There is a strong divergence within the May jobs report as released by the Bureau of Labor and Statistics (BLS) [DATA HERE]. Payrolls increased 339,000 in May from April and previous months were revised up by 93,000. That is good news. However, the household survey, from which the unemployment rate is derived, showed employment down 310,000 jobs and the unemployment rate increased to 3.7%.

One of the aspects driving higher payroll starts are the number of people taking on additional part-time jobs. This aspect is noted in a decline for the number of hours in the average workweek. As more PT jobs are added, the number of hours in a workweek declines. As noted in the BLS data, “the average workweek for all employees on private nonfarm payrolls edged down by 0.1 hour to 34.3 hours in May.”

There were 161.0 million people working in April. There are 160.7 million people working in May.

There were 5.7 million people unemployed in April. There are 6.1 million unemployed people in May.

The unemployment rate increased from 3.4% to 3.7%.

There are 310,000 fewer people working in May than were working in April. However, payrolls increased by 339,000 over the same timeframe. See graph above for where those jobs were gained.

(NBC) – […] Job gains were broad-based last month with health care contributing 52,000 and leisure and hospitality adding 48,000. Food services and drinking places led the increase in the latter industry, which had been adding an average of 77,000 jobs per month over the prior 12 months.

Overall, the U.S. economy added 339,000 jobs for the month, much better than the 190,000 Dow Jones estimate and marking the 29th straight month of positive job growth.

The unemployment rate rose to 3.7% in May against the estimate for 3.5%. The jobless rate was the highest since October 2022, though still near the lowest since 1969.

Olu Sonola, head of U.S. regional economics at Fitch Ratings, said the jobs report is a mixed bag.

“The strength of the payroll survey is clearly a big surprise, largely on the back of robust job growth in the healthcare sector and the business and professional services sector,” said Sonola. “However, the 0.3% increase in the unemployment rate is the highest monthly increase since April 2020.” (more)

WAGES – As noted within the BLS report, “In May, average hourly earnings for all employees on private nonfarm payrolls rose by 11 cents, or 0.3 percent, to $33.44. Over the past 12 months, average hourly earnings have increased by 4.3 percent.” Wage growth still lags inflation; the middle class is getting poorer. However, with the fed focused on wage growth as the leading indicator of their false pretenses to combat inflation, wage growth is too high (they want around 3.0%).

The Biden economic and monetary policies are delivering the results they want. Higher energy prices, higher costs of living, lower real wages and increased middle class pressure. The serf model.

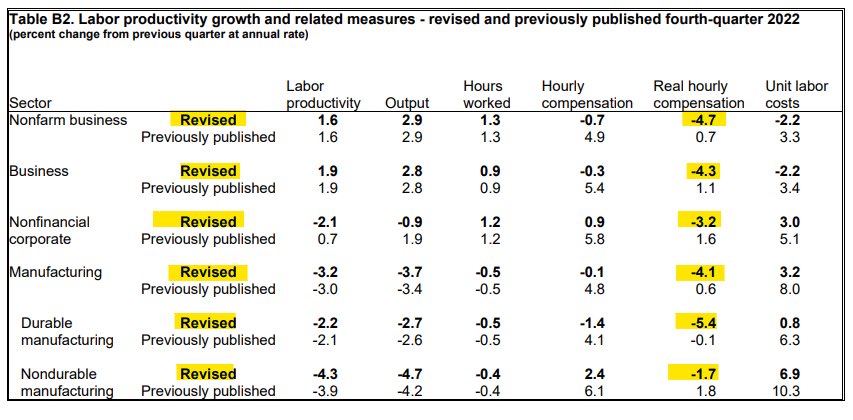

The BLS was forced to admit yesterday their Real Hourly Compensation growth was previously flawed. [CHART DATA SOURCE]

That chart of revisions to real wages tells us a lot about the economic pain being felt by the working class in the U.S. If it feels like you are working harder and going backwards in your ability to afford basic essentials, that’s because you are.

The prices for essential goods and services have risen at a much greater rate than the wages needed to afford them. This is the result of Joe Biden’s energy policy, economic policy, and now magnifying monetary policy.

Our goods and housing costs are higher. Our wages are not growing much. The cost to borrow money to afford the gap is increasing. This is unsustainable.

In my opinion, the economy overall – as a measure of units produced and sold – has been in a contracting position since the fourth quarter of 2021. The appearance of economic growth, the value of goods and services, is an illusion that has been created by higher prices, ie. inflation.