QUESTION: Hello Mr Armstrong.

I understand the logic of the weakness / strength of currency that you outline from time to time in your modelling of the global crisis.

You omit to explain the importance in the pace of change in the value of a currency; for instance Venezuela and Argentina according to your explanation of the dollar weakness ought to have benefited from a free falling currency. They are both exporters of natural resources that receive foreign exchange for their exports. Can you please elaborate on this difference? The US dollar is of course not free-falling, but for the global reserve currency, it has fallen precipitously year to date.

My second question concerns the groundhog mentality of a lot of commentators about the dollar and its safe haven status. I wonder why it is that when a group of large countries decide to exclude the dollar from their transactions, it would have nothing to do with that currency’s weakness?

You say the US is an oil exporter; well it does export oil, and it also imports oil of the a different grade to the one it exports. In addition, is it just a coincidence that countless countries with oil assets have been invaded and/or sanctioned in the last 70 years? Persia, Iraq, Libya to name but a handful of energy nations, and let’s also throw in the case of the opium trade coming out of Afghanistan and which has the fingerprints of the US all over it.

I would appreciate not hearing an explanation about the need to spread democracy, human rights and being the honest broker as the reason the US holds 800 bases around the world and is currently the process of agitating to cause harm to the middle east, eastern europe and the south china seas.

Many thanks for your voluntary service to readers, especially the historic aspect of your memos, which are quite fascinating.

Best regards

CAL from Switzerland

ANSWER: Your proposition that the “pace of change” in the value of a currency when it collapses in such places as Venezuela and Argentina ought to have benefited from a free falling currency, is an interesting question that truly reveals the importance of CONFIDENCE. True, Trump and his predecessors since Ronald Reagan have preferred a weaker currency to stimulate foreign sales and thus the theory is such a policy will increase jobs. This is seriously flawed as always because of this one-dimensional analysis attempt to always reduce everything to a single cause and effect.

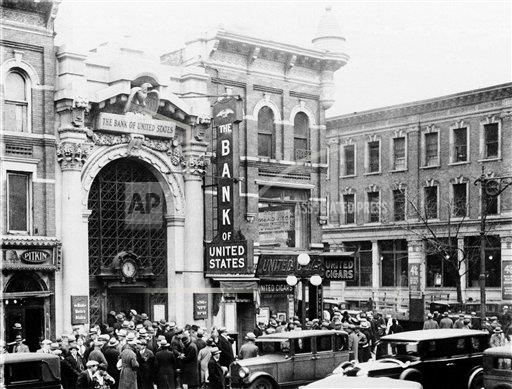

The value of a currency at its base is constructed upon CONFIDENCE in the government. If you do not TRUST the government, you simply will not accept their currency. This has been the case throughout history. I have pointed out how the Emperor of Japan lost the CONFIDENCE of the people and as such they would no longer accept his coinage. Japan stopped issuing coins for nearly 600 years because each emperor devalued the outstanding coinage to be 10% of his new coins. Thus, people would not accept Japanese coins for they could become worthless on the whim of an emperor. They reverted to bags of rice and Chinese coins – not Japanese.

Therefore, a weak currency will stimulate foreign sales provided you TRUST the government. Lacking that, the currency simply goes into a free fall and becomes worthless. This was the fate of the hyperinflation in Germany. It was NOT the Quantity of Money theory, it was the fact that there was a 1918 Communist Revolution in Germany where they had even asked the Communist Russians to take over Germany. It was the collapse in CONFIDENCE that led to the hyperinflation. We saw the same thing in every instance of hyperinflation for that is the free-fall when people not longer trust government. It has never been the Quantity of Money and this is also why the Quantitative Easing policy of the ECB has failed.

