Tag Archives: Unemployed

Why the Quantity Theory of Money is Destroying Capital Formation

Armstrong Economics Blog/Economics

Re-Posted Mar 20, 2020 by Martin Armstrong

There is no question that the fundamentalists #1 Golden Rule has been when stocks crash, run to bonds. We are entering the collapse in public confidence and this is BEYOND the central banks despite the massive attempts to intervene. Keynesianism is DEAD!!!! We have entered uncharted territory which is the darkest fears of academics for they know nothing about such scenarios. I rushed to try to get Manipulating the World Economy because this was critical given what Socrates was projecting for 2020 and the correction. (3rd edition is at the printers, 2nd edition may still be on eBay).

The bond markets are offering no refuge this time for the flight to quality. The diversification strategies, real value investors, and correlation desks have all lost the most money during this crisis all because the #1 Golden Rule has crumbled and fallen to the ground in a pile of dust. The traditional 60% in shares and 40% in fixed income has collapsed. There has been a worldwide panic to dollars both among institutions as we see in the FX markets, but in the physical world of cash dollars have been vanishing as hoarding skyrockets. There have even been shortages of physical dollars in New York City. Paper dollars have been hard to find in Europe and in many places they are now selling for a premium.

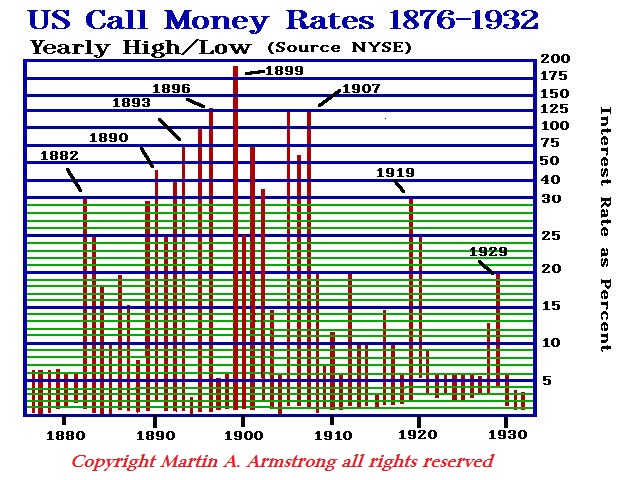

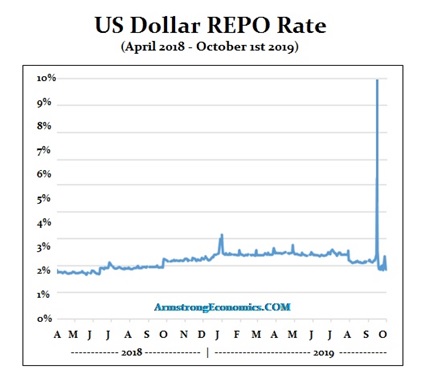

The failure of the bonds to provide the alternative in a stock crash confirms that Keynesian Economics is dead and monetary policy has lost its stimulative power because of this insane negative interest rates. Real rates rise in times of a crisis as illustrated by the call money chart showing dramatic rises in rates pre-Federal Reserve and pre-Keynesian Economics. The central banks have been trying to PREVENTthe rise in short-term rates taking place in the Repo Market since September 2019.

The central banks have been fighting a losing battle against the normal forces of how capital moves during a crisis. During a crisis as this, interest rates rise with the perception of a rise in credit risk. The central banks have been trying to create a bear market in interest rates in the middle of a bull market where rates would instinctively rise

All of those clinging to the Quantity Theory of Money from politicians, analysts, goldbugs, and central bankers, you have to wonder how many times must they all be wrong in assuming an increase in the supply of money must be inflationary. That theory has proven to be suitable for a bedtime story for children. Academics, who has fostered this theory, lack any trading experience. Sorry – all things DO NOT REMAIN EQUAL!

