QUESTION: Mr. Armstrong; You are obviously the person worth listening to when it comes to gold. Every fundamental these people have argued to support gold has proven completely false. Confusion in gold is really very high. You have to be really stupid at this point to listen to this nonsense. Can you express any opinion on gold?

It would be very helpful

PL

ANSWER: You are correct, that concerns over U.S.-Russian relations, coming talks on the Korean Peninsula, action in Syria over a suspected chemical weapons attacks and uneasiness over trade conflicts would normally be the battle cry to buy gold. Traditionally, this would form a cocktail of geopolitical uncertainty that would lead to screams buy gold! The uncertainty has not led to support for gold. They are proving to be a narrative that no longer seems to be factors for the bulls.

We have to understand one thing. The younger generations do not see gold as money as do the aging generation. The older generations remember being taught that is school and the days of the gold standard. The younger generation does not even bother with paper money and pays with their cell phones. This is raising the question of whether gold will remain as a safe-haven instrument in the future if the younger generation does not even consider gold suitable for anything other than a trinket.

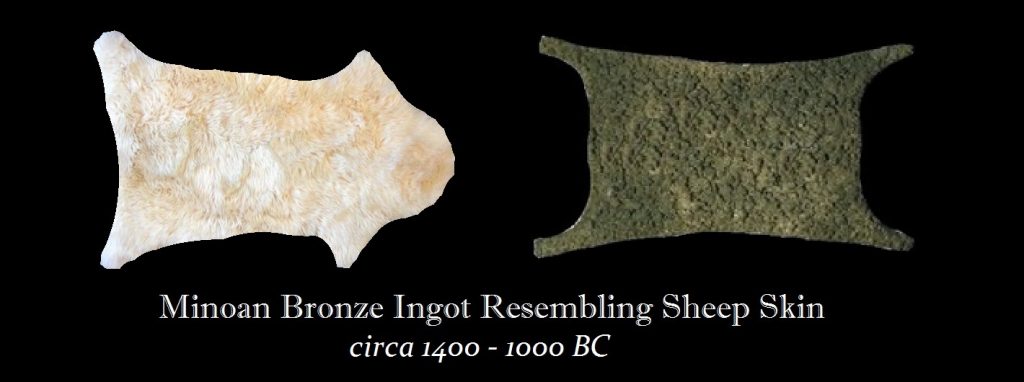

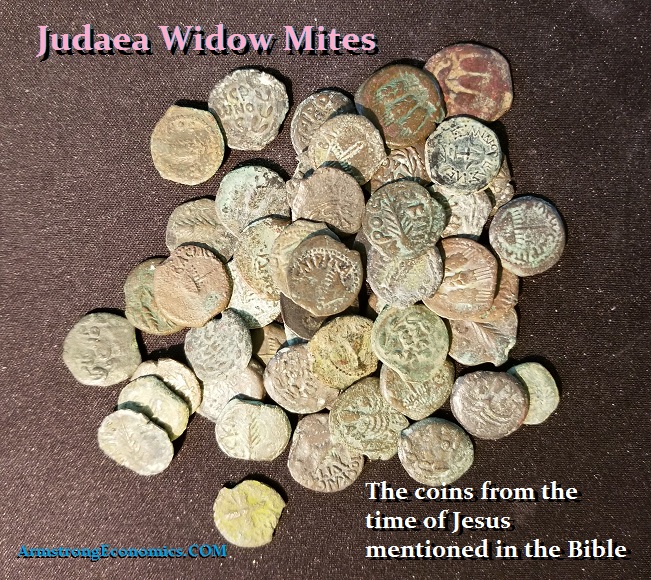

There are cycles to yet cycles to cycles. Just as we moved from gold to paper, we have then moved from paper to electronic. With each passing trend, there are always people who refuse to leave behind the old ideas and traditions. The real question emerging shall be: Will people even regard gold as anything but jewelry 300 years from now? Of course, there will be those who immediately will argue that gold has always been money. They are simply wrong. Money has been many things to many different societies. The real issue is not whether gold is money, silver, copper, bronze, seashells, sheepskins or cattle. The real question is will money be COMMODITY based (Tangible) with its roots in barter or will it be simply a representative of economic output that can be electronic? That is the real question. Are we headed into a future as in Star Trek where physical money is obsolete?

There are cycles to yet cycles to cycles. Just as we moved from gold to paper, we have then moved from paper to electronic. With each passing trend, there are always people who refuse to leave behind the old ideas and traditions. The real question emerging shall be: Will people even regard gold as anything but jewelry 300 years from now? Of course, there will be those who immediately will argue that gold has always been money. They are simply wrong. Money has been many things to many different societies. The real issue is not whether gold is money, silver, copper, bronze, seashells, sheepskins or cattle. The real question is will money be COMMODITY based (Tangible) with its roots in barter or will it be simply a representative of economic output that can be electronic? That is the real question. Are we headed into a future as in Star Trek where physical money is obsolete?

