Armstrong Economics Blog/Real Estate

Re-Posted Feb 17, 2018 by Martin Armstrong

QUESTION: Hi Martin,

I just finished your new NYSE Boom/Busty report. This is excellent work and as always extremely fascinating. Thank you for continuing to share these profound views with us.

My question relates to your view that we are looking at a complete collapse of Quantitative Easing and that will likely see a massive capital flight to the dollar and the major safe haven will be EQUITIES. In the context of this possibility, are you able to comment on how this may relate to Real Estate. Your ECM seems to be calling for Real Estate to top out and structurally fall in 2032. Is it not possible that with the collapse of QE and potentially economies that we will see more negative rates in the short end and with the government powers to seize assets in bank accounts, would it not be prudent to have zero cash in hand and hence we see a massive capital flight to Real Estate too? Or will the collapse of QE lead to significantly higher rates across the curve and hence blow all leveraged exposure sky high?

Many thanks as always,

David

ANSWER: The problem with real estate has been that its value depends upon lending. This was what the government did as part of the New Deal by creating 30-year mortgages. This was a scheme to get prices up by extending the period people could pay off the loan. Typically, the duration was 5 years previously.

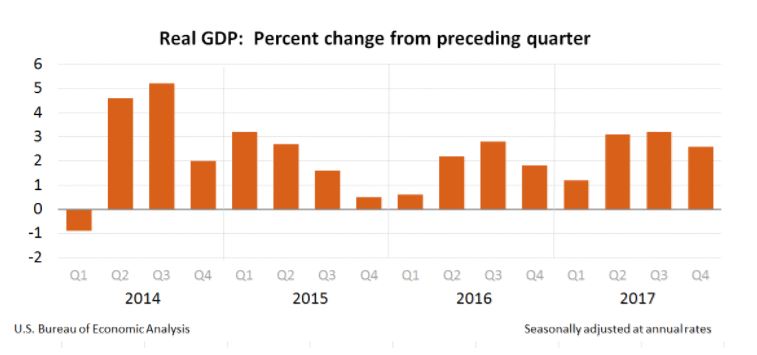

The collapse in Quantitative Easing will have the effect of causing rates to rise on the long-term. However, there will be a shift toward private assets and this will help to a large extent. However, keep in mind that many institutions will be trapped and unable to shift to private assets. Many boards will not understand the shift and still believe, wrongly, that unsecured government debt is best.

Prices of real estate will decline in proportion to the decline in mortgage availability. We are already witnessing banks beginning to withdraw from lending on real estate.

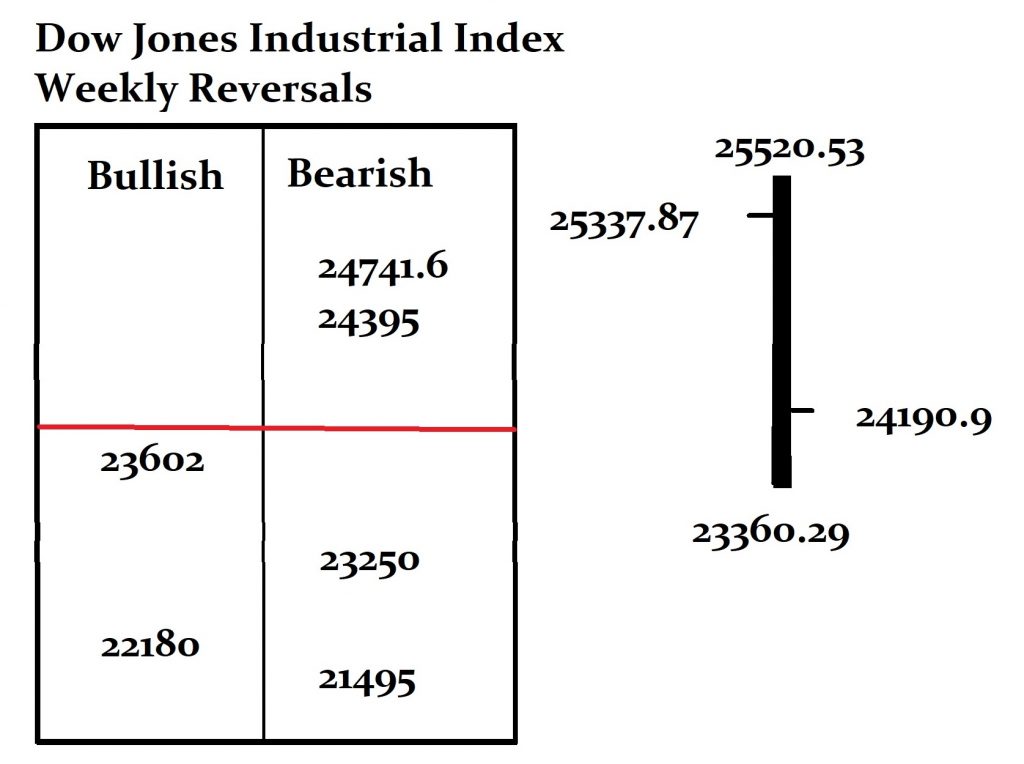

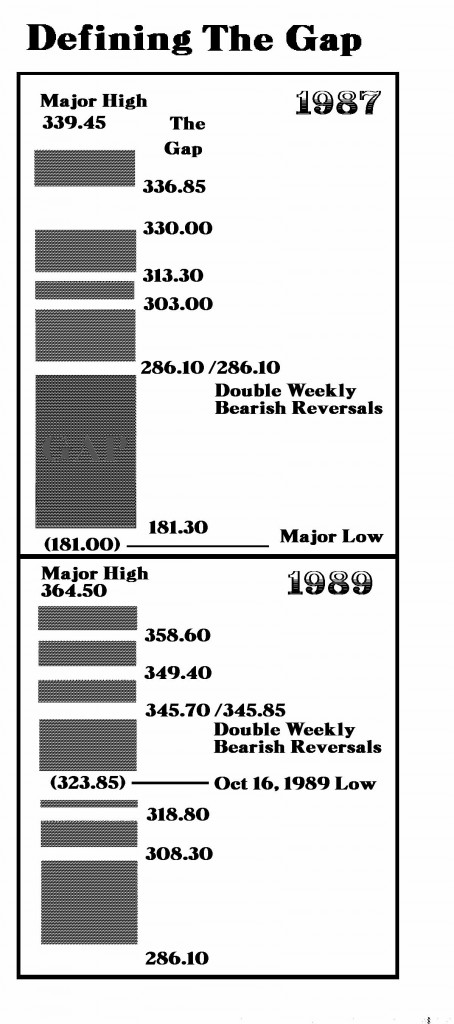

I have provided the guide-posts for what is to come. This will be an interesting future.