Armstrong Economics Blog/Bonds

Re-Posted Jan 4, 2020 by Martin Armstrong

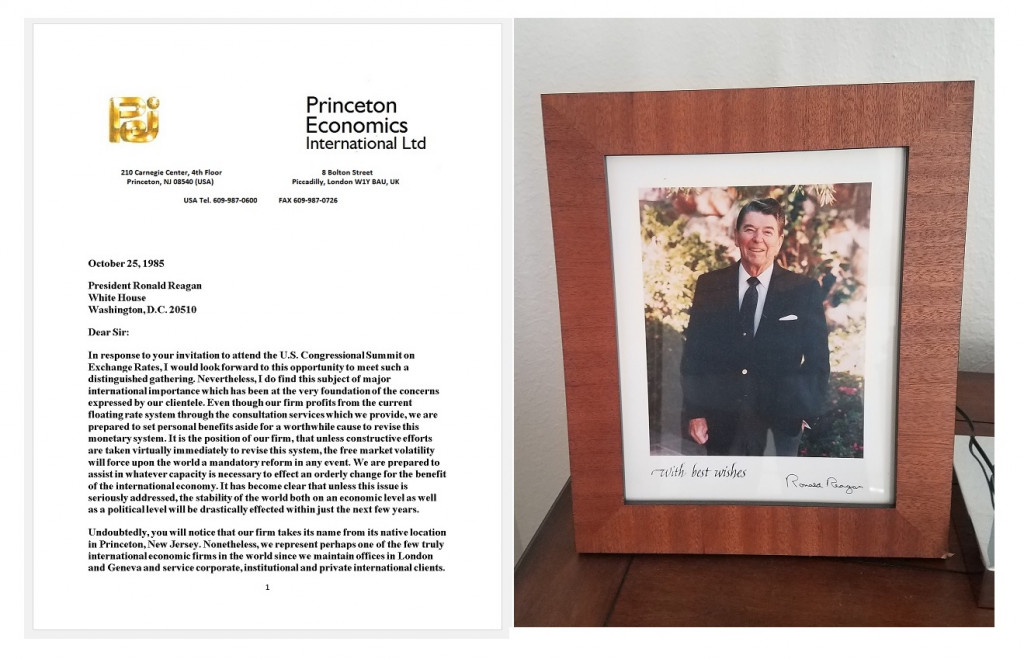

QUESTION: Mr. Armstrong; I just finished reading the Repo Report. I understand why you are reluctant to discuss this publicly when no one else seems to understand what is taking place. I was referred to it by a friend who is on the board of another company. He informed me that many regard you as the best analyst of all time because you have actually been in the trenches. We have no respect for academics in our company. They are always wrong and qualify their forecasts as all things remaining equal. I respect that you have actually worked at high levels. My question is this. Do you think you will be able to assist central banks in avoiding such a meltdown?

RH

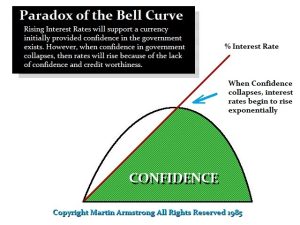

ANSWER: I wish I could answer that question in a positive manner. Unfortunately, in this instance, the epicenter is outside the domestic jurisdictions of even the Federal Reserve. If you look closely at the minutes of the last meeting, there was the unanimous opinion that interest rates would not be lowered in 2020. The free market is pushing rates higher. The Fed was being bullied to lower rates just before the September Repo Crisis hit. They had a private meeting with Trump to explain he had to stop the talk of negative interest rates.

Even if the Fed called me in and gave me dictatorial powers over domestic policy, there is nothing I could do the prevent this crisis because it is outside the United States which is spreading and has become a cancer that threatens the global economy. China agreed to a trade deal as did Trump BECAUSE of the Repo Crisis. There are far bigger fish to worry about here than the nonsense of trade.

