The Trump Tax Reform is a very major deal. There are seven brackets in today’s individual tax code. The Senate version of the Trump Reform is not a windfall for the rich lowering their bracket from 39.6% to just 38.5%. The seven tax brackets currently are:

10%, 15%, 25%, 28%, 33%, 35%, and 39.6%.

Changes individual income tax brackets will be:

– 10% (income up to $9,525 for individuals; up to $19,050 for married couples filing jointly)

– 12% (over $9,525 to $38,700; over $19,050 to $77,400 for couples)

– 22% (over $38,700 to $70,000; over $77,400 to $140,000 for couples)

– 24% (over $70,000 to $160,000; over $140,000 to $320,000 for couples)

– 32% (over $160,000 to $200,000; over $320,000 to $400,000 for couples)

– 35% (over $200,000 to $500,000; over $400,000 to $1 million for couples

– 38.5% (over $500,000; over $1 million for couples)

The House bill, by contrast, only calls for four brackets: 12%, 25%, 35% and 39.6%.

Both the House and Senate bills nearly double the standard deduction. For single filers, the Senate bill increases the standard deduction to $12,000 from $6,350 currently; and it raises it for married couples filing jointly to $24,000 from $12,700. This will be a very big tax benefit for the low end. It will also reduce the number of people who itemize their deductions to get more deductions which complicate matters for most people.

However, currently, you’re allowed to claim a $4,050 personal exemption for yourself, your spouse and each of your dependents. Both the Senate and House bills eliminate that option. Large families with three or more children will probably not benefit from this change. The Average number of people per household in an American family in the United States from 1960 to 2016 consisted of 2.53 people. So for the average household, this will still be a tax cut.

Nevertheless, the Senate bill increases the child tax credit to $2,000 per child, up from $1,000 today, and above the $1,600 proposed in the House bill. This will help ease the pain for bigger families. The age limit will be available for any children under 18, up from today’s under-17 age limit. But it reverts to under 17 again in 2025, a year before the increase is set to expire on the bill. This is crazy since the 17-year old cannot vote and cannot be drafted. Yet, the Senate bill also greatly expanded the eligibility for the credit by raising the ceiling on the income thresholds. Currently, the credit starts to phase out in the higher brackets. For married tax filers, that ceiling was set at $110,000 and the Senate has raised it substantially to $500,000. What does change is the subsidy. If you pay no tax, you get no credit whereas today you get $1,000 even if you pay no taxes.

For the first time, people taking care of their parents as dependents in old age have not been able to deduct them from the children credits. Now, these people will get a new $500 nonrefundable credit per dependent. Under the House bill, there would be a new $300 per person credit for parents and dependents over 17.

The biggest controversial provision is eliminating the deduction for state income tax. This has been bantered around for decades. It has finally come to reality. I recall in New Jersey when the income tax was put in, the sales promotion was it would cost you nothing because you would be able to deduct it from the federal income tax. This has been a major gripe in Washington for it has unjustly incentified states to spend without limit increasing state income tax at the expense of other states. So this will finally eliminate that deduction and at last, those living in insanely taxed states like New England area and California, will wake up and realize their local government has been squandering the money on themselves. With a rise in population, taxes should decline, but they only keep going up in New York and California without end.

The biggest controversial provision is eliminating the deduction for state income tax. This has been bantered around for decades. It has finally come to reality. I recall in New Jersey when the income tax was put in, the sales promotion was it would cost you nothing because you would be able to deduct it from the federal income tax. This has been a major gripe in Washington for it has unjustly incentified states to spend without limit increasing state income tax at the expense of other states. So this will finally eliminate that deduction and at last, those living in insanely taxed states like New England area and California, will wake up and realize their local government has been squandering the money on themselves. With a rise in population, taxes should decline, but they only keep going up in New York and California without end.

The real estate killer is also here. Up to now, those who itemize deduction have been deducting their property taxes as well as their state and local income or sales taxes. There have been many who called for this to be eliminated for it too is subsidizing reckless local spending with no accountability. Every municipal government has usually all the top management expenses for salaries and pensions. This has driven so many to abuse the legal process transforming their police into revenue agents who no longer protect society, but exploit it for their own salaries with tickets and fines.

While the original Senate bill called for a full repeal of the property tax deduction, it was amended to preserve an itemized deduction for property taxes but only up to $10,000, which is identical to the House measure. Once again, those in big houses or the high taxed states paying more than $10,000 in property taxes will for the first time feel the real cost of their local corruption.

The Senate bill would still let you claim a deduction for the interest you pay on mortgage debt up to $1 million. The House wants to cap the loan limit at $500,000 for new mortgages. Since the House and Senate bills both sharply increase the standard deduction, the percent of filers who claim the mortgage deduction would decline significantly anyway. If this were eliminated along with property taxes, we would see a real estate crash that would make the S&L Crisis look trial run. No doubt, Trump understand that one unlike the Democrats back in the 1980s.

