QUESTION: Dear Mr. Armstrong:

Thanks for your soon reply. I ask you:

1. Why do you consider Jesse Livermore the greatest investor of all time?. 2. Which are the main reasons?.

I look forward to hearing from you as soon as possible.

Sincerely,

JEMV

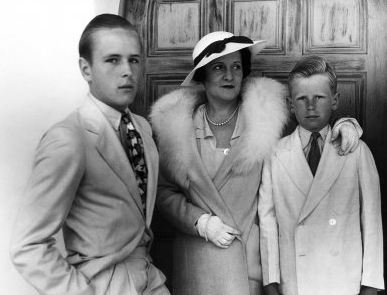

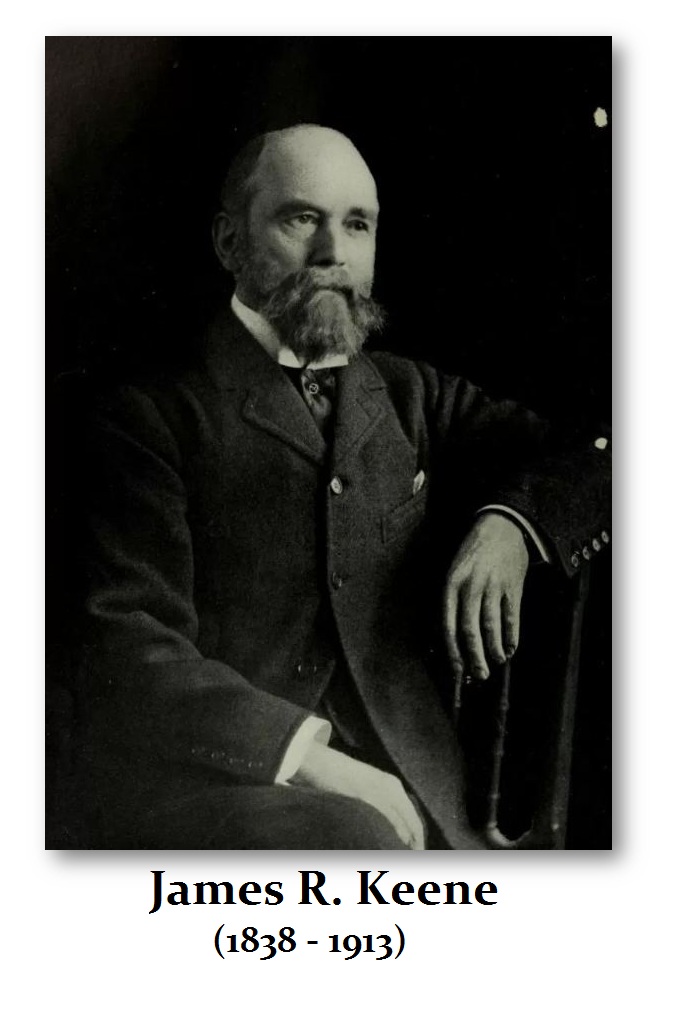

ANSWER: Jesse Livermore (1877 – November 28, 1940), was a famed American investor and security analyst who was not always right. He was famous for making and losing several multi-million dollar fortunes and renowned for his short selling during the stock market crashes in 1907 and 1929. I would not necessarily say he was the all-time BEST trader in history. He has often been regarded as such. Jesse was very good. He could have been a bit more disciplined, but perhaps that applies to us all. Just as I may regard Jesse as one of the best, Jesse Livermore called James R. Keene (1838-1913) the “greatest of them all” with no hesitation. I, however, disagree. There is a difference between a perpetual bull and someone who can play the short-side. It takes a “nose” to be the latter.

ANSWER: Jesse Livermore (1877 – November 28, 1940), was a famed American investor and security analyst who was not always right. He was famous for making and losing several multi-million dollar fortunes and renowned for his short selling during the stock market crashes in 1907 and 1929. I would not necessarily say he was the all-time BEST trader in history. He has often been regarded as such. Jesse was very good. He could have been a bit more disciplined, but perhaps that applies to us all. Just as I may regard Jesse as one of the best, Jesse Livermore called James R. Keene (1838-1913) the “greatest of them all” with no hesitation. I, however, disagree. There is a difference between a perpetual bull and someone who can play the short-side. It takes a “nose” to be the latter.

