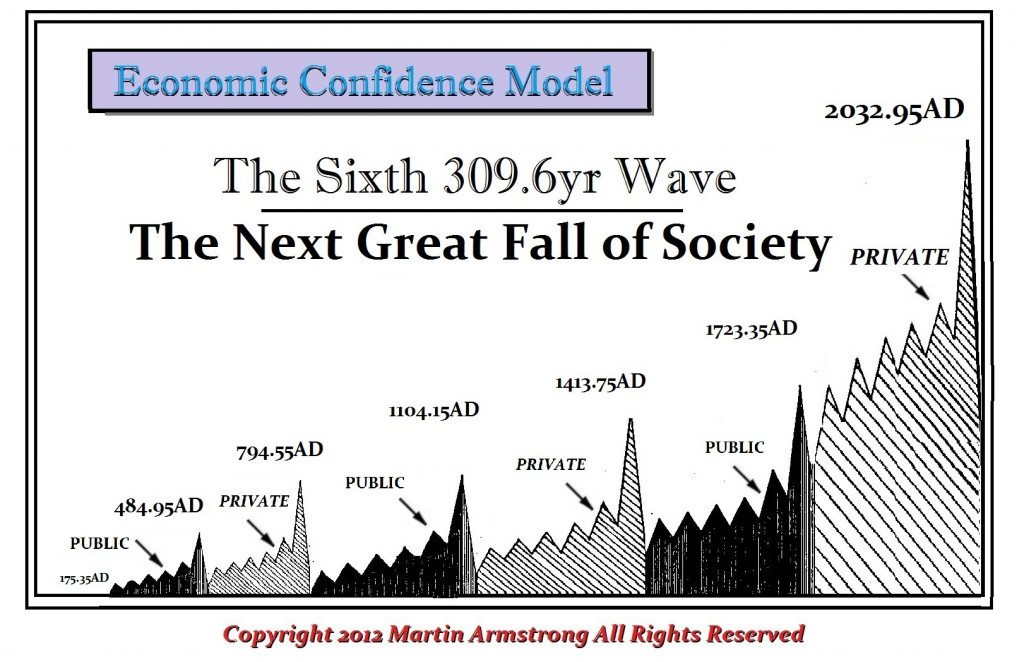

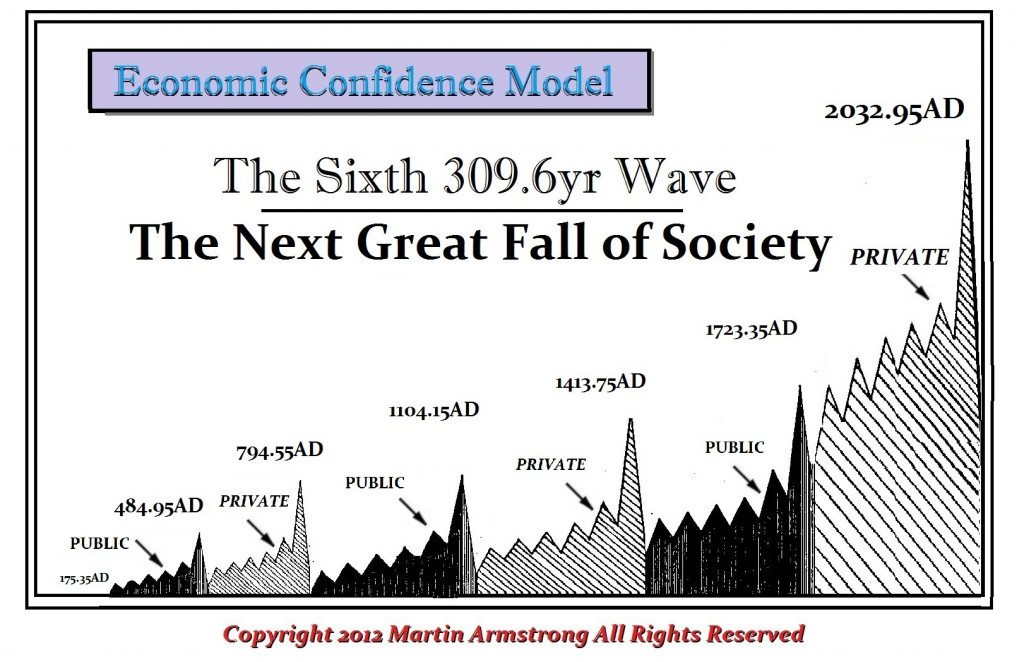

COMMENT: Mr. Armstrong; First I want to say I greatly admire your work. You are unbiased with markets, politics, and religion. Your cycle which targets 2032, agrees with the Islamic cycle some call the cycle of power which will peak. According to the Quran, there is a cycle of power, and this is mentioned in chapter 30 “the Romans”, verse 9,

