Armstrong Economics Blog/Economics

Re-Posted Apr 10, 2019 by Martin Armstrong

QUESTION: Dear Mr. Armstrong,

I have a question that might interest not just me but also other blog Readers:

In your blog Posts you write that you expect that we will have a hard landing going into 2020.

My question is: What does that mean for the Dow? Do you expect the dow to correct into 2020 more that 20%.

Thank you for your work and best Regards,

A

ANSWER: The hard landing is economic and will have its greatest impact outside the USA. While central banks have sold US Treasuries in an attempt to keep the dollar down, the private sector has been pouring assets into the USA and particularly the Dow. Our capital flows have tracked a significant shift in global capital flows into the USA especially from Europe. That should come as no surprise given the chaos in BREXIT as well as the May elections.

We still do not see a major correction in the Dow. We have been undergoing a shift from public to private assets on a global scale. Therefore, the hard landing will be more economically based and central banks will try to do something, as in lowering rates, but they have run out of bullets. The Fed has tried to back off on rates after buying into the problem of a hard landing outside the USA. The ECB has been on its hands and knees, pleading with the Fed not to raise rates when they will have to continue their QE programs or face sovereign debt defaults.

Austria Moves to Tax Online Companies

Armstrong Economics Blog/The Hunt for Taxes

Re-Posted Apr 8, 2019 by Martin Armstrong

The EU has been unable to agree on taxing the internet. As a result, Austria went ahead and passed its own digital tax this week on revenues earned by online companies in their country. The entire problem with this type of taxation is the burden of accounting. This means that the online world will be forced to file taxes in every country with a matrix of tax rates and specifications. Small business will be the ones impacted the most and they will more likely just ban their products for sale in various countries.

Governments are going broke. They will never stop to look at the ramifications their actions have caused within the global economy.

German Economy Turning Down Hard into 2020

Armstrong Economics Blog/Germany

Re-Posted Apr 6, 2019 by Martin Armstrong

The German economy is what holds up Europe. The data on the industrial sector in Germany is out and it has disappointed everyone once again with production dropping 0.8% month-on-month in January 2019. January’s contraction was driven by a steep drop in capital goods output and a fall in intermediate goods production. However, consumer goods production did manage to increase moderately.

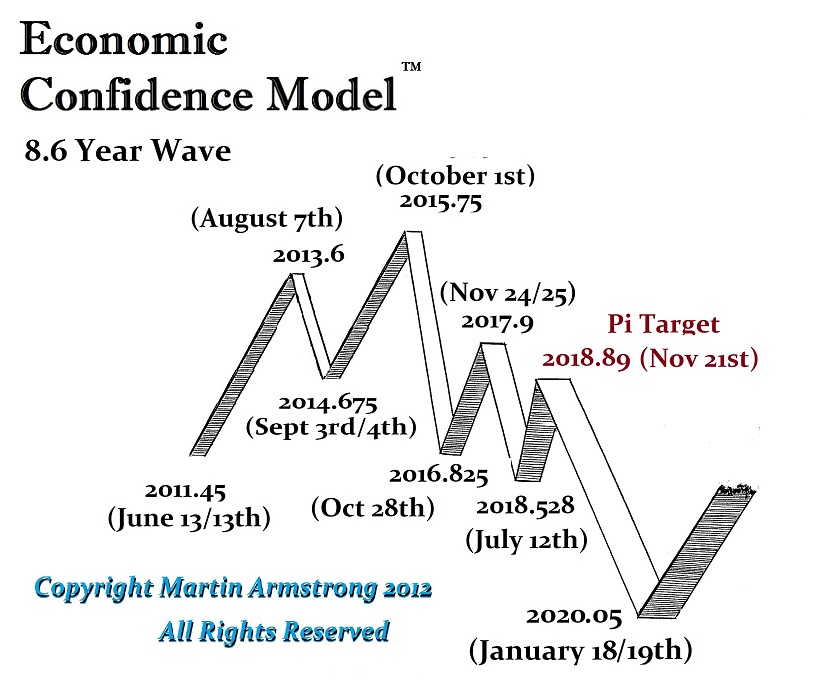

On a year over year basis, industrial output fell 3.3% in January, which was an even sharper contraction than December’s revised 2.7% drop (up from -3.9%). These numbers are clearly in line with our model showing a hard landing into the bottom of the Economic Confidence Model in early 2020. A no-deal for Britain will impact the German economy even more as car sales, which are already declining, will come into question.

