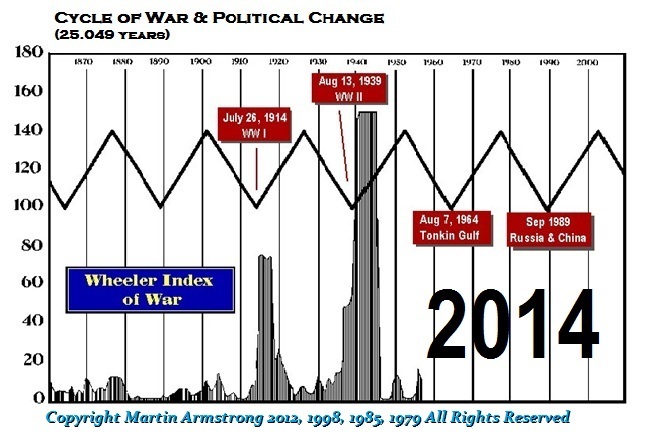

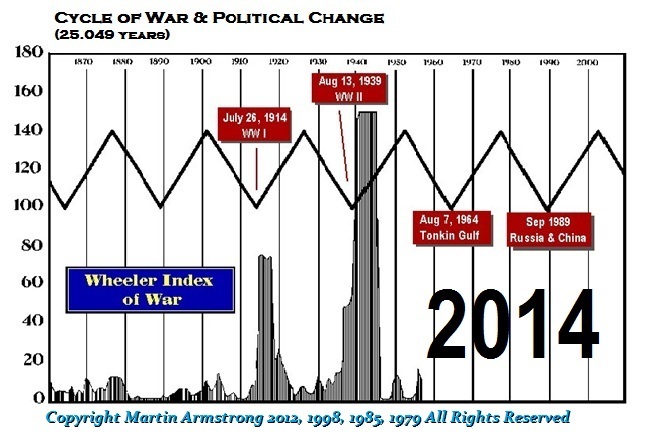

QUESTION: Mr. Armstrong; I find it amazing that you were the only analyst I found who consistently called the bull market in the Dow until January. You have forecast even weather. You have so many correct forecasts there is nobody who even comes close. Then there is your War Cycle that turned up in 2014. You warned that 2018 is where it would start to pick up steam. You have also said it is in the west rather than with Korea. The newspapers are starting to talk about war with Russia. Is everything still on track?

MS

ANSWER: Unfortunately yes. The NATO Secretary-General Jens Stoltenberg has constantly been pushing for a confrontation with Russia, He has been moving military installations to the Russian border while Putin has been forced to pursue buffer zones around Russia. The European Member States have been instructed that they should construct roads and bridges that will allow tanks to freely move throughout Europe. Interestingly, it was the construction of the roads in Turkey that allowed Cyrus the Great of Persia to invade and conquered the entire Anatolia region. So what on the one hand would allow Europe to deploy tanks against Russia, would also allow Russia to take Europe much easier. Indeed, in Poland, there is a motorway leading east to the Ukrainian border that is rarely used.

