Armstrong Economics Blog/Interest Rates

Re-Posted Sep 30, 2019 by Martin Armstrong

QUESTION: Mr. Armstrong; When I first brought this topic up at our board meeting about the split in interest rates between private and public, there was skepticism because such a proposition had never taken place in the short-term memory of our perception of history. I explained your theory and the rest of the members listened only because it was you saying this. That skepticism has now vanished. It is painfully obvious that the events in repo market have proven your theory was correct that the real rate has risen and the Fed has been forced to intervene to try to prevent real rates from exploding. Is this what the future holds? The free market will undermine the central banks?

KH

ANSWER: I understand what I have warned about is not in any textbooks we were ever handed in school. During a liquidity crisis in which we have begun post-Labor Day, the shortage of money forces real rates to rise and that can be very dramatic. Don’t forget that it was the REPO market which brought down Lehman and Bear Stearns.

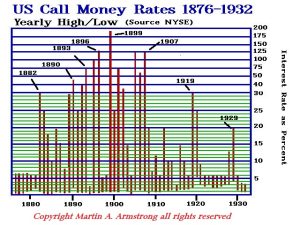

In 1899, there was a major liquidity crisis when call money rates soared touching 200%. The Federal Reserve did not exist at that time, but the Bank of England (BoE) did. There was a surge in stocks and the BoE feared speculation. Their discount interest rates were 3% in February 1899. They intervened and doubled the interest rate to 6% in November 1899. This set off a major panic. The British investors in America were forced to sell assets to take money home to meet the liquidity crisis created by the BoE. This created a global contagion and the US market plunged into a massive liquidity crisis as well as imported thanks to the BoE.

The USA had no central bank so the call money rates were a totally free market. The week of December 4th, 1899, saw the US share market collapse opening BELOW the previous week’s low and plunged 20% in just two weeks. On December 18th, 1899, the call money rate touched 200% in the midst of this liquidity crisis.

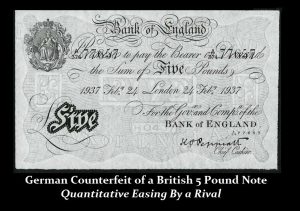

When I say we have put together the largest database on a global scale of the world economy, I am not kidding. I fully understand that nobody has ever heard of a split in the interest rates between public and private that can be at odds with one another. But in assembling all of this data and allowing the global correlations to unfold, we actually have a shot at understanding how the economy truly functions and where we are headed. All of the economic theories we were taught in school have FAILED!!!!! Quantitative Easing for more than 10 years has utterly failed to produce inflation despite the vast increase in the supply of money. That alone stands as a witness that Keynesian Economics does not work.

I have learned both from my clients around the world which taught me to view the world from their perspective based upon their currency. Socrates has taught me so much by showing me the correlations that no one else has ever dreamed of. This combination has resulted in a different perspective that I fully UNDERSTAND will often go against the established norms.

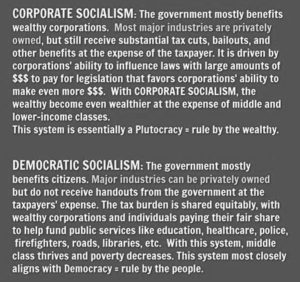

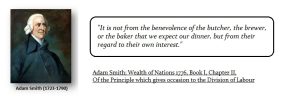

As for what lies ahead, the Free Markets will dictate the trend. The central banks have lost control of the world economy and they have become the source of the problem. They are trapped. As time passes, you will come to see the full force of the Free Markets. BTW – it was also the Free Markets which defeated Communism. They are doing the same with socialism.