Armstrong Economics Blog/Banking Crisis

Re-Posted Oct 7, 2019 by Martin Armstrong

QUESTION: Dear Martin Armstrong,

In your blog post “Liquidity Crisis & the Pending European Banking Crisis” Posted Oct 2, 2019 ” you write

‘Those in Europe who have a position in cash, it may be better to have shares or a private sector bond or US Treasury. Given the policy in Europe of no bailouts, leaving cash sitting in your account could expose you to risk in the months ahead.”

I am in England/Uk and I am lucky to be in the position of trying to buy an ‘average priced’ house with cash, therefore, I have money spread across a few UK banks. Should a person like myself be worried? You are the only person out there who I trust to have an impartial assessment because of the amazing work you have done with your computer Socrates. With the highest regard and many thanks from a concerned UK citizen.

ANSWER: As far as bank bailouts are concerned — no, they are separate as they will fall under separate central banks. However, prior to the crisis, structured trades were signed separately using negotiated ISDAs. Once they started trading through an exchange, it was London that won that mantle. So today, most derivatives are cleared in London and that is where the problem could ultimately lie.

In February, the BOE and the EU announced that European counterparties could trade in London and that ESMA (European Securities and Markets Authority) would immediately recognize the three London clearers (LCH, LME, and ICE). This is where London really lost its chance of separating itself from the mess. Because of this action, the market has maintained trade, but at what cost?

There is a huge gap between the board of directors of banks and those who are actually trading. Consequently, even the big banks are clueless with respect to the hidden risks in the financial markets because of the interference of politicians.

There is a huge gap between the board of directors of banks and those who are actually trading. Consequently, even the big banks are clueless with respect to the hidden risks in the financial markets because of the interference of politicians.

The banks are not aware of the problem because their management are not traders. It was this action that relieves the bank’s board or clearers from running the risk that they run. Very few people will see this risk coming as ‘no-one’ looks at the amount of money that is proportioned to clearinghouses. The burden is expected to be borne by the clearers, but what happens if half the clearers all go at the same time?

The REPO market is where 2008 began. However, very few people even on a trading floor will see that as a risk and definitely no one on the board! It will not be until the NIM (Net Interest Margin) starts to underperform that questions will be asked at the board level. And as we know, by that time it is way too late.

Some do not understand why we even get called in because there is the presumption that bankers know what is going on. That is so far from the truth. Congress will call heads of banks to explain and testify, but they are only relaying what they have been told by others.

The trading desks in banks have to sell trades to management using fundamental explanations. It is akin to trying to explain a trade to freshman students in high school with no experience. There is just a major gap between the levels even within major banks.

One of the top 10 banks was having an international internal meeting about the problems in markets. Two offices insisted we be there to address the meeting. They paid our fees and everything, but at the last minute the senior board said no, they did not want to air the problems in front of an outside firm. That’s what I mean when I say we never get called in to avoid a crisis, only when the crisis hits. Then the trading side of the banks wants us to come in because then they hope the boards will listen to us rather than them who they want to blame for everything.

The Coming European Crisis

Armstrong Economics Blog/European Union

Re-Posted Oct 6, 2019 by Martin Armstrong

QUESTION: Hi Martin,

first of all thank you for being alive and bring your knowledge to the world. I am also worried for when you will not be here, wondering if there is or will be anyone like you there?

I have a question as I am worried about my parents. They live in Europe, Spain, and they do not have much economic knowledge. They somehow trust in what the bank says, and for now they have their money on a fund which of course is giving almost nothing or even losing. What would you recommend to this kind of people if they just want to leave the money in a place without worrying too much, have better returns than a bank and have money available any time? Would you also recommend a private (non standard bank related) passive fund?

I am worried for the coming system crash as we are in difficult times and there is no “easy investment” by the looks of it. I hope to provide an educate answer to them and try to convince them to not to trust banks.

I guess this is the situation for a lot of people in the 70s, 80s in Europe. Last years most of them has lost a lot of money because of the bad advice from the banks whom they used (and somehow still but they are seing a bit the reality) to trust.

Thank you in advance.