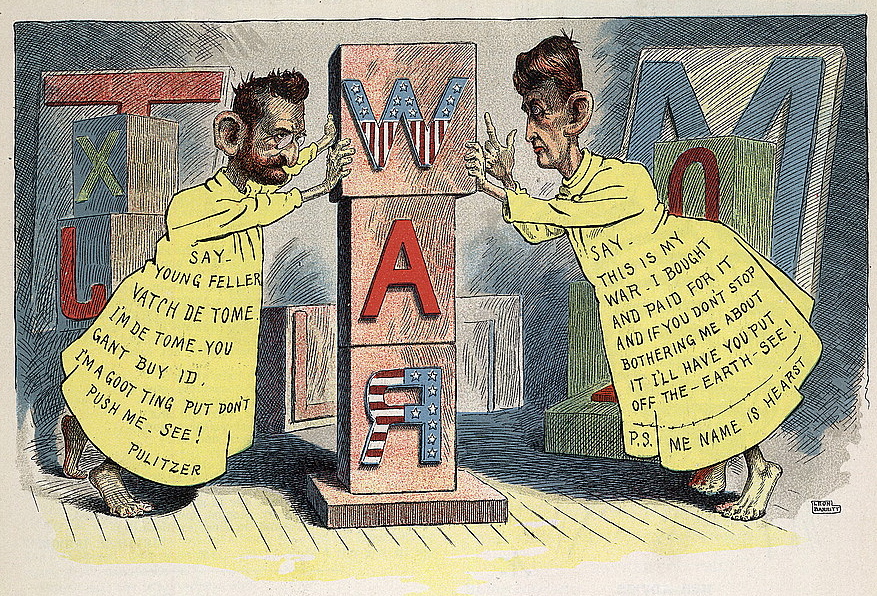

This has not been a market crash sparked by the black swan event using a novel virus that central bankers cannot defend against, this has been an orchestrated overreaction with ulterior motives. There is NO amount of money that can be poured into the economy to reverse the trend as long as people’s confidence in the future has been destroyed by the media. This is no different from how the media created the Spanish American War accusing the Spanish of attacking an American ship that never happened. They name the prize for good journalism after the father of fake news.

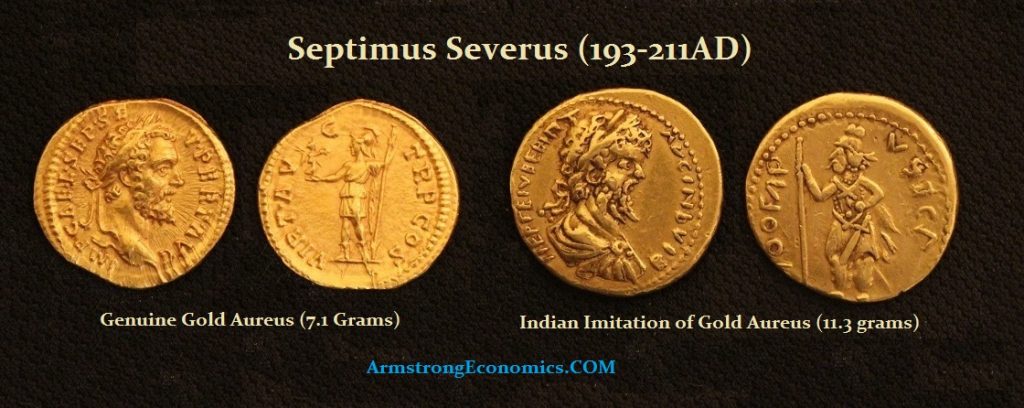

This is the destruction of capital formation. The entire Quantity Theory of Money is bogus and has never held up if you simply investigate the history. The old theories of debasing money which led to the start of that theory was during an era when coins were precious metal and they exchanged in value among nations on their metal content. That was the Latin Monetary Union. The same amount of metal established the foreign exchange rate among nations. However, as debasement took place and wars suspended the precious metal standards, money revealed its hidden nature – political power.

The true nation of money was always international confidence in the government. India would imitate the gold coins of Rome because people trusted the Roman coinage. Gold carried a premium over its metal content based upon political power. The ancient coinage demonstrated that money was NOT the pure intrinsic value of the metal, but the confidence in the political state issuing that coinage.