Interestingly, there are some changes that will impact the real estate market and take the froth off the surface. The Senate bill makes two important changes on home-related financing. It disallows interest deductions for home equity loans. And it lengthens the time you must live in a home to get the full tax-free exclusion on your gains when you sell it. Therefore, this will impact the borrow against your home market all over the radio if they tell the consumer the truth that a home equity loan will NOT BE DEDUCTIBLE. Additionally, this will impact the home-flippers as well who have been calling their income capital gains when they are flipping homes as a business.

The Senate kept the Alternative Minimum Tax (AMT), but it raises the amount of income exempt from it. The AMT originally was intended to ensure the richest tax filers pay at least some tax by disallowing many tax breaks at the high end. Now filers making between $200,000 and $1 million today will have to pay the tax. So once again, it is not a windfall for the rich.

The clash between the Senat and the House comes into play really with the death tax. Unlike the House bill, Senate Republicans have not proposed repealing the estate tax. Instead, the Senate proposed to double the exemption levels. Death Taxes have been destructive when it comes to trying to keep a family small business or farm going. The founder has paid taxes their whole life. Then when they die, the government wants to prevent you from saving for your family after you are gone. This has resulted in selling off farmland to pay taxes and the consolidation of farming into the hands of big corporations. Likewise, small businesses are in the same boat.

The other clash between the Senate and the House is medical expenses. Currently, those who itemize their deductions may include their medical and dental expenses that exceed 10% of their adjusted gross income. The House bill eliminates that deduction, while the Senate bill retains it and temporarily lowers that 10% threshold to 7.5% for tax years 2017 and 2018.

The other clash between the Senate and the House is medical expenses. Currently, those who itemize their deductions may include their medical and dental expenses that exceed 10% of their adjusted gross income. The House bill eliminates that deduction, while the Senate bill retains it and temporarily lowers that 10% threshold to 7.5% for tax years 2017 and 2018.

Obamacare mandate to buy health insurance is included as a repeal to reduce the taxes on the youth. It is estimated to save money since fewer people who qualify for subsidies if they actually bought insurance. Currently, they pay the Obamacare Tax and are subsidized.

The big issue will be with business. The Senate bill, like the House bill, cuts the corporate tax rate to 20% from 35% today. But the 20% rate would not take effect until 2019 under the Senate proposal. The delay would reduce the cost of the measure in the first 10 years. But this will also reduce the likelihood of an economic boom short-term. The Senate Republicans did make it possible for businesses to immediately and entirely expense new equipment for five years. This the morons think will be beneficial to the economy. Not everyone is into heavy equipment. Reducing the corporate tax rate will allow companies to expand and hire more high-end staff rather than buy equipment. They are obviously living still in the old world of heavy manufacture.

Most U.S. businesses are set up as pass-throughs, and not corporations. That means their profits are passed through to the owners, shareholders, and partners, who pay tax on them on their personal returns under ordinary income tax rates. Both the Senate and House bills lower taxes on the business portion of a filer’s pass-through income. The House bill dropped the top income tax rate to 25% from 39.6%, while prohibiting anyone providing professional services, which will include lawyers and accountants. The professional services groups will not be allowed to take advantage of the lower rate. It also phases in a lower rate of 9% for businesses that earn less than $75,000.

The Senate bill lowers taxes on filers who pass-through their business earnings by letting them deduct 23% of their income, up from 17.4% originally. The 23% deduction would be prohibited for anyone in a service business — except those with taxable incomes under $500,000 if married ($250,000 if single). There is a carve-out. Should the owner or partner of a pass-through operation also draws a salary from the business, that money would be subject to ordinary income tax rates.

In order to curb people from recharacterizing their wage income as business profits to get the benefit of the pass-through deduction, the Senate bill would automatically limit the deduction to half of the W-2 wages of the pass-through entity or its share to the individual taxpayer. The W-2 rule would not apply, however, if the filer’s taxable income is under $500,000 if married, $250,000 if single.

The big change will be how the US-based multinational corporations will be taxed. Currently, U.S. companies pay taxes on all their profits, regardless of where the income is earned. They’re allowed to defer paying U.S. tax on their foreign profits until they bring the money home. This is why there is such a vast hoard of about $3 trillion overseas.

The big change will be how the US-based multinational corporations will be taxed. Currently, U.S. companies pay taxes on all their profits, regardless of where the income is earned. They’re allowed to defer paying U.S. tax on their foreign profits until they bring the money home. This is why there is such a vast hoard of about $3 trillion overseas.