30:9 Have they not traveled through the earth and observed how was the end of those before them? They were greater than them in power, and they plowed the earth and built it up more than they have built it up, and their messengers came to them with clear evidence. And Allah would not ever have wronged them, but they were wronging themselves.

REPLY: Yes, the Quran recognizes that there is also a cycle of about 300 years. What is interesting, is that in Christianity, the Revelations also expressly recognizes a cycle:

Revelation 20:3 He threw him into the Abyss, and locked and sealed it over him, to keep him from deceiving the nations anymore until the thousand years were ended. After that, he must be set free for a short time.

Saṃsāra (Sanskrit, Pali; also samsara) in Buddhism the cycle of death and rebirth to which life in the material world is bound. Samsara is considered to be dukkha, unsatisfactory and painful, perpetrated by the desire and avidya (ignorance), and the resulting karma. In Buddhism, rebirths occur in six realms of existence, namely three good realms (heavenly, demi-god, human) and three evil realms (animal, ghosts, hellish). Samsara ends if a person attains nirvana, the gaining of true insight into impermanence and non-self reality.

It is fascinating that we do live in a world of ignorance denying that cycles exist because this gives power and justification to the government. They seize power to eliminate cycles and create the perfect existence, but corruption destroys the best intentions. We have risen in the cycle of corruption and that is a peril. I agreed with Buddhism insofar as the cycle is created by our ignorance of it.

Edward Gibbon wrote in his Decline and Fall of the Roman Empire:

“The hill of the Capitol, on which we sit, was formerly the head of the Roman Empire, the citadel of the earth, the terror of kings; illustrated by the footsteps of so many triumphs, enriched with the spoils and tributes of so many nations. This spectacle of the world, how is it fallen! how changed! how defaced! The path of victory is obliterated by vines, and the benches of the senators are concealed by a dunghill.“

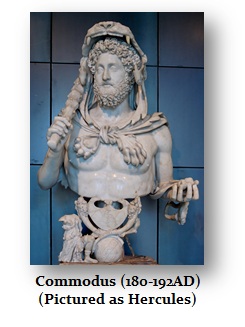

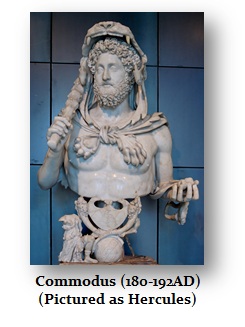

However, he too illustrated how corruption destroys civilization. Once the rule of law crumbles into the self-interest of the government, then the very purpose of creating a civilization no longer exits. He explained how the fall of the Roman Empire began with the collapse in the rule of law under Commodus (177-192AD).

“[D]istinction of every kind soon became criminal. The possession of wealth stimulated the diligence of the informers; rigid virtue implied a tacit censure of the irregularities of Commodus; important services implied a dangerous superiority of merit; and the friendship of the father always insured the aversion of the son. Suspicion was equivalent to proof; trial to condemnation. The execution of a considerable senator was attended with the death of all who might lament or revenge his fate; and when Commodus had once tasted human blood, he became incapable of pity or remorse”

“[D]istinction of every kind soon became criminal. The possession of wealth stimulated the diligence of the informers; rigid virtue implied a tacit censure of the irregularities of Commodus; important services implied a dangerous superiority of merit; and the friendship of the father always insured the aversion of the son. Suspicion was equivalent to proof; trial to condemnation. The execution of a considerable senator was attended with the death of all who might lament or revenge his fate; and when Commodus had once tasted human blood, he became incapable of pity or remorse”

(Book 1, Chapter 4).