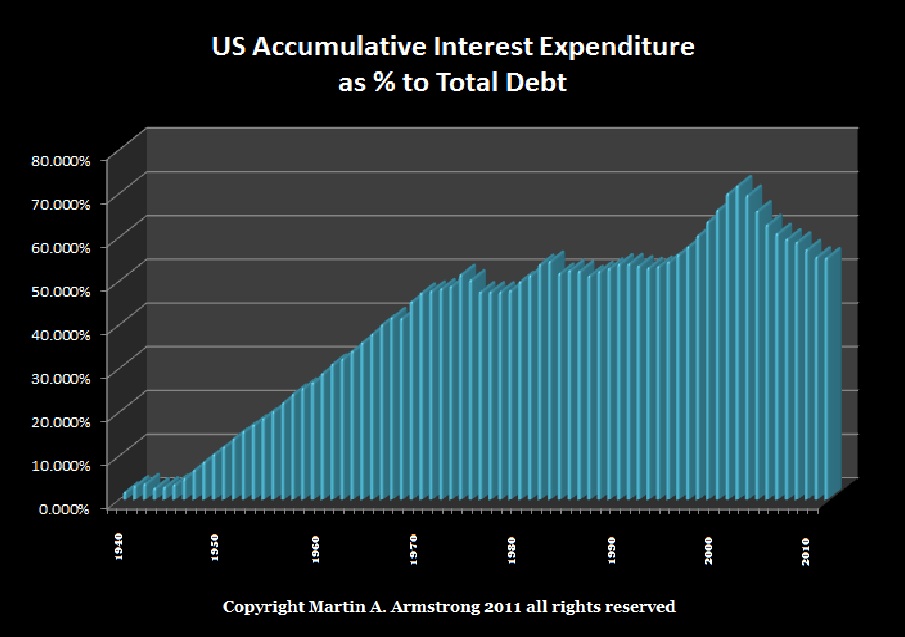

What you must understand is that the West NEEDS a war desperately as a distraction from the collapse of Socialism. NATO has been looking for any excuse to turn this into a confrontation with Russia. The crazy thing is that war has changed. Neither side wants to “occupy” the other as was the case with Napoleon and Hitler. So why are we preparing for war? What is the objective?

Turkey needs a war and they are becoming much more aggressive because the currency is collapsing. Yet Turkey is a NATO member who is threatening Greece another NATO member. Turkey is strategically moving closer to Russia than Europe. At the Ankara summit, the impression was clear that Turkey was on his side of Russia. This has fundamentally changed the situation on the Black Sea and indirectly also in Eastern Europe. In the east of the Black Sea, that is also Russia’s southern border.

Russia had included the Crimea peninsula. It gave it to Ukraine when it was part of the Soviet Union. Russia took it back because it was strategic and you can bet that the USA would have done the same had Japan tried to take Okanowa. The Russian Black Sea Fleet has been located in Crimea for more than two centuries. There was no possible way Russia would have given that back to Ukraine. The West knew that and have used that excuse for sanctions against Russia knowing full well that they were turning up the heat that could easily lead to war.

NATO has signed numerous agreements with Ukraine providing it with arms and has in all but name made it a NATO member. NATO continues to portray Russia as an aggressor when it knows that Crimea was part of Russia until 1954 when it formally gave it to Ukraine to manage, But the dominant language spoke in Crimea remains Russian – not Ukrainian. NATO is also encouraging Romania and Bulgaria to create fleets to confront Russia using the Crimea crisis as justification.