The Pi Target (2018.89) marked the dramatic shift in capital flows. In the Dow, it marked the beginning of the correction and the bottom in Energy came 5 weeks later. Everything we have checked seems to have shifted at that point in time, setting the stage for the hard landing. The economic numbers all began to decline noticeably in the fourth quarter of 2018.

Why Has Everything Turned Sour? Is it the Press? Or is the Press Part of the Cycle?

Armstrong Economics Blog/Press

Re-Posted Apr 5, 2019 by Martin Armstrong

QUESTION: Hello Mr. Armstrong,

QUESTION: Hello Mr. Armstrong,

I´d like your opinion on this,

During 7 Decades in which our lives got better, longer, richer, safer, healthier, better educated, more peaceful and more stimulating. Even World poverty has decreased in a rate never seen before, still, news coverage got increasingly negative

What explanation could there be for this? Is it excessive competition for attention as media sources multiply or an excessive any deeper reasons? I compare it to Markets, seems to be similar like trading on news, which is impossible because when the news is the worst, usually its the low and when everything and everyone is optimistic its the high.

regards

ES

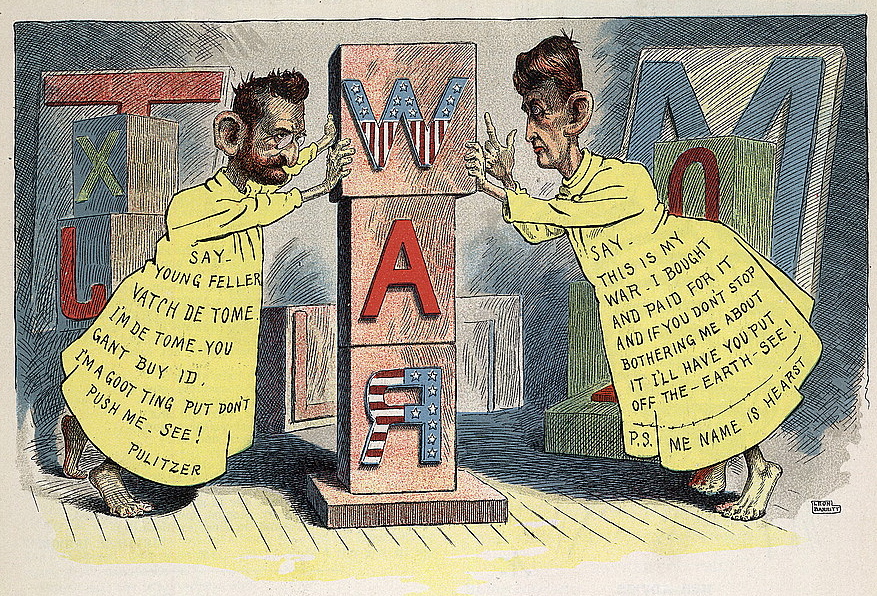

ANSWER: Coming out of World War II, society really advanced in many ways from technology to medicine. This is the part of the societal cycle that is best to live in. Then what happens is corruption. The news becomes corrupt in sync with politics. I believe this becomes the case because news becomes institutionalized as it is owned by big firms who then direct the news to slant to their personal benefit. This is a funny skit on British News. It is so true here in the States as well. The Democrats love CNN and the Republicans love Fox. The news gravitates to a political slant and is no longer about news – it is always about selling more ads.

Yellow journalism was created by the battle between Pulitzer and Hearst. They created the Spanish American War to sell papers. Pulitzer’s name was worthless. To rehabilitate it he donated money to create the Pulitzer Prize for good journalism, which he never practiced.

Now we are in the downtrend of that cycle. The corruption has taken over everything. Just look at the list of presidents since Jimmy Carter. There is not a single president who has not been subjected to a special prosecutor investigating some action, which is always brought by the opposing party. I really fear who will come after Trump. Trump is probably the perfect president at this moment for he has such thick skin. Who else is going to run? If they do not have thick skin, what is the point? Will any rational person want to put their family through such scrutiny?

