COMMENT: Hello.

I know that although the current level of Socrates is not designed for day trading, but as a professional daytrader even this level is still amazing for that. I simply plot out the numbers that Socrates gives (made an important high at X, resistance forming at Z, etc.) for all three of the major U.S indices. Even when there are not enough points for a certain index, all three tend to generally move at the same times, thus giving most stocks the same pattern for that day. I have been longing and shorting on those numbers and it’s amazing how accurate its been, even with such limited functionality. It’s done far better than any other daytrading system I know.

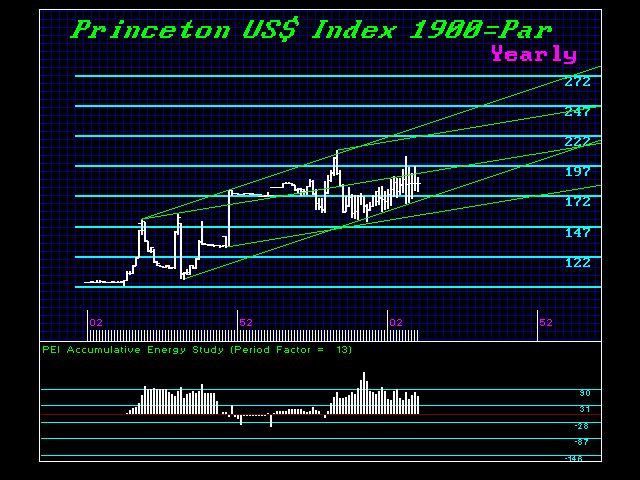

It has only been a week since I’ve been using it this way. So my question is, how long is a level valid when Socrates says something that may just be a daily level? For example, for the NASDAQ: “The Daily level of this market is currently in a full bullish immediate tone with support at 729174”. I have noticed that the support or resistance levels still bounce from those points even after a day.

It was amazing as there were some people who had been accusing me for quite some time of drawing the lines in advance and that it was impossible to predict beforehand, (I am a member of an online trading forum or reddit.) so I made sure to post them as it happened later.

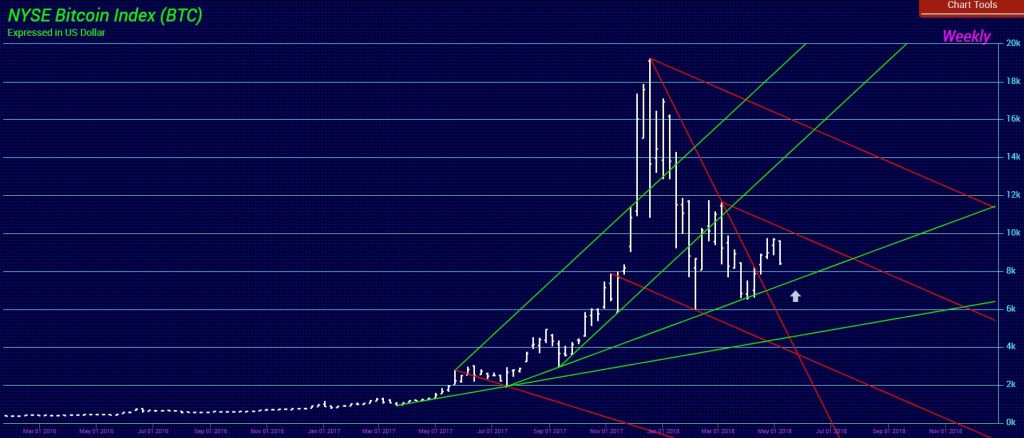

REPLY: The numbers are the numbers. They are generated by a mathematical formula based upon physics and cyclical movements. No, it is not intended for day trading. However, it provides a road map to any market so you can easily see where it is going. Keep in mind that the most money to be made is in position trading. It may appear that day trading is less risky, but far too often your focus is just the intraday action. You lose sight of the big movements coming in like a wave that is bigger than the rest crashing into the shore.

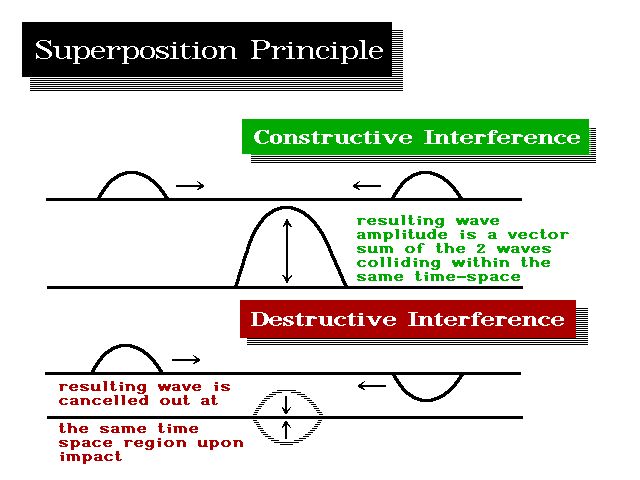

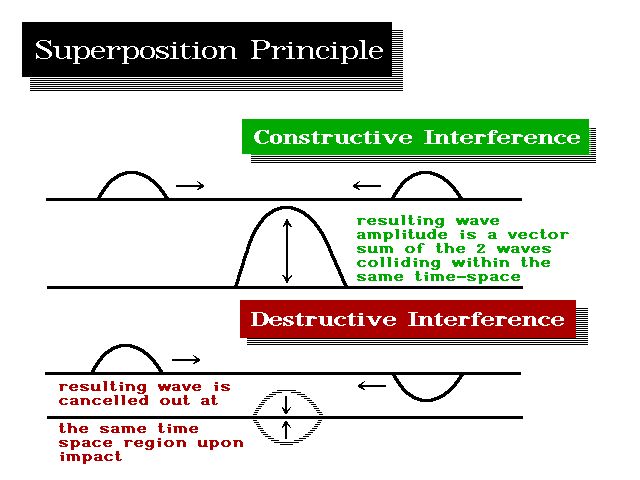

If you stand at the beach and look at the waves closely, you will notice that one wave is larger than the rest. This is constructive inference. When several waves align in sync, suddenly the wave that is produced is larger than the rest.

If you stand at the beach and look at the waves closely, you will notice that one wave is larger than the rest. This is constructive inference. When several waves align in sync, suddenly the wave that is produced is larger than the rest.

This is a fundamental basis of cyclical activity that applies to everything in the universe. It is why the sun beats like your heart. There is a cycle of absolutely everything, which is why we are born, mature, and then die. There are some people who are so afraid of dying, that the sacrifice their life living in fear only to die in the end anyhow.

So never take your eye off the Weekly level at the very least. If you do, the day trading will wipe you out for you will never see that big wave about to hit the market and devastate everyone in its path.