Mrs. Maria Bartiromo is good at pretending, very good. However, CTH has never pretended or played the game of pretending and we can spot a pretender a mile away.

The game of pretending is needed in order to retain the illusion of the Potemkin Village of DC. A construct manufactured by the power structure that exists behind the puppet show, with the full intention to distract us. Pretending is what gives rise to a Florida governor on a ‘book tour’ run for 2024. Pretending is what kicks the can of accountability away until it can be buried.

Pretending is needed in order to say Republicans will make a difference, or the black eye doesn’t hurt, and look he bought me flowers. Perhaps some reminders and clarifications of the real game inside DC politics are needed. After all, I am this close > < to going back into that mess to destroy some silos.

The House Oversight and Government Reform Committee, hereafter called the House Oversight Committee or HOC, has a very specific function in DC circles that too few understand. Once again, let us be clear while trying to explain decades of false information founded upon arcane legislative outlooks.

Understanding the DC game of Chaff and Countermeasures…. A “Countermeasure” is a measure or action taken to counter or offset a preceding one.

Politically speaking, the deployment of countermeasures is a well-used tactic by professional politicians in Washington DC to counter incoming public inquiry and protect themselves from anger expressed by the electorate. The Republican leadership are very skilled in the management of “chaff” (outrage), and “countermeasures” (the distraction).

