Armstrong Economics Blog/The Hunt for Taxes

Re-Posted Dec 22, 2017 by Martin Armstrong

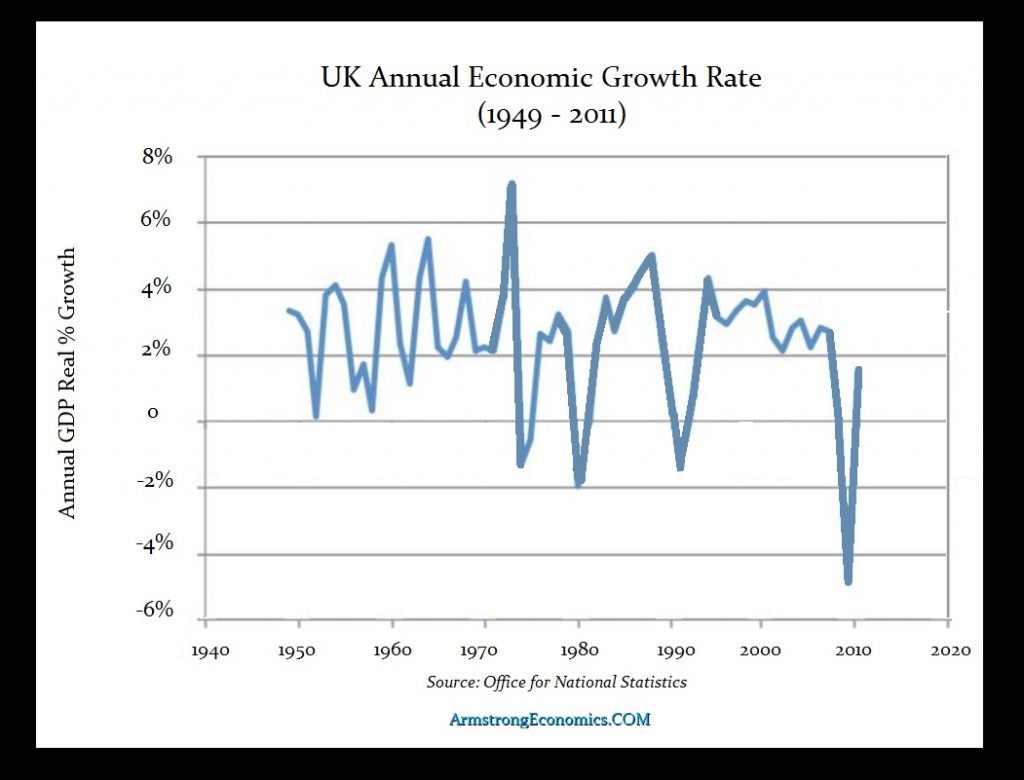

While the American press keeps pushing the class warfare along with the Democrats, outside the USA there is a major panic taking place on a grand scale. I have been called into meeting in Europe and even in Asia all deeply concerned about the loss of competition with the United States due to the Trump Tax Reform. Naturally, the American press would NEVER tell the truth how cutting the corporate tax rate will upset the powers that be around the globe.

A German study warns that its economy will be among the losers in the face of the Trump Tax Reform, which they warn will fuel the tax competition between America and Europe, but also the study leader, Christoph Spengel from the Economic Research Institute ZEW, came out and told Reuters:

“In addition, competition between EU members for US investment will increase; Germany is the loser.”

German Industry is already screaming. They want the Solidarity Surcharge terminated. That was put on for the unification and was never lifted, as is always the case. Without the surcharge, the German corporate rate would be 28.2%, still well above the EU average tax rate of 20.9%.

To finance the reunification of Germany a surcharge, the government taxed all taxpayers on their income tax withholding and corporation tax. The assessment basis was the income tax or corporation tax. This became known as the Solidarity Surcharge and is currently 5.5 % of the relevant assessment basis. Therefore, the effective corporate tax rate in Germany has been 33.7%. Of course, the Solidarity Surcharge is no longer is really needed to pay for the unification. But as always, once a tax is imposed, the government just can’t let it go.

The taxation levels in Germany were always much higher. When I was working on corporate restructuring helping companies select where to set up inside Europe for the birth of the Euro, I never placed any manufacture in Germany. I sent them to Britain for the net tax was 40% less. If they did not need skilled-manufacturing labor and just the best tax rate, I put those companies in Ireland. Never did I recommend anyone to move to Germany or France.

The advice I gave to those in a position to put the counter-reform in motion was straightforward. I advised them to ELIMINATE income tax completely. The political cover should be that they are adopting the original structure of the United States whereas only indirect taxation was permitted prior to 1913. A few mouths dropped. But they underst6ood the advice I was giving if they really wanted to compete.