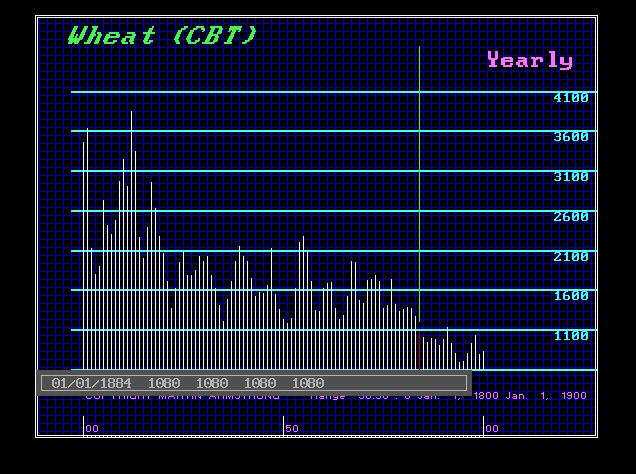

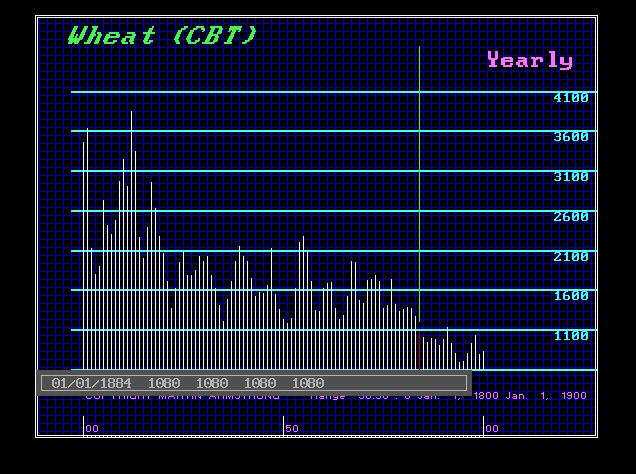

Keene also made and lost fortunes many times over. He made his first fortune in California trading stock in mining companies. He rose to the top and even became the present of the San Francisco Stock Exchange. In 1876, he moved to New York City where the big money traded. He began investing heavily in race horses. Then in 1884, he suffered tremendous losses in the Chicago grain market, which wiped him completely out. It was this loss that made me lose respect for him. He was betting on the long-side, not the short-side. He simply bought and held. That is not a “trader” in my book.

Keene also made and lost fortunes many times over. He made his first fortune in California trading stock in mining companies. He rose to the top and even became the present of the San Francisco Stock Exchange. In 1876, he moved to New York City where the big money traded. He began investing heavily in race horses. Then in 1884, he suffered tremendous losses in the Chicago grain market, which wiped him completely out. It was this loss that made me lose respect for him. He was betting on the long-side, not the short-side. He simply bought and held. That is not a “trader” in my book.

Yet, James began a remarkable comeback after he was hired by Wall Street investor William Havemeyer to manage a stock fund. His reputation grew and he was very good at market manipulation. He was then hired by J.P. Morgan and William Rockefeller to manage their funds. Keene knew how to “manipulate” markets to make money, but on the long-side. That is not a trader to me. Yes, he had a talent for marketing something to make a profit. But anyone can get rich with a buy and hold strategy. If they are completely wiped out in a crash, that proves they do not have a “nose” for trading. They are just the standard buy and hold variety.

Therefore, what I will say is this with respect to WHY I rank Jesse above Keene. Jesse began trading at the young age of fourteen, and I understand this because I began at the age of thirteen. Jesse ran away from home because his father wanted him to be a farmer. I did not run away from home, but my father wanted me to be a lawyer. What I can say from my personal experience is that some of us are just born with a “nose” for some talent. You see kids with amazing talents who sing or play a piano. Who knows where it comes from. All I can say is nobody taught me how to trade — I just did it. I suspect that Jesse was the same. He was born with a talent to see patterns within patterns and developed a “nose” for trading.

Therefore, what I will say is this with respect to WHY I rank Jesse above Keene. Jesse began trading at the young age of fourteen, and I understand this because I began at the age of thirteen. Jesse ran away from home because his father wanted him to be a farmer. I did not run away from home, but my father wanted me to be a lawyer. What I can say from my personal experience is that some of us are just born with a “nose” for some talent. You see kids with amazing talents who sing or play a piano. Who knows where it comes from. All I can say is nobody taught me how to trade — I just did it. I suspect that Jesse was the same. He was born with a talent to see patterns within patterns and developed a “nose” for trading.

