Armstrong Economics Blog/ECM

Re-Posted Mar 10, 2018 by Martin Armstrong

QUESTION: Dear Mr. Armstrong,

QUESTION: Dear Mr. Armstrong,

QUESTION: Martin. Have you read the book Creature of Jekyll Island by Edward Griffin it is about the Feds and how they control? Many years ago I thought it was fiction but after reading it again it is true. My Question what can we do money will be what they want it to be the control?

ST

ANSWER: The book you refer to is propaganda. There are quotes in there that he simply made up about the Rothschilds. Go ahead and try and find the source. I have written about this before. That book is highly dangerous for it completely misrepresents and fails to understand that elastic money began in the 1850s and was created privately by clearing houses. It worked perfectly fine and it was not economically disastrous but BENEFICIAL!

The ability to create money by the Federal Reserve is essential. However, that design was directly beneficial for it would buy ONLY short-term corporate paper in a crisis when banks could not lend. Buying in corporate paper saved jobs. The key was a simple fact it was corporate and NOT the government. Corporates have to pay back – the government does not.

It was not that the Fed was evil, it was that the Fed was usurped by Congress during World War I and directed to buy only the paper of the government. It was that aspect that has altered the role of the central bank and is demonstrated who the ECB in Europe now own 40% of all government debt and they cannot stop without creating a crisis.

The Creature of Jekyll Island advocates what Jackson did, and that will lead to a massive Sovereign Debt Crisis among the States and undermined the entire economy both domestically as well as internationally. That is by no means the answer. The answer lies in the curtailment of politicians. The banks owned the Fed BECAUSE it was a bailout system that they paid into. It was never intended that taxpayer money would be used to bail out banks. Once the banks became the seller of government debt, they then had a grip on government and with the Fed only buying government debt, the entire system is nothing like the intended design.

QUESTION: Mr. Armstrong; Has interbank lending collapse due to a lack of confidence concerning counter-party risk?

Thank you for being a rare source with experience

ER

ANSWER: Yes that is a correct statement. The failure of Lehman and Bear Sterns was the result of interbank lending when they could not make good on the collateral they posted the day before in the REPO market. Then we had the collapse of MF Global, which was also a loss linked to the overnight markets. Now mix in the LIBOR scandal and banks were scrutinized for manipulating LIBOR rates in the interbank market.

The interbank lending market is a market in which banks extend loans to one another for a specified term, typically 24 hrs. Most interbank loans are for maturities of one week or less, the majority being overnight. Such loans are made at the interbank rate (also called the overnight rate if the term of the loan is overnight).

The collapse of this market is a clear warning that liquidity is extremely vulnerable. When crisis strikes, liquidity will simply vanish entirely. This warns that volatility will rise sharply and it appears to be predominantly focused in on the debt market.

CNN Money is reporting the headline “A top JPMorgan Chase executive is warning that stocks could fall as much as 40% in the next few years.” CNN reports that Daniel Pinto, JPMorgan’s co-president, said on Bloomberg Television he believed that market gains should continue for the next year or two. However, he added that investors were nervous could result in a “deep correction” of between 20% and 40%, “depending upon the market values at the time the downturn starts.”

Indeed, this was the pause we were looking for from January. We did not see a collapse as in terms of 1987. Instead, this is simply the transition period where the marketplace must come to grips with a Sovereign Debt Crisis and that means rising interest rates will devastate the bond bubble. So exactly how does that equate to a 40% decline in equities?

What is clear is that the initial stages of this consolidation period involved the marketplace coming to grips with the shift from PUBLIC to the PRIVATE rationale. In other words, inflation, rising interest rates, the rapid rise in interest rates, explosion in public debt, and the inability of governments to fund their never-ending deficit spending at the federal, state, and local levels. Then as the economy begins to worsen, this will also historically lead to trade wars.

This is good news. We need the majority of analysts to turn bearish in order to restore the upward bias we have enjoyed for the past 8 years. We can see that our Energy Models are not in a position for a major high. They have been rising, not declining as new highs were made. This strongly suggests we will still see higher highs in the years ahead. The more analysts we get back to bearish, the strong the breakout to the upside later on.

The Latvian Financial Supervisory Authority is concerned announcing a resolution plan for the crisis bank ABLV that is threatening a contagion risk of further closures of financial institutions in the country with a predominantly foreign customer base. There is a serious risk of a contagion unfolding that will also force consolidation and mergers in the industry as a whole. The financial system of the Baltic country has seen a run with customers withdrawing about 500 million euros in deposits in recent weeks. There are about ten banks in Latvia who have been serving primarily foreign customers. Concerns and a decline in confidence unfolding in Europe as a whole over the banking system as a whole may force a change in the business model of Latvian banks where they must return to a reliance upon domestic deposits rather than foreign.