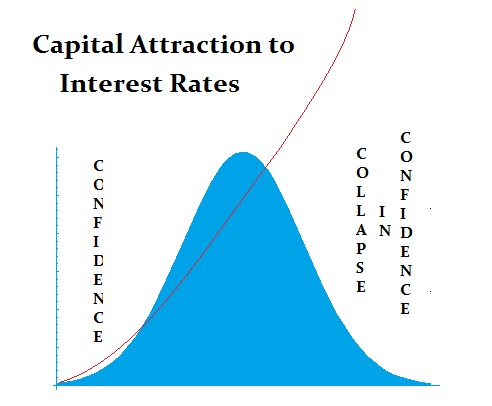

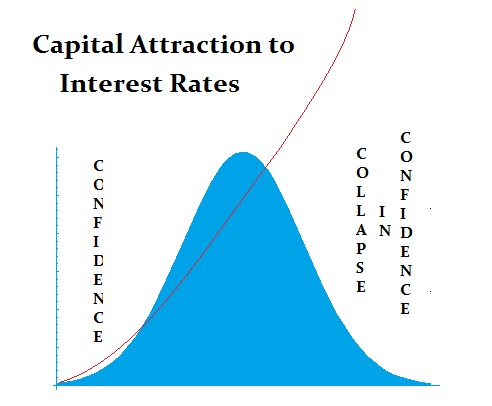

Likewise, you will see the same impact in interest rates, which are the reflection of future inflation. Rising interest rates will attract capital inflows but only to a point where CONFIDENCE is maintained. If CONFIDENCE in government collapses, then interest rates soar reflecting the risk factor in the Survivability of government.

Consequently, all of these theories are not linear. They operate on a BELL CURVE. It is like my mother always said – too much of a good thing can be bad. A cookie or ice cream may taste great. But you cannot eat only cookies and ice cream. There is a limit to all things before the BELL CURVE comes into play.

Your second question as to why when a group of large countries decide to exclude the dollar from their transactions, it would have nothing to do with that currency’s weakness? This is simple. The strength of the dollar is based on capital flows, not trade. There has been the safe haven issue that dominated World War I and World War II because the USA really cannot be invaded. The USA was nearly bankrupt in 1896 when JP Morgan had to lend it $100 million in gold. By the end of WWII, the USA then had 76% or the world gold reserves because (1) it manufactured everything for Europe and provided food, and (2) capital fled to the States lacking security in Europe.

China and Russia and complain about the dollar all they want and attempt to denominate commodities in their own currencies. But trade is a tiny fraction of international capital flows. This is why the Euro has utterly failed to become a major reserve currency that even China liquidated and drastically reduced their Euro holdings because there was no central government debt. Anyone investing in Euros still had to pick and choose among the Eurozone debt and they selected Germany. Just look at the differentials in interest rates within the Eurozone. This reflect the same differences between the States in the USA compared to the Federal debt.

China understands what is necessary to create a reserve currency. They are opening a bond market to investors. This takes time. China must establish a solid rule of law in order to provide CONFIDENCE for foreign capital to park money in their currency. This is exactly what Europe has failed to do because Germany does not trust the other governments.

Your attempt to brush aside the fact that the US is an oil exporter tends to show more of a bias. The point is from the 1970s when OPEC embargoes were put into place, the USA was a major importer because oil was cheap. As with everything, raise the price and you will create the alternative, solar, wind, and fracking. As far as wars and the invasion of Iraq, do not confuse political corruption of Cheney with the state of the nation.

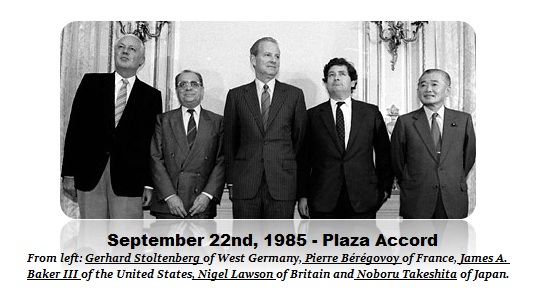

Your request that you “would appreciate not hearing an explanation about the need to spread democracy, human rights and being the honest broker as the reason the US holds 800 bases around the world and is currently the process of agitating to cause harm to the middle east, eastern Europe and the south china seas.” I have stated countless times that we are in a Crisis in Democracy and we by no means live in a Democracy – this is a Republic. I have been warning we are in a Private Wave since 1985 and governments only care about power, not human rights by any means. They are bankrupt and as such they are destroying the world economy by hunting money for taxes. You are in Switzerland. The Swiss secrecy was because Hitler made it illegal to have money outside of Germany. Today, the Swiss have given up everything that made it a safe haven. Fund managers are leaving for Singapore because the Swiss have adopted EU regulations. There is no longer an advantage to a Swiss account and they have given up everyone from Americans to Germans and Italians. Swiss secrecy is over. That ends the Swiss Comparative Advantage of David Ricardo.