We find the very same trend 600 years earlier when Athens was the financial capital of the world. Silver was imitated in the form of Athenian Owls, which was the first worldwide currency to appear. Athenian Owls were imitated in Europe to Africa. Once again, these were not counterfeits but imitations. The metal content was some time of an even higher grade. This confirmed that the premium of currency was created by the political stature of the issuer.

This is what we are witnessing right now – the Panic to the Dollar. You must understand that this is a long historical documented reaction. The rush to dollars right now is as old as recorded history. The currency of the dominant financial capital of the world will always trade at a premium in times of crisis.

The massive liquidation going on among hedge funds who have never understood the Quantity Theory of Money is taking us into the end game where there is no shelter in bonds, but only cash. The statement of Ray Dalio that “cash is trash” illustrated the arrogance of that philosophy constructed on the false Quantity Theory of Money. The typical flight to quality running to government bonds has failed and the rush is to simply cash.

If you look at the markets and not the headlines, as the U.S. stocks collapsed in panic on Wednesday by 5%, turn to the TLT $17 billion exchange-traded fund that tracked long-dated Treasuries. That very day saw its second-worst day ever in the middle of a panic. That was NOT supposed to happen, according to the Quantity Theory of Money believers. If we simply trade by the numbers and not dogma, we saw both equities and bonds plummet. Those who have been focused on cross-asset correlations, none of this was supposed to be even possible. Even gold plunged alongside equities and government bonds. We entered the new reality where Keynesian Economics has collapsed and there is nothing to replace it.

The staggering losses that will come out this quarter because of the fund managers who have all been based on the Quantity Theory of Money warns that we may yet face the shocking revelation of just how much capital was destroyed. Even those who relied upon a risk-parity index that was supposed to create a diversified systematic strategy as it allocated money based on volatility levels has been blown out of the water. I did a presentation at one of the largest investment houses in the world, and I answered the question if I believed in diversification models. My reply was NO! Why invest in something I expect to lose money in as insurance when I can do the proper analysis and determine where to invest.

While the European Central Bank tried to claim that it had NOT run out of ammo announcing an emergency bond-buying program worth €750 billion euros, all this does is keeps the government on life-support. The greatest risk at this time is to dump money into government debt. Even gold has not proven to be a better option in the long term as hedge funds have lost so much money in other areas, they have been forced to liquidate gold simply to raise cash.

This Keynesian Model of lowering interest rates has completely failed and it has acted counter-trend to how the capital functions in a panic – the top priority becomes credit risk. The closer the yield of fixed moves toward zero, the more negatively skewed bonds become. Bonds have simply become a tremendous risk for they are becoming not a place to hide, but a place to obtain a guaranteed loss. The risk of negative-yielding debt is that their prices will collapse 20%-60% as capital in the free market looks at credit risk and what level of return is necessary to prevent hoarding of cash.

The Real Definition of Capitalism

Armstrong Economics Blog/Socialist

Re-Posted Mar 20, 2020 by Martin Armstrong

QUESTION: You champion companies that then dominate the system which is the foundation of capitalism. Is this not against the people you seem to support?

HF

ANSWER: No business that is guaranteed by the government is capitalist. That is self-evident in education, insurance, and even medicine. Once the government gets involved to supposedly guarantee something, claiming they are doing so to help the people, corruption expands and the people will always pay more.

All new businesses begin as a monopoly. Someone first has to invent the idea. It is the competition that then takes place that is the core of capitalism — freedom. Once some industry turns to the government for some advantage, then competition is reduced and that ceases to be a capitalistic system. There are some things that need to be monopolized. Take utilities or trains. In both cases, you have to have a single network of delivery. If there were five utility companies all delivering electricity and they had to run their own network of lines, the street would be littered with cables and then what do you do with the poles? Who owns them? The same problem existed with railroads. If a company had to pay each individual railway for the use of their rails for say 10 miles, there becomes a point where the competition prevents economic expansion. This tends to apply only where there is a common delivery network that must be shared.