JS

ANSWER: The real liquidity crisis hit in Europe. When the 2008-2009 crisis hit, the US bailed out the banks by taking the bad assets off their books. In Europe, they would not do that because it would mean money might flow from the north to the south to bail out banks the north had no respect for. Instead, they left the European banks with all the toxic losses and cut rates to negative, hoping the banks would make money on their own to cover their losses. That never happened. So Europe has been unable to recover all because of that policy which refused to consolidate the debts.

I do not like to recommend private funds that would impose a duty on me to constantly monitor them. I don’t have the time for that, and I do not charge for what I do so it would require ongoing resources and that would mandate a fee.

I also do not sell advertising on here because someone might think I am endorsing a particular investment just by allowing them to advertise. So I am careful about this sort of thing and understand that people respect me for my independence. I like to keep it that way. I even had a first-time attendee to one of our conferences remark I didn’t try to sell him anything. If I am trying to sell somebody something, then you do free seminars to get as many people to attend to listen to the sales pitch. Sorry, I am not selling investments.

All of that said, the best I can do is to say move the bulk of the money out of Europe to a major name money market fund investing in AAA short-term paper in the USA exclusively. This would be the best thing to do probably into 2021 before we would need to review the trend. Stay liquid. The politics in Europe will prevent any bailout. This will only lead to more discontent in Europe and put greater pressure on the separatist movements.

European Bank Failure & Conflicts in Law in US Branches

Armstrong Economics Blog/Banking Crisis

Re-Posted Oct 4, 2019 by Martin Armstrong

QUESTION: Hi Marty –

Thank you for the insight you provide as regards how the world really works. Spending 10 minutes reading your daily blog is equivalent to hours of reading the MSM propaganda and trying to discern the truth.

My question to you is in response to your 10/2/19 post >> Liquidity Crisis & the Pending European Banking Crisis. My mortgage is held by Santander bank, which I believe is headquartered in Spain despite being incorporated in Delaware. What can happen to my mortgage when the crisis is fully apparent to the world? I have minimal money in a savings account at Santander to meet their deposit requirements for a lower interest rate.

Would you re-finance to another US bank or credit union? Would you cash out some retirement savings to pay it off? I have a fair amount of money in retirement, but removing money with taxes and penalties would hurt and it would definitely put a dent in savings, which by the way is all held in mutual funds in US stocks only.

Thank you for your attention.

– STM

ANSWER: If you have a mortgage, as long as you are current, a bank failure will not impact your mortgage in the United States. Typically, assets of that nature are sold off to other banks. However, even a European bank operating in the USA is actually a different entity from Europe. They are under the regulation of the Federal Reserve and must be a member of FDIC.

Even if the parent went down in Europe, the US division would be subject to US rules and there would be considerable conflicts in law that would emerge. The US division would most likely have to be sold to another bank and the Fed may not allow a bail-in on US soil. The more likely scenario would be a shotgun wedding.

Staying Liquid May Be the Best Bet

Armstrong Economics Blog/Real Estate

Re-Posted Oct 3, 2019 by Martin Armstrong

QUESTION: Dear Mr. Armstrong.

I hope that you will please give me some advice on the following topics. Sorry for the grammar.

I live in Denmark and have been saving up some money that I want to invest. My options are:

– buying a house and rent it out (I have 1/5 in cash and need to lend the rest as fixed mortages) or buying stocks for the money or simple wait and saving up more money and then buy stocks or a house in 1-2 years when things fall apart in Europe? What would you suggest?

I already have some money invested in stocks (only Danish stocks). Is it better to sell out now (in 1-2 years) or hold on to them through the next crisis?

And how about in the long term (when war breaks out in 2024-2027) is it better to buy something else or save the money so I can quickly migrate to another place on Earth (with cash?)

Regards J

ANSWER: I believe the best thing is to remain liquid, and equities tend to be the better road rather than investment property which is not movable. You can open an account in the USA or even Singapore or Thailand. In that way, you can always move your money offshore as Europe become more aggressive in their hunt for taxes.