Even Melania Trump’s decision to wear a custom blue Ralph Lauren suit to her husband’s presidential inauguration in January 2017 set off a firestorm to the point that a staff member at Ralph Lauren publicly stated: “We immediately started to get complaints about Melania Trump wearing [the label]. And people [on Twitter] are using the #boycottralphlauren hashtag.”

Even a First Lady is now targeted for what she wears. This level of criticism was unheard of decades ago. Now everything offends someone and they seem to be looking for issues to claim they are offended.

Is Gold Still Liquid in Bullion Form?

Armstrong Economics Blog/Gold

Re-Posted Apr 5, 2019 by Martin Armstrong

QUESTION:

Hi Martin–

Thank you for your daily blog. I read it first thing each morning.

Regarding the bank liquidity problems with the Eurozone banks: would it make sense to put assets in precious metals as a hedge against problems in the banking sector (i.e., getting capital out of the banks and into a safe harbor of sorts)? Do you see this liquidity problem impacting major brokerage houses in the U.S.?

Thank you

Jack

ANSWER: The only problem with precious metals is that governments are targeting the bullion industry, and by regulation they can also create a real nightmare from a liquidity perspective. They are targeting dealers and compelling them to report on their clients. There used to be a big international coin show in Paris. The government demanded the dealers report everyone who sold and bought at the show. They shut it down and moved. Back in 2015, France targeted gold coins, and they also targeted the ancient coin show in Paris. The French government forbid cash sales and they threatened dealers with fines and imprisonment for failure to report on buyers/sellers who were their clients. The major rare coin show in Paris left as dealers refused to comply with such reporting. The French were driving to Belgium to deal in gold and the French government was complaining about that.

While we could sell some coins from hoards to people who attended our conferences in the USA, we cannot bring such materials to Europe or even Canada. You will find that gold bullion will also get caught up in a liquidity crisis in Europe where you will be unable to sell it even if you have purchased it with cash after taxes. The hunt for taxation is really destroying the world economy. The best hedge is to have it outside of Europe. Even Singapore or Hong Kong is ok as long as you DO NOT have a bank with offices in Europe. They are fond of telling banks to turn over lists of clients who belong to their jurisdiction. Germany did that by paying bribes to Swiss bankers to expose lists of German citizens with accounts in Switzerland. Perhaps the best hedge is paper dollars that you hide someplace.

Gold will survive long-term. But don’t count on it being available during the period before the crash and burn.

The Coming Retirement Crisis | Real Vision™

California Collapse Approaching Despite Silicon Valley’s Huge Supply of Tax Dollars

US$ Rallies as Central Banks Sell Dollars

Armstrong Economics Blog/Capital Flow

Re-Posted Apr 3, 2019 by Martin Armstrong

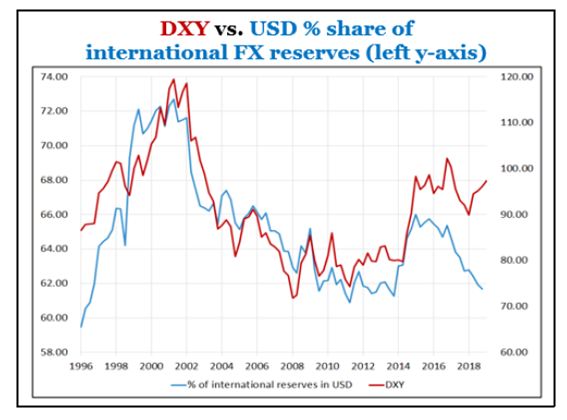

QUESTION: I am a mega dollar bull – I totally get how it is the only game in town. I’ve lived it too, having seen how the big banks work their balance sheets from the inside. However… occasionally people send me charts like the one below and get all excited. They say we are de dollarizing etc. My off the cuff remark is that the central bank reserves are a tiny part of daily FX transactions.

Just wondered if Martin might comment on the blog?

Cheers!

T

ANSWER: Hello. Hope the institutional desk is keeping you young these days. Your chart is interesting no doubt. The central banks have been trying covertly to defend against the dollar. Even China and Russia are desperately trying to price things outside the dollar but this is not helping either.

The U.S. dollar’s share of currency reserves as reported by the International Monetary Fund (IMF) fell to a near five-year low going into the end of 2018. The Chinese yuan’s share of allocated reserves shrank for the first time in the third-quarter 2018 since the IMF began reporting its share of central bank holdings in the fourth quarter of 2016. Insofar as the Japanese yen, Reserves reached a 16-year high in the third-quarter 2018 according to the IMF.