This is why socialism and communism fail. They try to create common networks that then curtail competition and prevent economic growth. Look at medicine. They compare the US to free medical care in Canada or the UK. But when people in Canada need serious treatment, they come to the USA. The best doctors leave for America because they can make a lot of money. In the UK, they are government employees. The only way to have medicare for all is to nationalize medicine and then the entire system becomes like the Veterans Administration. In the USA, the government is subsidizing the medical profession and politicians always demand nationalizing health insurance rather than looking at the system and the corruption within the system where hospitals overcharge for everything. That is again anti-capitalistic.

There are those who point to big corps and how they own government and then call that capitalism. Sorry, that is just corruption and it is to PREVENT competition to rig the game in their favor. That is ALWAYS the downside of any republic. Once you allow career politicians, they inevitably sell their power to the highest bidder. You will never have a government of “We the People” as long as you have a republic without term limits. I strongly suggest you review your definition of “capitalism” for nowhere in there is the justification for bribery. That defeats the entire system for it is no longer a free market.

Never Give Your Money to a Fundamentalist!

Armstrong Economics Blog/Forecasts

Re-Posted Mar 20, 2020 by Martin Armstrong

COMMENT: You mention Dalio saying cash is trash. Did you happen to see them ask Tudor Jones about those comments only an hour after in Davos as well? He pretty much ignored the question as they are “friends” but you could tell he disagreed. I’ve watched other interviews with both of them together and is painfully obvious Jones is a trader and looks at the world through capital flows (yes obviously followed you for years) while Dalio is the traditional fundamental analysis type. Jones also talked about the coronavirus being a curveball that could interrupt the markets, while the reporters didn’t even believe him, at that point in time.

ps I will forward your letter on to John James candidate for US Senate against the incumbent democrat Peters

MR

REPLY: Yes, Paul actually bought hundreds of copies of the Greatest Bull Market in History back in 1986 and handed them out to all his clients. There is a SUBSTANTIAL difference between fundamentalists who try to reason the world and you cannot do that. A trader cares not if a given market rises or falls – it’s just a trade. I have told the story of how I went to lunch with the CEO of one of the biggest Swiss banks in Geneva. I was going to open our first office overseas in 1985 and I knew there was underlying American resentment in many places throughout Europe. I had a list of various names we came up with like European Advisers or something like that. He asked me to name one European analyst. I was embarrassed because I couldn’t. I apologized and said I sure there were, but just never met any.

He laughed and said there were none. If he was British he was also bullish the pound. The same with the French or Germans. He then explained to me why everyone used my firm. He said you do not care if the dollar rises or falls. We became the largest FOREX adviser because the analysts who worked for banks could never take a bearish position on their currency because the European politicians always used it as the proof they were doing a good job post-World War II because the currency rose in values reflecting the booming recovery.

A trade calls a currency, the Dow, gold, or whatever be it up or down because it is just a trade. I warned at the WEC in Orlando that the market was ripe for a correction come the January turning point on the ECM because it had risen 11 years.

Fundamentalists assume markets move only on events. That is not true. The market moves and the commentators try to find the explanation. It simply declined because it was tired and everyone who thought of buying had already bought it. Thus, a correction was ripe. That does not negate the long-term and new highs again just as we saw from the 1987 Crash or the 2009 low.

This is why you should NEVER give your money to a fundamentalist to manage. NEVER!!!!!

Federal Reserve to Return to its Original Design

Armstrong Economics Blog/Central Banks

Posted Mar 15, 2020 by Martin Armstrong

The Federal Reserve will return to its origin and it will do what it was originally designed to do. They will lend now on commercial paper rather than just government. As everyone knows, this has been my strongest recommendation and criticism of Quantitative Easing. The Fed was originally designed to create Elastic Money buying corporate paper to prevent a recession and job losses. World War I saw government interfere and directed the Fed should be buying government debt.

