Armstrong Economics Blog/China

Re-Posted Apr 28, 2018 by Martin Armstrong

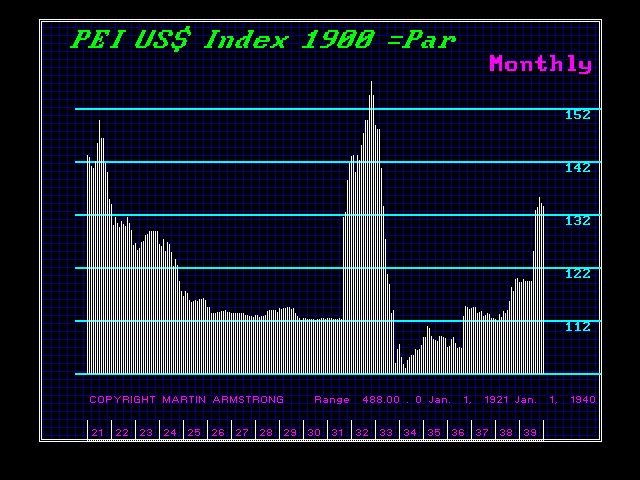

China is on its way to reaching the title of the Financial Capital of the World post-2032. However, that is also NOT going to be accomplished all on its own. In part, this is the moving trend and the shift our computer has been forecasting also because the West is in a Sovereign Debt Crisis and by raising taxes and imposing stiff regulations to try to keep the game going, GDP in the West will decline.

Nevertheless, China has some adjustment it must go through before it reaches that goal. It will surpass the EU, but the EU is hard at work of just trying to protect the jobs of bureaucrats rather than to actually make Europe a better place to live. Right now, China’s Debt to GDP stands at 250% mainly because to stimulate their economy, they actually lent money to people. The Western government bought their own bonds back to the “indirectly stimulate” the economy which never made it to the people. This is why Europe is still in deep trouble. The US took the bad loans from the banks and stuffed them in Freddie & Fannie. The EU left the bad loans on the books of the banks because it was seen as a bailout for Southern Europe. Now we have a banking crisis in Europe that never ends.

China’s debt problem is quite different. On the back of a boom in property prices, household borrowing has been climbing for the past 10 years straight. We are now approaching the correction point in this trend. The borrowing had expanded at a pace that exceeded the biggest speculative booms in the West. Now, some $6.7 trillion in personal debt also exists and this is now 50% of GDP. Private debt is now approaching crimping consumer spending power and therefore lies the recession ahead.

We will be focusing on China at the Singapore World Economic Conference in June 2018.