Latvia’s third largest financial institution, ABLV, is about to collapse after being accused by the US of being involved in money laundering by customers from neighboring Russia and Ukraine. The bank denied the allegations but simply making those allegations by New York prosecutors can have a devastating impact upon foreign banks. A run on the bank began after the allegations were made public. The European Central Bank (ECB) came to the conclusion that the bank was facing collapse. The European Agency for the Settlement of Marged Banks (SRB) classified the bank as non-systemically important and left it to its fate. In Latvia, loans are provided mainly by Scandinavian banks located in Sweden. Many Latvian banks have specialized in financing themselves mainly through deposits of foreigners rather than domestic Latvian citizens. The crisis brewing stems from the fact that about 40% of Latvian bank deposits come from abroad. Allegations of money laundering by the US authorities have been sending foreign depositors into a state of panic.

The risk that this presents is self-evident from the Banking Crisis of 1931. The failure of Credit Anstalt, which was partly owned by the Rothschilds, sent a wave of panic throughout the entire banking system. Once the rumor was that the Rothschilds had failed, all banks began to get hit. This resulted in the Sovereign Default of 1931.

The risk that this presents is self-evident from the Banking Crisis of 1931. The failure of Credit Anstalt, which was partly owned by the Rothschilds, sent a wave of panic throughout the entire banking system. Once the rumor was that the Rothschilds had failed, all banks began to get hit. This resulted in the Sovereign Default of 1931.

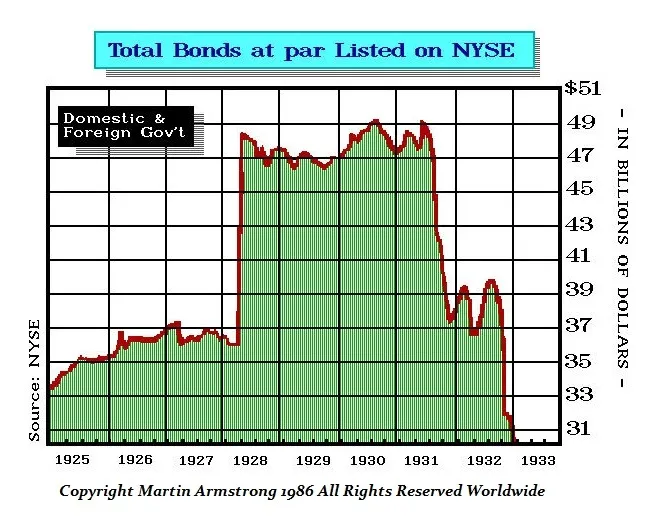

We can see here looking at the foreign bonds that were listed on the New York Stock Exchange and how they just defaulted going to zero. Therefore, the question is not whether the Latvian banks are essential to the country, a collapse can still have a profound contagion impact simply because people are losing confidence in the banking system as a whole.

There is no such thing as letting these banks go because they are “not essential” with respect to Latvia.

We are dealing with a matter of PUBLIC CONFIDENCE that is just not something that is very solid right now.

The man who is killing the Euro as a viable currency is none other than Donald Franciszek Tusk who is a Polish politician who has been the President of the European Council since 2014. He is the living example why politicians MUST be prohibited from making any decisions whatsoever regarding economics and finance. These people have ZERO qualifications in the field yet rise to the top of politics and then assume positions based entirely upon politics – not economics.

The man who is killing the Euro as a viable currency is none other than Donald Franciszek Tusk who is a Polish politician who has been the President of the European Council since 2014. He is the living example why politicians MUST be prohibited from making any decisions whatsoever regarding economics and finance. These people have ZERO qualifications in the field yet rise to the top of politics and then assume positions based entirely upon politics – not economics.

The crisis that is pending for the Euro is all about political control. The desire of British banks to achieve free access to the European Single Market even after Brexit and this was rejected by the EU. Council President Tusk spoke out against maintaining the British-European financial center in London after Brexit. He fails to comprehend that NEITHER the French nor the Germans possess the infrastructure no less the expertise to maintain global markets in the Euro.

Tusk claims that Britain is trying to be like Norway which has free access but pays dues as a member of the EU for free access. On the other hand, Tusk characterizes British desires and trying to blend the Canadian position, which only has a free trade agreement, with full access like Norway but pays no dues like Canada. Meanwhile, France is taking the position that they want to fill the shoes of the London financial markets who have never been able to create deep markets.

