Armstrong Economics Blog/Socrates

Re-Posted Mar 10, 2019 by Martin Armstrong

We are progressing in uploading all the memory modules. Soon, we will have all modules plugged in. I had an interesting meeting with one institution. One CFO still questioned if there was any human involvement in the reports. He said that the writing was too good for just a machine and assumed someone had to be editing them. I laughed, and explained with covering over 1,000 instruments currently and about 9,000 more to go, I asked how many people would it take to do that? There cannot be any human involvement for the sheer size of the project would consume probably every person who has ever lived that was interested in analysis.

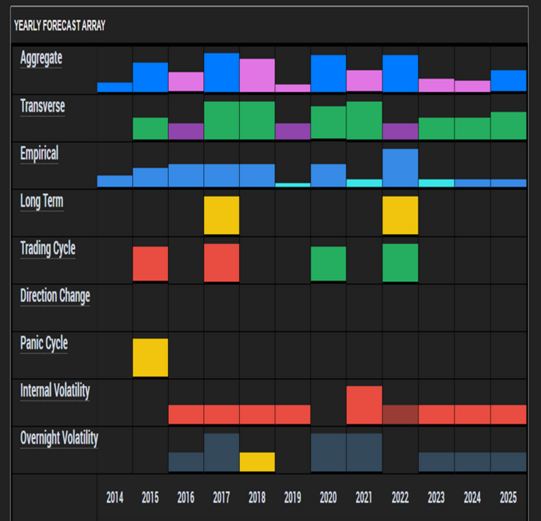

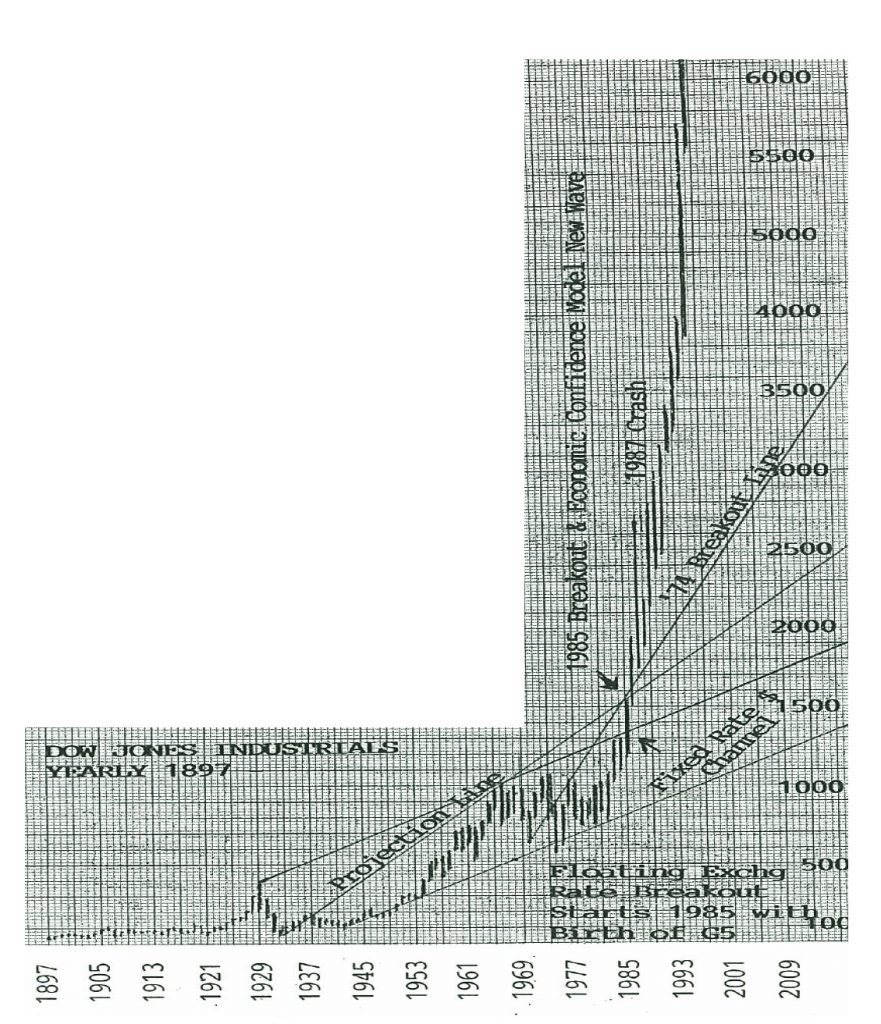

For example, Socrates will employ technical analysis itself and write its conclusions. Once again, there is no human behind this for it would be impossible to put out over 3,000 individual reports every day using humans. This is what it wrote for the Dow Jones Industrial Index on the daily level.

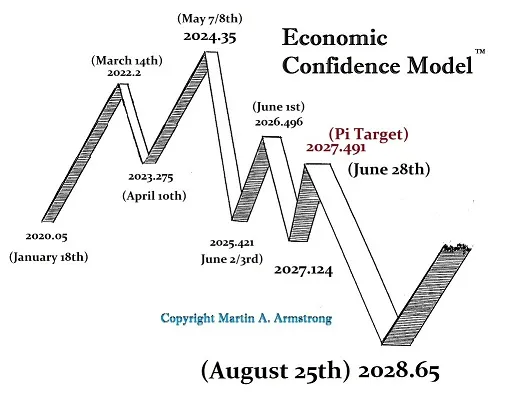

After the historical high was established during 2018, a major low was created on 12/26/2018 at 2171253 which was 51 days from that major high.