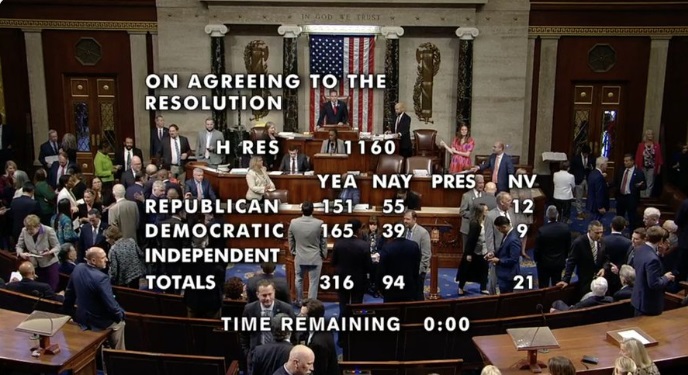

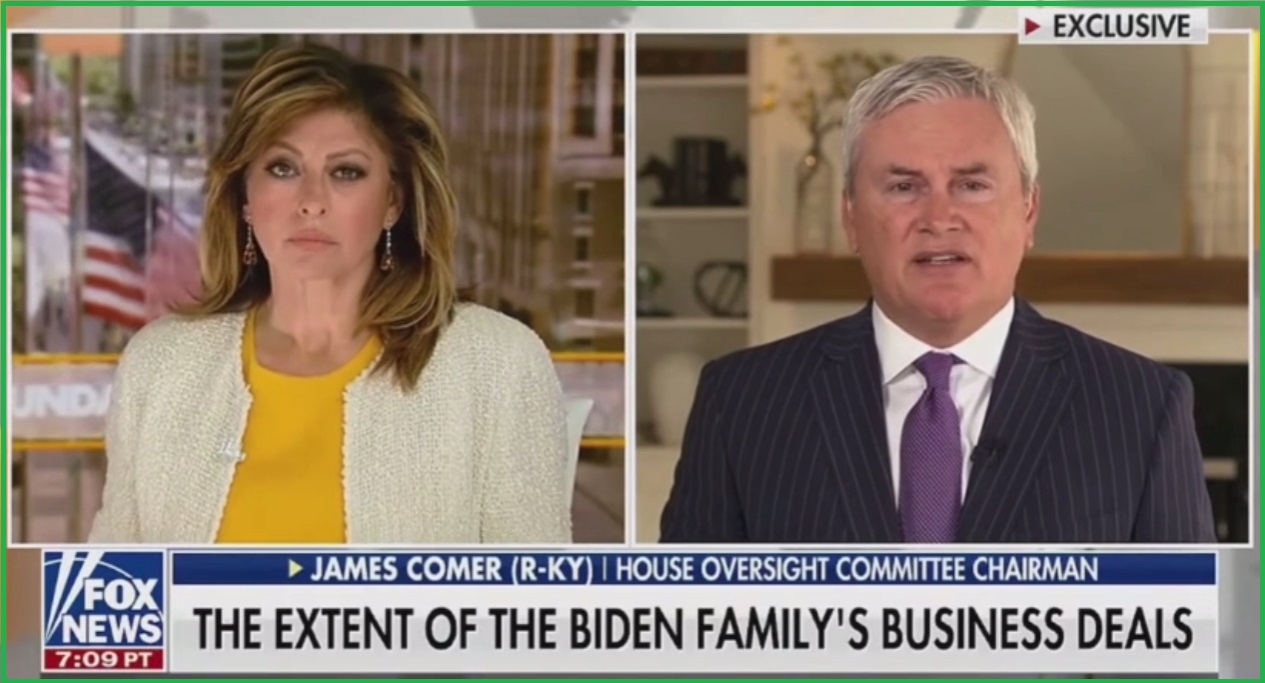

Within Washington DC, the HOC has a very specific and unique function. What Fox News is to corporate conservative punditry, so too is the HOC to the same DC system of pretending. The House Oversight Committee is the “Chaff and Countermeasures” committee. The HOC operates for both parties with the same mission.

The House Oversight Committee was/is created by the House legislative leadership to make money for the party in control of the Chair. When the House Speaker is notified of a DC corruption issue, inside his/her office they will often be heard saying, “give it to oversight.” The intent of that instruction is to give the issue to the HOC, so they can hold hearings, create soundbites and fundraise from the issue.

Making money for the party in control of the Chair is the primary function of the House Oversight Committee. The HOC does not exist to create accountability or oversight; the HOC exists to exploit the issue for fundraising and satiate the base voters of the party in control of the Chair.

The HOC presents the illusion of accountability by constructing soundbites and member performances which are then broadcast on television for appearances to the voting audience. It is essentially theater.

The HOC is a “general oversight’ committee, not a committee of “specific jurisdiction.” Thus, the HOC is the vehicle where Democrats and Republicans publicly display their political initiatives, frame their narratives and then broadcast them on MSNBC, CNN (Democrats) or FOX NEWS (Republicans).

Depending on the issues at hand, the HOC committee members are generally those performance actors best known to the audience of both parties. This is not accidental; this is by design. Again, for emphasis, I am only talking about the HOC, a “generalized oversight” committee. Only this specific committee has this specific mission.

A hot button topic enters the committee ecosphere. Specifically trained staffers and performance artists, uniquely qualified to put on theatrical productions (both parties), are then deployed to assist the representatives in creating the soundbites that hopefully will go viral and assist them with fundraising and opportunities to say, “here’s what we are doing.” Outlining this construct is not an exhibition in cynicism; this is the reality of what the HOC is designed and created to do.

When you see the HOC performing at their best, you will see lots of soundbites created.

The Chair of the HOC is always part of the House Speaker’s close inner circle. From that association you will discover by training, by habit, and by consequence, the HOC framework is developed to sustain the process itself as an end result. The questioning is the sum total of all accountabilities. The performance is the interview; the conversation is the point; the smoke is the fire.

Oversight, in the HOC framework of narrative creation, has evolved into reveling in the endless process (a fundraising proposition) and, as a consequence, it completely ignores the end point, misses the bottom line, doesn’t actually SEE the subject matter, and never actually applies accountability toward what might be discovered. This is why you end up with high blood pressure, frustrated with the questions not asked, and throwing bricks at the screen or monitors when viewing.

The point of HOC hearings is to create what are now described as “viral moments” that can be used to generate money. The second, and lesser objective, is to give the illusion of accountability while not actually ever holding anyone or anything accountable. See prior HOC reference points like Fast and Furious, IRS targeting, Benghazi, the Twitter File review or the current Joe/Hunter Biden crime syndicate investigation.

If you watch the HOC through the prism of expecting some form of accountability for the violations of law, you will be frustrated and disappointed. However, if you watch the HOC through the prism of how well the members will do at raising money from their performances, then you can evaluate the effectiveness – the proverbial winning and losing.

The HOC is designed by House leadership to perform the same basic function for both Democrats and Republicans. The HOC committee assignments are selected based on the theatrical skills of each representative. This is not to say the motives of the members are sullied or impure, it is simply to point out the motive of the committee itself is to generate fundraising from the skillsets of the members on the committee.

Once you fully grasp what the intent of the House Oversight Committee is about, and once you drop the expectation that any accountability in oversight is the intent, then you can watch the performances through the entertainment prism of partisan politics and genuinely enjoy them – or hate them.