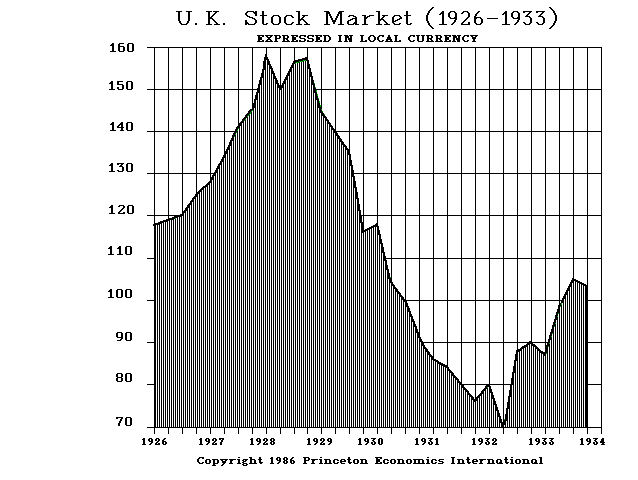

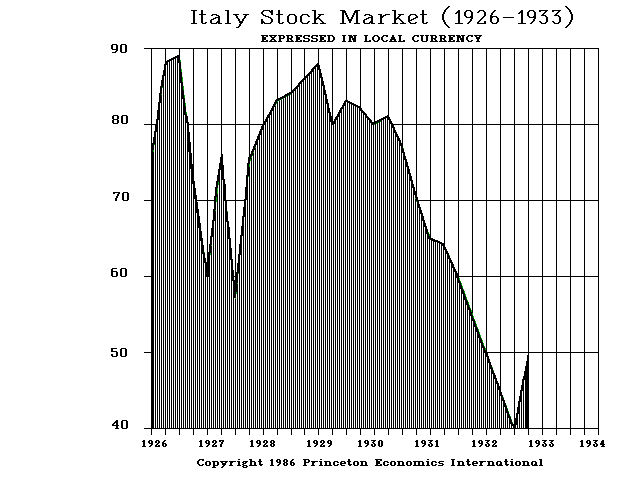

The Central banks have been trying to use reserves to help support their respective currencies and suppress the dollar’s rally without any real impact. This is very similar to the crisis of 1927. Back then, there was also a capital flight from Europe. There too, the European share markets all peaked well before the US market in 1929. The capital flight from Europe to the dollar was massive. This was one of the criticisms of the Fed level by Milton Friedman that they did not expand the money supply with all of the refugee gold hopping on every ship to the USA.

The Central banks have been trying to use reserves to help support their respective currencies and suppress the dollar’s rally without any real impact. This is very similar to the crisis of 1927. Back then, there was also a capital flight from Europe. There too, the European share markets all peaked well before the US market in 1929. The capital flight from Europe to the dollar was massive. This was one of the criticisms of the Fed level by Milton Friedman that they did not expand the money supply with all of the refugee gold hopping on every ship to the USA.

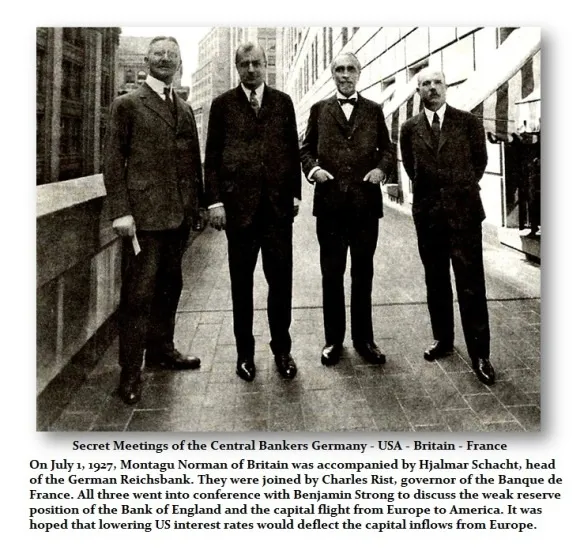

The three main central banks of Europe traveled to New York City for a secret meeting. You might call this the first G4 in history. They lobbied the US Fed to lower its interest rates, as they have been doing of late once again, in hopes of altering the capital flows and diverting the flow back to Europe.

