Armstrong Economics Blog/Uncategorized

Re-Posted Aug 30, 2018 by Martin Armstrong

The rumors running around is that Turkey will default as Erdogan decides to move to align with Iran and Russia and leave the West behind. While there have been speculative attacks on the Turkish economy and US tariffs and sanctions have been detrimental, the initial causes of this growing monetary problem are really all internal. Erdogan’s management of the economy has been a disaster. He has pretended to borrow too much money from foreign investors to stimulate the economy. It is true that the total debt rose to over $450 billion, about half of GDP. Turkish exports and the current account deficit rose to $50 billion. This has led to rapid inflation that has been at least an annual rate of nearly 7% on average during the last ten years. In truth, Erdogan was really trying to build the economy to fulfill his dream of reestablishing the Ottoman Empire and emerge as at least the dominant power over the Middle East.

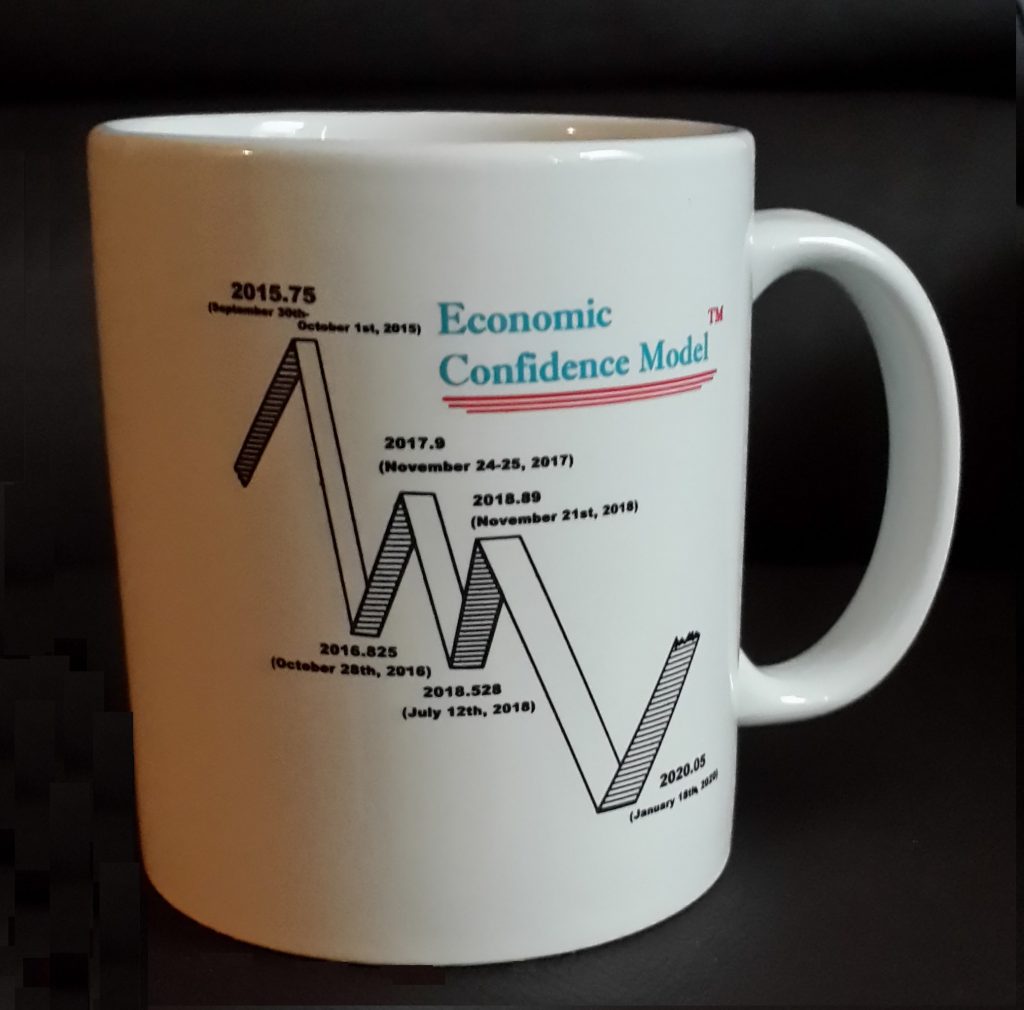

Unfortunately, Erdogan is stubborn and he really has no way out. He wants his cake and consumes it all at the same time. The rumors running around the trading desks is that he will pull the plug and turn his back on the West. By doing so, he can then justify defaulting on the debt of the “corrupt” West who wants to subjugate Turkey will be the justification spin of things. It looks like this will remain volatile into October.