Nevertheless, historically, ONLY those currencies of the dominant military power have EVER been the reserve currency. So you may not want to hear about the 800 bases etc, but you cannot escape the fact that part of the reserve status of any currency is the military power. When Athens became a major power after defeating the Persians, it was the Athens Owl (tetradrachms) that was being imitated in Europe, Asia, and in India.

We find Indian imitations of Roman gold aureus spanning more than 100 years. They are not counterfeits in the sense of trying to create gold plated coins, but they were of equal or greater metal content yet struck in the image of Rome because people TRUSTED the Roman currency in India just as people will TRUST US dollars in Russia or China. The dominant military power is also the reserve currency historically.

As for the decline in the dollar, we need the false move to set the stage to break the back of the world monetary system. ONLY then will we see a new reserve currency emerge. That will NOT happen with a lower dollar. A dollar rally will create sovereign debt crisis outside the USA and reduce trade exports for the USA, and the hunt for taxes will continue to reduce world GDP as today 2% is regarded as fantastic growth when 6% was the optimum in the 1980s.

There has never been actual tangible money issued by any government that was worth strictly its metal content. It was always valued greater than its intrinsic value. Even the first coins issued by any government took place in Lydia, located in modern Turkey. They used gold simply because that was the private medium of exchange. The first step was simply to create a standardized weight for in the Bible they talked about weighing the silver to make payment. When the king began to stamp his seal on money, fiat began. People used metal and wheat as a medium of exchange. The

There has never been actual tangible money issued by any government that was worth strictly its metal content. It was always valued greater than its intrinsic value. Even the first coins issued by any government took place in Lydia, located in modern Turkey. They used gold simply because that was the private medium of exchange. The first step was simply to create a standardized weight for in the Bible they talked about weighing the silver to make payment. When the king began to stamp his seal on money, fiat began. People used metal and wheat as a medium of exchange. The

In general, Europeans are still trapped in World War II thinking that a stronger currency means economic boom. When all the currencies were wiped out by the war, politicians used the currency value in Europe as a reason to prove they were doing a good job. So the historical bias in Europe has been dominated by the perspective. The USA was a third world country during the 19th century. It was the “emerging market” for European investors. It was virtually bankrupt in 1896 and it was World War I and II that raised the USA to the richest country in the world by 1950 holding 76% of the total world gold reserves. That was accomplished not by Marxism, political economic manipulation, or anything any politician enacted. It was create SOLELY and EXCLUSIVELY by capital inflows because of Europe running around destroying itself.

In general, Europeans are still trapped in World War II thinking that a stronger currency means economic boom. When all the currencies were wiped out by the war, politicians used the currency value in Europe as a reason to prove they were doing a good job. So the historical bias in Europe has been dominated by the perspective. The USA was a third world country during the 19th century. It was the “emerging market” for European investors. It was virtually bankrupt in 1896 and it was World War I and II that raised the USA to the richest country in the world by 1950 holding 76% of the total world gold reserves. That was accomplished not by Marxism, political economic manipulation, or anything any politician enacted. It was create SOLELY and EXCLUSIVELY by capital inflows because of Europe running around destroying itself.

Therefore, throughout economic history we always have long-term structural reform. Do not expect either gold or oil to always be a valuable component. If you go all the way back to a Dark Age, governments collapse as does money because civilization reverts back to a tribal state and then the only value becomes food once again.

Therefore, throughout economic history we always have long-term structural reform. Do not expect either gold or oil to always be a valuable component. If you go all the way back to a Dark Age, governments collapse as does money because civilization reverts back to a tribal state and then the only value becomes food once again.