Armstrong Economics Blog/Economics

Posted Aug 16, 2019 by Martin Armstrong

QUESTION: Mr Armstrong,

In this morning’s blog you stated that the Dems are trying to take control of the power in Chicago, which I assume is the plan for everywhere eventually. My question is; In your opinion is the fact they are being so blatant in their attack on our freedoms indicate that they are desperate or just arrogant and confident?

JN

ANSWER: Unfortunately, the answer is yes they are desperate, but arrogant and have convinced themselves the rest of the world is evil. This is socialism collapsing because they have promised everything but funded nothing. Instead of looking at the problem, they think all they have to do is solve next month’s rent and worry about what comes later, later.

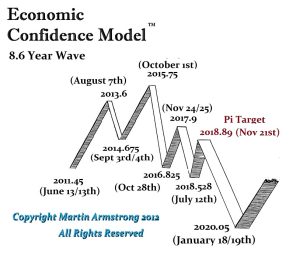

I know there are people who are extremely left and read this blog simply because they hate me and need something to rant about to others. But if we look just at the unfunded liabilities for pensions on a global scale, it will reach $400 trillion by the end of this cycle. There is certainly NO WAY this can be achieved if you confiscate absolutely every dime anyone has who earns more than $100,000 annually. We are in a total meltdown. They can rant all they want, but the math will catch up and their future will not exist. Their hatred of anyone who has more than them blinds them to their own demise.

I know they do not want to hear it and they just want their benefits at all costs. But this is how Empires, Nations, and City-States crumble to dust. I am sorry, but we cannot live in a financially fictional world. If we do not wake up soon, well, all I can say is thank God I am not 25. I feel like saying: “Please, Scotty beam me up!”