is no comparison with the States.

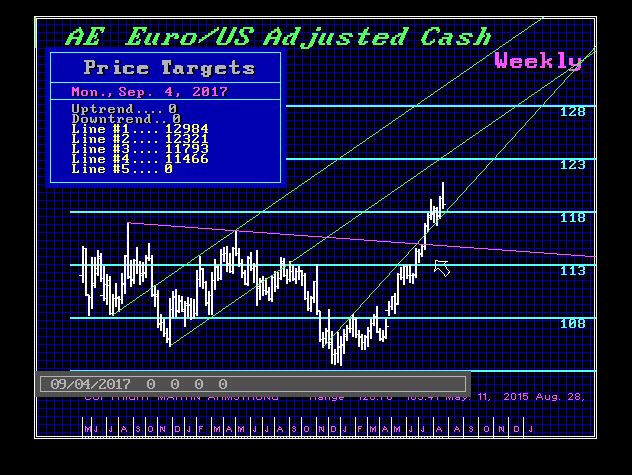

The ECB expects to gradually lower the constant QE purchases of government debt in the Eurozone, which has really kept the governments on life-support. In part, this is why Macron is pushing to federalize Europe in its budgetary and financial markets. There is a fear that there will be severe distortions on the exchanges in the months ahead. What is hoped is that the Euro will decline and make the difficult weaning more tolerable by increasing exports and creating inflation. A lower currency will help to stimulate the Eurozone whereas a rising currency will only add to the deflationary pressures.

The ECB will most likely allow bonds to simply mature rather than sell them back to the marketplace. Any news of the ECB actually selling bonds would send a wave of panic through the European markets. Thus, the only practical way to approach this is to (1) reduce purchases and (2) allow current holding to mature and hopefully they money will be reinvested by the private sector. Accordingly, allowing bonds to simply mature and not the ECB will not reinvest, will eventually lead not to a meltdown of bond purchases but and transfer of buying to the private sector. This wonderful scenario of private reinvestments will not take place at current interest rate levels. It is more likely that the ECB will be compelled to continue to be a major player in the Eurozone bond market for many years to come. They are more likely than not trapped and unable to escape from this life-support system without grave consequences.

The central bank itself, however, is covered by how it reinvests the money from maturing papers. The ECB announced that it would be flexible and as long as necessary. European analysts predict that the majority of funds from matured securities will flow into federal bonds. They hope that Italian and French government securities will also benefit. The ECB has been buying government bonds and other securities on a large scale since March 2015. The purchases of public debt securities were with maturities of two to thirty years. The total program has now amounted to €2.28 trillion.

Draghi has put off any discussion until this month’s meeting at best. The ECB will proceed as slowly as possible. The ECB is expected to reduce its monthly purchases from €60 billion to €40 billion in 2018, but it will most likely avoid any definitive target leaving it open for fear of market disruptions. His June 2017 speech that the ECB could possibly go a less expansive course because of economic recovery, sent the markets down, not up. The DAX peaked in June with Draghi’s first statement on reversing QE. That result was painful and Draghi has been criticized behind the curtain.

Nothing has yet changed. We are still 500 points away from the start of important resistance. Keep in mind that the ONLY way to break the bank of the monetary system will be a STRONG DOLLAR – not a weaker on. People far too often make a serious mistake and believe that a strong currency reflects a strong economy. Trump wants a lower dollar to reduce the trade deficit, increase sales of US products, and hence create more jobs.

Nothing has yet changed. We are still 500 points away from the start of important resistance. Keep in mind that the ONLY way to break the bank of the monetary system will be a STRONG DOLLAR – not a weaker on. People far too often make a serious mistake and believe that a strong currency reflects a strong economy. Trump wants a lower dollar to reduce the trade deficit, increase sales of US products, and hence create more jobs.

ANSWER: It was not based upon the rise or fall of gold. The objective is to establish the yuan as a reserve currency until we reach the Monetary Crisis Cycle conclusion. The logical step is to try to boost the yuan as a redeemable reserve currency with stability. You either PEG it to the dollar (unwise for political reasons) or you “LINK” it to gold – but do not PEG it to gold. If you attempt to PEG the yuan to gold, that would fail for you are making the same mistake as Bretton Woods. The only possible way is to “LINK” it to gold but on a floating exchange rate. That way you are encouraging confidence in the yuan allowing it to be redeemed on a floating basis with gold. Hence, the political risk of the currency is reduced for it could become possible that the currency system breaks apart and politically currencies could be politically frozen and nonredeemable.

ANSWER: It was not based upon the rise or fall of gold. The objective is to establish the yuan as a reserve currency until we reach the Monetary Crisis Cycle conclusion. The logical step is to try to boost the yuan as a redeemable reserve currency with stability. You either PEG it to the dollar (unwise for political reasons) or you “LINK” it to gold – but do not PEG it to gold. If you attempt to PEG the yuan to gold, that would fail for you are making the same mistake as Bretton Woods. The only possible way is to “LINK” it to gold but on a floating exchange rate. That way you are encouraging confidence in the yuan allowing it to be redeemed on a floating basis with gold. Hence, the political risk of the currency is reduced for it could become possible that the currency system breaks apart and politically currencies could be politically frozen and nonredeemable.