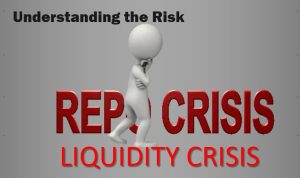

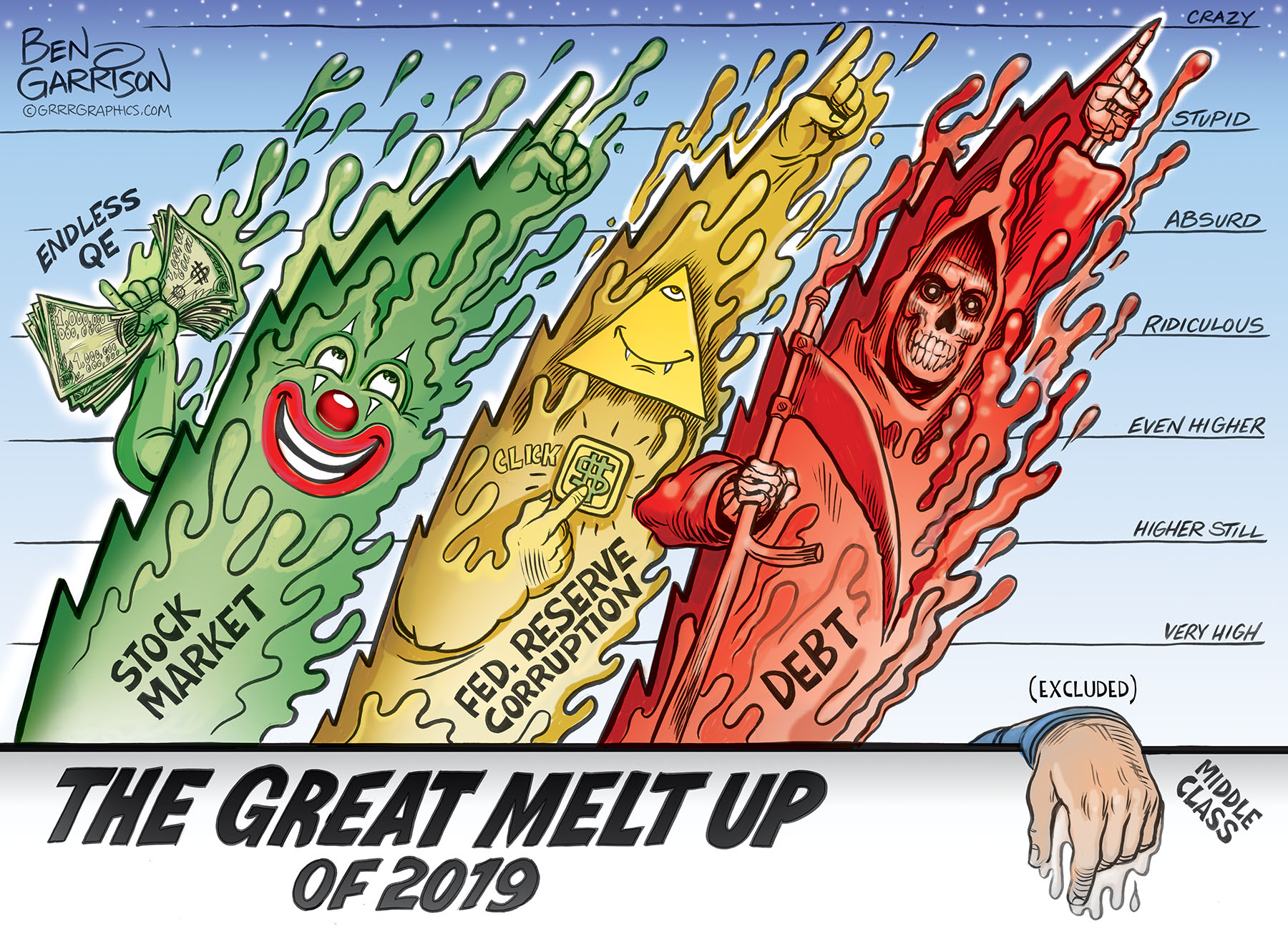

I am glad you understand the crisis I have laid out in this report. I am the only analyst who understands it appears because I have worked with institutions for nearly 40 years. These people come up with all sorts of conspiracy theories and claim this is helicopter money to just Quantitative Easing. In both circumstances, those theories were predicated upon a recession/depression which meant classic Keynesianism was being applied to increase the quantity of money to “stimulate” the economy. But unemployment is back to 1960s levels and the economy is ok. They just spout out the same nonsense they have done since 2007 without ever noticing that QE was buying long-term debt BECAUSE central banks do not control the long end of the curve. Central banks have dominated the short-term interest rates. So when the Repo Rate shot to 10%, that exposed the fact that the central banks are LOSING control of even the short-term rates.

I warned that there had been a destruction of the bond markets and I did a video interview on that when I was in Germany last year which was published in April 2019. I warned about the liquidity crisis and Basel III, which has also contributed to creating the current Repo Crisis. I also warned that we would enter a liquidity crisis come September.