The next several years are not like the ’50s or even the ’80s. They are going to be much more choppy and volatile. So this is something you will have to keep an eye on for the trends will tend to swing every 2 to 3 years.

We all need a place to live. So what I am talking about is investment properties. They will be highly dependent upon banks willing to lend mortgages. As the banking sector get hit, you will find that the liquidity in real estate will dry up very rapidly.

Liquidity Crisis & the Pending European Banking Crisis

Armstrong Economics Blog/Banking Crisis

Posted Oct 2, 2019 by Martin Armstrong

A lot of people have been writing in about the liquidity crisis and the banks with exposure to Deutsche Bank. This is clearly the European Banking Crisis we have been warning about. Most European (and Swiss) banks are having to overpay 30-40bps over libor. Even A+ rated banks are having to pay this premium.

Keep in mind that the Lehman and Bear crisis took place in the REPO market. This is why the crisis is appearing in a market most never hear about or see in interest rates. Those in Europe who have a position in cash, it may be better to have shares or a private sector bond or US Treasury. Given the policy in Europe of no bailouts, leaving cash sitting in your account could expose you to risk in the months ahead.

In all honesty, if this explodes in Europe, no-one will be safe and it will be pot-luck who’s cash you will be holding when it hits the fan. The Fed will bailout the US banks, but it cannot get involved in bailing out the European banks. This is becoming a clash in public policy which all stems from the FAILUREto have consolidated the debts. That refusal to consolidate, the terms demanded by Germany, also precludes bailouts where the money would cross borders. They want to pretend this is one happy family, but they insist on separate accounts.

As one European banker put it in a private conversation, it is almost a calm collapse. As I have REPEATEDLY warned, we are facing scenarios that nobody has ever seen before. The interconnectivity runs so deep, this clash in public policies can result in a serious crisis emanating from Europe.

Despite all the negativity against Trump in the domestic press, they remain oblivious to the global trend. There are some urgent measures which need to be taken and fast. But the politics in Europe make it extremely difficult to do the right thing. If there is truly a will to address the critical issues at the core of this crisis, we have a team ready to provide guidance. As for our central banking clients outside of Europe, please monitor our services on Socrates.

Well, this is going to be a VERY VERY VERY Interesting WEC this year.

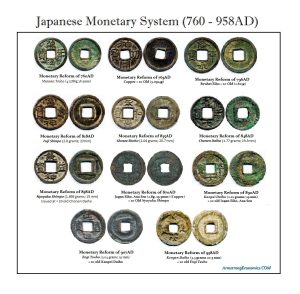

Japan’s Monetary System is a Warning to Modern Society

Armstrong Economics Blog/Japan

Re-Posted Oct 1, 2019 by Martin Armstrong

QUESTION: Mr. Armstrong; My friend who retired from the Bank of Japan told me you had recreated the monetary system of Japan and that was how you could predict the yen would go below par back in 1995 and again in 2011. Could you please publish the chart on the yen showing the full monetary system from the Meiji reform?

Thank you

AH

ANSWER: Japan has been through a truly wild ride when it comes to currency. The emperors would devalue the outstanding money supply when they came to the throne and reduce it to 10% of its former value. This allowed the new emperor to issue coins as if he were beginning anew. By the time the third emperor pulled this stunt, the people simply refused to accept the coins of the emperor ever again.

The Japanese resorted to using bags of rice as money and Chinese coins. Eventually, they also used ingots of silver or gold for larger transactions by the 18th to 19th century.

This is actually a very good reference point because Japan lost the ability to issue money for 600 years until the Meiji reform in 1870 when the yen was born. The last official Japanese coin issue was in 958 AD.

The Meiji Reform of 1870 set the yen at par with the US dollar based upon a silver yen which was the equivalent of the US silver dollar.