The three main central banks of Europe traveled to New York City for a secret meeting. You might call this the first G4 in history. They lobbied the US Fed to lower its interest rates, as they have been doing of late once again, in hopes of altering the capital flows and diverting the flow back to Europe.

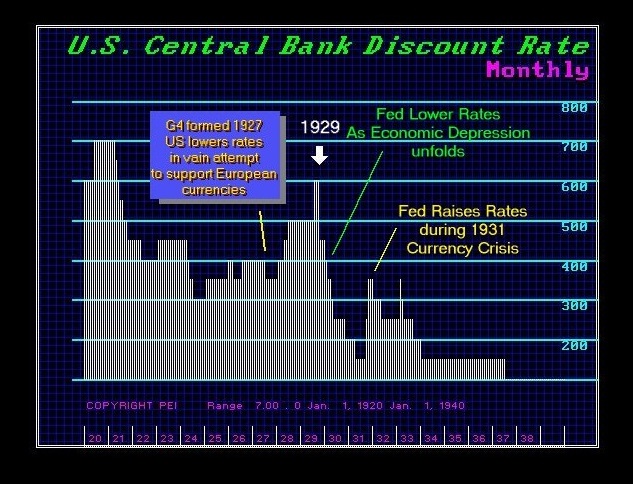

The Fed indeed lowered the US interest rates in 1927. However, just as quantitative easing has failed, lowering the US interest rates resulted in the opposite expectation. Instead of the capital diverting back to Europe, it intensified into the US buying real estate creating the Florida land boom, and pushing the US share market to record highs in 1929.

As I have said many times, these people try to reduce everything to a single cause and effect. This is why Keynesian economics has completely failed. Even Paul Volcker back in 1978 in his Rediscovery of the Business Cycle pointed out that this new era of Keynesian economics had utterly failed. Nonetheless, the economic community keep trying to make it work. It is like sticking your finger in a power outlet figuring sometime you will not get shocked.

The Fed lowered the rates in 1927, then as the capital inflow really intensified, they nearly doubled the interest rates into 1929 also without succeeding in prevent the stock market rally. They will most likely make the same mistake once again following Keynesianism. Expect them to chase the stock market raising rates and ignoring the rest of the world

London Property Market

Armstrong Economics Blog/Real Estate

Re-Posted Apr 3, 2019 by Martin Armstrong

COMMENT: I just wanted to say how amazing I am at Socrates. The Nationwide Building Society here in Britain has confirmed that London was the worst-performing region in Britain and has declined now for 7 years. Just wanted to thank you. I sold out and you probably saved my marriage. My wife disagreed but now she is very happy and wants to shake your hand in Rome. I can’t wait for Socrates to go public.

