Armstrong Economics Blog/Conspiracy

Re-Posted from The Conservative Tree House May 6, 2018 by Martin Armstrong

COMMENT: I saw you in front of the Bank of England. Then within a matter of days, the pound crashes. You may not be a household name but you are in the circles that matter. So did you orchestrate the reverse trend in the pound?

OD

REPLY: No! The pound crashed simply because it was on schedule. My mere presence in London did not signal the end of the pound rally. I was there for some very important meetings with clients regarding other matters, not to help the Bank of England sell the pound. I do get rather tired of being blamed for everything. What you fail to grasp here is that there are very few of us with international experience. Local economists do not cut it and it seems that nobody else with hedge fund experience who has actually traded billions of dollars when a billion used to be a lot of money is around for consultation. They were trying to make another documentary about such things and nobody else was willing to appear because they feared to speak publicly about the fate of the Euro.

I get called because I tell the truth. I do not twist my view to what they want to hear just to get paid like some actor putting on a show. It is what it is. I have intimate knowledge of many aspects because when they were creating the Euro the commission in change all attended our WEC in London that year. I have been called into just about every crisis since the mid-1970s.

You cannot get in the door if you have ANY conflict of interest. I no longer manage money so there is no concern about insider trading that I will profit from the info from a closed-door meeting. It is as simple as that. I also sign confidentiality agreements to ensure that sensitive names and positions are not disclosed.

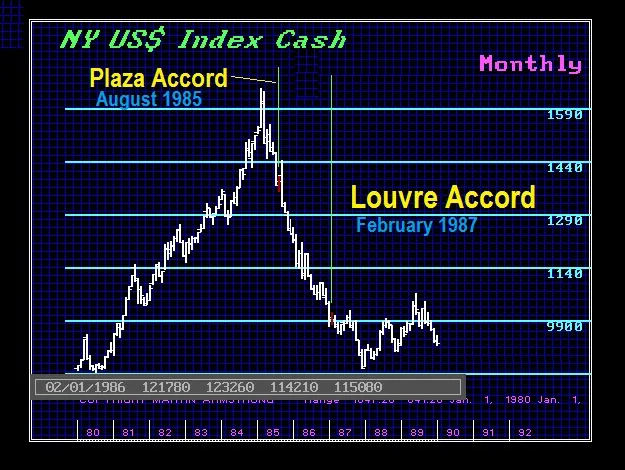

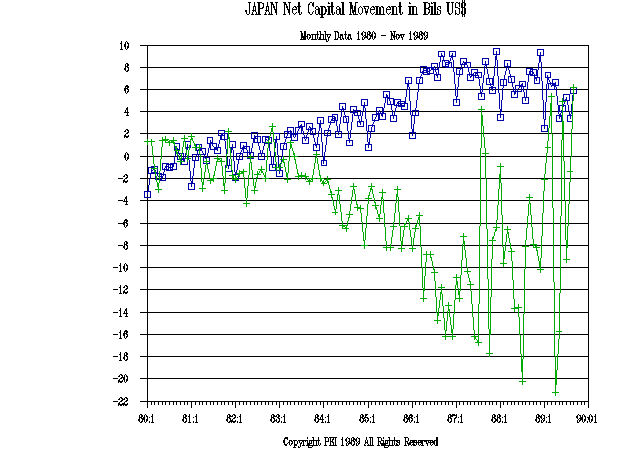

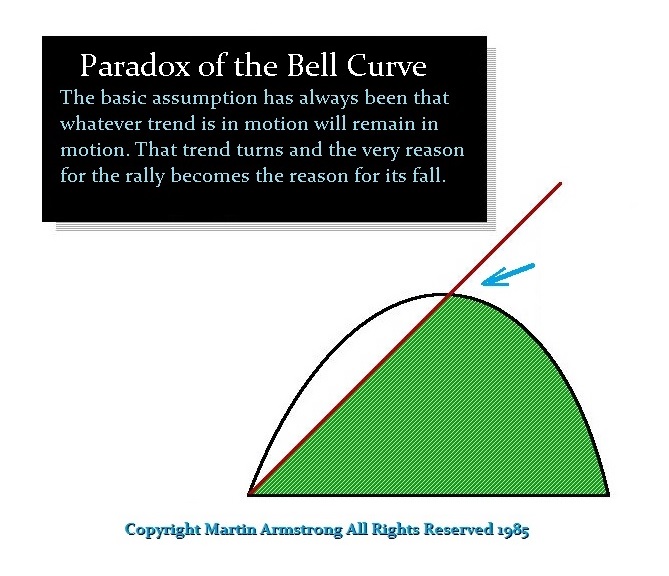

I did NOT meet with the Bank of England to orchestrate the shift in trend in the pound. The markets are bigger than me, and bigger than the Bank of England and ALL the central banks combined. Remember the Louvre Accord? That is when the central banks came out and tried to stop the decline in the dollar going into 1987. NEWS FLASH!!!! They failed! So, what happened? They called me again since I was the one warning them in 1985 they would unleash volatility.

Everyone knows my work. You cannot manipulate an individual market because we are all connected. Capital flows around the global financial system like a bottle on the ocean current.

I am called by governments and institutions, not for my OPINION, but because the computer is the only thing in the world that monitors the entire political-economic landscape and has a proven track record for almost 40 years.

You cannot manipulate any market beyond the normal channel of daily noise. You cannot make gold rise or fall if it is out of sync with the rest of the world. Those who keep poisoning the minds of people on that do so because their theories are wrong and have been since 1971