Armstrong Economics Blog/Economics

Re-Posted Mar 12, 2019 by Martin Armstrong

QUESTION: These economists who propose this MMT claim that since the U.S. borrows in its own currency, it can print dollars to cover its obligations, and can’t go broke. The theory has won converts among freshman Democrats like Alexandria Ocasio-Cortez as a way to finance such social policies as the Green New Deal and Medicare For All. There seems to be something seriously wrong here. You have taught me to see the world as a whole. I think these people have blinders on and do not take into account foreign ownership of US debt. Would you comment on that aspect, please?

JG

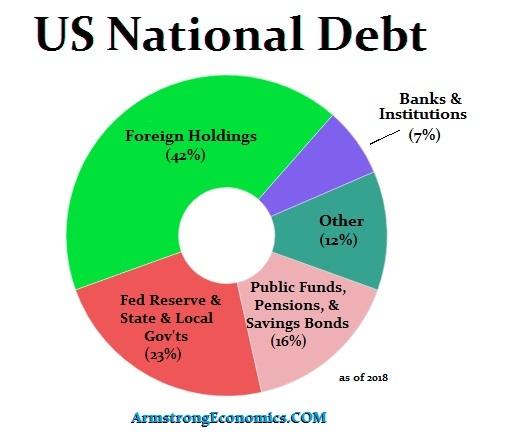

ANSWER: Very good. Yes, we are all connected and these people behind MMT are idiots. This is the same old story that we can just print our way out because we owe money to ourselves. That is a nice naive theory which reflects the ignorance of those behind MMT. At the end of 2018, foreigners owned about $6.2 trillion of U.S. debt or approximately 42% of the total national debt. Meanwhile, the American public/institutions held $16.1 trillion and 23% of the national debt. The sheer numbers available from the government prove what they are saying is NOT TRUE!!!!!! Their theory that MMT is possible because we borrow from ourselves is just absurd.

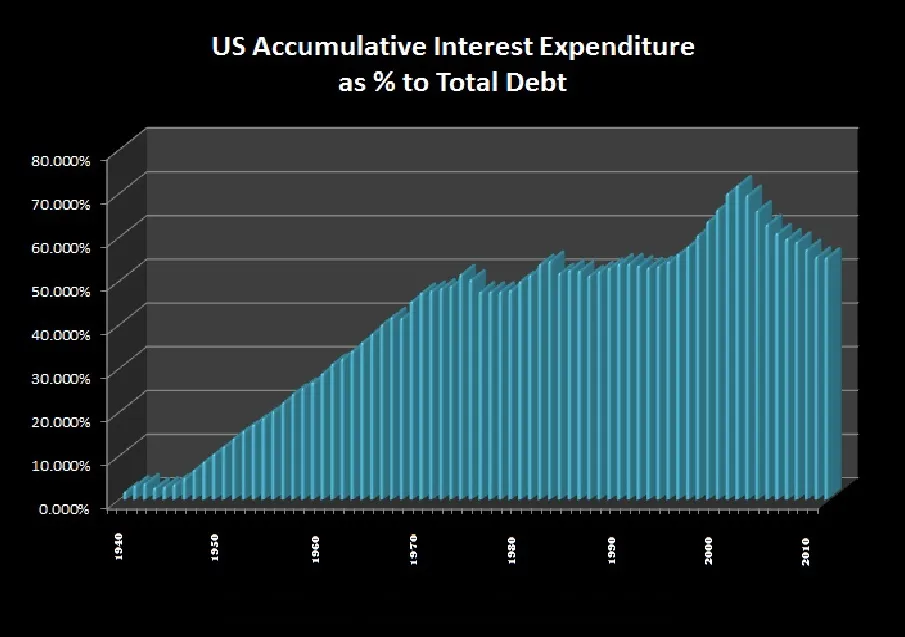

They assume that we can borrow indefinitely and just print money to cover the expenses. The fallacy here involves the simple fact that 39% of the debt is held by foreigners. That reality exists BECAUSEthe dollar is the reserve currency as Europe is drowning in its socialism. Federally, the states have income taxes but not a consumption tax. In Europe, you have an income tax that is higher than the USA by at least 20%, and then on top of that you have a 20% VAT consumption tax. Additionally, there are mountains of municipal taxes and all sorts of regulations and fees. The USA has the biggest consumer economy because the consumer is left with nearly one-third more of their income as disposable to spend compared to Europeans. Add the fact that the USA also has NEVERcanceled its currency and therefore the US dollar is used internationally. About 60% of American dollars all circulate outside the United States. Clearly, MMT would also disrupt the entire world economy.

The theory that QE proves them correct is seriously wrong. The world is in a deflationary trend. The dollars are in HIGH demand because it is going nuts everywhere else. The increase in the supply of dollars has NOT been inflationary because the world is sucking them up. They do not understand the demand is global, not domestic. Remember the Money Plane? Skids after skids were being shipped outside the USA of $100 bills to supply the demand worldwide. When that demand shifts, their entire theory of MMT will blow up in their face.