Without question, the “worldwide” tax system puts American businesses and citizens at a huge disadvantage when other nations (except Japan) tax income earned in the place you are domiciled. The theory is fair. Taxes are supposed to be for your “fair share” of services provided by the government. If you are not living there, then what is your fair share of services that you do not use? ZERO! Foreign competitors come from countries that do not tax worldwide income and they can compete to get projects to build dams in China and beat American firms every time. I testified before that very issue in front of the House Ways and Means Committee back in the 1990s.

The Supreme Court in 2015 held that the Maryland income tax was unconstitutional because it did not allow a resident or corporation to deduct taxes paid to other territories on its income derived out of the state (See: COMPTROLLER OF THE TREASURY OF MARYLAND v. WYNNE ET UX., 575 US _ (2015)). The Supreme Court previously held in Central Greyhound Lines, Inc. v. Mealey, 334 US 653, 662 (1948), which invalidated state tax schemes that might lead to double taxation of out-of-state income in violation of the Commerce Clause.

The entire problem stems from the fact that Congress never defined “income” in the legislation. That left the door open for the Supreme Court to determine what was and what was not income. As a result, the Court decided in Eisner v. Macomber 252 US 189 (1920) to address that question. The starting point was their reference to the dictionary. “Income may be defined as the gain derived from capital, from labor, or from both combined, provided it be understood to include profit gained through a sale or conversion of capital assets.” The Court then went into a lengthy explanation as to how this definition applies to a stock dividend which the case was all about. In the end, the Court decided that the stock dividend was not taxable because it was merely a book adjustment and was not “severable” from the underlying stock. In other words, income would not be realized until the stock itself was sold.

After the Eisner decision, what emerged was a new question. The next challenge reached a climax in 1924 when the Supreme Court ruled in COOK v. TAIT, 265 U.S. 47 (1924) brought by a U.S. citizen living in Mexico that taxing non-resident citizens on their global income was indeed constitutional. This is the paragraph that has severely ignored the foundation of territorial jurisdiction recognized by the entire world.

“The contention was rejected that a citizen’s property without the limits of the United States derives no benefit from the United States. The contention, it was said, came from the confusion of thought in ‘mistaking the scope and extent of the sovereign power of the United States as a nation and its relations to its citizens and their relation to it.’ And that power in its scope and extent, it was decided, is based on the presumption that government by its very nature benefits the citizen and his property wherever found, and that opposition to it holds on to citizenship while it ‘belittles and destroys its advantages and blessings by denying the possession by government of an essential power required to make citizenship completely beneficial.’ In other words, the principle was declared that the government, by its very nature, benefits the citizen and his property wherever found, and therefore has the power to make the benefit complete. Or, to express it another way, the basis of the power to tax was not and cannot be made dependent upon the situs of the property in all cases, it being in or out of the United States, nor was not and cannot be made dependent upon the domicile of the citizen, that being in or out of the United States, but upon his relation as citizen to the United States and the relation of the latter to him as citizen. The consequence of the relations is that the native citizen who is taxed may have domicile, and the property from which his income is derived may have situs, in a foreign country and the tax be legal-the government having power to impose the tax.”

This holding that a citizen of the United States is forever an indentured servant of the country and can never escape taxes even if they left the country permanently. This defies every principle of the Constitution and the American Revolution for previously, if you were British and killed someone in Paris, the French could not prosecute you because you were the “property” of the king. They sent you back in chains and told the English king what you did and beg his vengeance. The ruling in Cook goes against territorial jurisdiction and is inconsistent with every other ruling on jurisdiction since inception. But once it is concerning taxes, the Supreme Court reverted to you are the property of the state.

This holding that a citizen of the United States is forever an indentured servant of the country and can never escape taxes even if they left the country permanently. This defies every principle of the Constitution and the American Revolution for previously, if you were British and killed someone in Paris, the French could not prosecute you because you were the “property” of the king. They sent you back in chains and told the English king what you did and beg his vengeance. The ruling in Cook goes against territorial jurisdiction and is inconsistent with every other ruling on jurisdiction since inception. But once it is concerning taxes, the Supreme Court reverted to you are the property of the state.

With that Eisner definition of income, was any income not clearly covered by its terms deemed to be nontaxable? In Helvering v. Bruun, 309 U.S. 461 (1940), the Court addressed the question of whether or not a lessor recognizes income from the receipt of a leasehold improvement made by a lessee during the lease when the improvement reverts to the lessor at the end of the lease. The Court ruled that the value of the improvement was taxable, noting that NOT every gain need be realized in cash to be taxable. There was a clear increase in the taxpayer’s wealth, and this increase did not have to be severed to recognize such increase as income for federal income tax purposes. This ruling could wipe out profits in BitCoin since it is marketed as a currency and that means it would be taxable even if you did not cash-in BitCoin. Then in Commissioner v. Glenshaw Glass Co., 348 U.S. 426 (1955), the Court severely qualified Eisner ruling that punitive damages recovered under a violation of anti-trust laws were included in gross income.