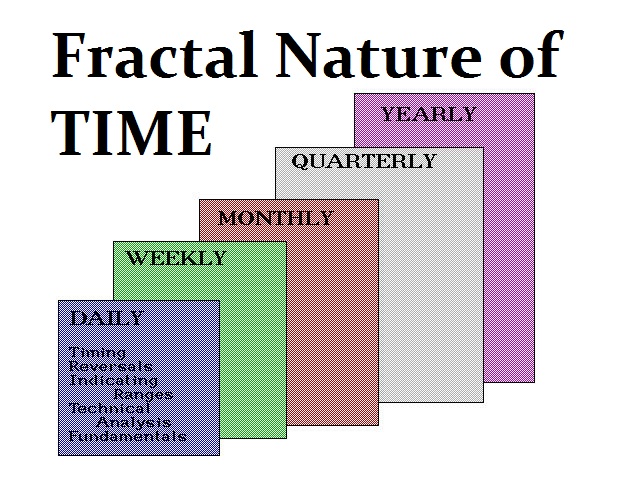

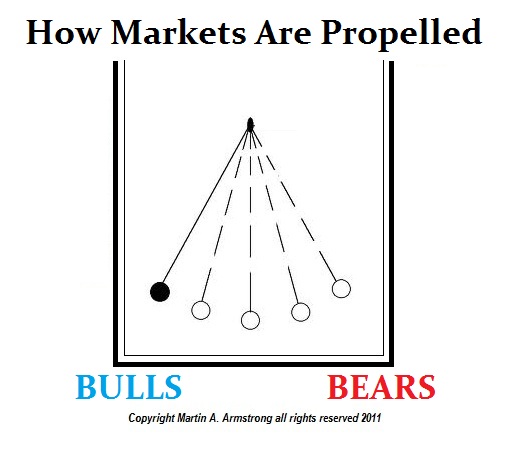

I too could smell the blood come from the tape of quotes and somehow had an instinctive “feel” for how a market would crash. I was named Hedge Fund Manager of the year back in 1998 because I made so much money shorting the markets for the Long-Term Capital Management Crash keying off of the Economic Confidence Model. But there was something in the air. I could smell it. Can’t really describe it. You feel it in your bones like a storm approaching. You just know. Jesse clearly possessed that same instinct. It was obvious from his trading. But Jesse may have made more money on the short-side, but that is because you just make far more money on a short in a crash compared to a long which is often like watching grass grow because it takes time. Jesse could see BOTH sides of a market. I have called bull markets and bear markets. That is a trader — not someone who is only a long-player. That is an investor and by no means a trader.

Jesse Livermore began his career by posting stock quotes at the Paine Webber brokerage in Boston. While working with the data, Jesse most likely saw the ebb and flow of the markets and the patterns within patterns. He would write down certain calculations he had about future market prices and then later check to see if he was correct. Some friend convinced him to put actual money on the market by making a bet at a bucket shop. By the age of fifteen, Jesse had made over $1,000 which was about an annual salary at that time. Because Jesse was a consistent winner, he was banned from most bucket shops from trading as they liked people who lost. This is probably why he left town and moved to New York City where he devoted all his energies to trading in the big markets.

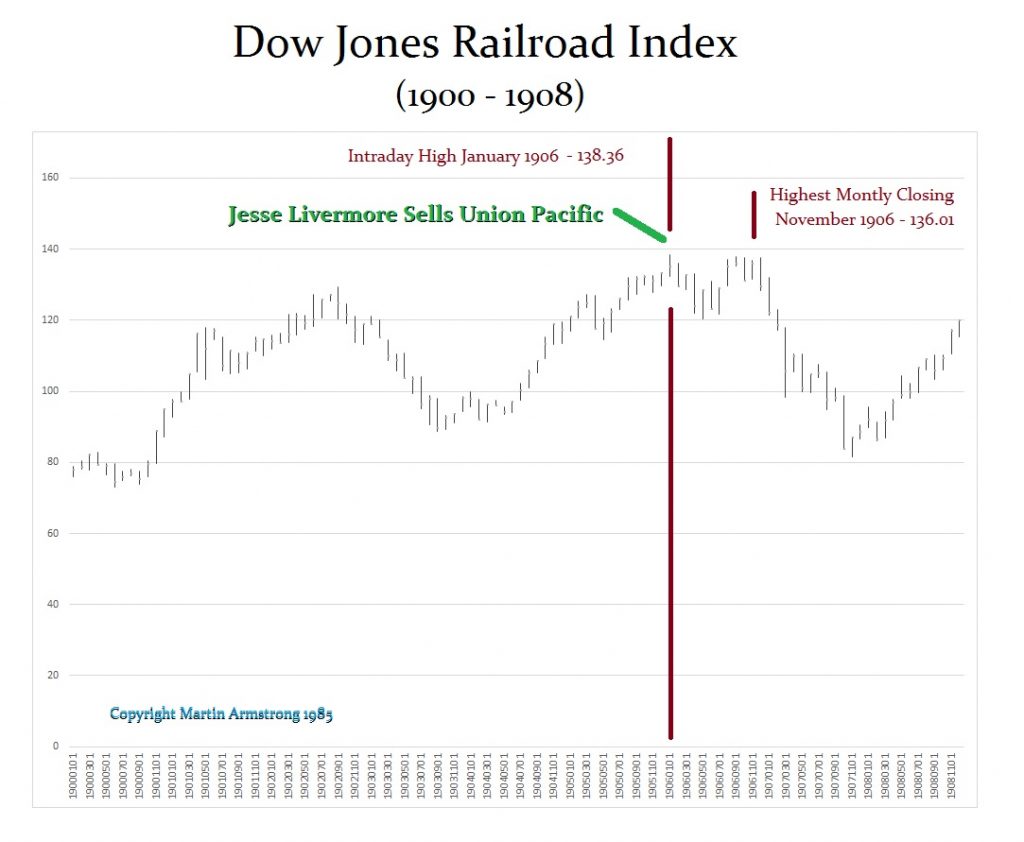

Jesse did not always trade by his rules. He was famous for playing his gut feelings, selling Union Pacific Railroad short right before the 1906 San Francisco earthquake. The key to being a good trader, believe it or not, is never think about the money. If you think about the money, you freeze and cannot trade. I fully agree with Jesse’s comment after taking a loss:

“The loss of the money didn’t bother me. Whenever I have lost money in the stock market I have always considered that I have learned something; that if I have lost money I have gained experience, so that the money really went for a tuition fee. A man has to have experience and he has to pay for it.”

