QUESTION: I was told that none of the big bankers during the Great Depression went to jail either. Doesn’t the government understand that this is the very image of draining the swamp?

DK

ANSWER: The bankers own the reign of government from the courts to the White House. In the years that followed the 2008 financial crisis, the Securities and Exchange Commission brought charges against more than 150 people and institutions and won $2.68 billion in penalties. The SEC loves big fines. Keep in mind if they charge the individual banker, it will never be profitable. Charge the bank and promise no criminal prosecutions and you get the big bucks. So yes, not one of the bankers went to jail from that financial meltdown that they created which left 8.8 million Americans jobless. It also led to a $700 billion government bailout to save the bankers which never stimulated the economy.

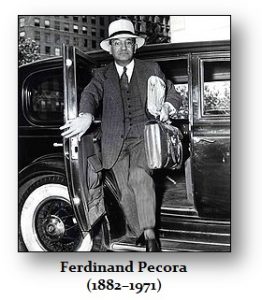

Your question was whether it was this way during the Great Depression. Virtually no bankers were jailed in the wake of the Great Depression. However, they were at least charged but beat the criminal charges.

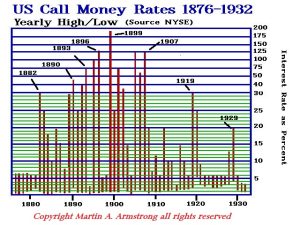

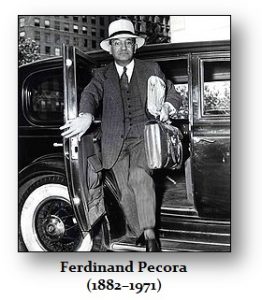

Beginning in 1932, the Senate Committee on Banking and Currency opened a public inquiry into the stock market crash. The Pecora Commission, as the investigation came to be known, led to indictments for several of the era’s finance giants. However, this was all before the SEC and Glass-Steagall, which Goldman Sachs had the Clintons repeal. Since banking laws did not guard against the kind of speculation that fueled the crash, most escaped prosecution for they did not violate any law.

Charles Mitchell was the president of the National City Bank, now Citibank. Mitchell built the bank into the nation’s largest by splitting it into two branches which fed each other. One half became its investment arm, while the other was its banking arm. Hence, this was the reason Glass-Steagall was enacted. The banks sold investments to clients, often financed with money borrowed from the bank. They also knew, as they did in 2007-2009, that the investments were toxic. When the market crashed, clients lost everything after listening to the advice of the bankers and the banks would often collapse. Mitchell resigned and admitted to the Pecora Commission that he knew his bank was pushing bad investments onto its clients, as was the case many alleged with Goldman Sachs in 2007. Mitchell was indicted for tax evasion but was ultimately acquitted. He paid a $1 million civil fine instead.

Then there was the utility magnate Samuel Insull who also appeared before the Pecora Commission. He fled the country in June 1932, which was about eight months before prosecutors brought fraud charges against him. Insull pioneered the concept of a holding company, in which one company holds partial or complete interest in another company. At the height of his success, Insull controlled businesses worth as much as $500 million in assets with just $27 million in equity. When the crash hit, 65 of his businesses failed, ruining 600,000 investors. Insull was eventually returned to the U.S. nearly two years later but he also beat the charges.

The Pecora Commission went after the individuals. The SEC and Justice Department protect those bankers today. The Securities and Exchange Commission is now controlled by the people from Goldman Sachs. The likelihood of the SEC ever prosecuting anyone from the banking industry is ZERO,

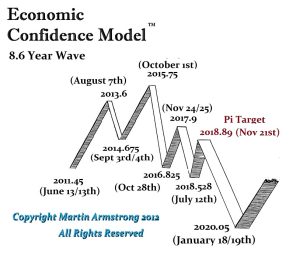

A lot of people have written in about my comments concerning how the world is completely in a state of global chaos which is why this year I will be providing a continued video update for the 2019 WEC attendees. Those looking at the arrays of many markets are also starting to notice how global markets are correlating on a worldwide basis. Never before have I witnessed such mass correlation around the world which is demonstrating that this is by no means about local issues or the rise and fall of GDP, interest rates, or inflation. We are facing a VERY serious crisis and this is part of the Monetary Crisis Cycle

A lot of people have written in about my comments concerning how the world is completely in a state of global chaos which is why this year I will be providing a continued video update for the 2019 WEC attendees. Those looking at the arrays of many markets are also starting to notice how global markets are correlating on a worldwide basis. Never before have I witnessed such mass correlation around the world which is demonstrating that this is by no means about local issues or the rise and fall of GDP, interest rates, or inflation. We are facing a VERY serious crisis and this is part of the Monetary Crisis Cycle