QUESTION: Mr. Armstrong; Are you aware of the 1988 Economist article predicting that in 30 years from then we would all be using the same currency? That is strangely your target of 2018 when you have warned that the Monetary Crisis will begin then. I met an attendee from your 1985 WEC there in Hong Kong. He said you gave that date of 2018 way back at that conference. Did the Economist take your work for that article?

PH

ANSWER: The Economist did not really make a forecast. They were just generalizing what might happen in 30 years from then. I do recall speaking to them back then, but I disagreed with the concept that everyone would be shopping with the same currency around the world. I was one of the people called in back in 1985 when they were creating the G5 (now G20) at the Plaza Accord. I had originally proposed back then that we adopt the SDR at the IMF as the new reserve currency.

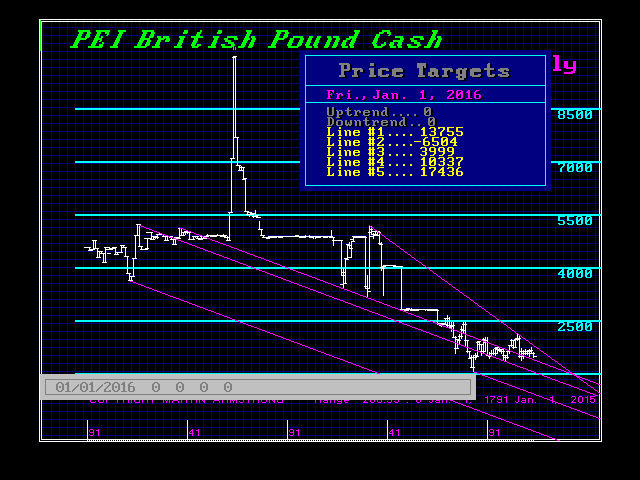

After dealing with many governments at that time, it became crystal clear that this idea of a single world currency that people would be using in everyday commerce was not practical. It was at the Plaza Accord in 1985 when the idea of the Euro was born. This article in the Economist was inspired by this idea of surrendering monetary authority to a single government in Europe. We can see how screwed up the outcome has been. After working with governments in Europe and America, it was abundantly clear that a single currency that would be used in daily commerce by everyone would never exist without monumental collapse in governments and a new one world government. But that would not last very long as we see the rebellion in Europe against Brussels. It demands also the surrender of one’s culture.

This idea of a one world government where everyone willingly surrenders their sovereignty and culture to some central power is the stuff of movies. Here is a letter from the White House. The chief objection is universal. It requires the surrender of domestic policy objectives to international.

There is no possible way this is happening without the entire world collapsing and a single government emerges by FORCE. Politics as we know will could no longer function. Politicians argue vote for them and they will tax the rich and hand it to the poor. How can that take place in such a system? They could not promises nonsense against the global trend as they do currently. The policy would be determined at the central power and politicians would be subordinate in every country unable to offer anything to get elected.

There is no possible way this is happening without the entire world collapsing and a single government emerges by FORCE. Politics as we know will could no longer function. Politicians argue vote for them and they will tax the rich and hand it to the poor. How can that take place in such a system? They could not promises nonsense against the global trend as they do currently. The policy would be determined at the central power and politicians would be subordinate in every country unable to offer anything to get elected.

I do not support the corruption that has engulfed the world. However, this idea that everyone will be using the same currency is a pipe-dream with no basis in reality for the amount of political change would require a bloodbath in revolution. It could NEVER unfold willingly with the political system we currently have. Even then, counter-revolutionary forces would emerge. It will not be just BREXIT, it will be countless civil wars against a central political institution.

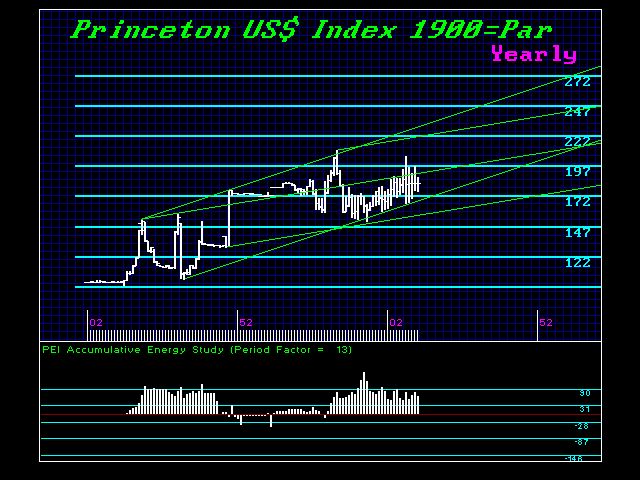

The very best will be a single new reserve currency to replace the dollar. But every country would still need to retain its own currency because the business cycle cannot be defeated so while some countries benefit, others must suffer. The entire world cannot possibly have a trade surplus all simultaneously until we begin trading with other planets.