I have personally said many times that one should appreciate victories but cherish losses. It is ONLY from losses that we learn HOW to trade!

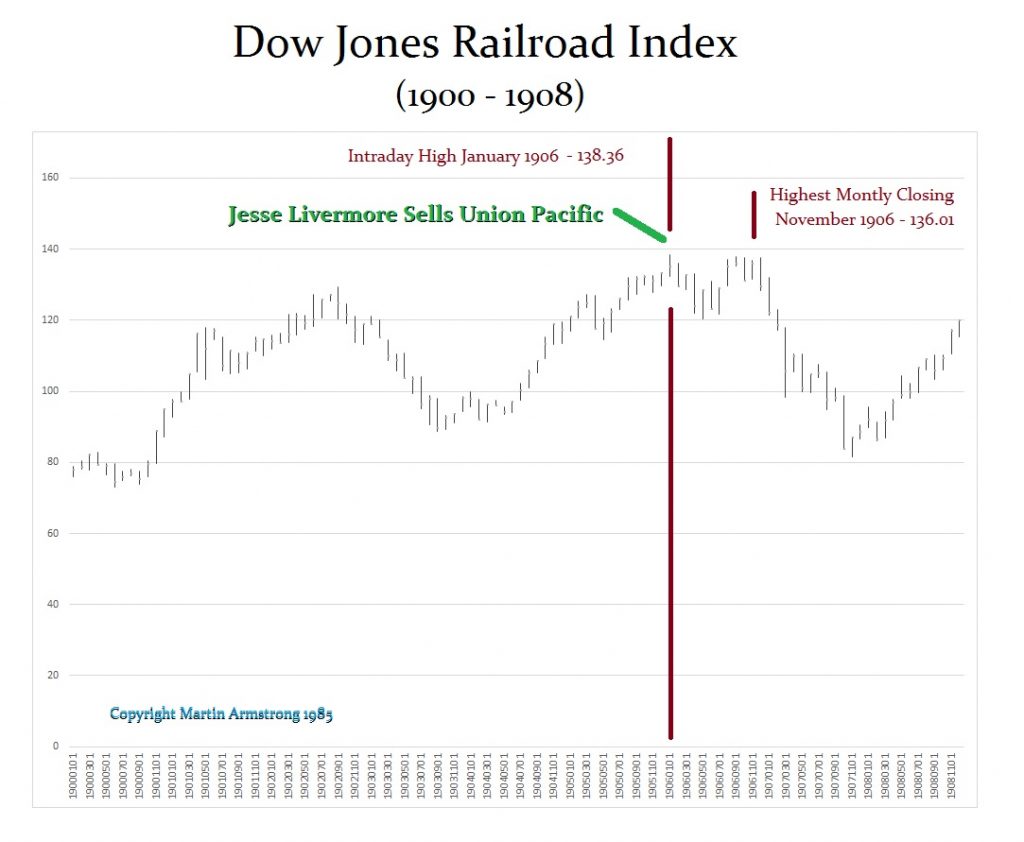

Many people criticized Jesse’s famous trade going short at the top of Union Pacific. Many claimed it was just luck and judged him based upon the fundamentals since he sold it before the April 18, 1906, San Francisco earthquake. With hindsight, the California earthquake of 1906 ranks as one of the most significant earthquakes of all time. However, the market peaked in January 1906 so it was not a tricky trade simply because the earthquake after he went short. I gathered the data to see IF I would have taken that trade personally. I must confess, I would have shorted that stock at the same time. Why? Let’s look closely and I will explain this as a trader who always had a good “nose” for trends myself.

As the story goes, one day in early 1906, Jesse stopped into a brokerage office where he was vacationing. Some said it was the Breakers Hotel Palm Beach in Florida which had opened up in 1896, and others said it was Atlantic City. Both were “the place” to go back then to get some sun. I would assume in January to March he would have gone to Florida and not New Jersey.

As the story goes, one day in early 1906, Jesse stopped into a brokerage office where he was vacationing. Some said it was the Breakers Hotel Palm Beach in Florida which had opened up in 1896, and others said it was Atlantic City. Both were “the place” to go back then to get some sun. I would assume in January to March he would have gone to Florida and not New Jersey.

