I wonder if you would care in a future blogpost to cast some light on the following?

The sole ‘legal tender money’ in the final analysis is the FRN (Federal Reserve Note — coins aside) collateralized by the Fed’s assets.All other ‘money’ is private bank credit money or suchlike,including Money Market Funds and other said-to-be money-like instruments.Despite the aspersions that surround Fiat money it is in toto a small number — around $1.6 bn. However there are promises to pay in FRN on demand.

Does that last fact account for the talk about banning cash ( ie the FRN) ?

Like the promise to pay in Gold it seems impossible to pay in the FRN were that ever to be demanded in size. De Gaulle ended the gold-on -demand offer so could something similar could happen to the FRN ? Back then Gold rose against all assets — ditto the FRN ?

I hope you are reading this in some comfortable place, given the atrocious weather in Florida.

Best Rgrds

Bill

ANSWER: Most money is actually created by the private sector through leverage and bank loans today. This is why when there is a crash, the contraction takes down banks for it is the leverage that collapses. When you have a debt based system, then the monetary system becomes leveraged. With the fall of Rome, the Catholic Church adopted the Sin of Usury thanks to Saint Thomas Aquinas and his 20 volume work, Summa Theologica.

There has never been actual tangible money issued by any government that was worth strictly its metal content. It was always valued greater than its intrinsic value. Even the first coins issued by any government took place in Lydia, located in modern Turkey. They used gold simply because that was the private medium of exchange. The first step was simply to create a standardized weight for in the Bible they talked about weighing the silver to make payment. When the king began to stamp his seal on money, fiat began. People used metal and wheat as a medium of exchange. The legal code of Hammurabi specified prices in wheat and silver. The king attempted to regulate the economy, but he did not borrow money nor did he issue coins.

There has never been actual tangible money issued by any government that was worth strictly its metal content. It was always valued greater than its intrinsic value. Even the first coins issued by any government took place in Lydia, located in modern Turkey. They used gold simply because that was the private medium of exchange. The first step was simply to create a standardized weight for in the Bible they talked about weighing the silver to make payment. When the king began to stamp his seal on money, fiat began. People used metal and wheat as a medium of exchange. The legal code of Hammurabi specified prices in wheat and silver. The king attempted to regulate the economy, but he did not borrow money nor did he issue coins.

The definition of fiat as stated in Merriam-Webster dictionary reads:

Definition of fiat

-

1: a command or act of will that creates something without or as if without further effort According to the Bible, the world was created by fiat.

-

2: an authoritative determination : dictate a fiat of conscience

-

3: an authoritative or arbitrary order : decree government by fiat

Fiat is anything dictated by government. It need not be limited to paper money. Historically, even gold and silver became fiat once government decreed its value. Above, we can see the coinage of Lydia was reduced in weight to expand the money supply to pay for war. This was fiat – the government dictating the value of money.

Therefore, these scenarios about fiat money are so grossly exaggerated. All money is fiat when issued by a government. Even gold coins were fiat since the value was set by government and there was also a profit to coin money. Rome funded itself about 80% by owning the silver and gold mines and they took the metal, coined it, and paid their bills. So even that was fiat since they declare its value. CONFIDENCE in the government of Rome was first shaken by Maximinus and his declaring that all wealth belonged to the state. Then the final straw came in 260 when the Emperor Valerian was captured by the Persians. Suddenly, Rome was vulnerable and then see the collapse in the currency.

As far as legal tender is concerned, that means it is acceptable by government to pay taxes and fines. What good is it that all your money is in BitCoin and you have to pay taxes when the government does not accept it?

This entire argument about fiat and money should retain a store of value is nonsense. That has just NEVER been the case historically. We live in a business cycle with booms and busts. To argue that money should be constant is Marxism. You cannot have it both ways where your house gains in value yet money itself remains constant. How is such a relationship even possible? They are mutually exclusive of one another.