-

The Senate bill proposes changes to move the U.S. to a territorial system. which is long overdue. Congress NEVER authorized worldwide income taxes. That was the Supreme Court which simply ruled that they never said no. It also includes a number of anti-abuse provisions to prevent corporations with foreign profits from gaming the system. Companies will be required to pay a one-time low tax rate on their existing overseas profits — 14.5% on cash assets and 7.5% on non-cash assets such as equipment abroad in which profits were invested. This is slightly higher than the 14% and 7% rates in the House bill.

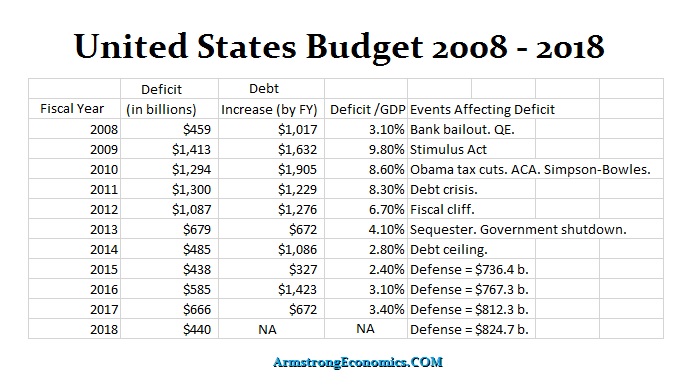

While the Trump Tax Reform will certainly not benefit the rich, the critics who simply argue the national debt will rise are just arguing nonsense. The national debt will continually rise because there is NEVER a balanced budget and there is NEVER any intent to ever pay off the debt. Up to now, the benefits go to the rich who donate big bucks to both parties and never to small business who do not lobby or to the average person. This is a much fairer way of dealing with the issues and of course, the Democrats will vote against it simply because they like the high taxes and handout tax exceptions behind the curtain for donations and law revisions like Hillary promising the bankers the moon.

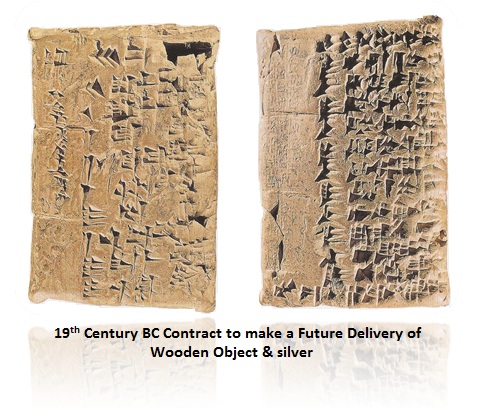

Even Hammurabi’s

Even Hammurabi’s

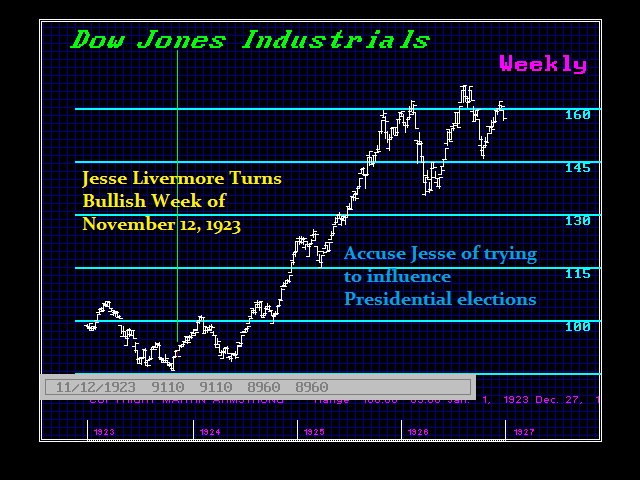

REPLY: Interesting. Soros became famous with the bet against the pound. But let’s make this very clear. That was a “riskless” trade betting against the break of a peg. If you are wrong, the peg holds and you get your money back. If you are right, you make a fortune. Everyone was betting against the pound. That was the coup against Margaret Thatcher who really wanted to take Britain into the euro. They forced the pound into the

REPLY: Interesting. Soros became famous with the bet against the pound. But let’s make this very clear. That was a “riskless” trade betting against the break of a peg. If you are wrong, the peg holds and you get your money back. If you are right, you make a fortune. Everyone was betting against the pound. That was the coup against Margaret Thatcher who really wanted to take Britain into the euro. They forced the pound into the