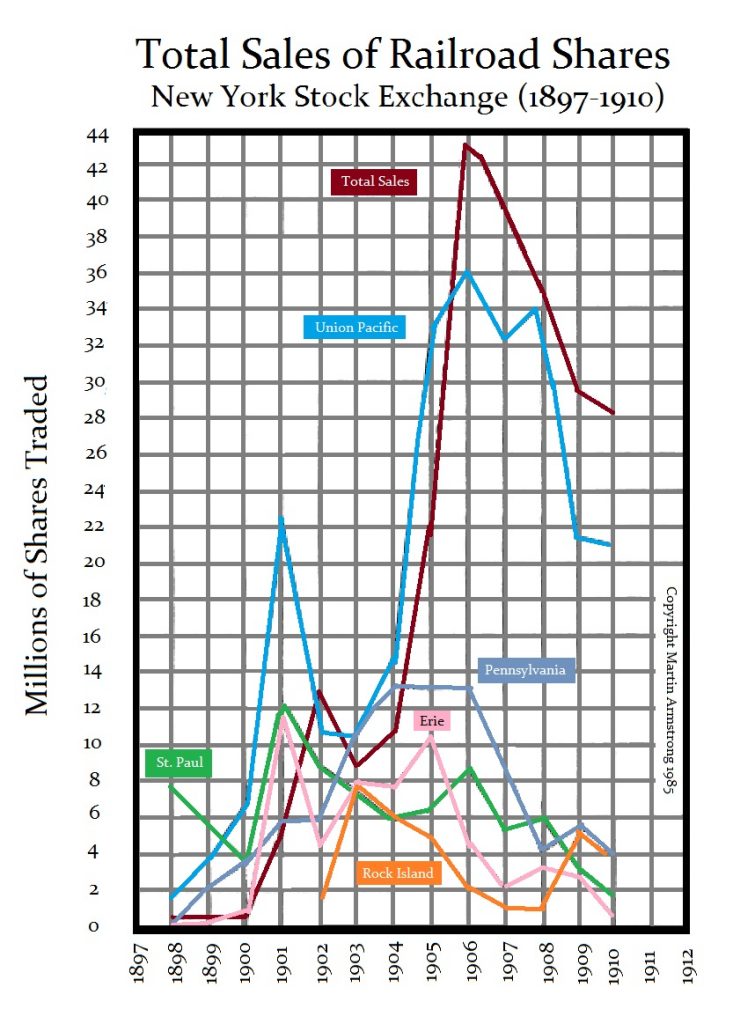

Livermore sold short Union Pacific, which was THE railroad giant and this one share accounted for around 50%+ of the trading volume back then. Jesse picked up a pad and wrote an order to sell a thousand shares of Union Pacific. The broker thought it was a mistake. Surely, he would not short a stock that always went up. After the first sell, Livermore began to press the market selling 2,000 shares short. He did these trades while on vacation. Jesse then cut his vacation short and quickly jumped on the train and returned to New York City. He added to his position again and the next day the San Andreas Fault ruptured at 5:13 a.m. on April 18, 1906.

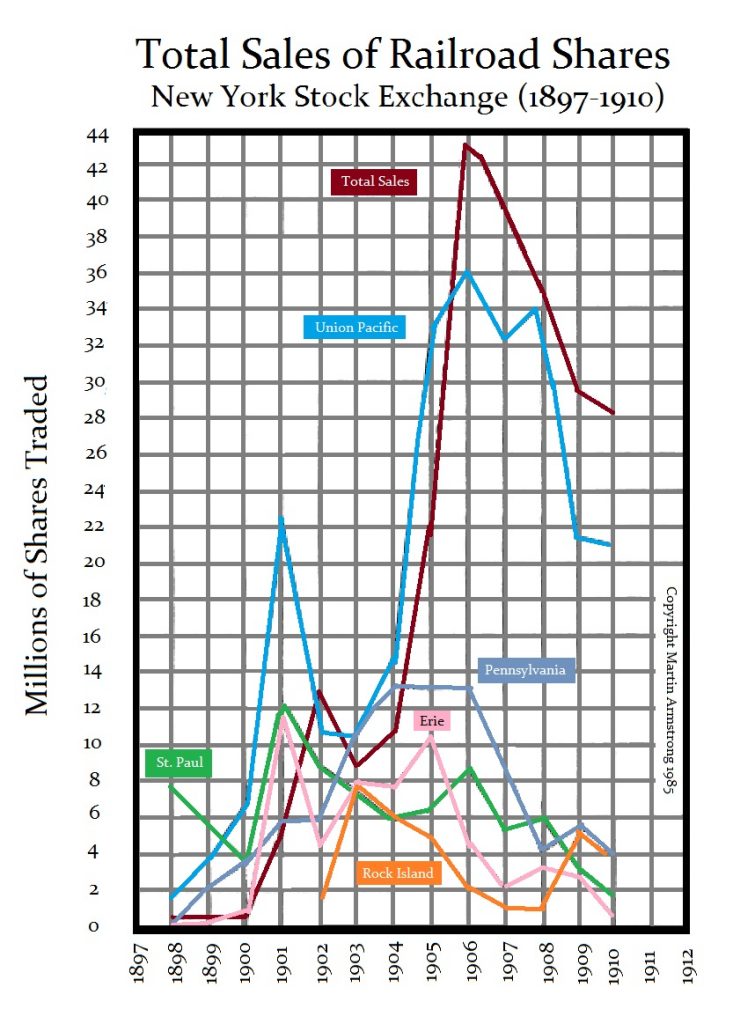

The Dow Jones Railroad Index had just been split off when the index began in 1885, tracking 14 shared composed of 12 railroads and two industrials. Because of mergers, the following year saw the index composed of 12 shares of which 10 were railroads and two industrials. In 1889, the index was now changed to 20 shares composed of 18 railroads and two industrials. Because of the Industrial Revolution was just starting, the index was split in 1897 into the industrials and the railroads. But it was the railroad stocks that were dominant until the Panic of 1907.