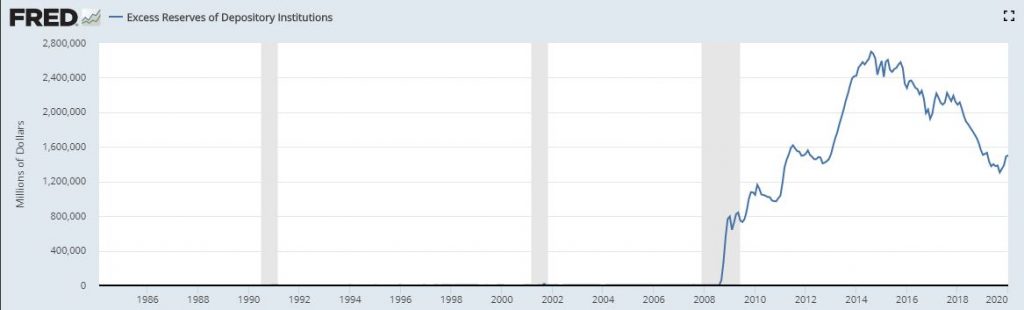

Injecting cash into the banks FAILED because the banks lacked the confidence to lend money. They turned and placed money at the Fed in Excess Reserves. Not that that bottomed in September 2019 with the Repo Crisis and is back on the rise again as banks are not lending.

Lowering rates FAILED because people will not borrow if they lack confidence in the future, Hence, Europe and Japan have destroyed their government bond markets and now they talk about nationalizing companies and eliminating paper money while seizing cryptocurrencies. They have no monetary power left in the central bank. All they can do now is turn draconian and seal the fate of their economic future.

The Fed will take a different path and lend directly to corporations because the bankers will hoard the cash and NEVER help the economy. This has been my #1 recommendation to save the economy and the central bank.

This is the REAL Crisis – not the coronavirus which has been at best the catalyst to set everything in motion for the monetary crisis and the Mother of All Financial Crises.

Coronavirus, Hedge Funds Blow Up & the Elephant in the Room Nobody Notices

Armstrong Economics Blog/Central Banks

Re-Posted Mar 15, 2020 by Martin Armstrong

I do not like to contribute to conspiracy theories. They are more often just wrong. I have mentioned that there was massive liquidation last week, but it is not over. The largest hedge fund run by Ray Dalio who said “cash is trash” and his #1 guy pronounced that the central banks had defeated the Business Cycle, is facing huge losses at Bridgewater Associates. The firm’s macro fund is down roughly 20% through this past Thursday. Their view has been anti-dollar, bullish gold, and thought that the rise of cryptocurrencies was a structural change that ended declines like this. The drop in the fund, Pure Alpha Fund II, comes nearly two months after Dalio told CNBC “cash is trash” in an interview held during the World Economic Forum.

The problem with such funds as Bridgewater is very clear – their strategy is based on human opinion. The ONLY way to survive the years ahead is to eliminate human opinion and stand objective between all the yelling and screaming. We are expanding our institutional service for small businesses. Governments are incapable of dealing with this event. Despite all the conspiracy theories about the Coronavirus and thousands of millions will die, all of that is COMPLETELYirrelevant!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

These are the typical ranting of people who have never dealt behind the curtain and are clueless as to how the world truly functions. They spin their theories about the Coronavirus and how Trump will be defeated, but the real elephant in the room that nobody seems to notice is the fact that central banks are at negative rates and lack any monetary policy room whatsoever to combat this economic decline. This is what I have been warning about – the Central Bank Crisis. They have shot themselves not in the foot, but in a vital organ. They have destroyed the Keynesian Economic Model. They have nothing left.

I have laid out in Manipulating the World Economy that the solution requires political action. The central banks are dead. This is a far greater crisis than most expect. (look for that book on EBay for now).

The Fed & Helicopter Money

Armstrong Economics Blog/Central Banks

Re-Posted Mar 13, 2020 by Martin Armstrong

QUESTION: You said that the Fed does not print money out of thin air on its own. The goldbugs say you are wrong. I suspect that they are wrong not you. You seem to have a much deeper understanding of money than anyone else. Would you clarify this issue?