Cheers from sunny London

SH

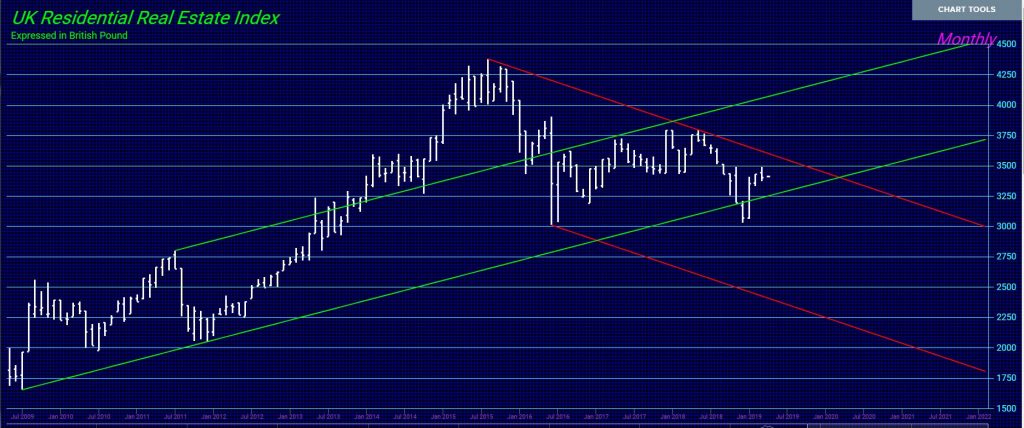

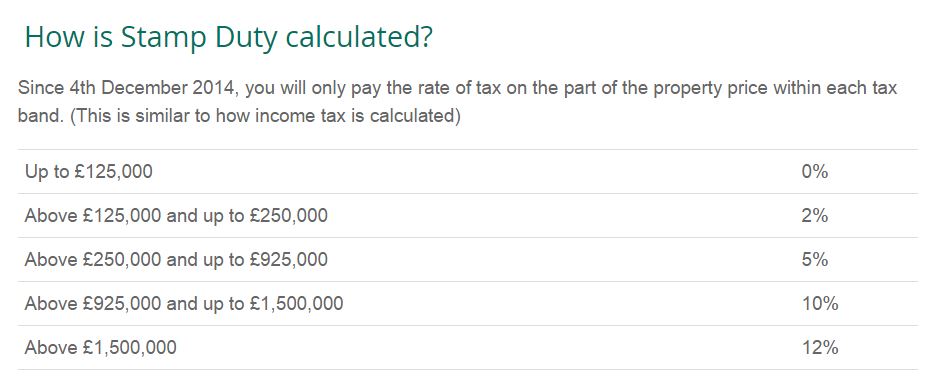

REPLY: The biggest problem with London real estate has been the change in taxation to supposedly make the property more accessible. That means that the government deliberately wanted to create a bear market. The stamp duty was really abusive. It is hard to see where London property could survive after that.

REPLY: The biggest problem with London real estate has been the change in taxation to supposedly make the property more accessible. That means that the government deliberately wanted to create a bear market. The stamp duty was really abusive. It is hard to see where London property could survive after that.

The London housing market sales began to crash from the peak in the Economic Confidence Model 2015.75 as reported in November 2015. Values crashed by 11.5% in the first month after the turn of the ECM. Landlords were joining together to challenge the Conservative’s (i.e. Tory’s) tax hike by filing a suit in the high court against their tax increase on “buy-to-let” investment properties. In July 2015, we warned that the Conservatives were going after the non-domiciled residents in London and that would stop the real estate boom.

The London housing market sales began to crash from the peak in the Economic Confidence Model 2015.75 as reported in November 2015. Values crashed by 11.5% in the first month after the turn of the ECM. Landlords were joining together to challenge the Conservative’s (i.e. Tory’s) tax hike by filing a suit in the high court against their tax increase on “buy-to-let” investment properties. In July 2015, we warned that the Conservatives were going after the non-domiciled residents in London and that would stop the real estate boom.

When the figures came out, they showed that the number of homes bought over the previous year crashed by 40% between March 2017 and March 2016. That was a drop from 173,860 to 102,810 properties sold. “That was thanks to new stamp duty rules introduced at the beginning of last April, which hiked stamp duty on second homes and led to a buying frenzy just before the rules were introduced,” reported Emma Haslett.

The biggest problem with these politicians who have attacked real estate, once the impose these crazy taxes, they do not lift them. Consequently, they tend to create a protracted bear market that can go for decades. Property investment shifted to the USA where they did not follow that socialist path against real estate as took place in Canada, Australia, and New Zealand. As the currency declines, prices will find a bottom. But they will have to decline to compensate for the tax increases

Debt & the Point of No Return

Armstrong Economics Blog/Economics

Re-Posted Apr 2, 2019 by Martin Armstrong

QUESTION: Mr. Armstrong; First I want to thank you for coming to Europe this year. It has been some time since your Berlin Conference. My question is simple. How can the ECB tell countries to reduce their debt when as you say nobody ever pays off the debt? Is this just fantasy or do they really believe what they are saying?

Looking forward to Rome.

WVM

ANSWER: The sheer demographics warn that more people will move into retirement, increasing expenditures at a faster pace than there are younger generations to compensate. This means that expenditures will rise and revenues will decline. Even if we were talking about governments that actually did pay off debt, they would still not be able to do so once we pass 2020.

Insofar as do they really believe their own nonsense? I am afraid they do. They have not yet reached the point where they will come to terms with the fact that this is a fictional world in which they dream of endless powers and they will prevail in the end. We have gone past the point of no return. We now require structural change and FAST!!!!!!!