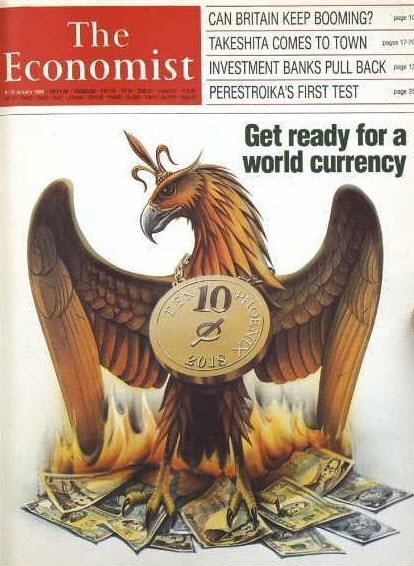

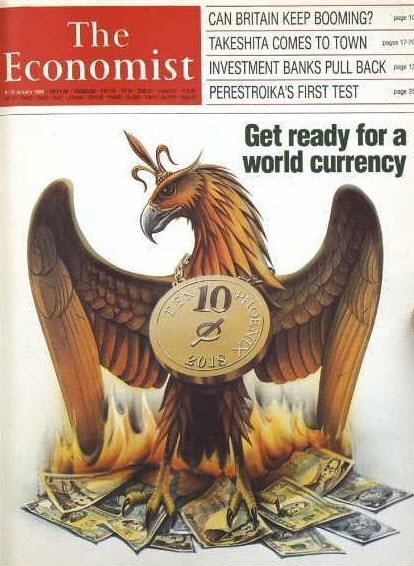

The Economist wrote:

Title of article: Get Ready for the Phoenix

Source: Economist; 01/9/88, Vol. 306, pp 9-10

THIRTY years from now, Americans, Japanese, Europeans, and people in many other rich countries, and some relatively poor ones will probably be paying for their shopping with the same currency. Prices will be quoted not in dollars, yen or D-marks but in, let’s say, the phoenix. The phoenix will be favoured by companies and shoppers because it will be more convenient than today’s national currencies, which by then will seem a quaint cause of much disruption to economic life in the last twentieth century.

–

At the beginning of 1988 this appears an outlandish prediction. Proposals for eventual monetary union proliferated five and ten years ago, but they hardly envisaged the setbacks of 1987. The governments of the big economies tried to move an inch or two towards a more managed system of exchange rates – a logical preliminary, it might seem, to radical monetary reform. For lack of co-operation in their underlying economic policies they bungled it horribly, and provoked the rise in interest rates that brought on the stock market crash of October. These events have chastened exchange-rate reformers. The market crash taught them that the pretense of policy co-operation can be worse than nothing, and that until real co-operation is feasible (i.e., until governments surrender some economic sovereignty) further attempts to peg currencies will flounder.

…

The new world economy

The biggest change in the world economy since the early 1970’s is that flows of money have replaced trade in goods as the force that drives exchange rates. as a result of the relentless integration of the world’s financial markets, differences in national economic policies can disturb interest rates (or expectations of future interest rates) only slightly, yet still call forth huge transfers of financial assets from one country to another. These transfers swamp the flow of trade revenues in their effect on the demand and supply for different currencies, and hence in their effect on exchange rates. As telecommunications technology continues to advance, these transactions will be cheaper and faster still. With unco-ordinated economic policies, currencies can get only more volatile.

….

In all these ways national economic boundaries are slowly dissolving. As the trend continues, the appeal of a currency union across at least the main industrial countries will seem irresistible to everybody except foreign-exchange traders and governments. In the phoenix zone, economic adjustment to shifts in relative prices would happen smoothly and automatically, rather as it does today between different regions within large economies (a brief on pages 74-75 explains how.) The absence of all currency risk would spur trade, investment and employment.

–

The phoenix zone would impose tight constraints on national governments. There would be no such thing, for instance, as a national monetary policy. The world phoenix supply would be fixed by a new central bank, descended perhaps from the IMF. The world inflation rate – and hence, within narrow margins, each national inflation rate- would be in its charge. Each country could use taxes and public spending to offset temporary falls in demand, but it would have to borrow rather than print money to finance its budget deficit. With no recourse to the inflation tax, governments and their creditors would be forced to judge their borrowing and lending plans more carefully than they do today. This means a big loss of economic sovereignty, but the trends that make the phoenix so appealing are taking that sovereignty away in any case. Even in a world of more-or-less floating exchange rates, individual governments have seen their policy independence checked by an unfriendly outside world.

–

As the next century approaches, the natural forces that are pushing the world towards economic integration will offer governments a broad choice. They can go with the flow, or they can build barricades. Preparing the way for the phoenix will mean fewer pretended agreements on policy and more real ones. It will mean allowing and then actively promoting the private-sector use of an international money alongside existing national monies. That would let people vote with their wallets for the eventual move to full currency union. The phoenix would probably start as a cocktail of national currencies, just as the Special Drawing Right is today. In time, though, its value against national currencies would cease to matter, because people would choose it for its convenience and the stability of its purchasing power.

…..

The alternative – to preserve policymaking autonomy- would involve a new proliferation of truly draconian controls on trade and capital flows. This course offers governments a splendid time. They could manage exchange-rate movements, deploy monetary and fiscal policy without inhibition, and tackle the resulting bursts of inflation with prices and incomes polices. It is a growth-crippling prospect. Pencil in the phoenix for around 2018, and welcome it when it comes