Thank you very much

PHK

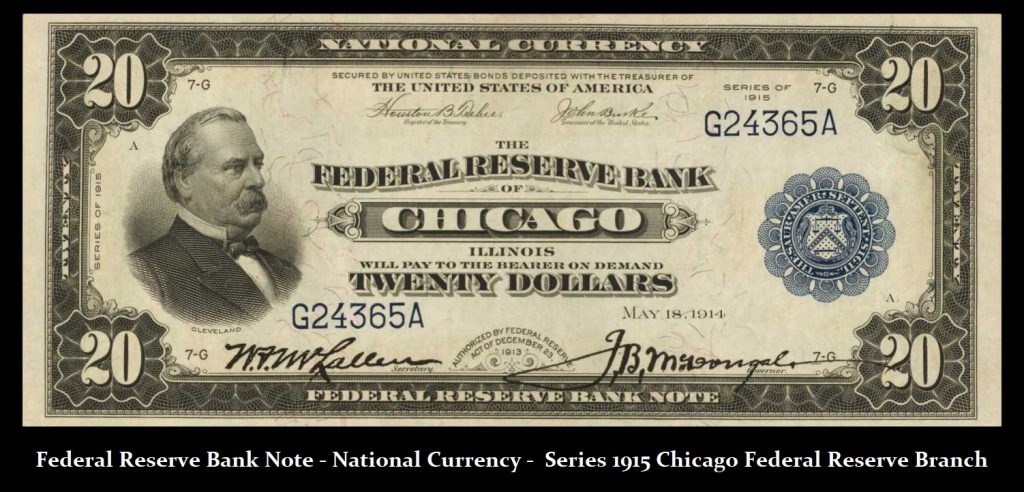

ANSWER: When Congress created the Federal Reserve, a completely new currency came into existence. There were two types of currency issued under the Federal Reserve. The main system currency was simply known as the Federal Reserve notes. Then there was the Federal Reserve Bank notes that were issued by the independent branches.

The Federal Reserve Bank notes are inscribed “National Currency.” The first series to be issued by the indeed the jewel banks of the Federal Reserve was dated 1915 and consisted only of $5, $10 and $20 denominations. They were only issued by the Atlanta, Chicago, Kansas City, Dallas, and San Francisco branches. The obligation of this issue was to pay the bearer on demand only by that specific Federal Reserve branch. The 1915 series stated it was “secured by United States bonds deposited with the treasurer of the United States of America.” The later issue of 1918 stated, “secured by the United States bonds or the United States certificate of indebtedness or United States one year gold notes deposited with the treasury of the United States of America.”

The Federal Reserve notes of 1914 were issued in all denominations from $5-$10,000. They were issued by the United States to the 12 Federal Reserve banks and through them to the member private banks and to the public. The notes were not issued by the banks themselves as were the Federal Reserve Bank notes and the obligation to pay the bearer is borne by the government and not by the Federal Reserve banks. Hence, these notes were not secured by the United States bonds or other securities. Therefore the Federal Reserve notes were not secured by any certified means of backing and were authorized by the government, not the Fed. The Federal Reserve notes simply states, “United States of America will paid to the bearer on demand.”

The difference was substantial. The Federal Reserve Note was directed to be issued to create money which was unbacked even by bonds. This was to create liquidity because people were hoarding money uncertain about the future. This version could be termed helicopter money but it was not authorized by the Fed itself. Only the currency actually issued by the Federal Reserve Banks was backed by government bonds which was a different structure all together.

The goldbugs seem to confuse the authority to create elastic money where they can issue money to buy government bonds injecting liquidity which is not printing money out of thin air but on an elastic basis which is electronic, not printed. The image of the Fed creating helicopter money is not correct when they are simply swapping bonds for cash.

The ECB has the authority to create money out of thin air because it cannot back the currency with federal bonds that do not exist. The ECB has the power to create money without backing whereas the Fed can issue notes only backed by federal bonds. The euros are actually printed by each of the member states and not by the ECB directly. Each note has a code stating which nation state-issued the currency.

