Armstrong Economics Blog/Training Tools

Re-Posted Jun 5, 2018 by Martin Armstrong

QUESTION: Hi Martin

Was curious if you could address what Socrates has popped up on the last report….of a “Knee Jerk Low” this quarter. Is this a possibility that we should be on guard for?

A very thankful follower of your work!!

C

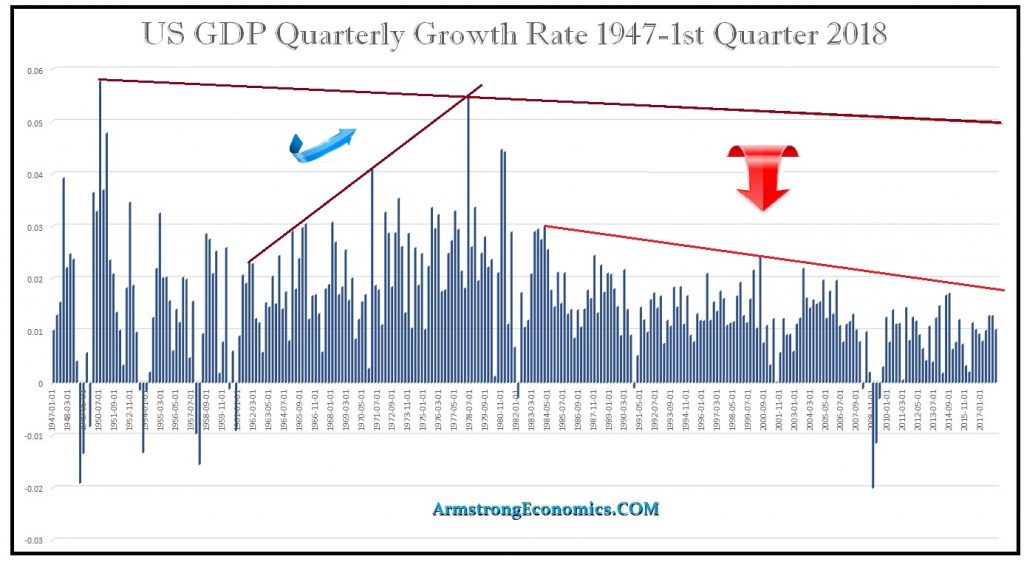

ANSWER: The terminology I have developed is unique and it comes from actually studying market behavior. I have explained that a “reaction” is limited to the time period of three or less be it a day, week, month, quarter, or year. Move beyond 3 years and you are changing trend. Keep in mind that when we are dealing with the higher level such as yearly, the percentage movement can be dramatic. But also the more dramatic the higher the probability that it will remain as a reaction. For example, the Dow Jones Industrial Index peaked in September 1929 at 386.10 and crashed going into July 1932 bottom at 40.56. That still qualified as a “reaction” being 3 years compared to the Nikkei which crashed but progressively moved lower into a bear market trend that bottomed in 19 years falling from 38957.44 to 6994.90.

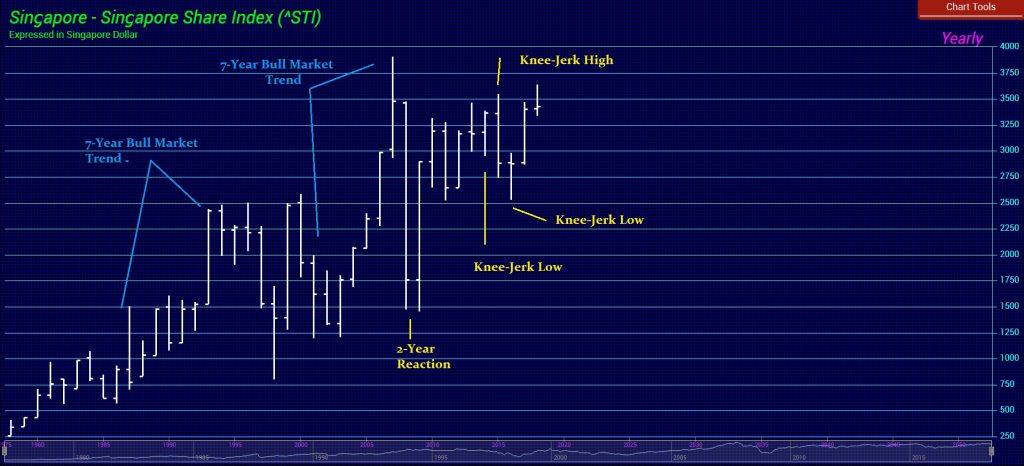

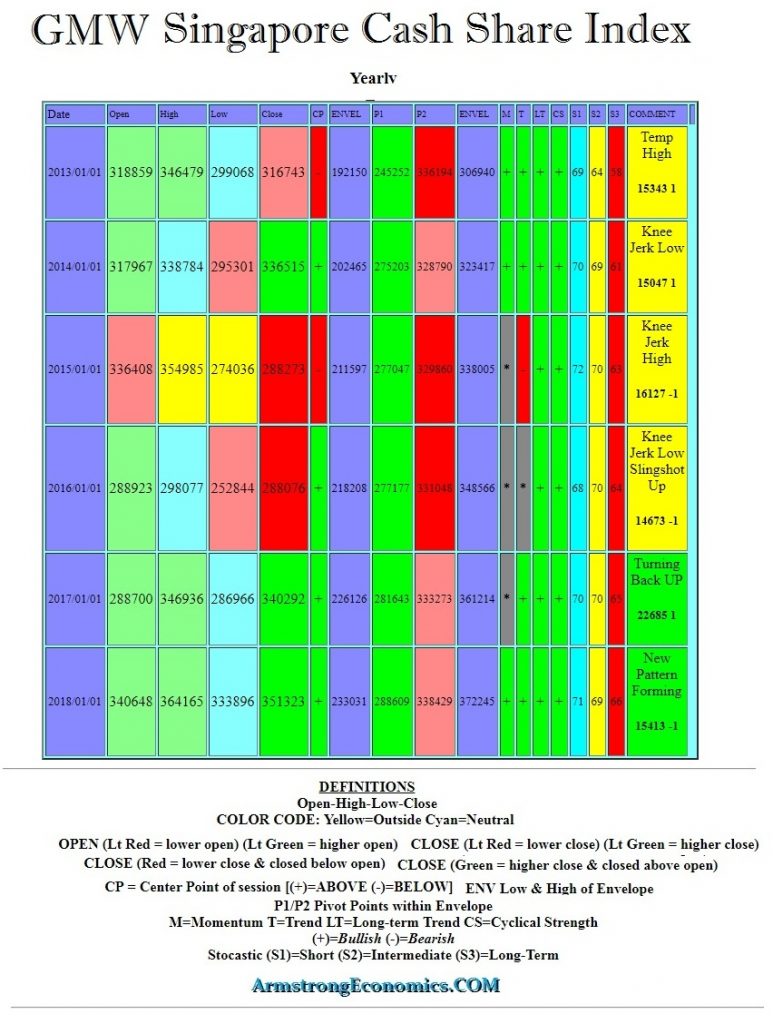

The Knee-Jerk events can be highs or lows but are confined to one unit of time. They refect choppy markets. Here is Singapore share index. Note that there were three back-to-back Knee-Jerk events. This is what the Global Market Watch is forecasting. Not necessarily a change in trend, just a choppy move normally in the opposite direction.