Armstrong Economics Blog/Economics

Re-Posted Nov 3, 2017 by Martin Armstrong

These days, US President Donald Trump is pushing his number one agenda of his term in office – major tax reform. Trump has been meeting with some of his own party senators seeking approval for the planned tax reform he is hoping will be signed by the end of December at the latest for a Christmas present. The negotiations on the details are in the final stages. If the reform is very real indeed, and make no mistake about it, this would be a tremendous triumph for Trump and for the nation as a whole. Trump has the potential to take the United States counter-cyclical (cycle inversion) that would actually put a tremendous amount of pressure on the rest of the world.

There are some who are concerned about removing the tax deduction for state income taxes. Deducting state income taxes from your Federal taxes has been quietly talked about behind the curtain for some time. It was also one factor in my own relocate out of New Jersey to Florida. The elimination of the deduction for state and local taxes will be a major death blow for the high taxed states like California, New York, New Jersey, Connecticut etc..

The states have been effectively double-dipping. I remember when the New Jersey state income tax was put in. The politicians said it would cost you nothing because you could deduct it from your federal taxes. Essentially, it was the way for the state to covertly get more money that they were not accountable for. That game is coming to an end. If Trump eliminates that deduction, then and ONLY then will the people start to hold the states accountable for the first time EVER! Repealing it would increase federal revenue by $1.3 trillion over the decade

Deductions would remain for mortgage interest and charitable contributions. Additionally, the standard deduction would nearly double to $12,000 for individuals and $24,000 for married couples.

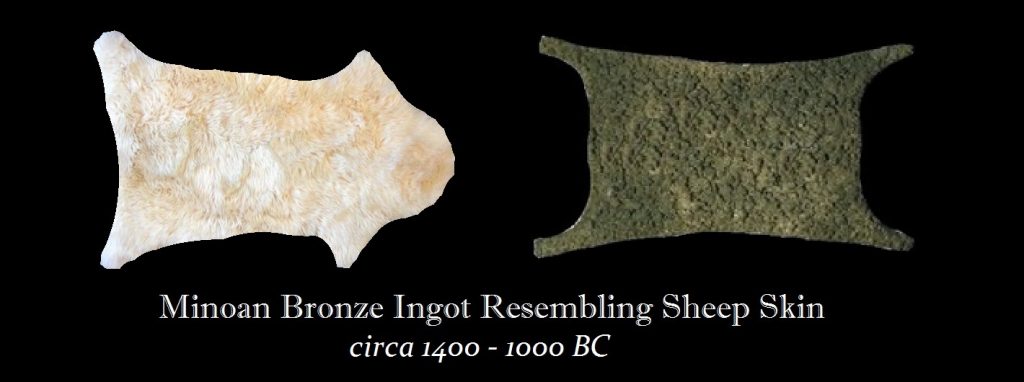

Gold would certainly be a better hedge against the Euro than the dollar. It has outperformed the dollar because you always have to look at the currency. However, money will NEVER shift from the stock market all into gold. Everyone has their pet investment in what they feel comfortable. Gold is a retail product – not institutional. The Institutions can trade ETFs, gold stocks etc., but they will never take possession of gold.

Gold would certainly be a better hedge against the Euro than the dollar. It has outperformed the dollar because you always have to look at the currency. However, money will NEVER shift from the stock market all into gold. Everyone has their pet investment in what they feel comfortable. Gold is a retail product – not institutional. The Institutions can trade ETFs, gold stocks etc., but they will never take possession of gold.