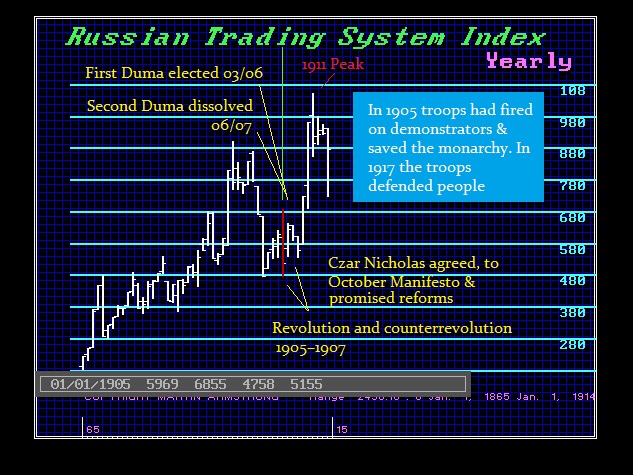

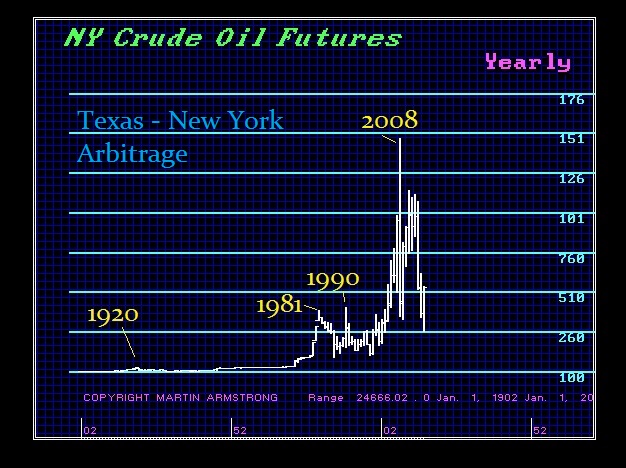

Russia, unlike China, lacks a strong domestic economy for it has been much like the Middle East – counting on commodity exports. However, as commodity prices have declined, this has weakened the Russian economy and here too Putin will need a war to overcome the economic decline ahead. NATO is an organization that can no longer be defined and it seeks to hold onto old world philosophies to justify its existence. NATO needs a war to ensure its own funding. If Russia has no real designs to invade and occupy Europe, then why do we need NATO?

The Prince Eugene of Savoy (1663-1736) was considered even by Napoleon as one of the seven greatest strategists in military history. He was also plagued by a rumor that he was really the illegitimate son of King Louis XIV of France which he perpetually denied. Yet, Louis XIV was always ashamed of such offspring and he restrained Eugene’s ambitions as if he was perhaps his son so that after 20 years of living in Paris and at Versailles, he left France and offered his talent to the kings of Europe. He fought for Leopold I (1640-1705), Holy Roman Emperor who was fighting the Turks. He distinguished himself in the siege of Vienna in 1683 and his military career was born.

The Prince Eugene of Savoy (1663-1736) was considered even by Napoleon as one of the seven greatest strategists in military history. He was also plagued by a rumor that he was really the illegitimate son of King Louis XIV of France which he perpetually denied. Yet, Louis XIV was always ashamed of such offspring and he restrained Eugene’s ambitions as if he was perhaps his son so that after 20 years of living in Paris and at Versailles, he left France and offered his talent to the kings of Europe. He fought for Leopold I (1640-1705), Holy Roman Emperor who was fighting the Turks. He distinguished himself in the siege of Vienna in 1683 and his military career was born.

Yet the Prince of Savoy was a man who observed patterns. This helped in in military strategy, but it also allowed him to see the function of government. He came to comprehend that standing armies would be easily used. It was his observations that kings would go to war BECAUSE they had standing armies that they paid for even if they did nothing. The Prince explained that there should be no armies and that would reduce war by itself. He passed on this brilliant insight to Montesquieu, who the Founding Fathers of the United States understood and thus created the right to bear arms which became the Second Amendment to the United States Constitution which is under attack today. In Switzerland, you enter military service to be trained, and then you take your gun home ready to be called upon if there is an invasion.

Yet the Prince of Savoy was a man who observed patterns. This helped in in military strategy, but it also allowed him to see the function of government. He came to comprehend that standing armies would be easily used. It was his observations that kings would go to war BECAUSE they had standing armies that they paid for even if they did nothing. The Prince explained that there should be no armies and that would reduce war by itself. He passed on this brilliant insight to Montesquieu, who the Founding Fathers of the United States understood and thus created the right to bear arms which became the Second Amendment to the United States Constitution which is under attack today. In Switzerland, you enter military service to be trained, and then you take your gun home ready to be called upon if there is an invasion.

Unfortunately, NATO by itself needs a war. As the budgets get tighter and tighter, funding is shifted to social programs. NATO will then layoff people and lose its power base. It needs to demonize Russia as much as possible and to even provoke a confrontation to justify getting more money. Of course, it seeks to provoke a confrontation for money but it assumes there will not be World War III because neither side desires to occupy the other. So exactly why do we need standing armies today is simply a political issue. However, maintaining such a military power also ensures that it will eventually be used.

If the reason for war is no longer occupation but more like a brawl between two drunks in a bar, they do we need standing armies especially when we can just push a button? It is sad to say that now we will see tensions rise from 2018 onward into the peak of the cycle.