This is an important point because as governments today try to eliminate their currency in the hunt for taxes, people are hoarding US dollars exactly as the Japanese began to hoard Chinese coins. Governments should look well at what they are proposing for they can lose the confidence of the people and they will lose the right to issue money. They only way to prevent hoarding requires a universal abandonment of all currencies and their replacement with a single electronic one-world currency. But that system will fail like the Euro for a single currency imports and exports the inflation or deflation from the core economy. Not all nations are on the same side of the business cycle

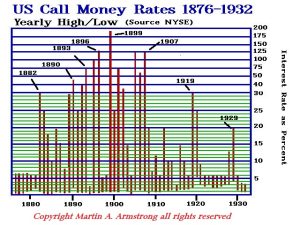

Split Between Official & Real Interest Rates

Armstrong Economics Blog/Interest Rates

Re-Posted Sep 30, 2019 by Martin Armstrong

QUESTION: Mr. Armstrong; When I first brought this topic up at our board meeting about the split in interest rates between private and public, there was skepticism because such a proposition had never taken place in the short-term memory of our perception of history. I explained your theory and the rest of the members listened only because it was you saying this. That skepticism has now vanished. It is painfully obvious that the events in repo market have proven your theory was correct that the real rate has risen and the Fed has been forced to intervene to try to prevent real rates from exploding. Is this what the future holds? The free market will undermine the central banks?

KH

ANSWER: I understand what I have warned about is not in any textbooks we were ever handed in school. During a liquidity crisis in which we have begun post-Labor Day, the shortage of money forces real rates to rise and that can be very dramatic. Don’t forget that it was the REPO market which brought down Lehman and Bear Stearns.

In 1899, there was a major liquidity crisis when call money rates soared touching 200%. The Federal Reserve did not exist at that time, but the Bank of England (BoE) did. There was a surge in stocks and the BoE feared speculation. Their discount interest rates were 3% in February 1899. They intervened and doubled the interest rate to 6% in November 1899. This set off a major panic. The British investors in America were forced to sell assets to take money home to meet the liquidity crisis created by the BoE. This created a global contagion and the US market plunged into a massive liquidity crisis as well as imported thanks to the BoE.

The USA had no central bank so the call money rates were a totally free market. The week of December 4th, 1899, saw the US share market collapse opening BELOW the previous week’s low and plunged 20% in just two weeks. On December 18th, 1899, the call money rate touched 200% in the midst of this liquidity crisis.

When I say we have put together the largest database on a global scale of the world economy, I am not kidding. I fully understand that nobody has ever heard of a split in the interest rates between public and private that can be at odds with one another. But in assembling all of this data and allowing the global correlations to unfold, we actually have a shot at understanding how the economy truly functions and where we are headed. All of the economic theories we were taught in school have FAILED!!!!! Quantitative Easing for more than 10 years has utterly failed to produce inflation despite the vast increase in the supply of money. That alone stands as a witness that Keynesian Economics does not work.

I have learned both from my clients around the world which taught me to view the world from their perspective based upon their currency. Socrates has taught me so much by showing me the correlations that no one else has ever dreamed of. This combination has resulted in a different perspective that I fully UNDERSTAND will often go against the established norms.

As for what lies ahead, the Free Markets will dictate the trend. The central banks have lost control of the world economy and they have become the source of the problem. They are trapped. As time passes, you will come to see the full force of the Free Markets. BTW – it was also the Free Markets which defeated Communism. They are doing the same with socialism.

Was the Labour Government the Cause of The British Pound Losing Reserve Currency Status?

Armstrong Economics Blog/BRITAIN

Re-Posted Sep 30, 2019 by Martin Armstrong

QUESTION: Mr. Armstrong, I have a question: First you remarked that capital is terrified if Labour takes Parliament. I believe Labour won Parliament the first time in the twenties. Did that set off the sterling crisis of the thirties? It seems as though nobody really wanted to record the history of the Sovereign Debt Crisis of 1931. I think you are right. It would have undermined the rising socialism of the era. Was there a link between Labour and the fall of the pound as the reserve currency back then?

