Armstrong Economics Blog/Uncategorized

RE-Posted Aug 27, 2017 by Martin Armstrong

It is becoming painfully obvious that the amount of sheer theft of our forecasts right down to names of publications is escalating unbelievably. I personally fear that these charlatans are only looking to exploit people and could care less what is really at stake. From outright just stealing our track record and claiming they called markets to the day of the 1987 Crash to taking the title of the Great Bull Market in History and calling it their own, are confirmations that they really cannot stand on their own.

None of these forecasts we have made for the past near 40 years was possible without the largest database ever assembled covering the entire world. Our initial Socrates launch covers about 500 instruments around the world. No individual analyst is capable of forecasting the world without such a database and computer systems designed to do so. There is just far too much for any analyst to watch every single day. And as for forecasting things to the precise day, only the Economic Confidence Model has accomplished that and I myself remain in awe of how the world is so precise. The complexity simply masks the hidden order. This was never my theory that I set out to prove, it is something that I bumped into along the way of just trying to forecast markets for my own trading.

I have advised more governments and been called into more crisis events than anyone I know of. That does not happen out of thin air. Such levels are achieved only with long standing track records that are know to be true over the course of decades.

Anyone taking our targets to stealing our track record claiming they accomplished the same, I warn that such conduct is not that of anyone you should trust. They are simply charlatans looking to exploit you for money and when crisis does come, they will be clueless what to advise. This not a game. This is reality. Such people are parasites looking simply to mislead you for profit.

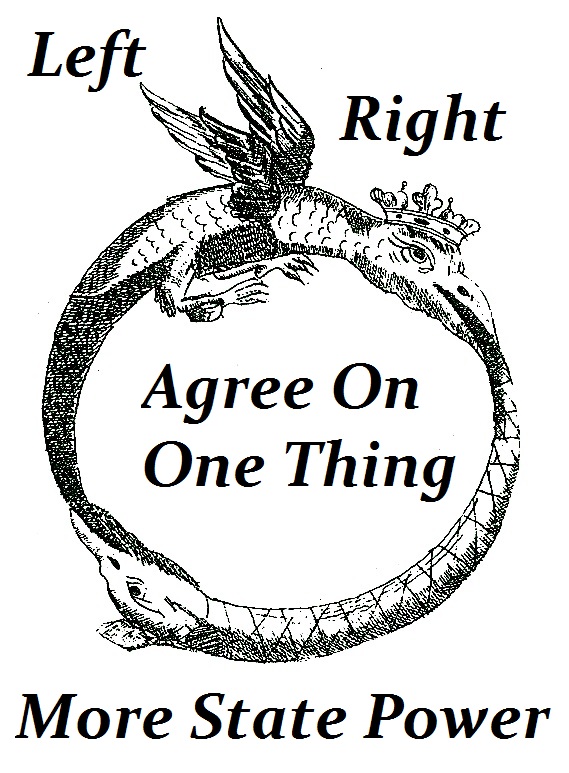

I have written before that if you go extreme right and extreme left, you reach the same political position with two different thought processes –

I have written before that if you go extreme right and extreme left, you reach the same political position with two different thought processes –