Meanwhile, the Downtrend Line from that major high of 2018 to the subsequent reaction high of 2627782 formed 26 days thereafter resides at 2404847. This had provided the original technical resistance which has been exceeded and can potentially become support going forward. The post high low was established at 2171253. We have not elected the two short-term Bullish Reversals from that important post high low on the daily level but we have elected both the long-term Bullish Reversals.

The more recent Downtrend Line constructed from the last high of 2624142 to the subsequent reaction high of 2615598 stands at 2608763 while drawing a channel provides us with support at 2557422. The market has already penetrated intraday this support provided by the bottom of the channel. However, the market has bounced back and closed above it warning that it is holding right now.

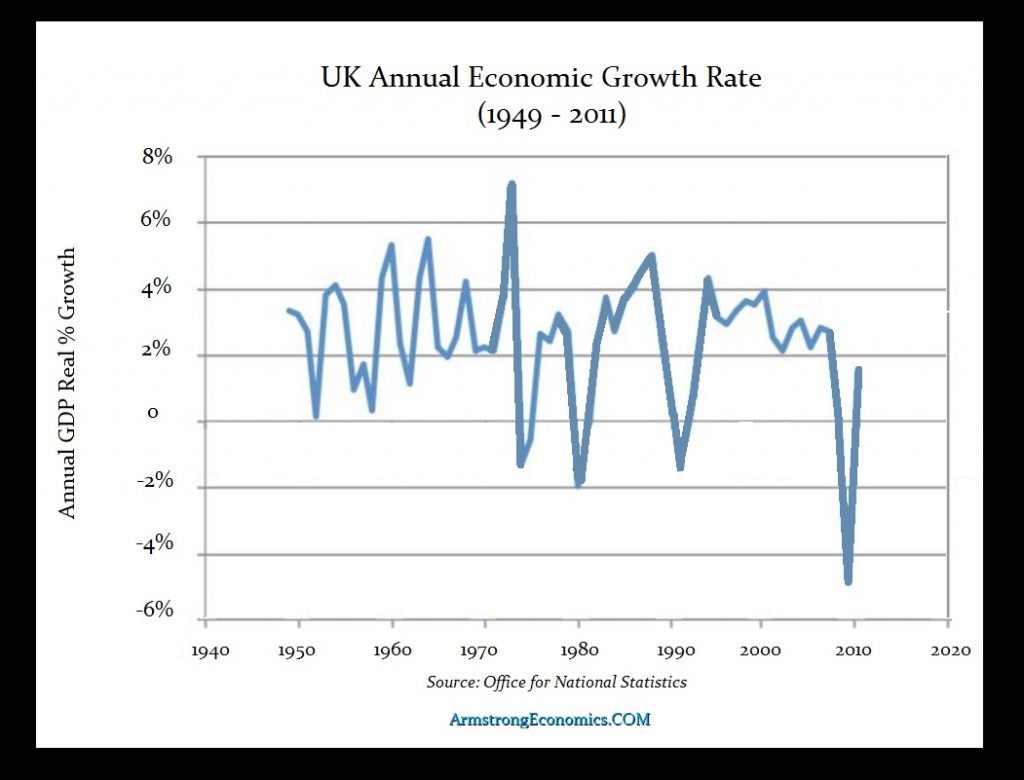

It is my hope that Socrates will provide the best management tool for society moving into the future. Kind of like the Biblical story of Joeseph and the Pharoh when he forecast 7 years of plenty followed by 7 years of drought. We cannot alter the cycles in motion and we should not try as Marx and Keynes did. We should understand the trends and prepare thereby living with them in harmony. The weather is turning toward global cooling. This is when disease increases (plagues) set in motion by malnutrition. If we understand the trend, we simply prepare for it instead of blaming everyone else but reality.

The BP Oil Spill was a disaster. However, any company that could show it had a loss in 2008 got in line with their hand out and were paid. They did not have to show any connection to the oil spill that caused their loss. The 2007-2009 economic decline produced losses by itself. There is always someone who has to be blamed.

The Red Tide of 2018 actually disrupted more businesses than the BP Oil Spill. But the Red Tide could not be blamed on a single company with deep pockets. You could not sue God or nature. A simple model on Red Tide demonstrated it was not farmers and chemicals but a 13-year cycle. On top of that, such events extended back to 1648 and predate chemicals or the Industrial Revolution.

While there are people in New York who hate our models because when they have lost big time in their attempts to manipulate markets like 2007-2009, they turn to blame our model claiming we are always too influential. They shift the blame rather than admit that their own corruption has led so many times to blow up the world economy. If we really understood the world and how everything is connected, we could manage the economy far better and even eliminate war which seems to rise as a means to shift blame to someone else when it is often our own governments that skew everything up.

This is what I hope to leave behind.