The entire system rests solely upon CONFIDENCE. You would only accept a gold coin in payment solely because you know someone else will accept it from you. With that degree of CONFIDENCE, nothing would be acceptable.

The only thing that will retain a barter value at all times has historically been food because you need it to live.

This is why I say that the Monetary Crisis Cycle comes into play when we have a collapse in public CONFIDENCE. It really has nothing to do with the quantity of money. We have witnessed massive increases in money supply by Quantitative Easing without an uptick in inflation. People have hoarded money – not spent it. When they shift their CONFIDENCE from government to the private sector, then they will see to spend their government money and move toward tangible assets. Many have been doing that with real estate.

Therefore, the leverage creates the real money supply. The physical supply of cash is tiny. The government is trying to reduce that even more to gain taxes. Bankers are in favor of eliminating cash for it would also prevent bank runs in the traditional sense.

ANSWER: Curious. I know that in Germany they do not really teach the details of the rise of Hitler. But he was the ultimate reaction to the events of the 1920s. There is a good book on the subject, but it is in German –

ANSWER: Curious. I know that in Germany they do not really teach the details of the rise of Hitler. But he was the ultimate reaction to the events of the 1920s. There is a good book on the subject, but it is in German –

There has never been actual tangible money issued by any government that was worth strictly its metal content. It was always valued greater than its intrinsic value. Even the first coins issued by any government took place in Lydia, located in modern Turkey. They used gold simply because that was the private medium of exchange. The first step was simply to create a standardized weight for in the Bible they talked about weighing the silver to make payment. When the king began to stamp his seal on money, fiat began. People used metal and wheat as a medium of exchange. The

There has never been actual tangible money issued by any government that was worth strictly its metal content. It was always valued greater than its intrinsic value. Even the first coins issued by any government took place in Lydia, located in modern Turkey. They used gold simply because that was the private medium of exchange. The first step was simply to create a standardized weight for in the Bible they talked about weighing the silver to make payment. When the king began to stamp his seal on money, fiat began. People used metal and wheat as a medium of exchange. The

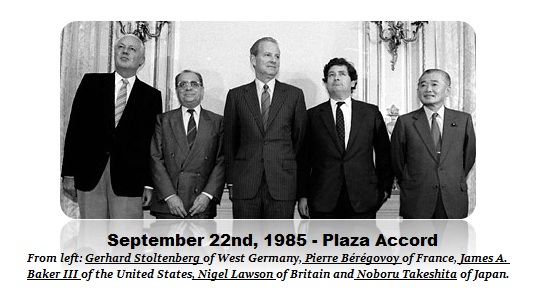

In general, Europeans are still trapped in World War II thinking that a stronger currency means economic boom. When all the currencies were wiped out by the war, politicians used the currency value in Europe as a reason to prove they were doing a good job. So the historical bias in Europe has been dominated by the perspective. The USA was a third world country during the 19th century. It was the “emerging market” for European investors. It was virtually bankrupt in 1896 and it was World War I and II that raised the USA to the richest country in the world by 1950 holding 76% of the total world gold reserves. That was accomplished not by Marxism, political economic manipulation, or anything any politician enacted. It was create SOLELY and EXCLUSIVELY by capital inflows because of Europe running around destroying itself.

In general, Europeans are still trapped in World War II thinking that a stronger currency means economic boom. When all the currencies were wiped out by the war, politicians used the currency value in Europe as a reason to prove they were doing a good job. So the historical bias in Europe has been dominated by the perspective. The USA was a third world country during the 19th century. It was the “emerging market” for European investors. It was virtually bankrupt in 1896 and it was World War I and II that raised the USA to the richest country in the world by 1950 holding 76% of the total world gold reserves. That was accomplished not by Marxism, political economic manipulation, or anything any politician enacted. It was create SOLELY and EXCLUSIVELY by capital inflows because of Europe running around destroying itself.