Armstrong Economics Blog/European Union

Re-Posted Dec 11, 2017 by Martin Armstrong

Most people do not understand that there is the Eurogroup, which is an informal body of finance ministers from the Eurozone member states that are intended to discuss matters relating to their countries’ common responsibilities related to the Euro. They do not keep any minutes so nothing emerges with respect to policy. There is now a clash building between this Eurogroup and that of the European Commission. The Eurogroup will most likely oppose the EU Commission’s plans for an EU finance minister. This, of course, is one more step toward federalizing Europe. The view in Brussels is that their dream project is collapsing. The answer is not more freedom, but to centralize power to prevent the collapse of the Euro.

The Commission wants to impose its own finance minister over the Eurogroup and in turn, the Eurogroup will insist on having its own presidency. There is a rising belief within the Eurogroup that it should delineate the role of the Eurogroup from the role of the Commission. They see the Commission as attempting to grab more power unto itself.

Its main task is to ensure close coordination of economic policies among the Eurozone member states and promote conditions for stronger economic growth. This was seen as a critical element to maintain stability in the Eurozone as a whole.

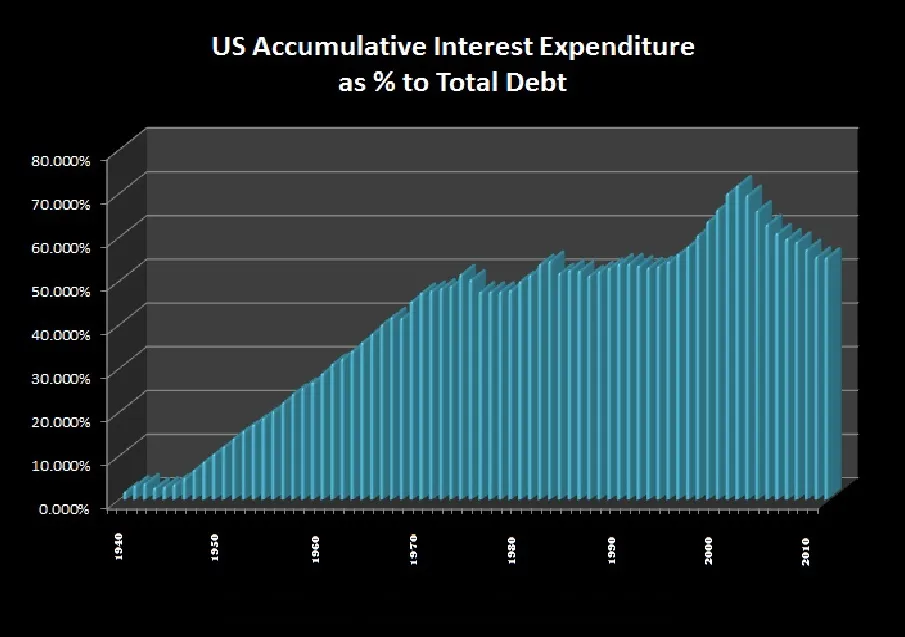

However, as I have made clear before, the failure of the euro has been due to the refusal to consolidate the debts. Then you would have had a clean federal European government and each member state would then have its own budget that would not be dependent upon the federal government. Now because of this refusal to consolidate the debts from the outset, we have the idea of creating an EU Finance Minister who will then have dictatorial powers over Eurozone members.

This is going far beyond the United States of Europe, but a single government eliminating the sovereignty of individual member states. The USA has a federal government with its debt and 50 states which are all on their own. The Feds are not impacted by the budget of an individual state whereas the structure of the Euro is dependent upon each state. This is also why the EU opposes all separatist movements. The design is seriously flawed.

The Eurogroup exists without any real power collectively. There is no transparency because it had no real power. The group was effectively mandated by governments to conduct financial operations but without any formal means to carry any directive out. The finance ministers have acted with no more success than the ECB. The European austerity policy has been a huge mistake and this has been imposed upon the whole by Germany.