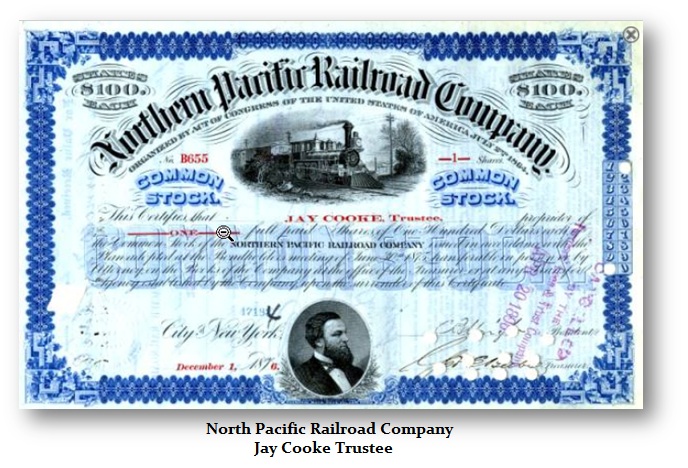

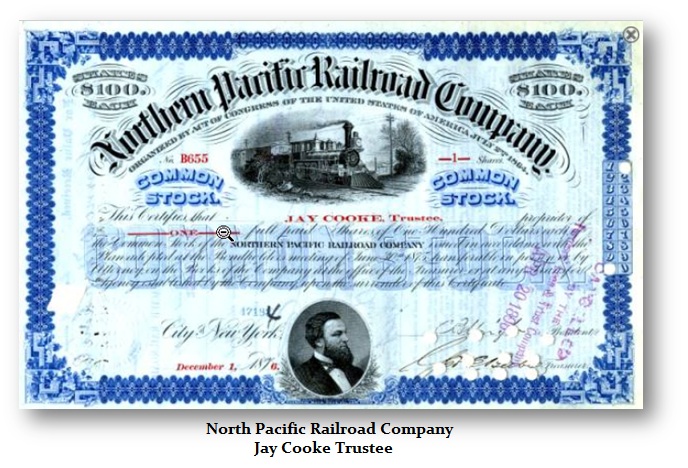

The Panic of 1901 is not high on the list of memories but it was an important event which actually resulted in the peak in most railroad shares. The Panic was in part caused by a manipulation on the New York Stock Exchange as the struggle between E. H. Harriman, Jacob Schiff, and J. P. Morgan/James J. Hill fought for the financial control of the Northern Pacific Railway, which has been the major focus of Jay Cooke back in the day of the Panic of 1873. As the market crashed, a compromise was finally reached and the players agreed to form the Northern Securities Company. Then in 1904, the Supreme Court ruled against them that it was a monopoly in Northern Securities Co. v. United States, 193 U.S. 197 (1904).

The Panic of 1901 is not high on the list of memories but it was an important event which actually resulted in the peak in most railroad shares. The Panic was in part caused by a manipulation on the New York Stock Exchange as the struggle between E. H. Harriman, Jacob Schiff, and J. P. Morgan/James J. Hill fought for the financial control of the Northern Pacific Railway, which has been the major focus of Jay Cooke back in the day of the Panic of 1873. As the market crashed, a compromise was finally reached and the players agreed to form the Northern Securities Company. Then in 1904, the Supreme Court ruled against them that it was a monopoly in Northern Securities Co. v. United States, 193 U.S. 197 (1904).

The market peaked on January 22, 1906, closing at 138.36 on the Dow Railroad Index. The night before the earthquake the index closed at 132.66. After the news hit New York and the full extent of the damage to the railroad was known, the traders panicked and Livermore sold even more shares short. When the market fell for 10 days straight, closing at 121.89 on April 28, Jesse brought back all of the shares and racked up a profit of a quarter of a million dollars on one trade.

When we look objectively at the position of the market, it is clear what Jesse saw. The railroad stocks overall had really peaked during 1901 and were devastated during that Panic. Then there was the Rich Man’s Panic of 1903 where the final low unfolded. The Panic of 1903 reached its nadir in the Industrial Index on November 9, 1903, while the railroads bottomed nearly two months before on September 28, 1903. Industrials were just getting started and were seen as the more risky market to play. John Gates (1855-1911), otherwise known as Bet-A-Million Gates because he was a huge gambler on horses, was considered one of the leaders of Wall Street. Gates was an industrialist who made his fortune by promoting of barbed wire. Gates went on a European business trip and vacation during 1902 and returned just in time for the 1903 panic. He was met at the dock by the press who wanted to hear his comments on the crash. He said:

