Europe is now replicating the 1930s and the mistakes it made with austerity back then as well outside of Germany. Of course, Merkel has imposed the German view of austerity based on their experience but has ignored the opposite experience of the rest of Europe that led to the 1931 Sovereign Debt Crisis and mass defaults.

It was the year of 1925 when then chancellor of the Exchequer, Winston Churchill, returned Britain to the gold standard. Britain was trying desperately to reestablish itself as the financial capital of the world as if nothing had taken place. Returning to the gold standard resulted in wages being forced down to compete with America.John Maynard Keynes at the time pleaded that this was madness. The pound was overvalued against the dollar by 10% trying to reestablish confidence in Britain but the net result crippled exports and unemployment began to rise and workers engaged in strikes for having wages reduced even though the pound was worth more officially.

Churchill acted in an effort to restore Britain but he was dead wrong. Keynes proved to be correct and this lesson has still been ignored by Europe today. The overvalued pound led to deflation and ultimately forced the economic collapse in 1931. The capital was fleeing Britain and bankers were pleading for austerity to retain bond values. The Labour government collapsed and a coalition national government was formed. They ignored the pleas of the bankers and abandoned the gold standard overnight. The pound fell from $4.85 to $3.40 against the dollar.

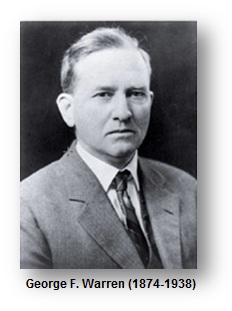

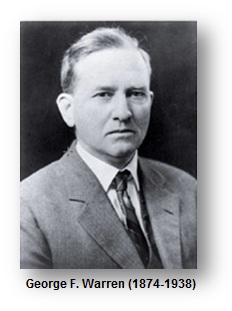

NEVERTHELESS, despite the dire forecasts of ultimate catastrophic consequences if Britain abandoned the gold standard, the economy held and began to recover. There was no revolution in the streets as predicted. The devaluation of the pound actually stimulated the economy and the austerity crowd proved to be completely wrong. Within just four years, the British industrial production had risen by 25% and unemployment fell from 3 million to 2 million. It was this experience that provided the support for the economist George Warren (1874-1938) who convinced Roosevelt that austerity was wrong and devaluation would also kick-start the American Economy. None of Roosevelt’s Brains Trust was ever experienced in economics. Most were simply lawyers trying to get around the Constitution. They too argued for austerity as Merkel does today. However, Roosevelt looked at the events of 1925-1931 in Britain and listened to Warren. The dollar devaluation is what turned the economy around at that moment in time.

NEVERTHELESS, despite the dire forecasts of ultimate catastrophic consequences if Britain abandoned the gold standard, the economy held and began to recover. There was no revolution in the streets as predicted. The devaluation of the pound actually stimulated the economy and the austerity crowd proved to be completely wrong. Within just four years, the British industrial production had risen by 25% and unemployment fell from 3 million to 2 million. It was this experience that provided the support for the economist George Warren (1874-1938) who convinced Roosevelt that austerity was wrong and devaluation would also kick-start the American Economy. None of Roosevelt’s Brains Trust was ever experienced in economics. Most were simply lawyers trying to get around the Constitution. They too argued for austerity as Merkel does today. However, Roosevelt looked at the events of 1925-1931 in Britain and listened to Warren. The dollar devaluation is what turned the economy around at that moment in time.

The USA share market began to recover from the depths of the Great Depression. History repeats, but I have stated it is like a Shakespeare play – the plot remains the same, but the actors change over hundreds of years. The lessons of history, therefore, repeat over and over again albeit by the same foolhardy reasoning.

Europe is trapped in similar orthodoxy to that of their prewar forebears. In Germany, they hold the firm belief that inflation is the greatest evil to inflict humankind. Yet the ECB has mastermind the greatest monetary expansion in history without success of stimulating anything. The policy of quantitative easing has been done only at the government level as taxes and tax enforcement has risen and thereby the people and consumption have been totally ignored for fear of inflation. This approach has created an economic nightmare that actually threatens to bankrupt the ECB. Unlike the US Federal Reserve which has the power to create elastic money, the ECB needs authority from government.

They do not flinch even when a quarter of high street shops close. They are like doctors laying the sick in the snow to see who will survive. Yet they hurl cash at friendly bankers and watch it vanish into the maws of directors and offshore speculators. And they dole out billions to prop up a euro of which they are not even members.

Keynes was right in 1925 – and proved right in 1931. Flexible exchange rates are a more painless way of forcing down labor costs and promoting trade than government austerity. Inflation is a better way of easing debt. The remedy for depressed demand is increased demand, simple as that. The risk of inflation in Britain at present is trivial compared with that of deflation and recession. And at least Britain’s currency can float. Imagine if it were part of the euro and trade had to cope with a pound probably 20% higher in value than now.

Hardly a month passes without another euro crisis and more imposed austerity. It is as if Keynes had never lived. Yet water still refuses to flow uphill. Heavily indebted countries certainly need to restructure their public sectors in the long term – and have plausible plans to do so – but they cannot repay debt, short or long term when they are in recession. Increasing unemployment and suppressing demand impedes growth and is no use to anyone.

Worse, Europe’s drawn-out austerity is undermining the very authority required to enforce it. When governments fall, no package can be enforced. Greece was forced last month into de facto default. Who would now buy a Spanish bond? What is the value of a Dutch finance minister? What price Nicolas Sarkozy’s signature on a bailout deal? As long as the euro shackles the continental economy in austerity it will never achieve political stability or a return to growth.

The euro was a Locarno dream. It was the last cry of the 20th century, envisaging a brave new order in which bankers and businessmen, workers and peasants, would stand arm in arm, singing Ode to Joy. All labor costs would become equal. There would be fiscal and regulatory integration across the entire continent. The euro would unlock the door of united states of Europe. Ireland and Greece would be to Germany what Nevada is to New York. The euro would squeeze and stretch the peoples of Europe until they were one.

This concept of a union must rank among the great mistakes of history. Like other pan-continental visions, it has proved no match for the crooked timber of European mankind. Its acolytes cannot bear revisionism or tolerate dissent. They have driven Greece into chaos and Spain into severe depression, with half its youth now unemployed. The Eurocrats do not care. Their incomes are secure. They dance only round the euro and claim its blood sacrifice. They will do anything but admit they were wrong.

The one salvation on the horizon is a true democracy. Last week the French electorate said no to more austerity and the Dutch government fell for the same reason. Spain faces a similar crisis, and the streets of Athens hold untold dangers. Even in Britain polls suggest an electorate unconvinced by the longevity of what by any standards is mild austerity. The peoples of Europe have had enough. The prospect of imposing on its nations the budgetary disciplines required for more German bailouts is unthinkable.

NEVERTHELESS, despite the dire forecasts of ultimate catastrophic consequences if Britain abandoned the gold standard, the economy held and began to recover. There was no revolution in the streets as predicted. The devaluation of the pound actually stimulated the economy and the austerity crowd proved to be completely wrong. Within just four years, the British industrial production had risen by 25% and unemployment fell from 3 million to 2 million. It was this experience that provided the support for the economist

NEVERTHELESS, despite the dire forecasts of ultimate catastrophic consequences if Britain abandoned the gold standard, the economy held and began to recover. There was no revolution in the streets as predicted. The devaluation of the pound actually stimulated the economy and the austerity crowd proved to be completely wrong. Within just four years, the British industrial production had risen by 25% and unemployment fell from 3 million to 2 million. It was this experience that provided the support for the economist