I warned that there had been a destruction of the bond markets and I did a video interview on that when I was in Germany last year which was published in April 2019. I warned about the liquidity crisis and Basel III, which has also contributed to creating the current Repo Crisis. I also warned that we would enter a liquidity crisis come September.

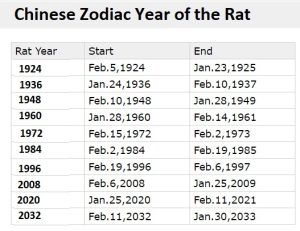

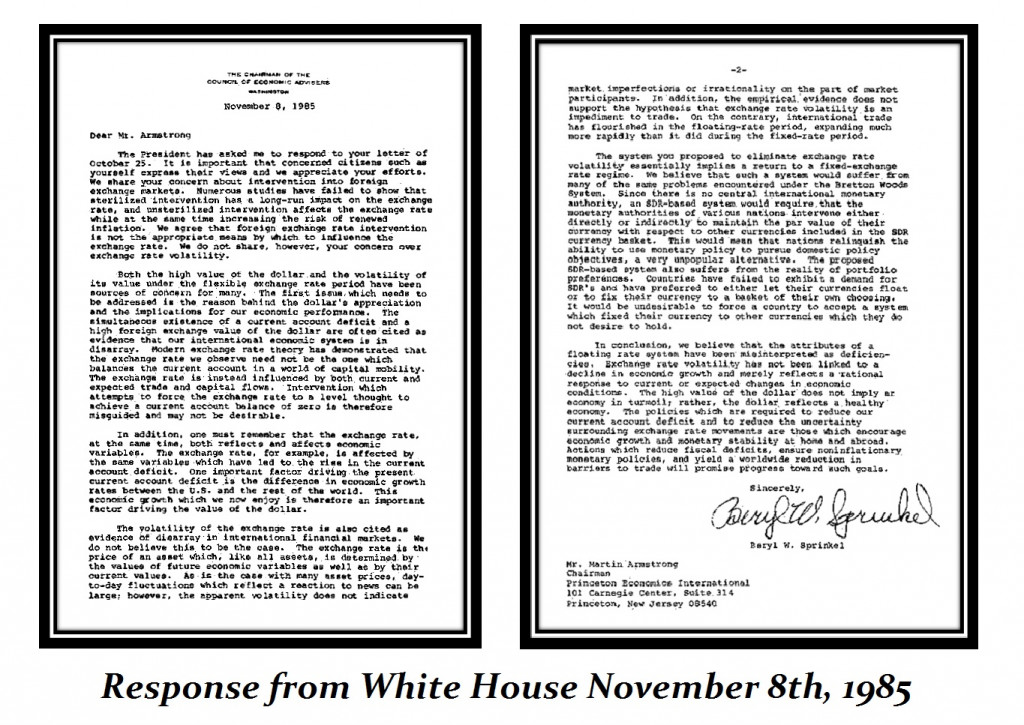

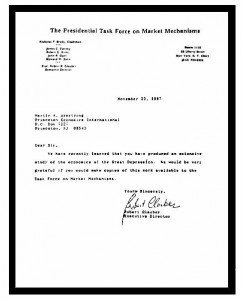

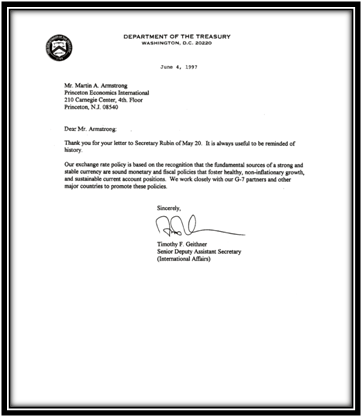

Beyond that, I must be cautious with this crisis because it is the Mother of All Financial Crises and it seems only professionals even grasp the crisis. I have contacts at the very core of the marketplace who see this coming but cannot speak due to confidentiality agreements. The best I can do is keep it to a private service for the time being. I really do not have any choice. The implications can be too great and too broad. It is not something that will affect just Repo. That is simply where it begins. We are talking about a crisis that will dominate the next 8.6-year business cycle. Because this involves governments, they will search desperately for someone else to blame. The way they operate is stark and blunt because governments will NEVER accept responsibility for disrupting the global economy. They accused me of “manipulating the world economy” and the Commodity Futures Trading Commission tried to subpoena me for a list of all our clients worldwide. I had to defend against them in court and prevailed ironically because there is no law against manipulating the world economy and that is just a joke. So please respect, with this one, I just need to be cautious. I can only discus that in a limited service.