When we look objectively at the position of the market, it is clear what Jesse saw. The railroad stocks overall had really peaked during 1901 and were devastated during that Panic. Then there was the Rich Man’s Panic of 1903 where the final low unfolded. The Panic of 1903 reached its nadir in the Industrial Index on November 9, 1903, while the railroads bottomed nearly two months before on September 28, 1903. Industrials were just getting started and were seen as the more risky market to play. John Gates (1855-1911), otherwise known as Bet-A-Million Gates because he was a huge gambler on horses, was considered one of the leaders of Wall Street. Gates was an industrialist who made his fortune by promoting of barbed wire. Gates went on a European business trip and vacation during 1902 and returned just in time for the 1903 panic. He was met at the dock by the press who wanted to hear his comments on the crash. He said:

“I am surprised at the condition of the stock market,” he told reporters who met his ship. “It is not natural. The causes are purely artificial, and they rest on a false basis. I do not believe there was ever a better time to invest in reasonable securities. I have come back stripped for the fray, and I am going down into Wall Street.”

Gates immediately formed a bull syndicate to buy up shares he believed were underpriced and of good value. Nevertheless, the market continued to trade against him during the spring of 1903 and then it resumed the decline during early summer.

The market really did not stabilize until late August when J.P. Morgan returned from his annual European art-collecting expedition. The mere presence of Morgan would calm markets. By October, the low was firmly in place with the railroad, but the industrials would have to wait for November before prices were on the way up.

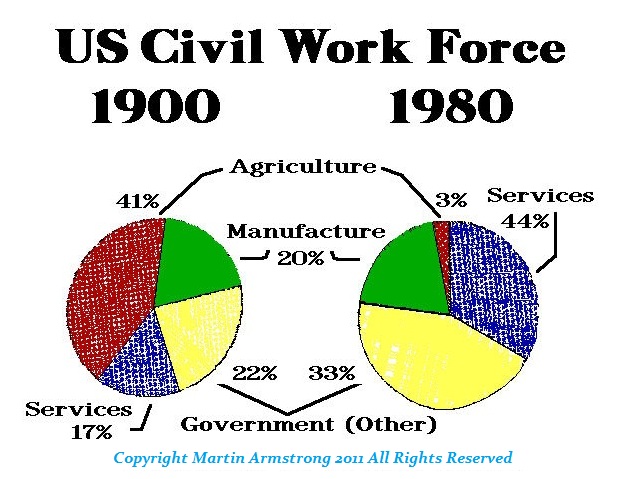

The Rich Man’s Panic was the test before the rally into 1906. The little investor was out after 1901 and no longer trusted the market. Thus the recovery was in the hands of the investment bankers.

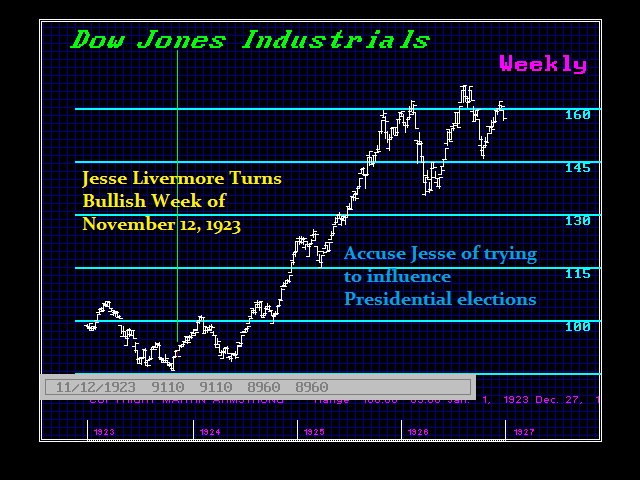

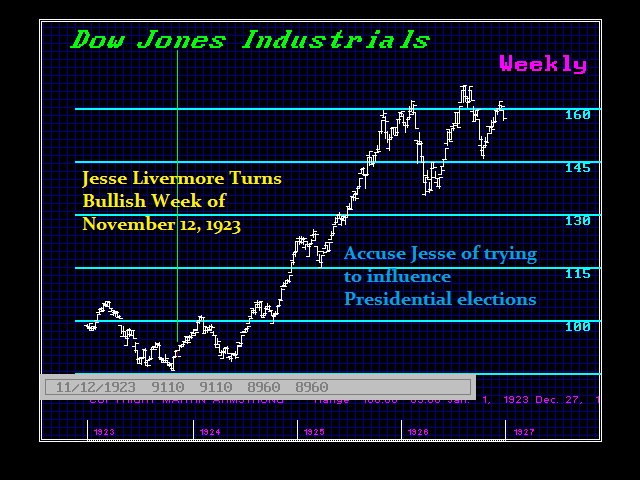

In 1923, the Wall Street Journal falsely accused Jesse Livermore of turning bullish on the market because he was friends with the president. The Journal accused him of trying to influence the presidential election. When the market broke out and rallied, all the other publications took swipes at the WSJ saying everyone reported Jesse’s comments “except” the WSJ. Livermore suffered at the hands of some in the press.