Thanks

WK

ANSWER: There is no question that if Jeremy Corbyn became Prime Minister, that would lead to the pound falling below par. In the aftermath of World War I, the US dollar’s growing dominance began to reduce sterling’s importance as a reserve currency. There was a massive run on sterling thanks to the win of the first Labour government taking office on January 22, 1924. They held it only between January 22 and November 4, 1924. The socialism which was engulfing Britain led to rising union strikes and militancy which really began in 1925 in the coal industry and then in 1926 a six-month coal strike began and a general strike which only accelerated unemployment. These events undermined the British Economy as there was no way the pound sterling would possibly remain as a reserve currency after Labor retook control between June 5, 1929 and June 7, 1935.

This is why capital is sacred to death if Labour took hold of Parliament under Corbyn for he is even more extreme than anyone ever was in Labour historically. The economic slide under the Labour government culminated in a massive run on sterling in 1931 and capital was pouring out to the United States. The Gold Standard broke down globally between 1930-1933 as Europe was clearly turning more socialistic at the time. The pound remained floating until 1939 and the outbreak of World War II.

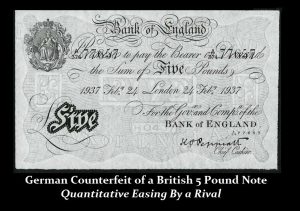

World War II saw The Nazi strategy of forging British currency in an effort to undermine their effort to fund their defense. The Nazi government was counterfeiting British notes in massive quantities. By 1943 the Germans were producing 500,000 banknotes a month. Fake pound notes were causing major headaches for the Bank of England. To counter the fraud, the Bank introduced at that time a metal thread during the war to differentiate its issue from Germany’s, and they stopped producing higher denomination notes

Australia Cashless Society

Armstrong Economics Blog/Corruption

Re-Posted Sep 27, 2019 by Martin Armstrong

Playing with the Facts to Fool the Majority

Armstrong Economics Blog/Corruption

Re-Posted Sep 27, 2019 by Martin Armstrong

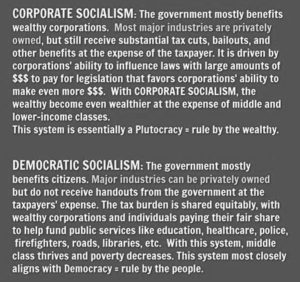

QUESTION: What do you say about the difference between corporate socialism and democratic socialism. Thank you. Its all the buzz among those supporting Senator Elizabeth Warren.

LP

ANSWER: This is a very clever way of excusing the core issue. The Democrats preach raising taxes and then sell loopholes to the big corporations. The bankers donated to Hillary — not to Trump. This is a clever campaign assuming, as always, the people (the great unwashed) are just stupid.

The Democrats were against the flat tax because it would eliminate lobbying for tax loopholes. But more importantly, if we had TERM LIMITS and one-time-and-gone, that would eliminate lobbying for dangle money before politicians of BOTH parties for favored status.

Even a tax break to a corporation that they claim is evil will NEVER result in lowering the taxes for everyone else. It is great propaganda. We run trillion-dollar deficits. They could NEVER raise taxes enough to balance the budget. That would destroy all their jobs.

The people who believe this nonsense will NEVER listen to the truth because they are the very type of people who believe only what they want to believe. That is a sad statement of fact. Just look at the presidential elections and you will see only 3 presidents ever had between 60% and 63% of the popular vote. Obama won 51.1% of the popular vote compared to Romney’s 47.2%.

That is hardly a mandate. They know that 45% of the people will vote Democrat no matter what you say and 45% will vote Republican. At best, there is perhaps 10% of the people who are free thinkers and will actually listen and make a judgment. The rest do not count for they will never listen to reason on either side.

We can eliminate corruption with TERM LIMITS. A flat tax should be imposed for it is unjust and a denial of equal protection of the law to discriminate for any reason including wealth. Then, corporations should not be taxed and there should be no double taxation with dividends. The majority of corporations are owned by pensions of the people and whatever is made should simply devolve down to a flat income tax on the shareholders. Corporations provide the jobs that actually produce, while the government does not. I believe there should be no income tax. Societies did well without income taxes until 1913. Rome lasted 1,000 years without income taxes. The founding fathers knew that and prohibited direct taxation for it requires every individual to report to the government, which is wrong. Taxes should be returned to ONLY indirect. I think the founding fathers knew best.