This hardline position against the financial markets of Britain remaining as the core trading center for the Euro is extremely dangerous. The Euro holds a minimal position among the reserves of central banks. The exact composition of the foreign-exchange reserves of China is a state secret. Nevertheless, based upon reliable sources, about two-thirds of Chinese foreign-exchange reserves are held in U.S. Dollars. The rest is composed of Japanese Yen, British pounds with less than 15% residing in Euros.

This hardline position against the financial markets of Britain remaining as the core trading center for the Euro is extremely dangerous. The Euro holds a minimal position among the reserves of central banks. The exact composition of the foreign-exchange reserves of China is a state secret. Nevertheless, based upon reliable sources, about two-thirds of Chinese foreign-exchange reserves are held in U.S. Dollars. The rest is composed of Japanese Yen, British pounds with less than 15% residing in Euros.

Brussels is far more interested in punishing Britain than in securing a strong and viable market for the Euro. With respect to a banking center, the primary competitors running second and third are Switzerland and Luxembourg. Never the less, France and Luxembourg are seeking to gain from blocking Britain as they seek to strengthen their positions against Britain. Luxembourg has the EU President Jean-Claude Juncker in their corner, who traditionally has a good relationship with the banks in his home country of Luxembourg. Ironically, while Germany is the largest economy within the Eurozone, by contrast, it relies heavily on trade in goods and financing rather than banking. We have a conflict of interests here where Germany actually need the free market in London for trade deals whereas France and Luxembourg are more interested in capturing business from Britain.

Meanwhile, Brussels needs control so they can maintain the outlawing of shorting government bonds and make no mistake about it, they will prohibit shorting the Euro when it goes against them as well. The danger of politics making the decision over such an issue is that any free market in the Euro will suffer. This is becoming a high stakes financial poker game. Even the President of the Swiss bank UBS, Axel Weber, has come out warning against a withdrawal of the euro clearing from London. “We have to be very careful that we do not shoot any own goals on the subject of Brexit.”

If the EU blocks Britain from euro clearing, this will be the end of the Euro. Politics will present far too great a risk for the Euro to survive going forward.

Foreign direct investment into Canada has absolutely plunged during 2017 to the lowest since 2010. There has been an effort to stop the sale of any property to foreign investors mainly from China. On top of that, there has been also a collapse in capital investment into the oil industry. There are fears also rising about an exodus of capital from the nation’s oil patch and worries about the fate of the North American Free Trade Agreement (NAFTA).

Direct investment into Canada declined by a stunning 26% dropping to merely $33.8 billion during 2017, according to Statistics Canada. Capital inflows have declined for the second year with the major high in 2015 in accordance with our Economic Confidence Model. The investment that did take place was from reinvested earnings of existing operations. Net foreign purchases of Canadian businesses turned negative for the first time in a decade. This means that foreign companies sold more Canadian businesses than they bought. The political shift in Canada to the left is also being seen as a political risk for the years ahead. A monthly closing BELOW 7305 on the futures will signal the collapse of the C$ is underway once again.

The largest public pension fund in the United States is the California Public Employees Retirement System (CalPERS) for civil servants. California is in a state of very serious insolvency. We strongly advise our clients to get out before it is too late. I have been warning that CalPERS was on the verge of insolvency. I have warned that they were secretly lobbying Congress to seize all 401K private pensions and hand it to them to be managed. Mingling private money with the public would enable them to hold off insolvency a bit longer. Of course, CalPERS cannot manage the money they do have so why should anyone expect them to score a different performance with private money? Indeed, they would just rob private citizens to pay the pensions of state employees and politicians.

CalPERS has been making investments to be politically correct with the environment rather than looking at projects that are economically based. Then, CalPERS has been desperate to cover this and other facts up to deny the public any transparency. Then, because stocks they thought were overpriced last year, they moved to bonds buying right into the Bond Bubble. Clearly, California’s economy peaked right on target and ever since there has been a steady migration of residents out of the state.

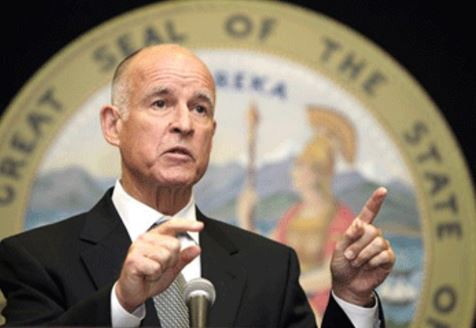

Meanwhile, Governor Jerry Brown has been more concerned about bucking the trend with Trump effectively threatening treason against the Constitution. The insolvency at CalPERS has exceeded $100,000 owed by every private citizen in California to government employees. It was $93,000 that every Californian owed back in 2016 for their state employees. In January 2017, Jerry Brown wanted a 42% increase in gas taxes to bailout CalPERS. California is an extremely liberal state – but that means they are also LIBERAL in spending the FUTURE earning of residents on public employees.