Central Banks & Their Erectile Dis-function

Armstrong Economics Blog/Central Banks

Re-Posted Mar 12, 2020 by Martin Armstrong

QUESTION: Marty, you are absolutely a Godsend. Nobody updates during the day of a panic but you. While everyone thinks the increase in the repo and cutting rates would save the market, you play these down as failed attempts. What is your take on this right now?

Your loyal follower for life.

HP

ANSWER: In the midst of this market turmoil, the New York Federal Reserve stepped in midday Thursday and announced a major asset purchase program. It offered $500 billion in three-month Repo operations, $500 billion in one-month Repo operations, and another at least $220 billion in operations with a duration of two weeks or under. This is a joke as was the rate cut. Rates rise in such panics because banks do not want to lend fearing credit risk and borrowers are not interested until the market settles. The rate cut was futile and the proof of the was the expansion of the Repo facility otherwise short-term rates would explode to probably 20%+.

There is nothing the central banks can do and this is becoming more and more obvious to the real money. We are entering a period we could call Central Bank Erectile Dis-function – they cannot keep the markets up & may not want to.

Clash of the Free v Artificial Market in Interest Rates

Armstrong Economics Blog/Interest Rates

Re-Posted Mar 12, 2020 by Martin Armstrong

QUESTION: Marty, I could not help but notice that the array you posted on the Fed also has high volatility at the end of the month and another target the week of March 23. Is this also reflecting the repo crisis against at the end of the quarter?

Thank you for Socrates.

VH

ANSWER: Yes. We will most likely come to another credit crunch at the end of the quarter. This time we have a confrontation between real interest rates, which are rising due to credit risks that is part of the Repo Crisis, and the artificial lowering of rates under Keynesian economics to stimulate demand irrespective of credit risk. We are facing a true clash of the free market v the fake market.

Jawboning the Fed on Cutting Rates

Armstrong Economics Blog/Interest Rates

Re-Posted Mar 11, 2020 by Martin Armstrong

COMMENT: Hello Martin, I see President Trump is still calling for interest rate cuts from the Fed. I know he is a businessman and with the current situation is he making the right call with all his business knowledge? ( not sure the reason for the name-calling?)

Trump presses ‘pathetic’ Fed to cut rates more

CN

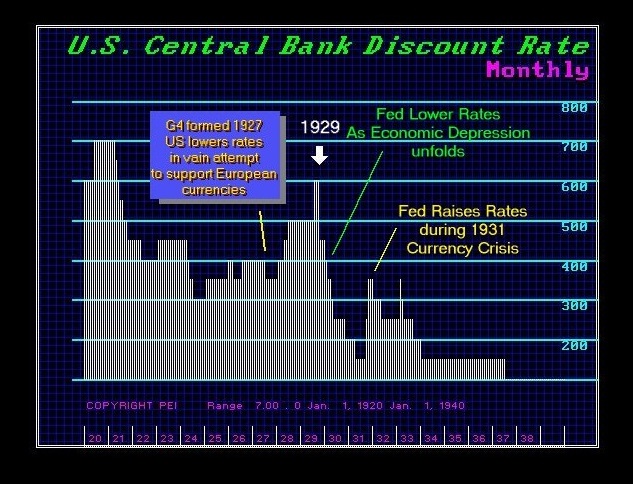

REPLY: Unfortunately, President Trump is still caught in the old school way of thinking in his belief that the Fed lowering rates will somehow magically stimulate the economy. The major thing that we have to respect about Trump is that he will listen and change his mind, unlike career politicians. The Fed cut rates and nothing happened, not because they did not cut enough, but because cutting rates does not work to begin with. The Fed cut rates dramatically during the Great Depression with no effect. If the Fed goes negative, the government debt will get trapped like that of Europe and the Fed cannot raise rates without blowing itself up.

I have been doing updates for the Repo Crisis. We are facing an unbelievable crisis ahead and Trump does not understand the international dynamics behind the curtain. While the Fed cut rates, it was forced to expand liquidity in the Repo market or else we are looking at Repo rates taking off like a rocket ship because the issue is not borrowing right now, it is all about credit risk.