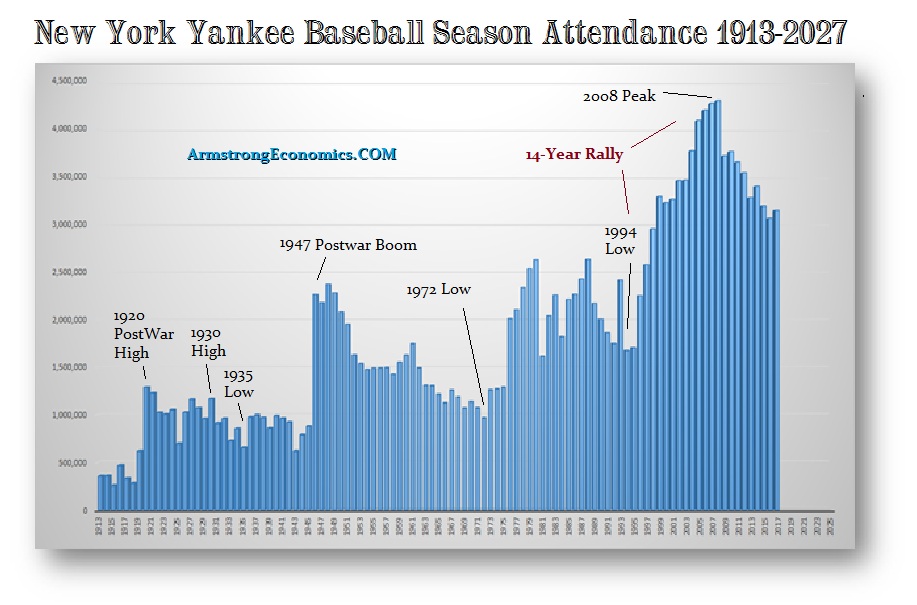

One of the primary reasons I would rank Livermore is the best trader is because he would take both sides of a market. By the end of the Panic of 1907, Jesse was worth at least $3 million and probably peaked at $100 million after the 1929 market crash. If we adjust this number for inflation, by 1932, Jesse was worth probably $1 billion in 2017 dollars. He subsequently lost that fortuned on the rally out of 1932. Livermore would add to positions as the market moved in his direction. Nevertheless, Livermore sometimes did not follow his own rules strictly. He claimed that his lack of adherence to his own rules was the main reason for his losses after making his 1907 and 1929 fortunes.

Jesse would lose money in the flat markets from 1908–1912. He was $1 million in debt and declared bankruptcy because of his poor trading, always looking for the big move. He proceeded to regain his fortune and repay his creditors during the World War I bull market after going into bankruptcy. Livermore owned a series of mansions around the world, each fully staffed with servants, a fleet of limousines, and a steel-hulled yacht for trips to Europe. He made money in bull markets and bear markets and lost in sideways markets.

Jesse appears to have misjudged the political change in 1932, and on March 7, 1934, Livermore was automatically suspended as a member of the Chicago Board of Trade. It was never disclosed to anyone what happened to the great fortune he had made in the crash of 1929. Many have debated that perhaps Livermore turned prematurely bullish and bought stocks and commodities long before the 1932 low. Other assume he failed to read the low. It is more likely that the Senate hearings into the short selling of the stock market weighed heavily on Jesse’s mind and he could no longer trade as he once used to.

So why did Jesse Livermore commit suicide? The most likely answer was the birth of the SEC. The sudden change in the atmosphere of trading would be fatal. Jesse Livermore had famously returned to the stock market twice before after going broke. However, the creation of the SEC contributed greatly to his loss of confidence and motivation that had been at the core of his character.

Nevertheless, on November 28, 1940, Jesse Livermore shot and killed himself in the cloakroom of the Sherry Netherland Hotel in Manhattan (lobby pictured above). The police revealed to the New York Tribune on November 30 that there was a suicide note of eight small handwritten pages in Livermore’s personal notebook. The police revealed a part of what it said:

Nevertheless, on November 28, 1940, Jesse Livermore shot and killed himself in the cloakroom of the Sherry Netherland Hotel in Manhattan (lobby pictured above). The police revealed to the New York Tribune on November 30 that there was a suicide note of eight small handwritten pages in Livermore’s personal notebook. The police revealed a part of what it said:

My dear Nina,

Can’t help it. Things have been bad with me. I am tired of fighting. Can’t carry on any longer. This is the only way out. I am unworthy of your love. I am a failure. I am truly sorry, but this is the only way out for me.

Love,

Laurie

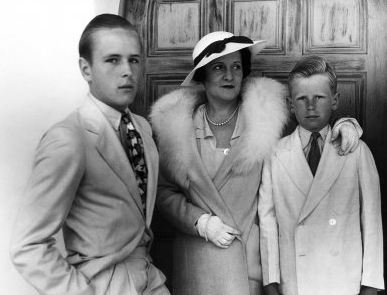

He left his family over $5 million in trusts. He is said to have suffered from depression in his final years. His oldest son, Paul, went on to become an actor