Meanwhile, Governor Jerry Brown has been more concerned about bucking the trend with Trump effectively threatening treason against the Constitution. The insolvency at CalPERS has exceeded $100,000 owed by every private citizen in California to government employees. It was $93,000 that every Californian owed back in 2016 for their state employees. In January 2017, Jerry Brown wanted a 42% increase in gas taxes to bailout CalPERS. California is an extremely liberal state – but that means they are also LIBERAL in spending the FUTURE earning of residents on public employees.

The pension crisis at CalPERS is getting worse by the day. The State looks to be totally bankrupt by 2021-2022. CalPERS has just decided to increase the contribution of local governments and cities to their fund. The cities say they are approaching bankruptcy because of rising subsidies, but CalPERS itself is approaching insolvency. The problem is that there really is no honest reform in sight. The choice is clear – CUT pension benefits of government employees or RAISE TAXES! CalPERS simply needs a bailout and very soon. It looks like they are hunting for ways to tax whatever they can for it only now about state employees getting their piece of your future income. This is a trend that will bring down Western society as a whole – the Sovereign Debt Crisis of untold proportions.

Board Member Steve Westly even told The Mercury News that a bailout was needed and soon. Currently, CalPERS manages approximately $350 billion of future pension claims of its members. Recently, CalPERS passed an amendment to the statutes, which resulted in higher contributions for the California municipalities. The amount of contributions has been increased several times over the past few years and this time the cities do not appear to be able to handle the increased costs. With the Trump tax reform, the real incompetence of local government is coming to a head.

Once CalPERS was 100% funded with assets under management. In fact, they had a surplus in the good old days before Quantitative Easing. Right now, the system no longer has more than two-thirds of future claims covered. CalPERS itself expects an annual return of 7% on its financial investments when it needs 8% minimum. Most pension funds run by the States are insolvent or on the brink of financial disaster. This is what I have been warning about that the Quantitative Easing set the stage for the next crisis – the Pension Crisis. The Illinois Pension Fund needs to borrow up to $107 billion to meet its payment obligations with no prayer of repayment. Promises to state employees are over the top and off the charts. This is why Janet Yellen at the Fed kept trying to raise rates stating that interest rates had to be “normalized” for this was the crisis she knew was coming. And guess what – Europe is even worse and Draghi will not raise rates for fear that government will be unable to fund themselves. The ECB is creating a vast European Pension Crisis while trying to keep member state governments on life-support. It has purchased 40% of all sovereign debt and appears trapped and cannot reverse this process. The choice is pensions collapse or state collapse.

Once CalPERS was 100% funded with assets under management. In fact, they had a surplus in the good old days before Quantitative Easing. Right now, the system no longer has more than two-thirds of future claims covered. CalPERS itself expects an annual return of 7% on its financial investments when it needs 8% minimum. Most pension funds run by the States are insolvent or on the brink of financial disaster. This is what I have been warning about that the Quantitative Easing set the stage for the next crisis – the Pension Crisis. The Illinois Pension Fund needs to borrow up to $107 billion to meet its payment obligations with no prayer of repayment. Promises to state employees are over the top and off the charts. This is why Janet Yellen at the Fed kept trying to raise rates stating that interest rates had to be “normalized” for this was the crisis she knew was coming. And guess what – Europe is even worse and Draghi will not raise rates for fear that government will be unable to fund themselves. The ECB is creating a vast European Pension Crisis while trying to keep member state governments on life-support. It has purchased 40% of all sovereign debt and appears trapped and cannot reverse this process. The choice is pensions collapse or state collapse.

There is NO WAY out of this crisis. The portfolio would have to be completely restructured and benefits reduced. Jerry Brown will do everything in his power to raise taxes and fees to try to hold CalPERS together. That is by no means a long-term solution. If you can transfer to one of the 7 states without income state – do it NOW before it is too late.

COMMENT: Mr. Armstrong, I read your piece on South Africa and you are the only person to explain that the hyperinflation in Zimbabwe took place after they stole all the land from the white farmers. You really turn over every stone in your research.

My hat is off to you sir.

MH

ANSWER: Well I was not aware of that, but it does not surprise me. Everyone attributes hyperinflation to the simple increase in the supply of money. I have stressed countless times that hyperinflation unfolds ONLY when people NO LONGER TRUST THE GOVERNMENT! The Zimbabwe hyperinflation ended the same way as Germany. Once Zimbabwe expropriated white farmers without compensation, public confidence collapsed. Nobody would invest in Zimbabwe after that. This is what South Africa now risks. Nobody will invest in a country that does not respect property rights. This is what we call COUNTRY or POLITICAL RISK!