The HOC is called the “Chaff and Countermeasures” Committee, because that’s essentially what the committee does. It gives the appearance of targeting, steering the target to a controlled destination, and then distracting the audience from the outcome of accountability.

If sunlight is achieved, meaning the Mainstream Media cannot ignore the issue as presented and questioned, and if the general public become more familiar with the controversial subject matter or topic at hand, and if the party of the Chair can fundraise from the issue, then the committee has succeeded. However, if you are looking for something to change as an outcome of any HOC investigation or hearing, you will be perpetually disappointed.

There seems to be a willful blindness on the part of the American people, a chosen refusal to acknowledge the implications of the unAmerican and unConstititional behaviors, actions and outcomes we are being served on a daily basis.

It can no longer be presumed to be a matter of “I can’t see what’s happening”, because a whole lot of normal Americans really are clean and articulate.

“I can’t see it” just doesn’t cut it.

NONSENSE! Most people can see it. Most are just choosing to reconcile the irreconcilable because it is more comforting to ignore the truth of it. Just be honest, for many people avoidance has become a survival mechanism.

It’s more along the lines of “I see what’s happening, but it’s scary and complicated and confusing, and if I admit that I see it, I will become responsible in a way that I am not if I keep pretending I can’t see it or hear it or maybe I don’t understand it.”

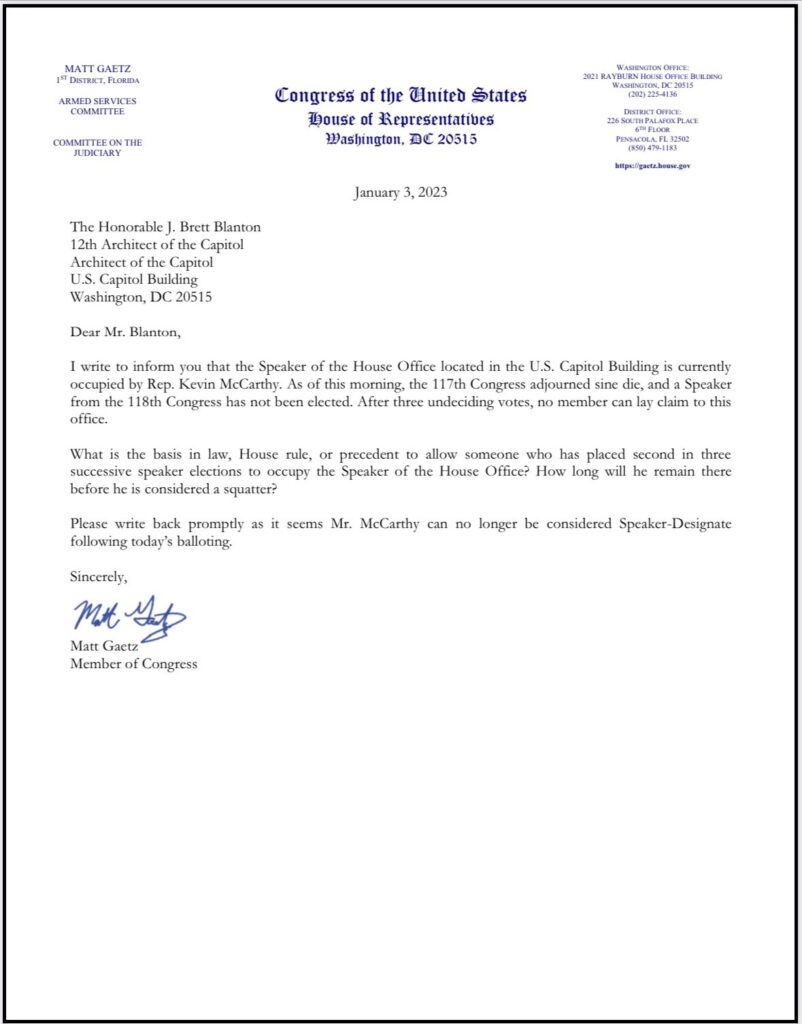

McCarthy’s Lucy has unlimited footballs.

Admit it or keep pretending.

The choices are ours.

Personally, I will not pretend.

If we all stop pretending, eventually the DC house of cards collapses.

I think we need to change things…

… more later!