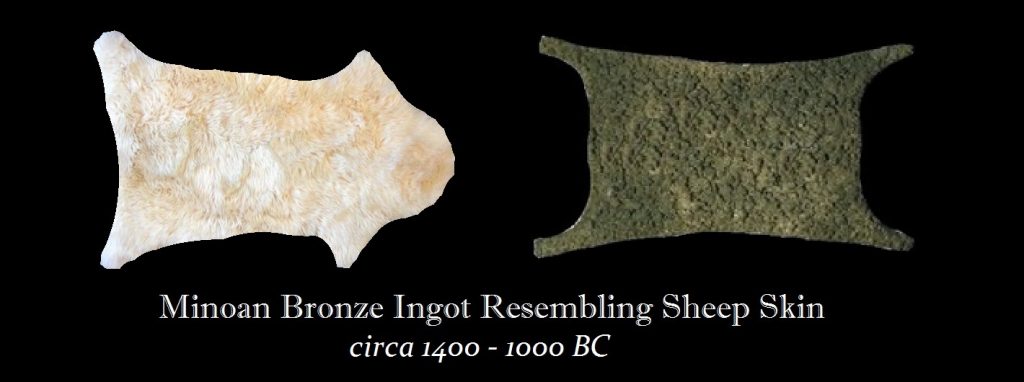

When we look at these transition periods in the monetary system throughout history, we see how money takes shape of a representation of what it once was. The Minoans fashioned their bronze ingots in the shape of a sheepskin because that is what use to be a symbol of value before the Bronze Age. We see the same transition in Rome with ingots of bronze with a picture of a cow because cattle was once money.

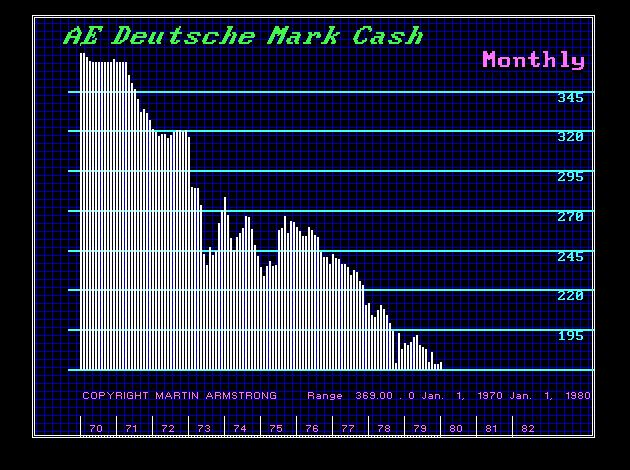

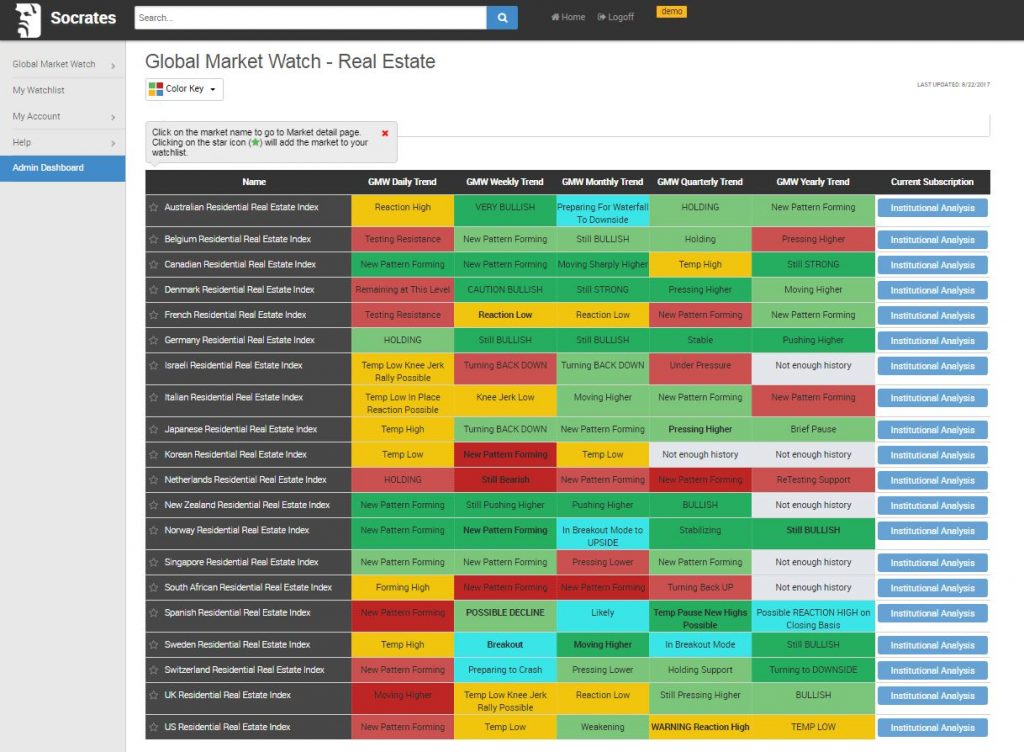

The real question is blunt. Are we also passing from a COMMODITY based monetary system to a purely electronic based system with the passing of the generations? Even the pitch that India buys gold because it is a tradition is starting to show it to moves with cycles. The younger generations do not share the same view of gold as the older generation. Things do change with the generations and the problem has always been that those of one generation judge the future ONLY by its own belief system. So, despite all the yelling and screaming that I was wrong and that gold would NEVER retest the $1,000 level, we have broken sharply falling to 1180 yesterday in the fact of a strong dollar as we approach the pending Benchmarks in September. Gold trades inversely to the dollar because it is now just a commodity-based asset class – not money. When we had a gold standard, it traded opposite against all asset classes. It will rally when the dollar backs off and decline as the dollar rallies until everything begins to enter the Great Aligment.