The French hyperinflation took place with the assignats, which were issued in conjunction with the revolution. They were so interested in robbing the rich and even the Catholic Church, that the confidence in banks and the government collapsed.

I have also shown numerous times that the famous German hyperinflation followed the Communist Revolution in 1918, which established the Weimar Republic. Once again, if you had any wealth, you hoarded it. People held foreign coins as the alternative to German currency.

In Venezuela, once more it is the collapse in the confidence of government that compels it to produce more and more money to pay its troops. This is the net effect once again when people no longer trust the government and wealth is hoarded using foreign currency – in this case, American dollars.

I have also make it abundantly clear that Japan LOST its ability to even issue coins for 600 years because, with each new emperor, he devalued the outstanding money supply to worth just 10% of his new coins. Once again, people lost faith in Japanese coins and began to use Chinese and bags of rice. It is ALWAYS the CONFIDENCE in government that is the primary component of hyperinflation.

I have also shown that the hyperinflation that took place in the Roman Empire during the 3rd century followed the capture of Emperor Valerian I in 260AD by the Persians. Once that took place, the barbarians from every angle began to invade the Roman Empire. Money was hoarded and the government had no choice but to debased the coinage to try to cover its bills.

There is a wealth of examples that demonstrate it is the collapse in CONFIDENCE that takes place and then the hyperinflation unfolds as a RESULT of that. It is NEVER as the goldbugs pitch to sell people gold that an increase in money supply is the cause of hyperinflation. It is ALWAYS, and without exception, the collapse in public confidence that precedes the hyperinflation.

QUESTION: Mr. Armstrong; I followed your advice and opened an account in the United States. I live in Britain and my daughter lives there in the States so I used her local address. To my shock, it was very easy. You said the USA has become the new tax haven. So the USA is not part of the common reporting that even covers the Middle East?

KL

ANSWER: That is correct. The Common Reporting Standard (CRS) is an information standard for the automatic exchange of tax and financial information on a global level. It was put together by the Organisation for Economic Co-operation and Development (OECD) back in 2014. Its purpose was to hunt down tax evasion primarily for the European Union. They took the concept from the US Foreign Account Tax Compliance Act (FATCA), which imposed liabilities on foreign institutions if they did not report what Americans were doing outside the country.

The legal basis of the CRS is the Convention on Mutual Administrative Assistance in Tax Matters. As of 2016, 83 countries had signed an agreement to implement it. First reporting took place in September 2017. The CRS has many loopholes for countries have to sign the agreement. This has omitted the United States as well as most developing countries. Note that countries that are included are China, Singapore, Switzerland, most tax havens and of course Australian/New Zealand as well as Canada.

As of 2018, the signing nations to avoid are:

Albania, Andorra, Antigua and Barbuda, Aruba, Australia, Austria, The Bahamas, Bahrain, Belize, Brazil, Brunei Darussalam, Canada, Chile, China, Cook Islands, Costa Rica, Dominica, Ghana, Grenada, Hong Kong (China), Indonesia, Israel, Japan, Kuwait, Lebanon, Marshall Islands, Macao (China), Malaysia, Mauritius, Monaco, Nauru, New Zealand, Pakistan, Panama, Qatar, Russia, Saint Kitts and Nevis, Samoa, Saint Lucia, Saint Vincent and the Grenadines, Saudi Arabia, Singapore, Sint Maarten, Switzerland, Turkey, United Arab Emirates, Uruguay, Vanuatu

I have created this site to help people have fun in the kitchen. I write about enjoying life both in and out of my kitchen. Life is short! Make the most of it and enjoy!

De Oppresso Liber

A group of Americans united by our commitment to Freedom, Constitutional Governance, and Civic Duty.

Share the truth at whatever cost.

De Oppresso Liber

Uncensored updates on world events, economics, the environment and medicine

De Oppresso Liber

This is a library of News Events not reported by the Main Stream Media documenting & connecting the dots on How the Obama Marxist Liberal agenda is destroying America

Australia's Front Line | Since 2011

See what War is like and how it affects our Warriors

Nwo News, End Time, Deep State, World News, No Fake News

De Oppresso Liber

Politics | Talk | Opinion - Contact Info: stellasplace@wowway.com

Exposition and Encouragement

The Physician Wellness Movement and Illegitimate Authority: The Need for Revolt and Reconstruction

Real Estate Lending